New Mexico Certificate of Merger of a Foreign Limited Partnership into a Delaware Limited Partnership

Description

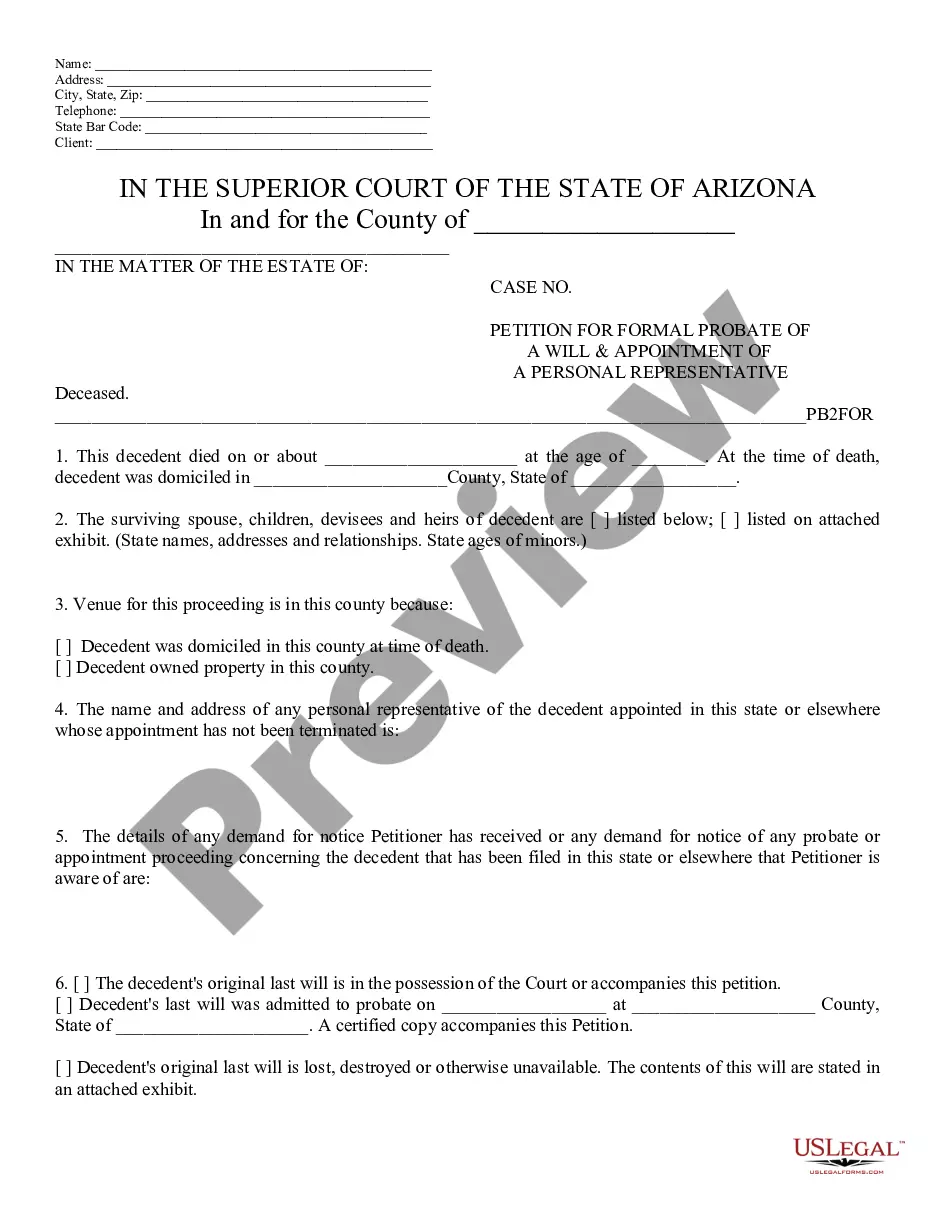

How to fill out Certificate Of Merger Of A Foreign Limited Partnership Into A Delaware Limited Partnership?

You may invest several hours on the Internet attempting to find the lawful document web template that meets the federal and state requirements you will need. US Legal Forms supplies a huge number of lawful forms that are examined by experts. You can actually acquire or printing the New Mexico Certificate of Merger of a Foreign Limited Partnership into a Delaware Limited Partnership from our assistance.

If you already have a US Legal Forms bank account, you are able to log in and click on the Download switch. Afterward, you are able to total, change, printing, or sign the New Mexico Certificate of Merger of a Foreign Limited Partnership into a Delaware Limited Partnership. Every single lawful document web template you purchase is your own property for a long time. To get one more copy of the purchased type, check out the My Forms tab and click on the related switch.

If you use the US Legal Forms site the very first time, follow the simple instructions under:

- Initial, ensure that you have chosen the correct document web template for your county/metropolis of your choosing. See the type description to make sure you have chosen the appropriate type. If available, utilize the Preview switch to look with the document web template at the same time.

- If you would like get one more model of your type, utilize the Search field to get the web template that meets your requirements and requirements.

- After you have found the web template you need, just click Acquire now to carry on.

- Select the pricing program you need, key in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You should use your charge card or PayPal bank account to fund the lawful type.

- Select the file format of your document and acquire it to the gadget.

- Make alterations to the document if required. You may total, change and sign and printing New Mexico Certificate of Merger of a Foreign Limited Partnership into a Delaware Limited Partnership.

Download and printing a huge number of document templates making use of the US Legal Forms website, which offers the most important assortment of lawful forms. Use specialist and condition-specific templates to tackle your company or personal requires.

Form popularity

FAQ

How much does it cost to file the Certificate of Registration of a Foreign LLC in Delaware? The state charges $200 for regular filings. If you're in a hurry, you can pay the state an extra $50 and they'll process your paperwork within six days of receiving it.

You can incorporate and register your business online, over the phone at 1-800-345-CORP, via fax at 302-645-1280 or through the mail by sending your documents to 16192 Coastal Highway, Lewes, DE, 19958.

Owners of a newly-incorporated business often wonder if they need a Delaware business address. No, you do not need to have a business address or office in Delaware. All businesses incorporated in Delaware require a Registered Agent with a physical street address in Delaware, such as Agents and Corporations (IncNow®).

To register a foreign corporation in Delaware, you must file a Delaware Foreign Corporation Certificate with the Delaware Division of Corporations. You can submit this document by mail, online, or in person. The Foreign Corporation Certificate for a foreign Delaware corporation costs $245 to file.

(a) As used in this chapter, the words ?foreign corporation? mean a corporation organized under the laws of any jurisdiction other than this State.

Statutory conversion: Your LLC's assets and liabilities will be automatically transferred to the new corporation without the need to create a new, separate entity. Statutory merger: You'll need to file to create a new corporation before your LLC's assets and liabilities can be transferred over.

A Delaware LLC merger happens when business agreements combine multiple entities into one sole entity. The LLC series isn't considered a separate entity ing to Delaware state laws.

What is a Delaware Limited Partnership? Delaware Limited Partnerships (DLPs) are a type of business entity in the United States. They are formed by filing a certificate of limited partnership with the Delaware Secretary of State. DLPs have two types of partners: general partners and limited partners.