Exemption From Charitable Solicitation Registration Statement (for Out-of-State Charitable Organizations Not Required to Register to Do Business in Nevada) is a document issued by the Nevada Secretary of State that allows charitable organizations conducting activities in the state but not registered to do business in Nevada to be exempt from the requirement to obtain a charitable solicitation registration statement. This exemption is for out-of-state charitable organizations that are not required to register to do business in Nevada. There are three types of Exemption From Charitable Solicitation Registration Statement (for Out-of-State Charitable Organizations Not Required to Register to Do Business in Nevada): 1. The federal tax exemption. This exemption applies to organizations that have been recognized by the Internal Revenue Service (IRS) as tax-exempt under the federal tax code, and are not required to register to do business in Nevada. 2. The state tax exemption. This exemption applies to organizations that have been recognized by the Nevada Department of Taxation as exempt from the Nevada state sales and use tax, and are not required to register to do business in Nevada. 3. The religious exemption. This exemption applies to organizations that are exempt from the requirement to obtain a charitable solicitation registration statement under Nevada law due to their religious nature.

Exemption From Charitable Solicitation Registration Statement (for Out-of-State Charitable Organizations Not Required to Register to Do Business in Nevada)

Description

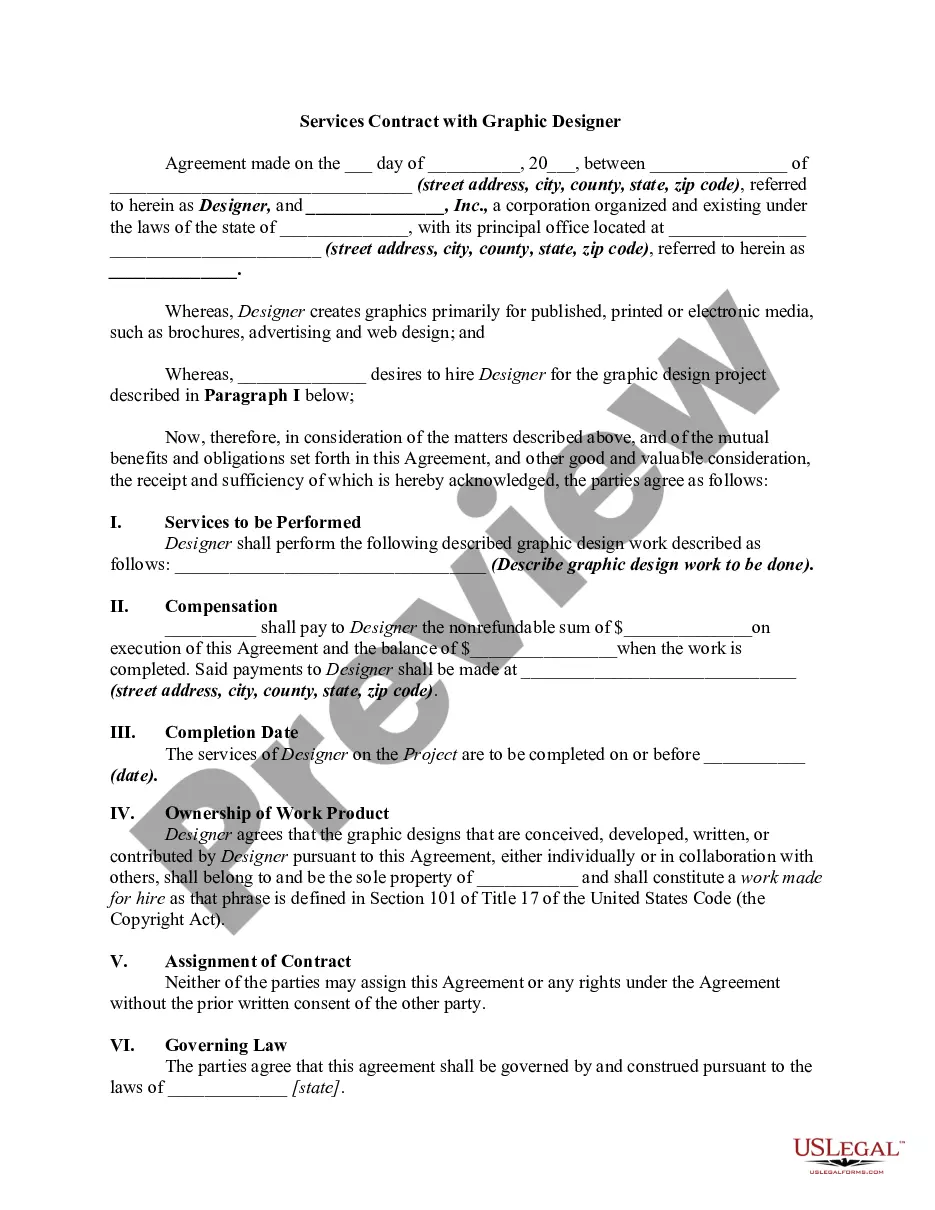

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Exemption From Charitable Solicitation Registration Statement (for Out-of-State Charitable Organizations Not Required To Register To Do Business In Nevada)?

