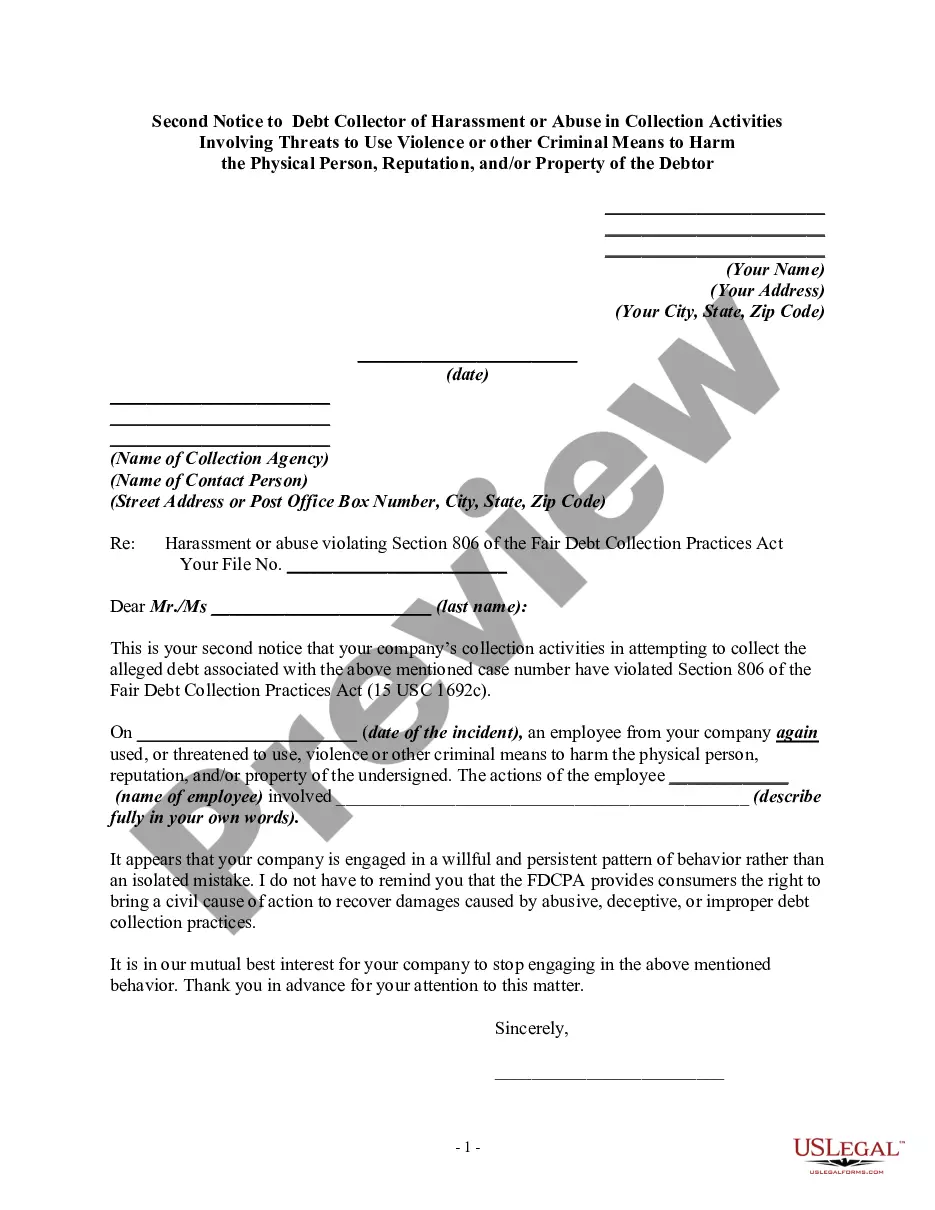

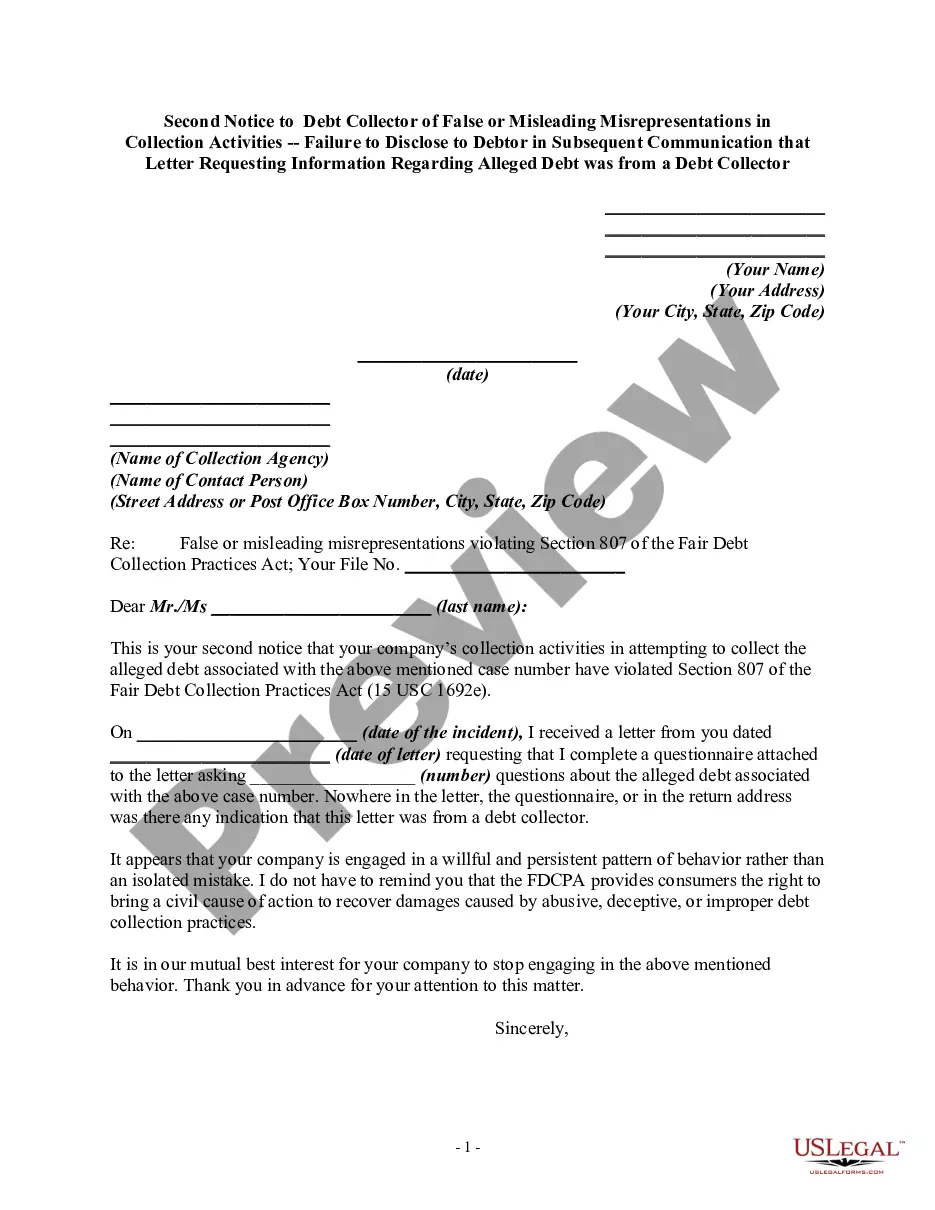

This form is a follow-up letter containing a warning that the debt collector's continued violation of the Fair Debt Collection Practices Act may result in a law suit being filed against the debt collector.

