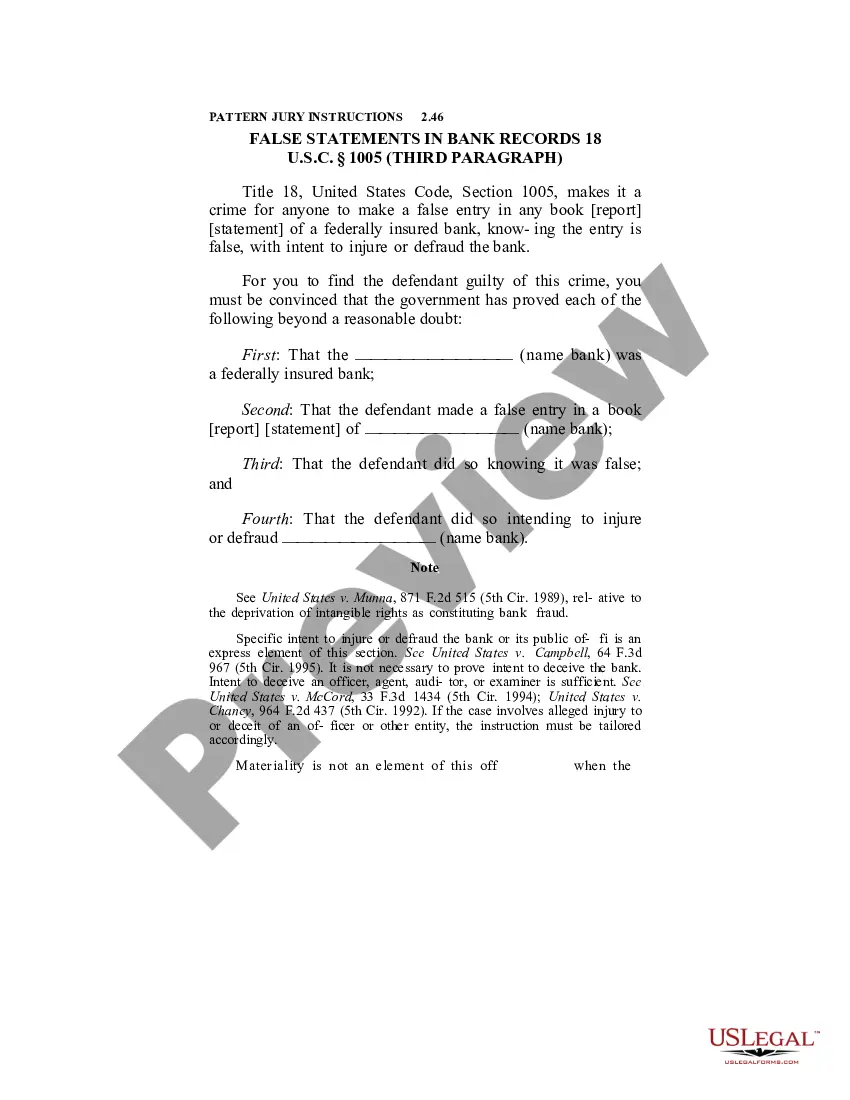

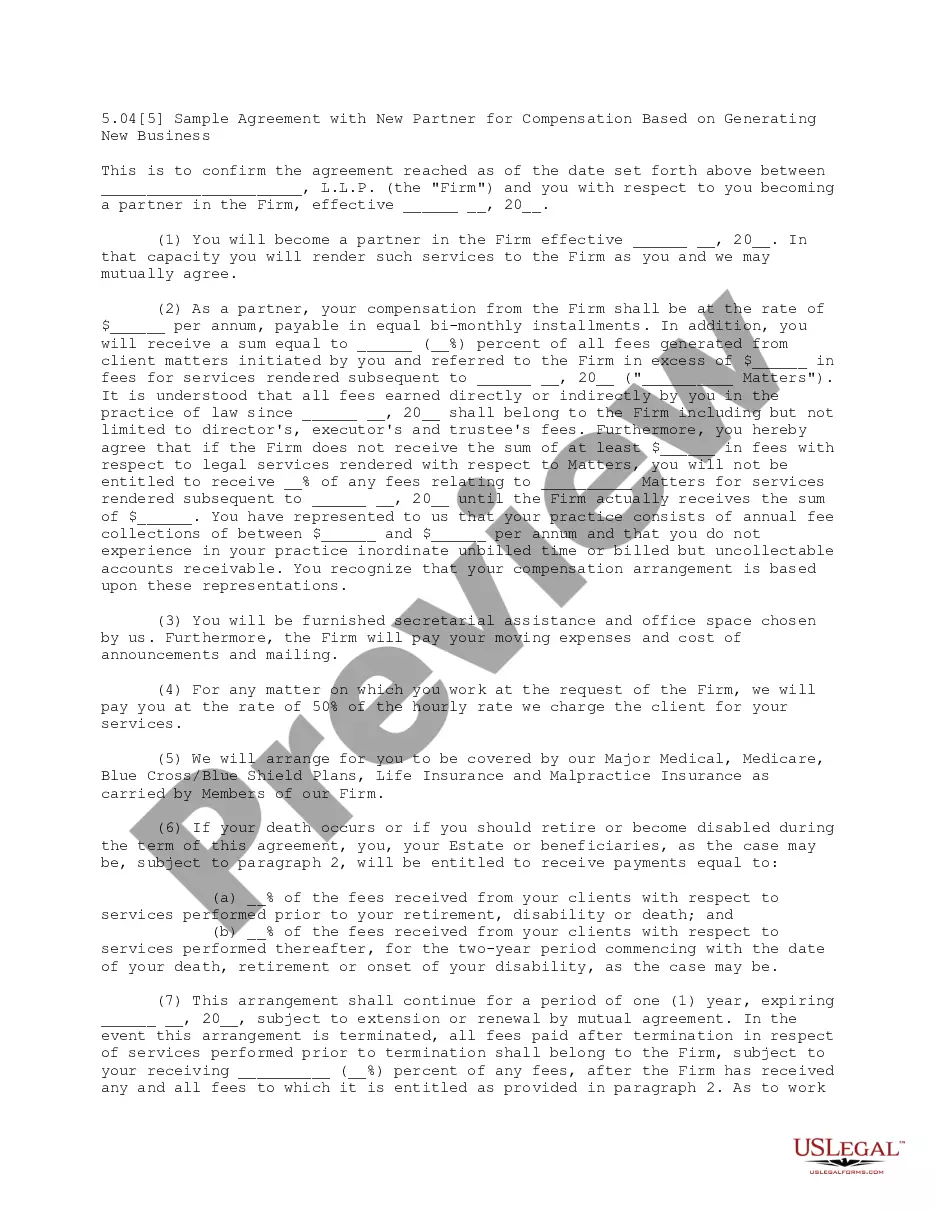

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

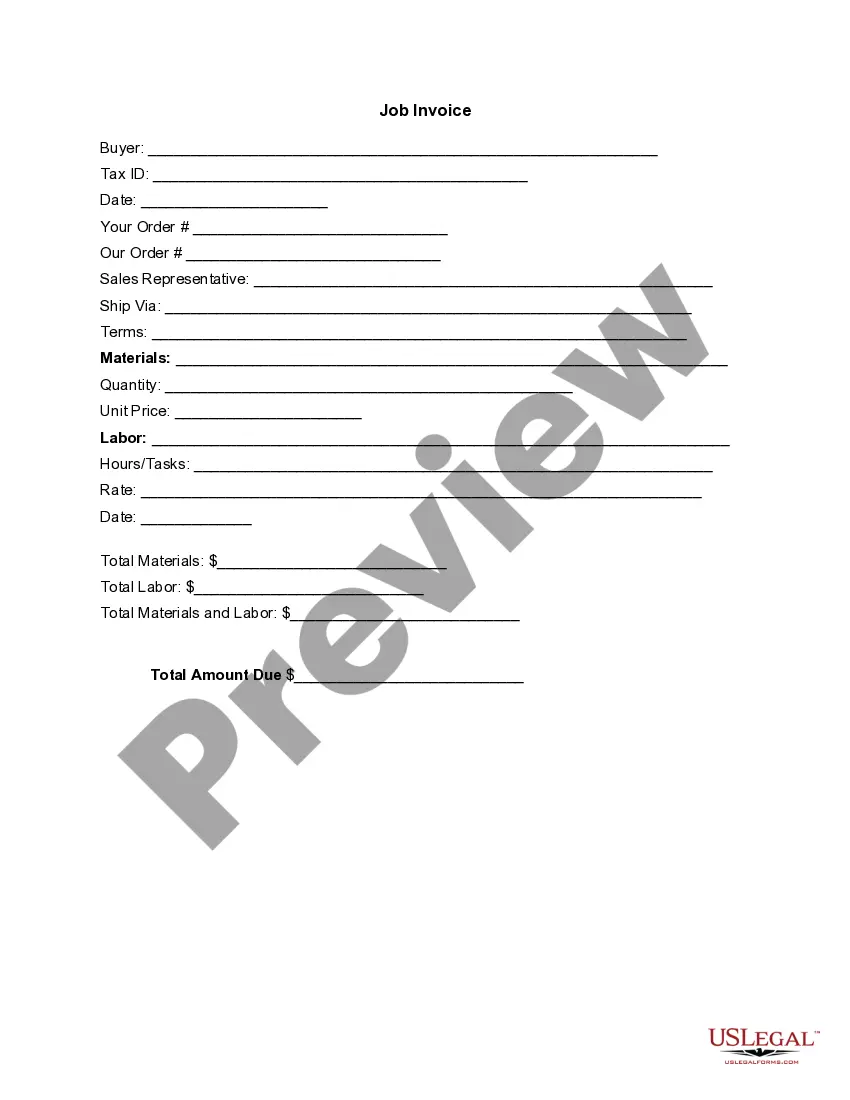

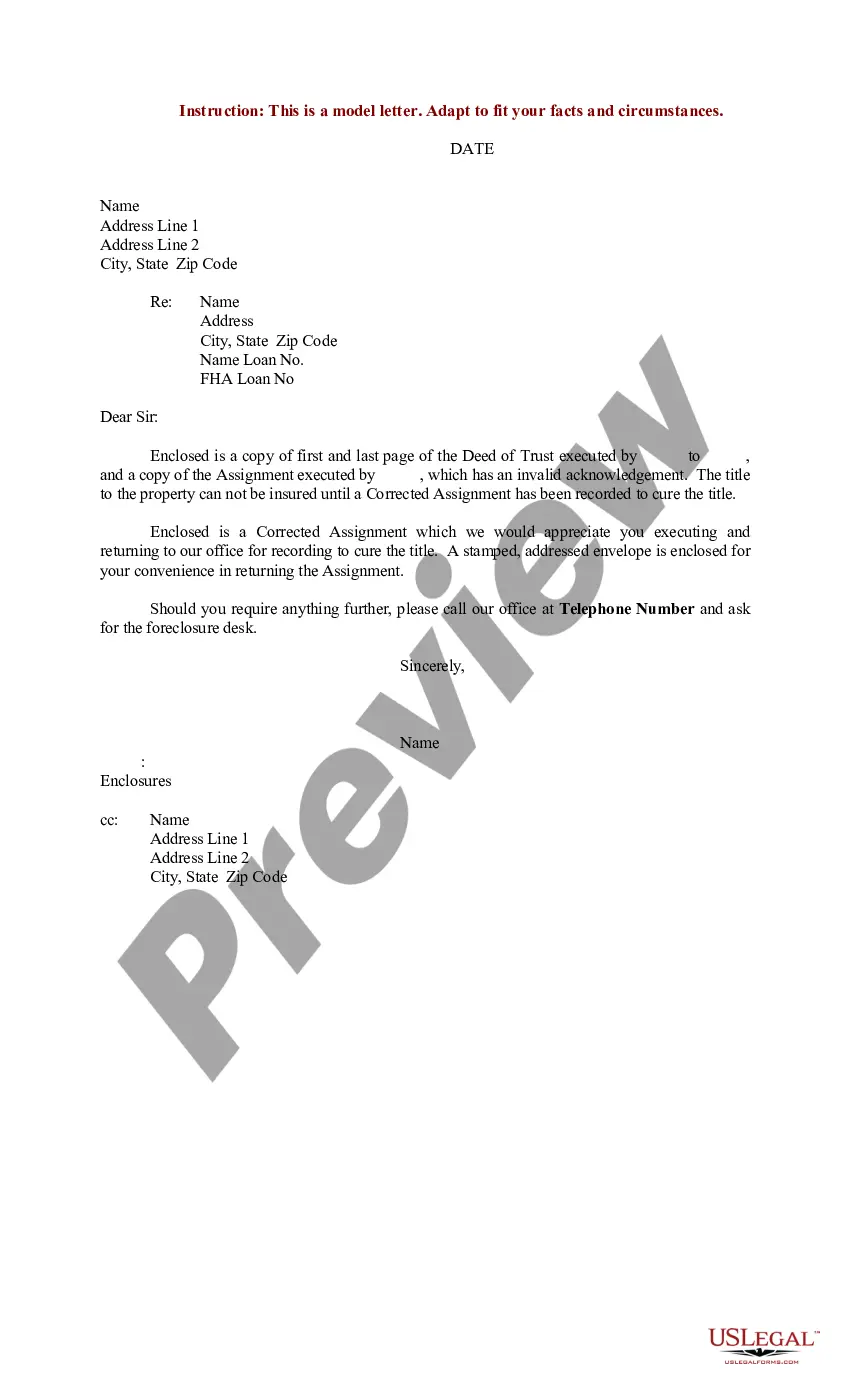

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

Are you presently in a circumstance where you need documentation for either business or personal purposes almost constantly.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers thousands of form templates, including the Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust, which can be created to meet federal and state requirements.

Select the payment plan you desire, input the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have a free account, simply Log In.

- Then, you can download the Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct area/state.

