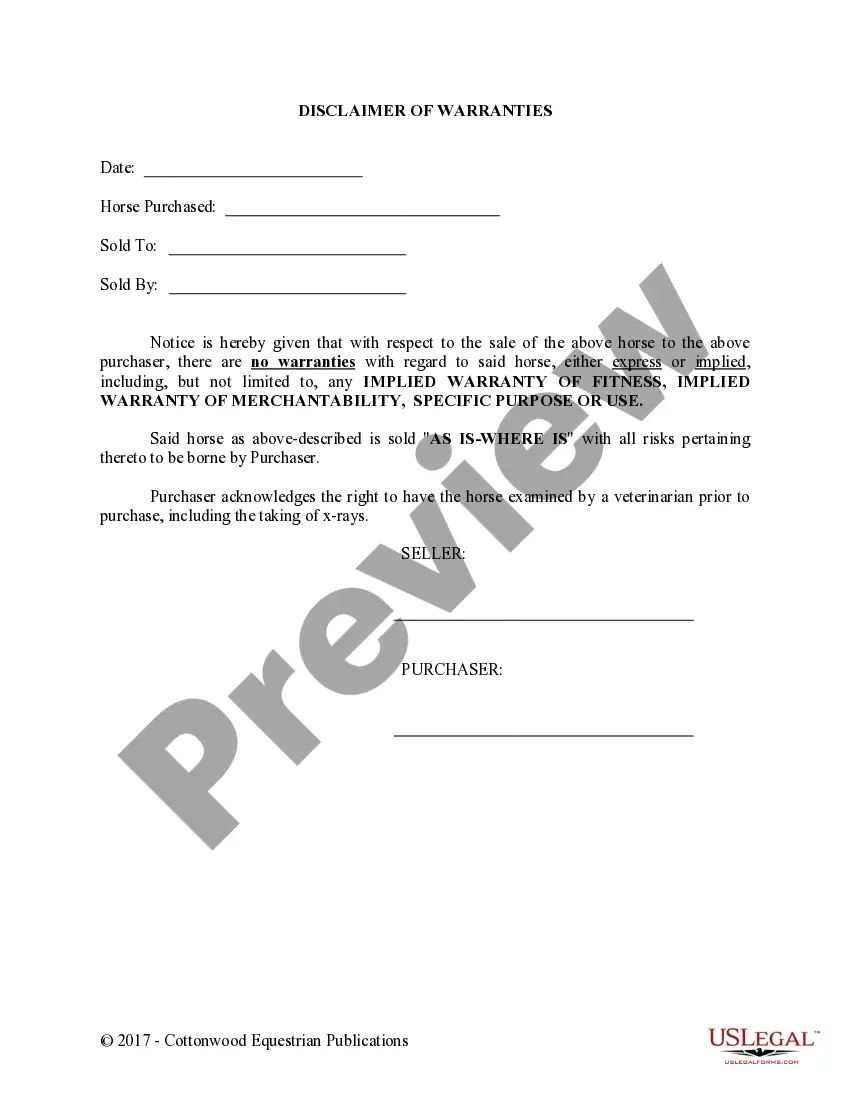

Nevada Disclaimer of Warranties - Horse Equine Forms

Description

How to fill out Nevada Disclaimer Of Warranties - Horse Equine Forms?

US Legal Forms is a special platform to find any legal or tax document for filling out, including Nevada Disclaimer of Warranties - Horse Equine Forms. If you’re sick and tired of wasting time seeking appropriate samples and paying money on record preparation/lawyer charges, then US Legal Forms is exactly what you’re searching for.

To reap all of the service’s advantages, you don't need to install any software but simply choose a subscription plan and sign up an account. If you already have one, just log in and get an appropriate template, save it, and fill it out. Downloaded files are all saved in the My Forms folder.

If you don't have a subscription but need to have Nevada Disclaimer of Warranties - Horse Equine Forms, take a look at the recommendations listed below:

- Double-check that the form you’re taking a look at is valid in the state you need it in.

- Preview the form its description.

- Click on Buy Now button to get to the sign up page.

- Select a pricing plan and keep on signing up by entering some info.

- Choose a payment method to finish the sign up.

- Save the document by selecting your preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are uncertain regarding your Nevada Disclaimer of Warranties - Horse Equine Forms template, contact a lawyer to examine it before you decide to send or file it. Begin without hassles!

Form popularity

FAQ

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

Disclaim Inheritance, DefinitionDisclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

A disclaimer is essentially a refusal of a gift or bequest.Disclaimers typically arise in the context of postmortem estate planning where a beneficiary may desire to make a qualified disclaimer under Sec. 2518 to achieve certain tax results such as qualifying for a marital deduction.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.