New Mexico Certificate of Foreign Limited Partnership

Description

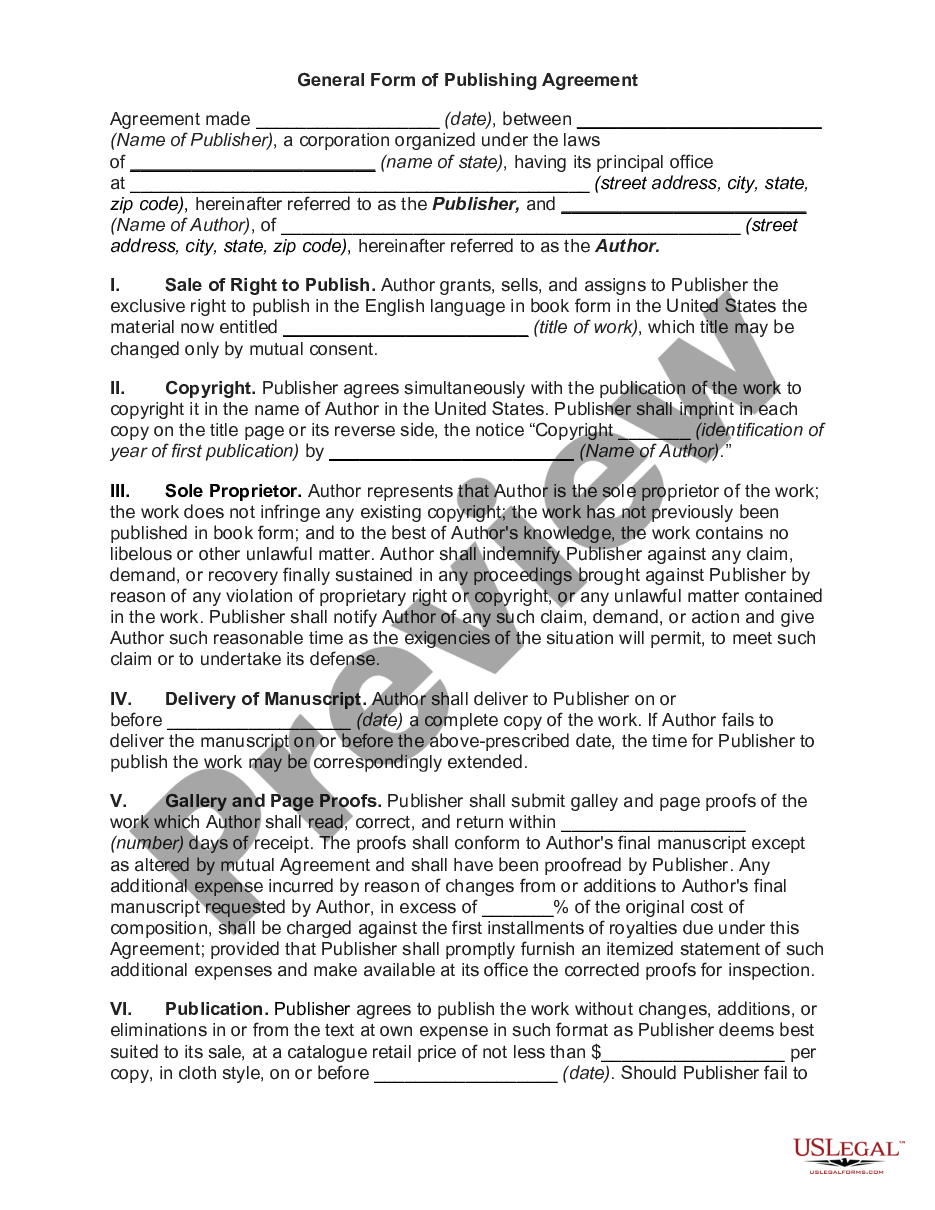

How to fill out Certificate Of Foreign Limited Partnership?

If you want to complete, down load, or printing authorized document themes, use US Legal Forms, the largest selection of authorized varieties, which can be found on the Internet. Make use of the site`s basic and handy look for to find the documents you want. Numerous themes for company and specific reasons are sorted by classes and states, or search phrases. Use US Legal Forms to find the New Mexico Certificate of Foreign Limited Partnership in just a few click throughs.

When you are presently a US Legal Forms buyer, log in to your bank account and click the Acquire button to obtain the New Mexico Certificate of Foreign Limited Partnership. You may also gain access to varieties you earlier acquired from the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have selected the form for your correct city/nation.

- Step 2. Make use of the Review method to examine the form`s articles. Don`t forget to see the explanation.

- Step 3. When you are unhappy with all the type, use the Look for industry on top of the display screen to find other models of your authorized type template.

- Step 4. When you have found the form you want, click on the Purchase now button. Choose the costs program you prefer and add your credentials to sign up to have an bank account.

- Step 5. Process the purchase. You should use your Мisa or Ьastercard or PayPal bank account to accomplish the purchase.

- Step 6. Select the structure of your authorized type and down load it on your own system.

- Step 7. Comprehensive, change and printing or sign the New Mexico Certificate of Foreign Limited Partnership.

Every authorized document template you acquire is the one you have permanently. You possess acces to every single type you acquired inside your acccount. Select the My Forms section and pick a type to printing or down load once more.

Compete and down load, and printing the New Mexico Certificate of Foreign Limited Partnership with US Legal Forms. There are thousands of expert and condition-specific varieties you can utilize to your company or specific requirements.

Form popularity

FAQ

You can get an LLC in New Mexico in 1-3 business days if you file online (and 2-3 weeks if you file by mail).

Maggie Toulouse Oliver - New Mexico Secretary of State.

New Mexico LLC Formation Filing Fee: $50 The fee to file your New Mexico LLC's Articles of Organization is $50. You must file with the New Mexico Secretary of State through the online Business Services Division portal.

Starting an LLC in New Mexico will include the following steps: #1: Name Your New Mexico LLC. #2: Designate a Registered Agent. #3: File Your Articles of Organization. #4: Create an Operating Agreement. #5: Request the Necessary Tax Identification Numbers. #6: Fulfill Annual Obligations.

This means that the LLC doesn't pay taxes; instead, the profits from the LLC pass-through to the taxes of the LLC members. Members will then pay taxes on their share of the LLC's income at the self-employment rate of 15.3% (12.4% for Social Security and 2.9% for Medicare).

? The Uniform Partnership Act has adopted the theory that a partnership is not a legal entity separate and distinct from its membership except for such purposes as keeping partnership accounts, marshalling assets and conveyancing.

Starting an LLC in New Mexico will include the following steps: #1: Name Your New Mexico LLC. #2: Designate a Registered Agent. #3: File Your Articles of Organization. #4: Create an Operating Agreement. #5: Request the Necessary Tax Identification Numbers. #6: Fulfill Annual Obligations.

New Mexico Foreign LLC Registration Register your out-of-state foreign company by filing your Application for Registration with the Secretary of State. The filing fee for a New Mexico Foreign LLC is $100. The state may have additional requirements, so contact the New Mexico Secretary of State for more information.