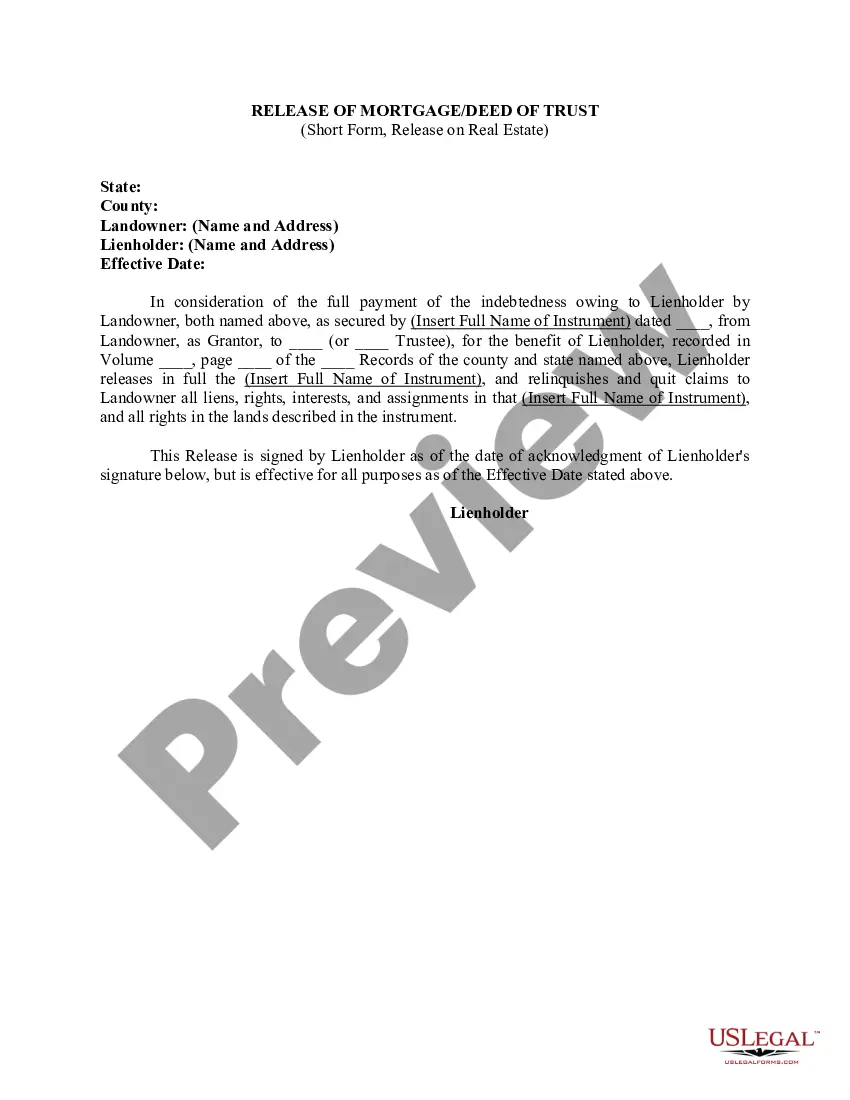

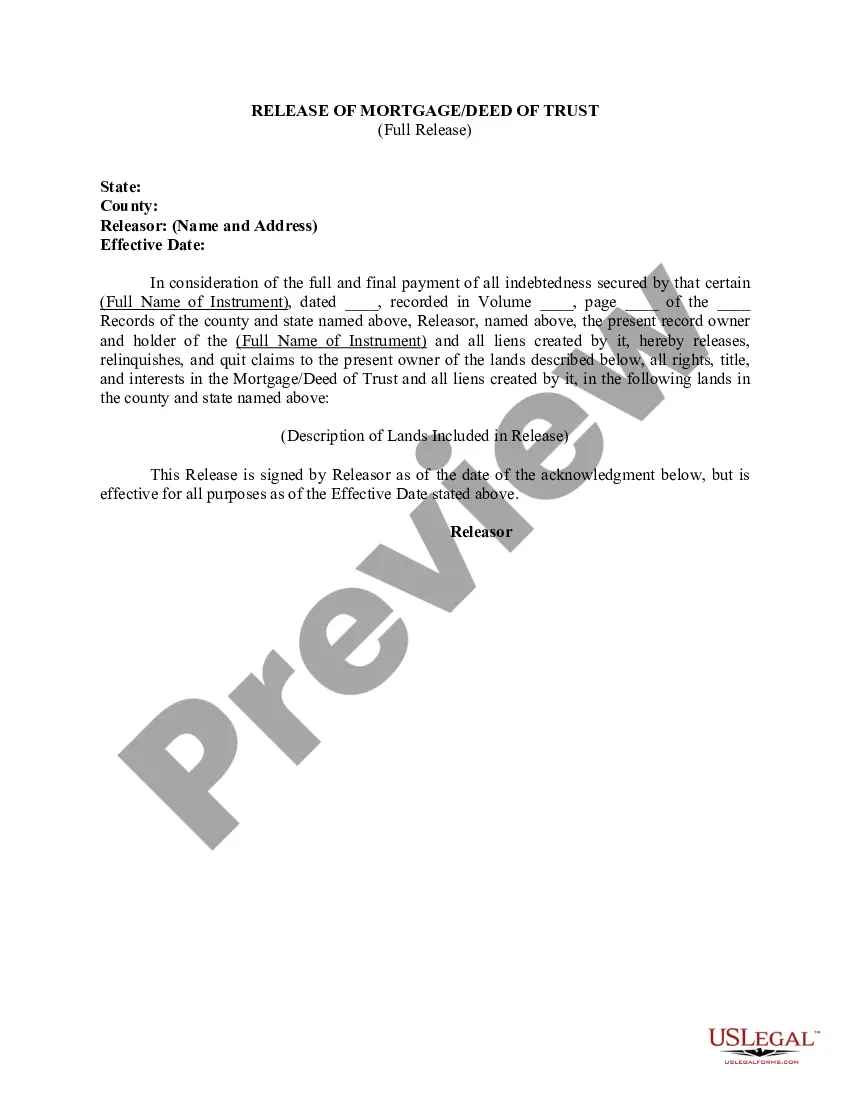

Release of Mortgage / Deed of Trust - Full Release

Description

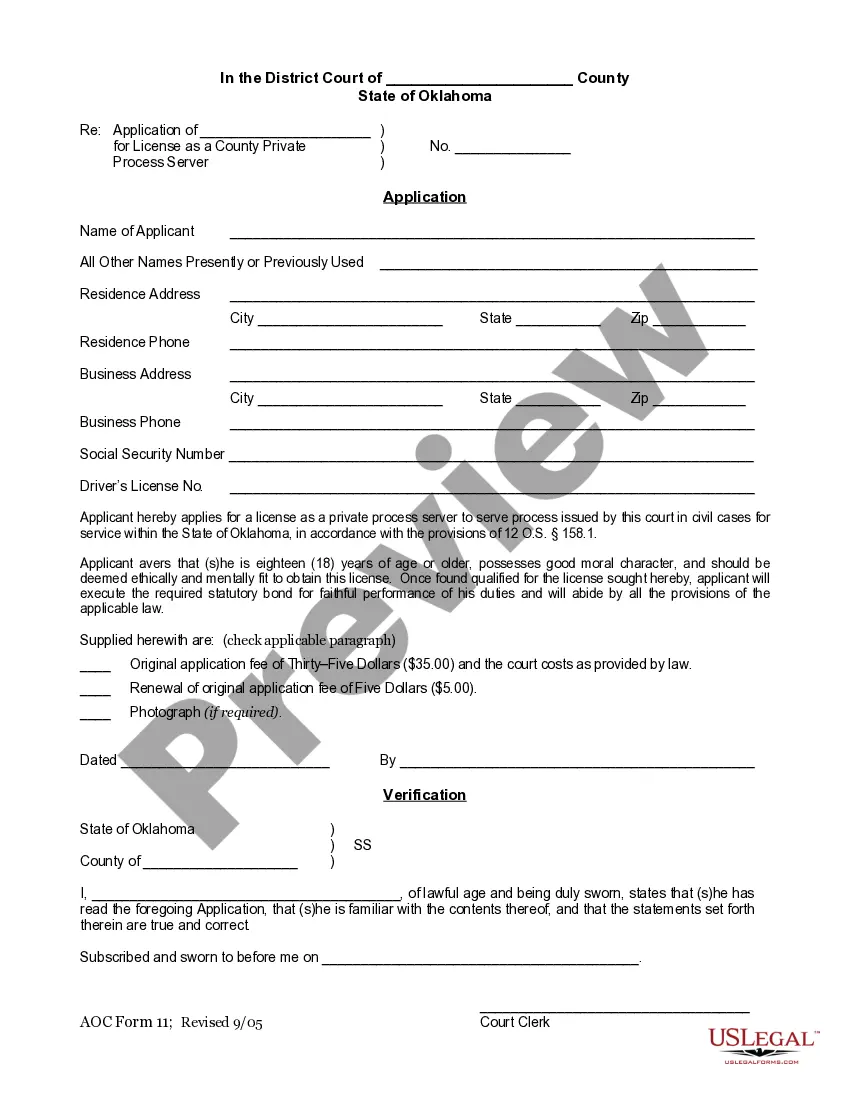

How to fill out Release Of Mortgage / Deed Of Trust - Full Release?

When it comes to drafting a legal form, it is easier to leave it to the specialists. However, that doesn't mean you yourself can not get a sample to use. That doesn't mean you yourself cannot get a template to utilize, nevertheless. Download Release of Mortgage / Deed of Trust - Full Release right from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. Once you are signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Release of Mortgage / Deed of Trust - Full Release promptly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Press Buy Now.

- Select the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/bank card.

- Choose a preferred format if several options are available (e.g., PDF or Word).

- Download the document.

When the Release of Mortgage / Deed of Trust - Full Release is downloaded it is possible to fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

In general a discharge fee costs between $275 and $325, but may be higher or lower. Some states impose a "release of mortgage" fee.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. It's signed by a representative of the lender and notarized, like other types of deeds.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

When you pay your mortgage loan in full, the lender should cancel and return the mortgage promissory note you signed when you took out the loan. This proves you have fulfilled the terms of the loan, and that you no longer owe the lender any money.

Once your lender receives the payoff letter and funds, the loan is paid off in full. Lenders then need to prepare a release deed or release of lien to clear the title to the property. The release, once recorded, gives notice to the world that you have paid off the loan and that the lien is no longer valid.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

Take possession of all the papers. Get an NOC. Get your CIBIL report updated. Get the lien withdrawn. Get an encumbrance certificate.