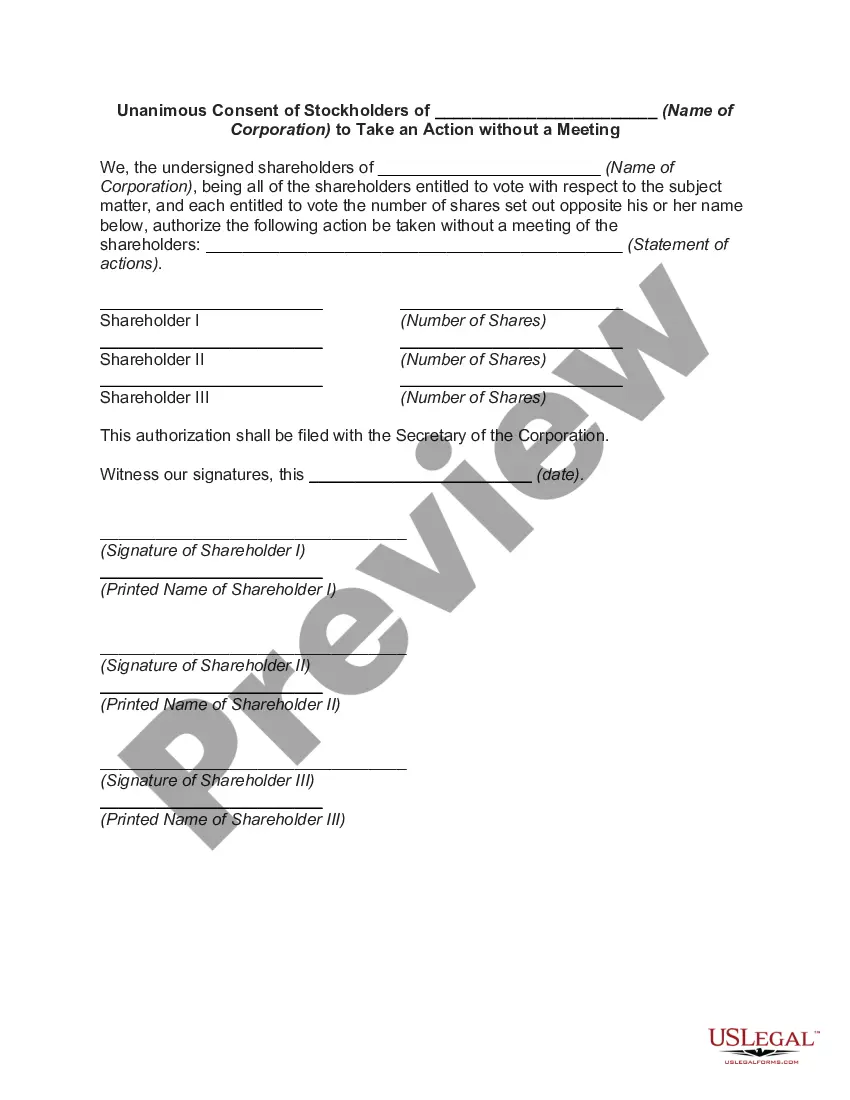

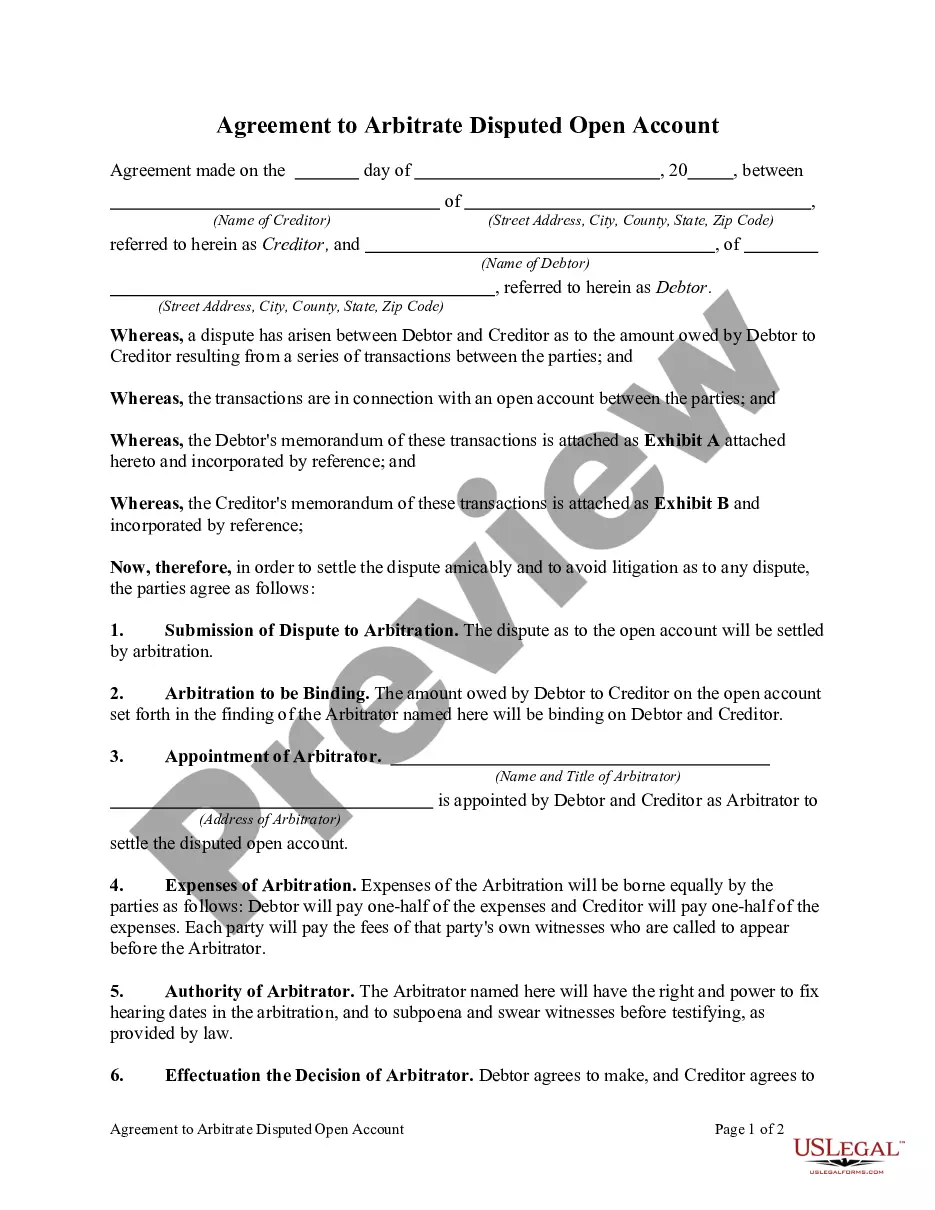

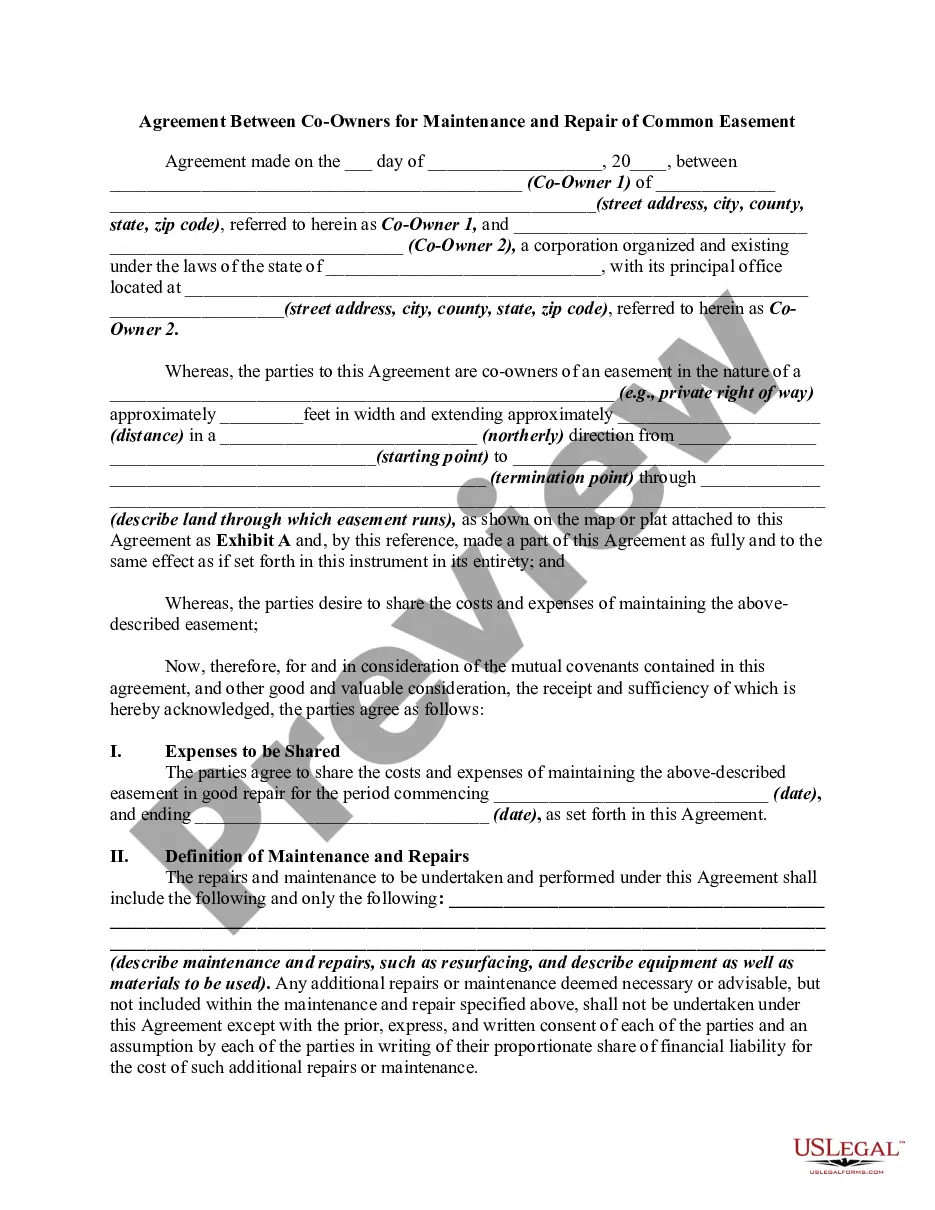

- Utilize the Preview button to review the form.

- Examine the information to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search section to locate the form that meets your needs.

- Once you find the correct form, just click Purchase now.

Form popularity

FAQ

Yes, trust income is typically taxable to the beneficiaries who receive it, depending on the trust's structure and the type of income generated. Beneficiaries may need to report this income on their personal tax returns. If you are considering a Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust, consulting a tax professional can be beneficial to ensure compliance with tax obligations.

Net income in a trust generally refers to the total income earned by the trust after expenses and deductions are accounted for. This includes earnings from investments minus any costs associated with managing those assets. If you're exploring options like a Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust, understanding net income will help shape your decisions regarding distributions and tax implications.

A beneficiary is any individual or entity that benefits from a trust, while an income beneficiary specifically receives income generated by the trust’s assets. In many cases, all income beneficiaries are beneficiaries, but not all beneficiaries necessarily receive income. When dealing with a Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust, it's important to clarify these roles to avoid potential confusion regarding rights and distributions.