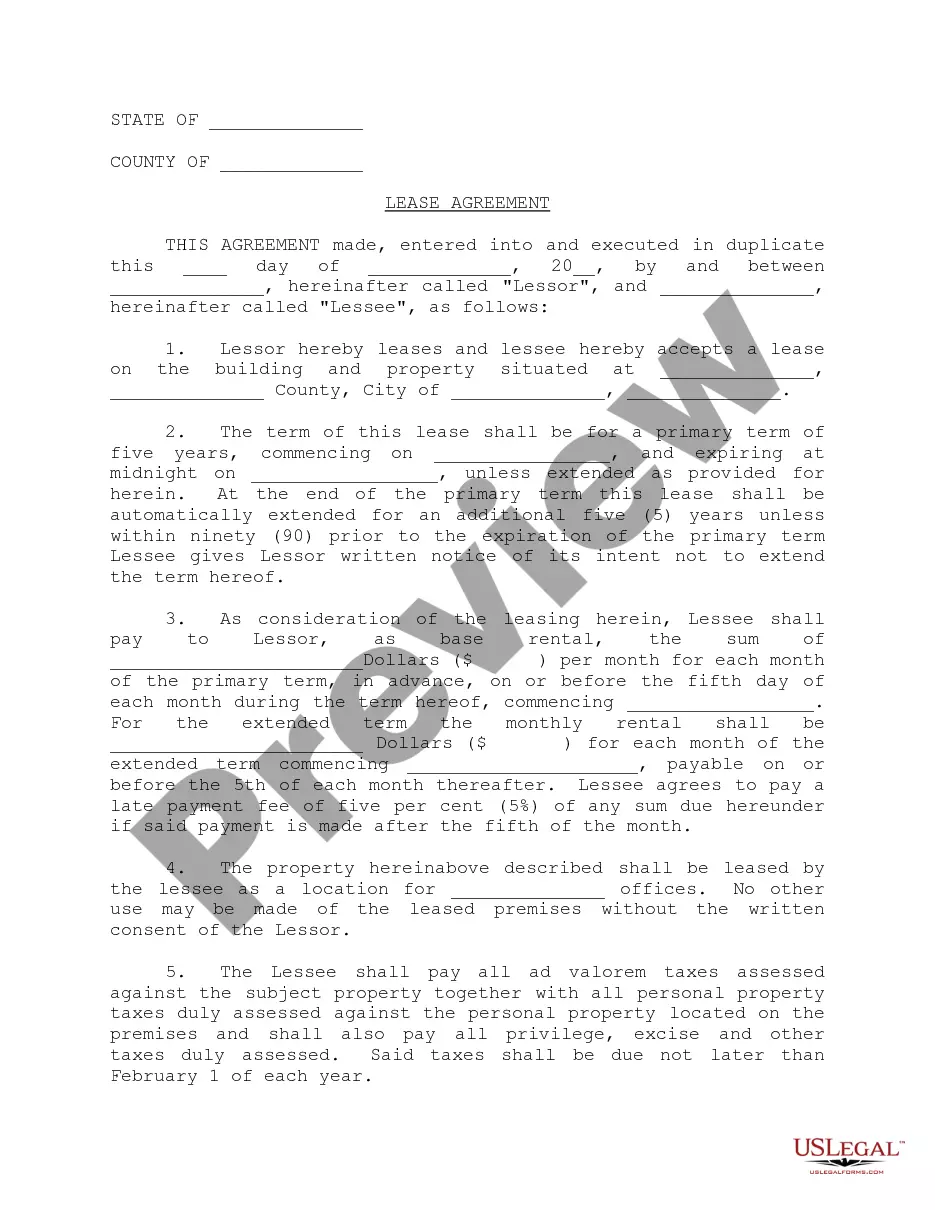

Dealing with legal documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Exemption From Charitable Solicitation Registration Statement (for Out-of-State Charitable Organizations Not Required to Register to Do Business in Nevada) template from our service, you can be sure it complies with federal and state laws.