Guam Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor

Description

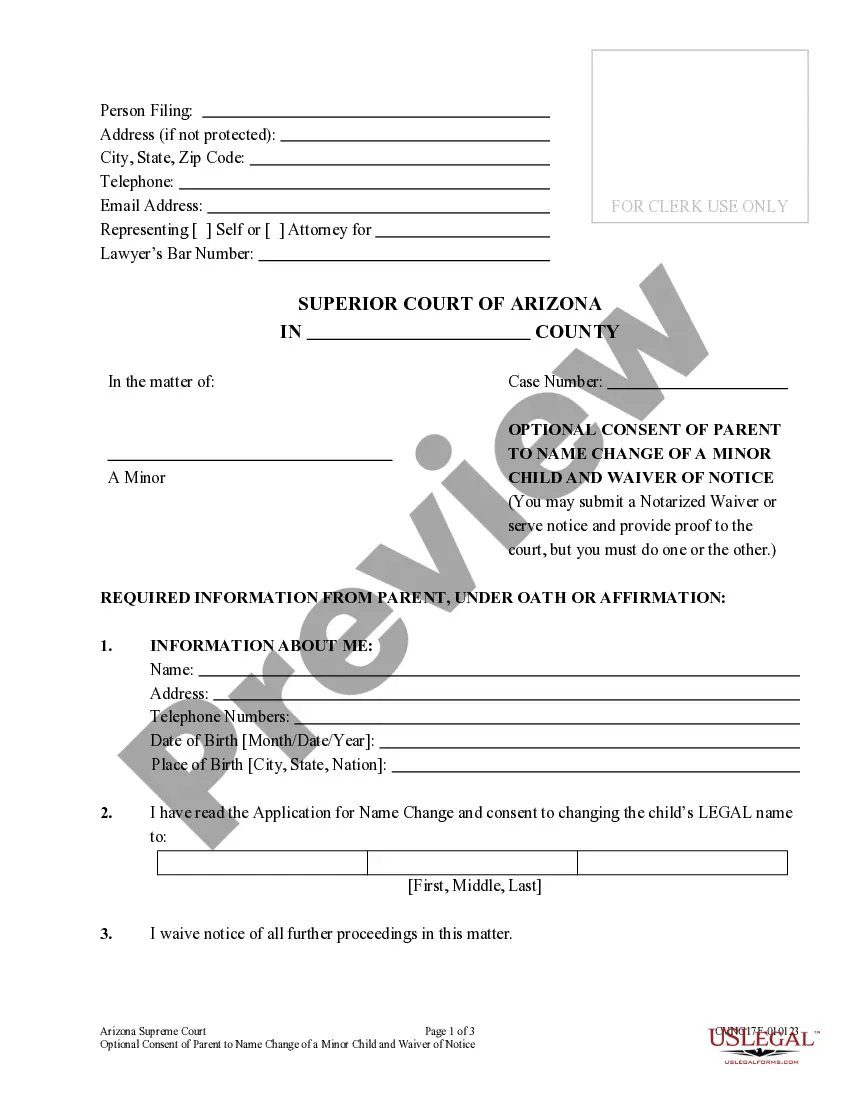

How to fill out Second Notice To Debt Collector Of Harassment Or Abuse In Collection Activities Involving Threats To Use Violence Or Other Criminal Means To Harm The Physical Person, Reputation, And/or Property Of The Debtor?

You can invest hours online attempting to locate the legal document template that satisfies the state and federal standards you require.

US Legal Forms offers a vast selection of legal forms that have been evaluated by professionals.

It is easy to obtain or print the Guam Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor from the service.

If available, utilize the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Next, you may fill out, modify, print, or sign the Guam Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents tab and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for your region/town of preference.

- Review the form summary to confirm you have selected the appropriate form.

Form popularity

FAQ

The most common violation involves debt collectors contacting consumers at inconvenient times or places, like during late hours or at work if the consumer has requested not to be contacted. Other violations include making false statements or using abusive language. Being informed about these violations can empower you as a debtor. When facing such actions, a Guam Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor is a key tool in asserting your rights.

To send a collection notice effectively, start by drafting a formal letter that outlines the details of the debt. Clearly state your right to send a Guam Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor. Include your contact information and a deadline for the response. Always keep a copy of the notice for your records to document your communication.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

Even if you do, debt collectors aren't allowed to threaten, harass, or publicly shame you. You can order them to stop contacting you.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

Yes , a debt collector can knock on your door. However, the Fair Debt Collection Practices Act prohibits a debt collector from contacting you at a time or place known to be inconvenient. The FDCPA also protects you from debt collector harassment and abuse.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Even if you do, debt collectors aren't allowed to threaten, harass, or publicly shame you. You can order them to stop contacting you.