Nevada Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

Discovering the right legitimate document format can be quite a struggle. Of course, there are tons of web templates accessible on the Internet, but how would you obtain the legitimate form you require? Make use of the US Legal Forms web site. The service offers a huge number of web templates, like the Nevada Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust, that can be used for enterprise and private demands. All the kinds are checked out by pros and meet up with state and federal needs.

In case you are previously registered, log in in your accounts and click the Down load switch to obtain the Nevada Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. Utilize your accounts to search with the legitimate kinds you might have acquired formerly. Visit the My Forms tab of the accounts and have yet another duplicate from the document you require.

In case you are a fresh customer of US Legal Forms, listed below are basic guidelines that you should stick to:

- First, be sure you have chosen the proper form for the area/region. You may check out the form utilizing the Preview switch and browse the form explanation to guarantee this is the best for you.

- If the form is not going to meet up with your needs, make use of the Seach area to obtain the right form.

- Once you are certain that the form is acceptable, select the Purchase now switch to obtain the form.

- Select the costs program you want and enter the needed info. Make your accounts and pay money for the order with your PayPal accounts or bank card.

- Choose the submit formatting and down load the legitimate document format in your gadget.

- Full, edit and print out and indicator the obtained Nevada Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

US Legal Forms may be the biggest local library of legitimate kinds in which you can see numerous document web templates. Make use of the company to down load skillfully-made files that stick to status needs.

Form popularity

FAQ

Who Gets What in Nevada? If you die with:here's what happens:children but no spouse, parents, or siblingschildren inherit everythingspouse but no children, parents, or siblingsspouse inherits everythingparents but no children, spouse, or siblingsparents inherit everything5 more rows

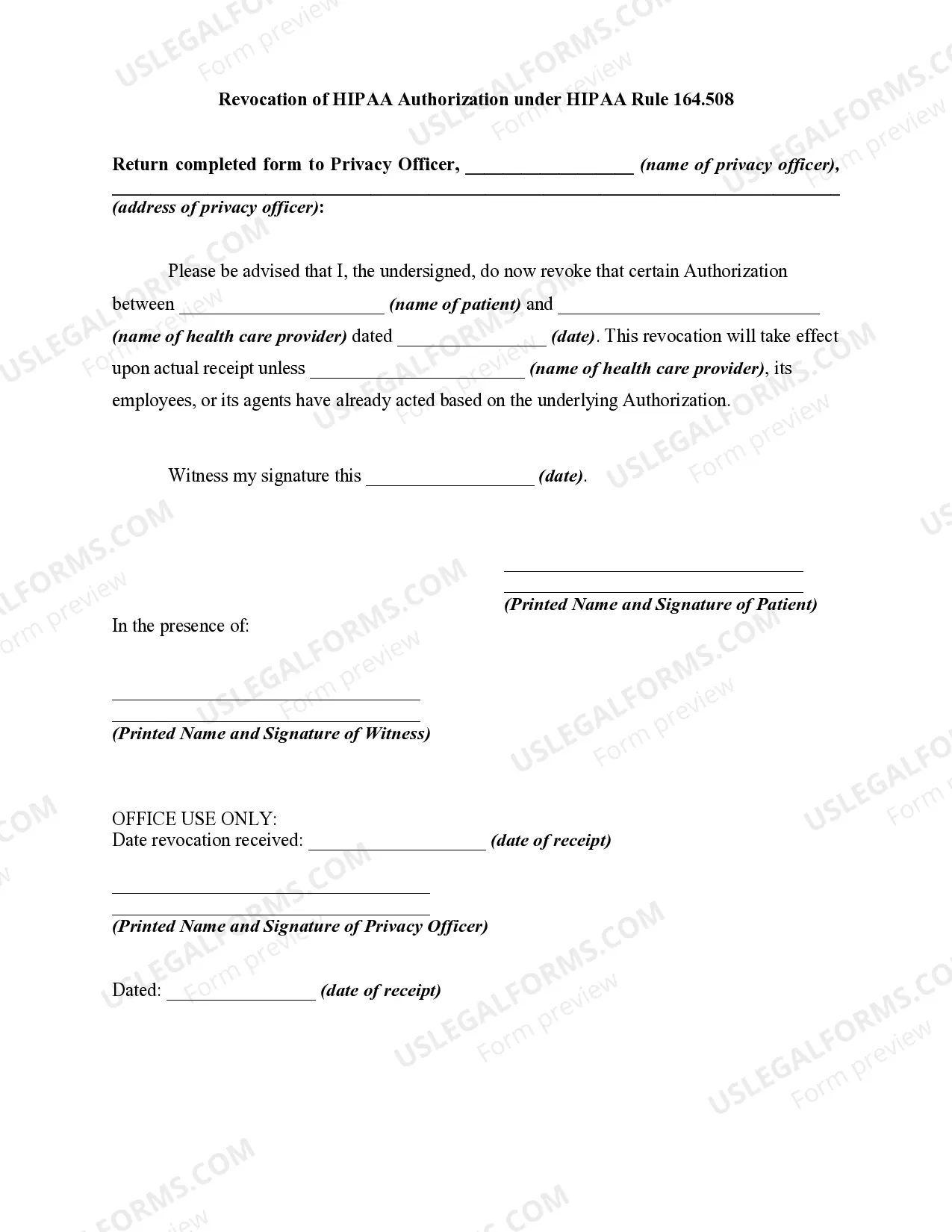

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

To receive inheritance money, you must provide documentation to the executor. It may include a copy of the will or trust, a death certificate, and proof of identity. The executor may also require additional documentation, such as a letter from a financial institution or a tax return.

