Nevada Disclaimer of Inheritance Rights for Stepchildren

Description

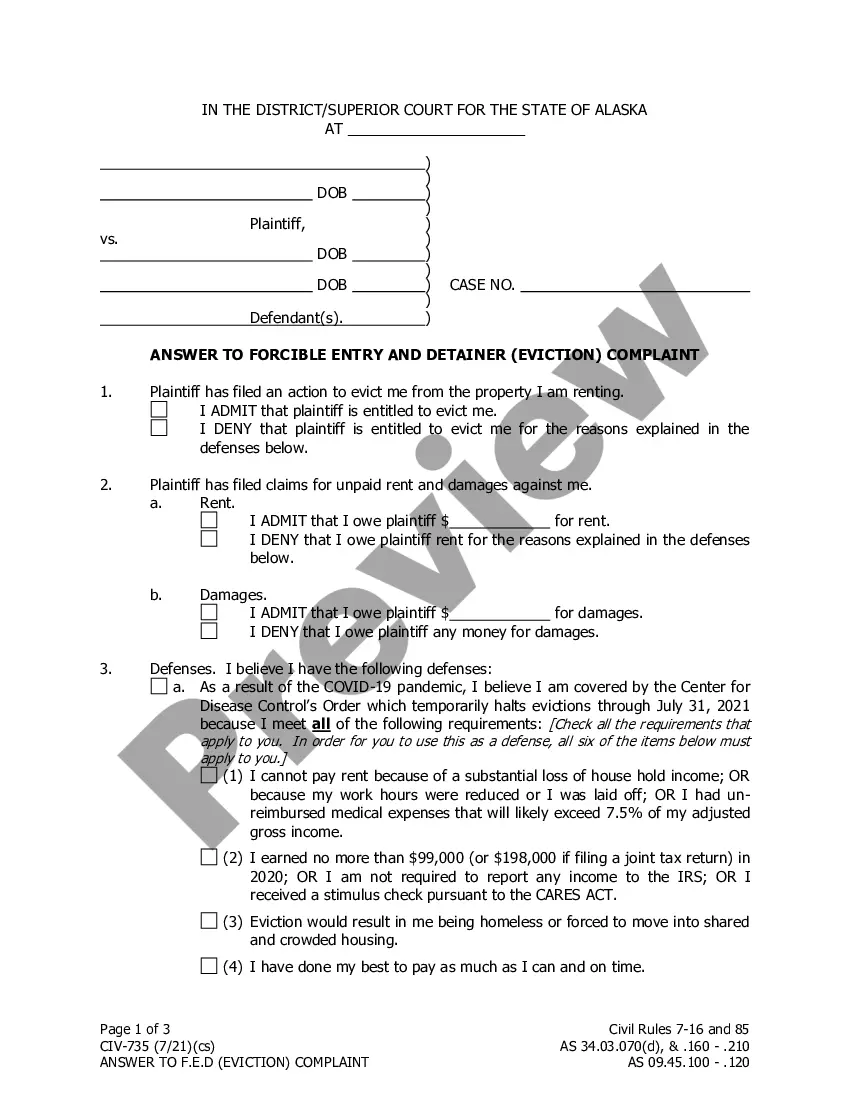

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

You are able to spend hours on-line looking for the authorized papers design which fits the state and federal specifications you need. US Legal Forms offers a large number of authorized varieties which are examined by specialists. It is possible to download or print out the Nevada Disclaimer of Inheritance Rights for Stepchildren from our service.

If you currently have a US Legal Forms account, it is possible to log in and click on the Acquire button. After that, it is possible to full, modify, print out, or indication the Nevada Disclaimer of Inheritance Rights for Stepchildren. Each authorized papers design you purchase is the one you have for a long time. To get an additional duplicate for any purchased form, proceed to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms web site initially, follow the basic instructions beneath:

- Initially, make sure that you have chosen the best papers design to the state/city of your choice. Browse the form information to make sure you have selected the correct form. If accessible, take advantage of the Preview button to look through the papers design as well.

- If you want to discover an additional model of the form, take advantage of the Search discipline to get the design that meets your needs and specifications.

- Upon having identified the design you need, click Purchase now to continue.

- Choose the prices plan you need, enter your accreditations, and register for your account on US Legal Forms.

- Full the purchase. You can use your bank card or PayPal account to pay for the authorized form.

- Choose the formatting of the papers and download it for your gadget.

- Make modifications for your papers if necessary. You are able to full, modify and indication and print out Nevada Disclaimer of Inheritance Rights for Stepchildren.

Acquire and print out a large number of papers themes while using US Legal Forms site, which provides the largest assortment of authorized varieties. Use professional and condition-particular themes to take on your business or individual needs.

Form popularity

FAQ

Generally speaking, if you are unmarried and die intestate in Nevada and have children, your children will inherit your estate in equal shares. If you die with no children but with living parents, your estate will pass on to your parents. If your parents are not alive, the estate then goes to your siblings.

Spouses in Nevada Inheritance Law In Nevada, intestate deaths can be tricky, since Nevada is a community property state. This means that spouses each own half of any assets received during the marriage. This supersedes who actually paid for the property or whose name is on the deed.

Step-siblings would only fit into sibling intestate succession if they were legally adopted by the parent of the decedent, thus having become their legal sibling. Usually, siblings will each be given an equal share of the Estate through probate court.

Legal definition of a ?survival? action in Nevada Sometimes accident victims die before they can bring ? or finish prosecuting ? a personal injury lawsuit. If this happens, Nevada's ?survival? laws under NRS 41.100 permit the deceased plaintiff's estate to take over fighting the case and recover any damages.

If there are no surviving children, grandchildren or great-grandchildren, the partner will inherit: all the personal property and belongings of the person who has died and. the whole of the estate with interest from the date of death.

Only about a third of all states have laws specifying that assets owned by the deceased are automatically inherited by the surviving spouse. In the remaining states, the surviving spouse may inherit between one-third and one-half of the assets, with the remainder divided among surviving children, if applicable.

Is an inheritance community property in Nevada? No, an inheritance is not considered community property in Nevada. An inheritance is instead considered separate property, along with any gift or personal injury award received during the marriage.