Working with our service is simple and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to get your Exemption From Charitable Solicitation Registration Statement (for Out-of-State Charitable Organizations Not Required to Register to Do Business in Nevada) within minutes:

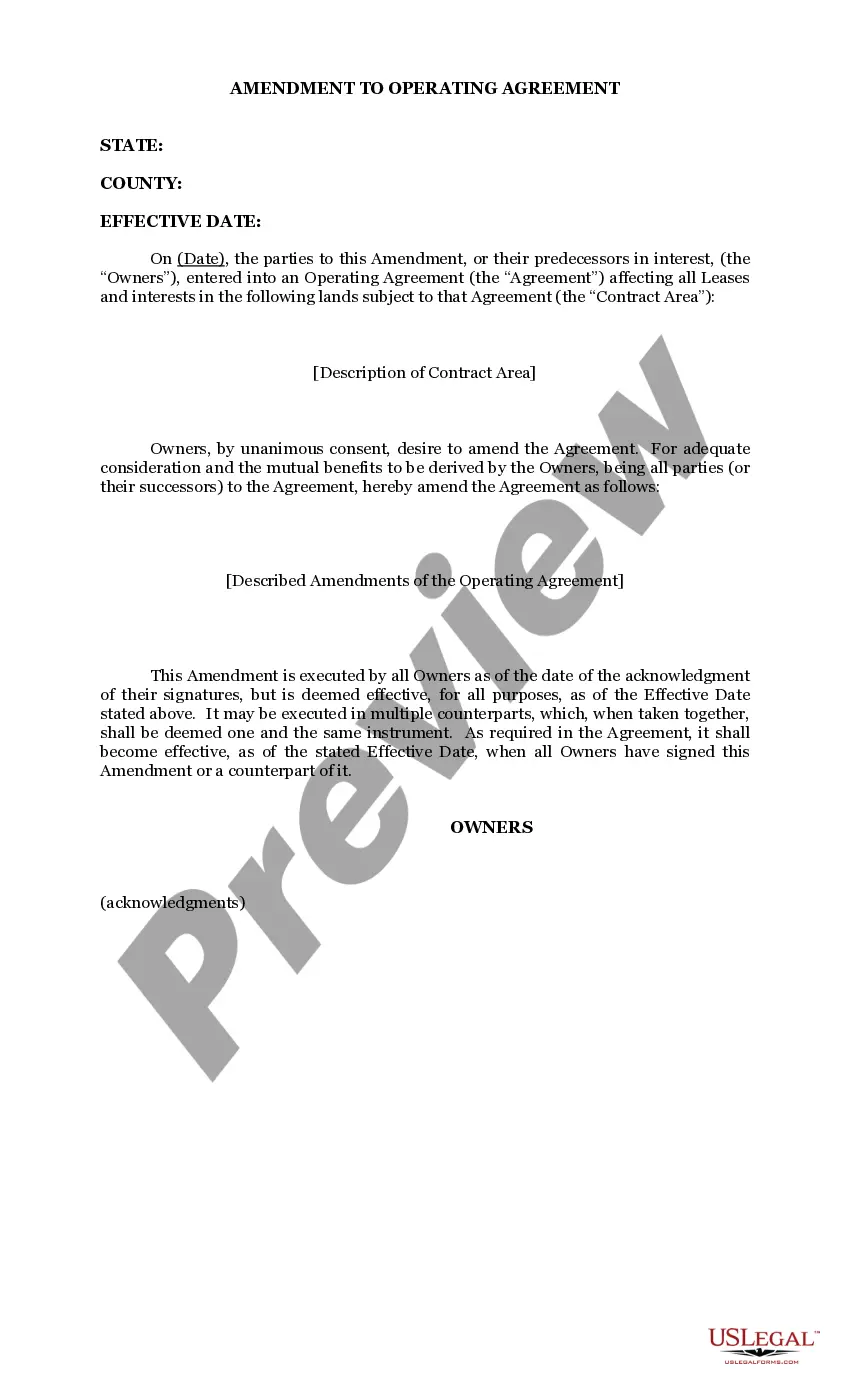

- Make sure to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Exemption From Charitable Solicitation Registration Statement (for Out-of-State Charitable Organizations Not Required to Register to Do Business in Nevada) in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Exemption From Charitable Solicitation Registration Statement (for Out-of-State Charitable Organizations Not Required to Register to Do Business in Nevada) you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Charitable Trustees 14 In California, any individual or organization that solicits charitable funds is considered a ?charitable trustee? or ?trustee for charitable purpose,?15 and is accountable for such funds.