It's important to understand that a parent has the legal ability to disinherit any child anytime they want, for any reason they want.

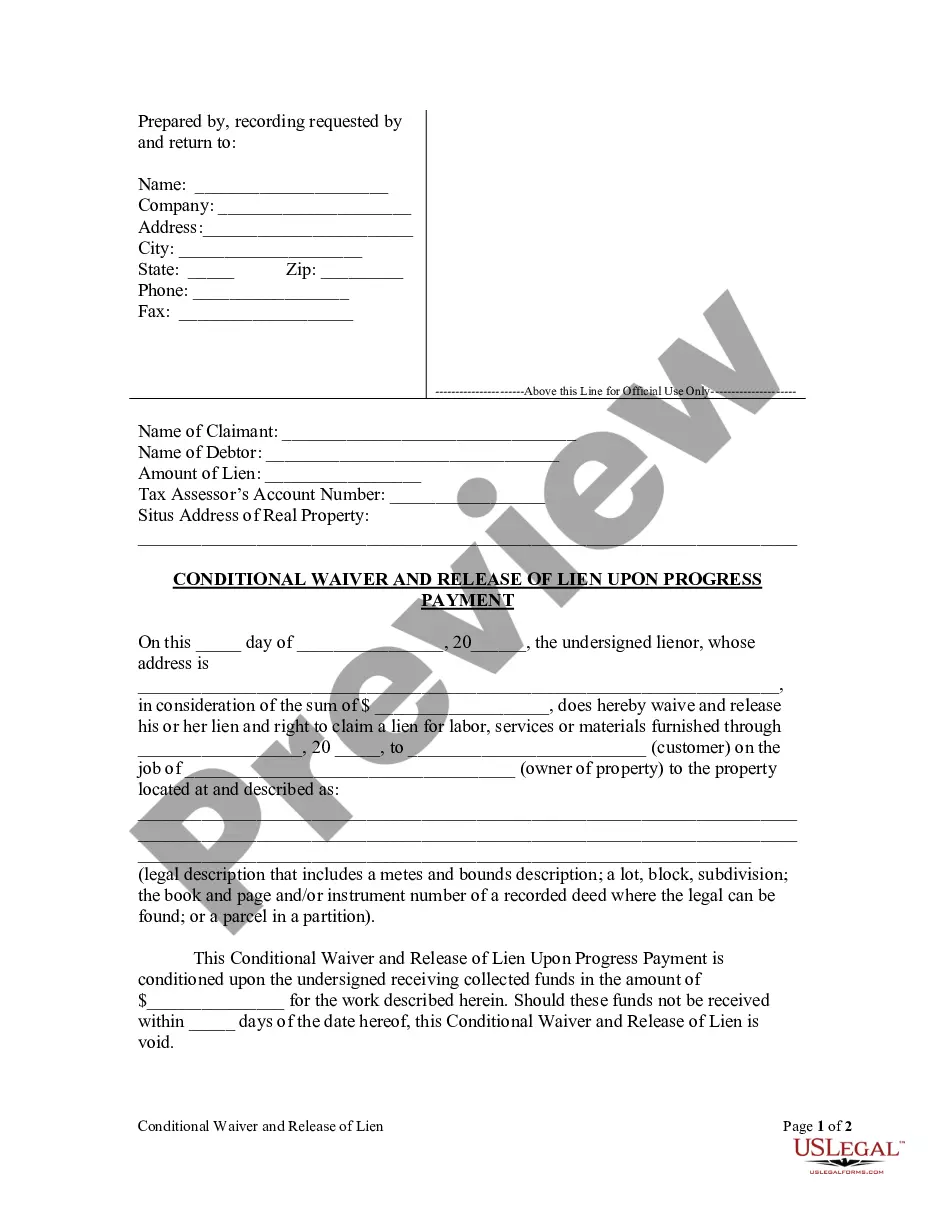

Trusts can be used in estate planning to give individuals and couples greater control over how assets are transferred to heirs with the fewest tax consequences. Sometimes, however, disclaiming assets makes the most sense. No special form or document must be completed to disclaim inherited assets.

For example, in her will a decedent leaves $500,000 to her nephew if he survives her, but if he does not survive her, this amount passes to her nephew's children who survive the decedent. If the nephew disclaims the property, it passes to his children who survive the decedent.