Nevada Fast Packet Services Payment Plan Agreement

Description

How to fill out Fast Packet Services Payment Plan Agreement?

Are you currently inside a situation that you require paperwork for possibly business or specific uses virtually every working day? There are a lot of legitimate papers layouts accessible on the Internet, but discovering ones you can rely on is not simple. US Legal Forms gives a huge number of kind layouts, much like the Nevada Fast Packet Services Payment Plan Agreement, that are created to fulfill federal and state demands.

Should you be already acquainted with US Legal Forms internet site and also have your account, basically log in. After that, you can acquire the Nevada Fast Packet Services Payment Plan Agreement design.

If you do not offer an accounts and would like to start using US Legal Forms, abide by these steps:

- Obtain the kind you require and make sure it is for that proper city/area.

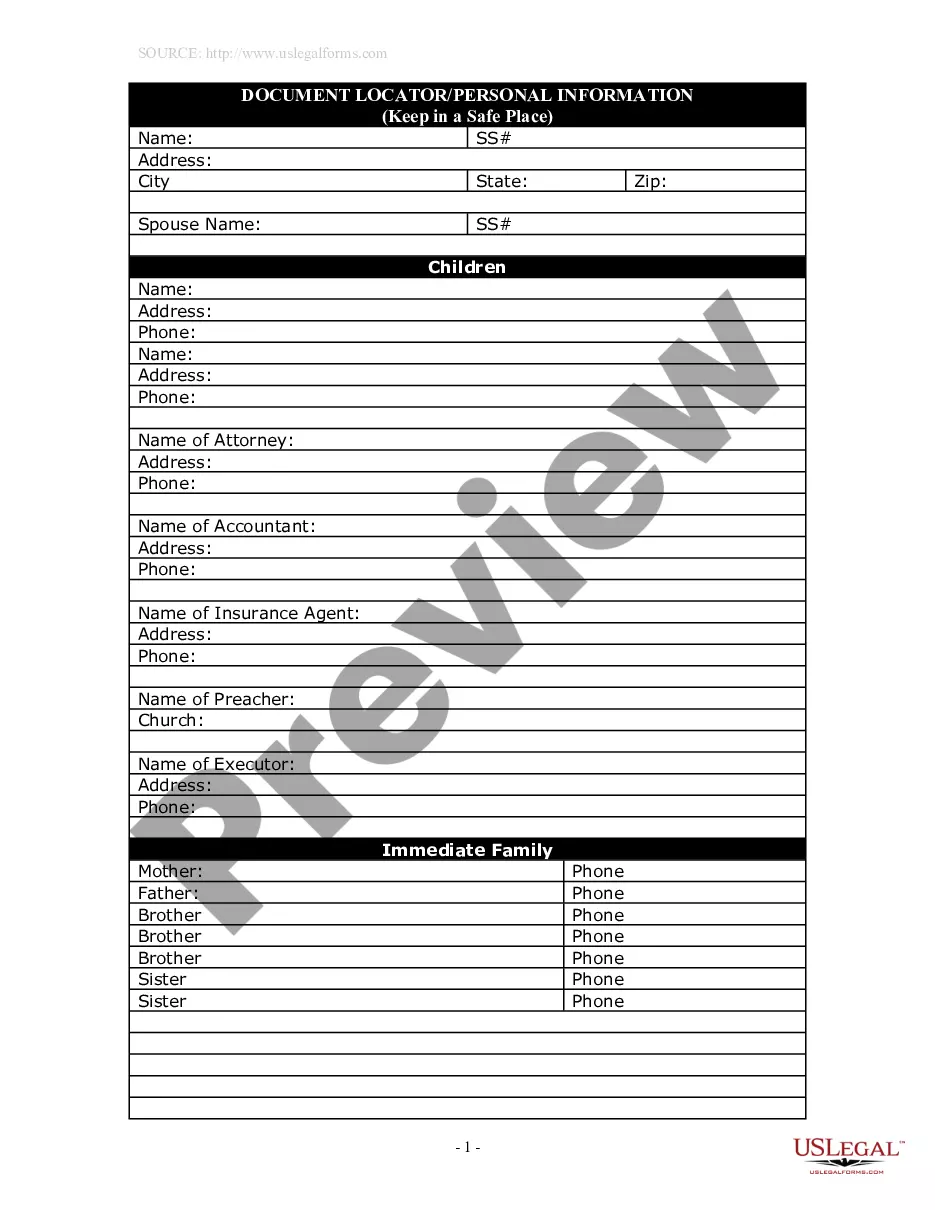

- Take advantage of the Preview button to review the shape.

- See the information to actually have chosen the appropriate kind.

- In the event the kind is not what you`re trying to find, make use of the Research discipline to find the kind that suits you and demands.

- Whenever you get the proper kind, just click Purchase now.

- Pick the costs strategy you want, submit the necessary info to create your bank account, and pay for an order using your PayPal or charge card.

- Decide on a convenient document structure and acquire your copy.

Discover every one of the papers layouts you possess bought in the My Forms food list. You can get a further copy of Nevada Fast Packet Services Payment Plan Agreement whenever, if possible. Just select the needed kind to acquire or produce the papers design.

Use US Legal Forms, one of the most considerable variety of legitimate types, to conserve time as well as stay away from faults. The support gives expertly manufactured legitimate papers layouts that you can use for an array of uses. Generate your account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

In place of my regular monthly payment of $__________due on the__________________________. I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible.

Contact your creditors by phone, email or letter to tell them about your situation and to make an offer to pay the amount you can afford. It's recommended to send a written copy even if you come to agreement over the phone. Use our template letter for your creditors to contact them about debt repayment plans.

Let's look at a quick example to illustrate the nature of a payment agreement. Person A (the debtor) borrows $5,000 from person B (the creditor). Both parties agree that person A must pay person B $1,000 a month over five months to repay the debt.

Including a clear description of the payment plan Clearly state the date the payment plan agreement is being created. List the full names of the parties involved in the agreement. Provide an itemized list of the payments that need to be made, including the payment amount and due date for each payment.

Explain the schedule of payments. You should include the date the loan will be paid in full. You also might want to attach to your payment agreement a schedule listing when monthly payments are due. On your schedule, list the day of each payment and the amount that the borrower should pay.

A Payment Agreement is a contract to repay a loan. Payment Agreements outline the important terms and conditions of a loan and help to document money that is owed to you or money that you owe to someone else.

How do you write a letter of agreement between two parties? Make sure you detail the specifics of the loan, from the name and address of the debtor and lender to the amount loaned, payment method, and terms of the agreement. Both parties will need to sign the agreement as a way to acknowledge its validity.

A Payment Agreement is a document you can use to outline the terms and conditions of a loan. You may use it instead of a Loan Agreement or alongside that document to ensure both parties are clear on their obligations regarding the repayment of a loan. Payment Agreements are legally binding documents.