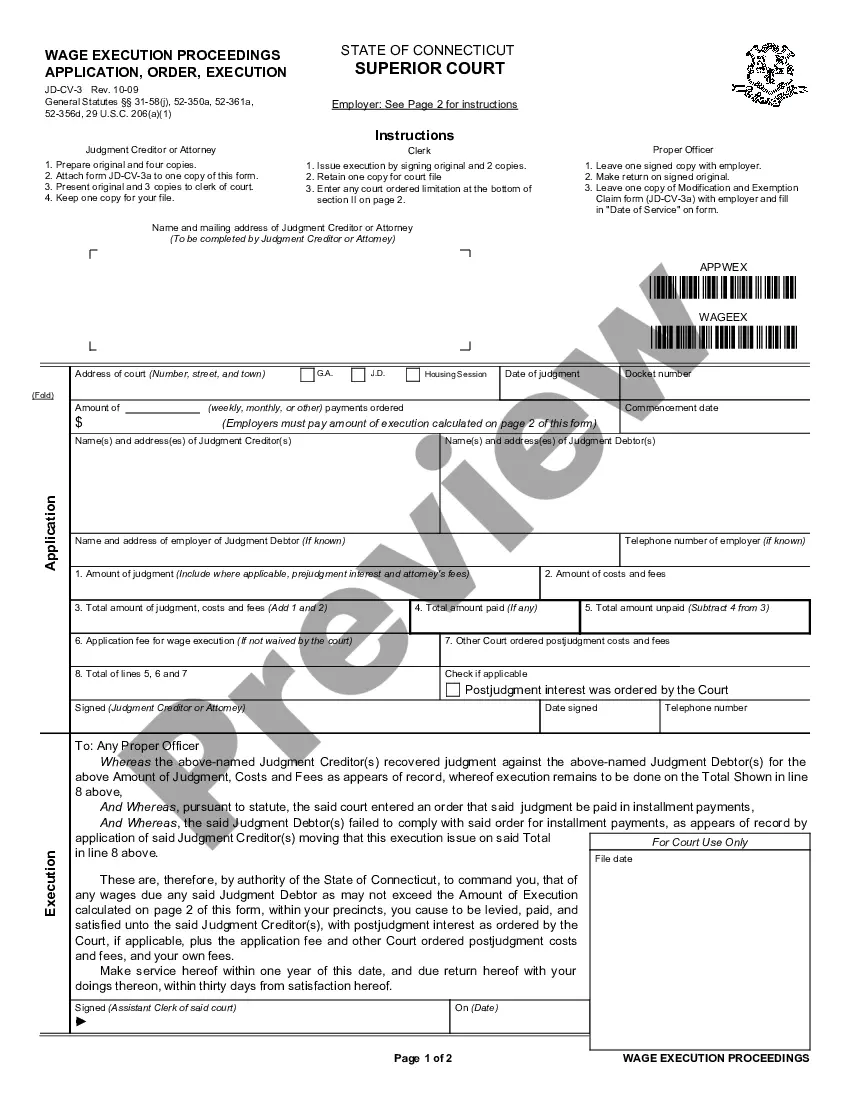

Approximately 40 states have enacted charitable solicitation statutes. Although specifics vary, state statutes usually require organizations to register with the state before they solicit the state's residents for contributions.

Under California law, a ?solicitation for charitable purposes? means any request for a gift of money or property in connection with which (i) any appeal is made for charitable purposes, (ii) the name of a charity is used or referred to in the appeal as an inducement for making a gift, or (iii) any statement is made

Every charitable corporation, unincorporated association, and trustee doing business in or holding property in California is required to register with the Attorney General's Registry of Charitable Trusts within 30 days of receiving charitable assets.

The Attorney General regulates charities and the professional fundraisers who solicit on their behalf. The purpose of this oversight is to protect charitable assets for their intended use and ensure that the charitable donations contributed by Californians are not misapplied and squandered through fraud or other means.

For your California charity registration, you fill out and submit CT-1 Form, (Initial Registration Form) to the office of the Attorney General, Registry of Charitable Trusts. Attach copies of your articles of incorporation and bylaws. There is a $25 registration fee.

How to Start a Nonprofit in Nevada Name Your Organization.Choose a Nevada nonprofit corporation structure.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.

Charitable Organizations must register with the Nevada Secretary of State's office before soliciting charitable contributions in Nevada.