Beneficiary income of a trust refers to the earnings or distributions that a beneficiary receives from the trust's assets. This income can come from various sources, such as investments, real estate, or business interests held within the trust. Understanding how this income works is crucial, especially with a Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust, as it may impact tax considerations and distribution planning.

The current income beneficiary of a trust is the individual or entity entitled to receive income generated by the trust’s assets during a specific time. This income can include interest, dividends, or other earnings. In the context of a Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust, the current beneficiary can assign a portion of their income share to another party, which can be a strategic financial decision.

Distributing trust income to beneficiaries generally requires following the specific guidelines set forth in the trust document. This may include making specific payments to each beneficiary based on the Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust. It's crucial to document each distribution accurately to maintain transparency and fulfill legal obligations. If you have concerns about the process, consider using USLegalForms for assistance in managing distributions effectively.

To report a beneficiary income, you typically need to gather the relevant financial documents and forms associated with the trust. This process often includes filing IRS Form 1041, where you will declare the Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust. Make sure to keep accurate records of any distributions received by beneficiaries to ensure compliance. Consulting a tax professional can provide clarity on the reporting process.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly outline the terms and conditions. This lack of clarity can lead to confusion among beneficiaries, especially when it comes to the Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust. To avoid disputes, parents should communicate their intentions and consider legal guidance. Utilizing platforms like USLegalForms can help ensure the trust is properly established and the terms are well-defined.

Beneficiaries in Nevada enjoy several rights, including the right to receive information about the trust and the right to distributions as defined in the trust document. Additionally, beneficiaries can request an accounting of trust assets and activities. By understanding the Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust, you can better navigate these rights and ensure compliance with legal standards.

Yes, beneficiaries generally have the right to view the trust document in Nevada. This right allows you to understand your interests and the terms governing the trust. Exploring how the Nevada Assignment by Beneficiary of a Percentage of the Income of a Trust affects this right can provide you with further clarity and peace of mind.