New Mexico Delivery Driver Services Contract - Self-Employed

Description

How to fill out Delivery Driver Services Contract - Self-Employed?

Selecting the proper legal document template can be quite challenging. Obviously, there is a plethora of designs accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the New Mexico Delivery Driver Services Contract - Self-Employed, which you can utilize for business and personal needs.

All the forms are reviewed by experts and comply with federal and state regulations.

If the form does not fulfill your requirements, use the Search field to find the appropriate document. Once you are certain the form is suitable, click the Get now button to acquire the document. Choose the payment plan you prefer and enter the required information. Create your account and finalize your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained New Mexico Delivery Driver Services Contract - Self-Employed. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to download professionally crafted paperwork that comply with state requirements.

- If you are already registered, Log In to your account and click on the Download button to obtain the New Mexico Delivery Driver Services Contract - Self-Employed.

- Use your account to search through the legal documents you have previously purchased.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your locality/county.

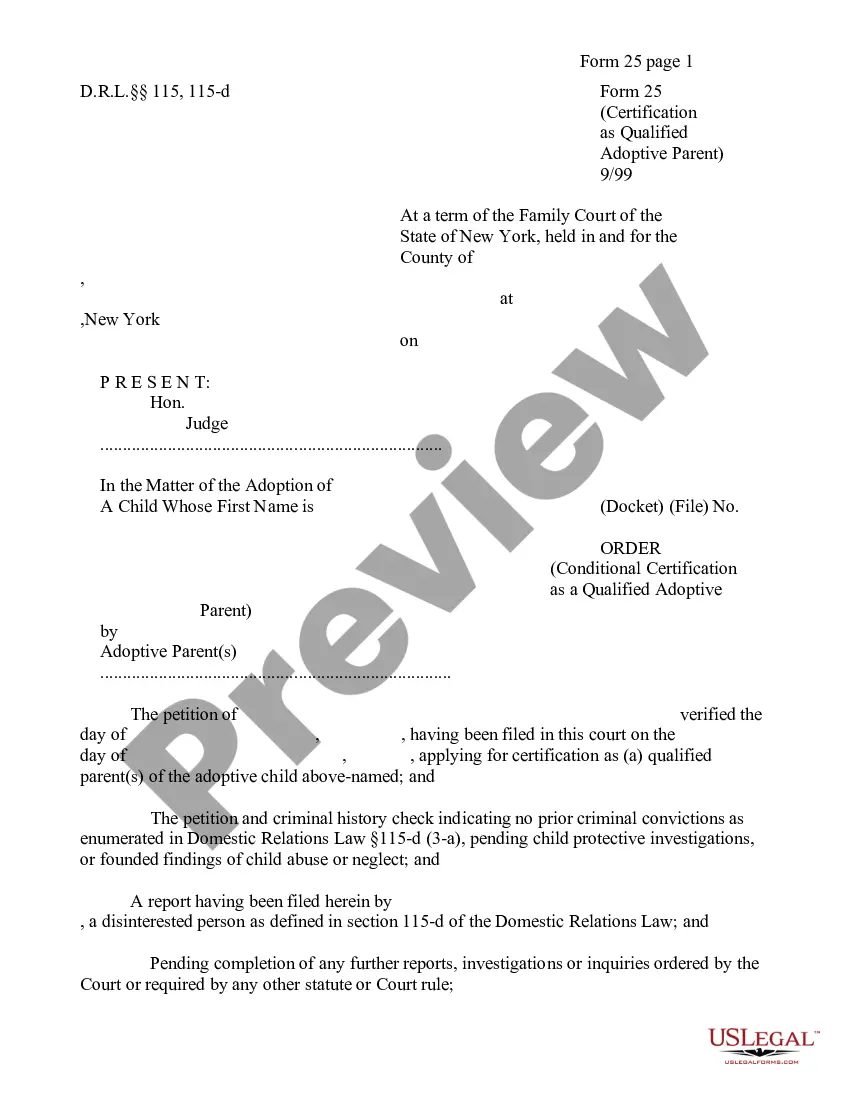

- You can review the document using the Review button and examine the form summary to confirm it is suitable for you.

Form popularity

FAQ

Yes, New Mexico requires businesses to file a 1099 form for payments made to independent contractors or self-employed individuals. If you earn over a certain threshold, your payments must be reported, ensuring compliance with state tax laws. By using a New Mexico Delivery Driver Services Contract - Self-Employed, you can formalize your agreement and enhance the accuracy of your 1099 filings. This step helps safeguard both you and the business you work with.

Yes, a contract employee is generally considered self-employed. When you work under a contract, you maintain control over how you complete your tasks. Being classified as self-employed means you are responsible for your taxes and can benefit from certain write-offs. A clear New Mexico Delivery Driver Services Contract - Self-Employed can define your obligations and rights, reinforcing your status.

Filing taxes as an independent delivery driver requires you to report all income from your deliveries. You should track your earnings and expenses related to your work. It's important to categorize your expenses, such as fuel and vehicle maintenance, which can help reduce your taxable income. Utilizing a New Mexico Delivery Driver Services Contract - Self-Employed can simplify this process and provide clarity on your self-employment status.

Yes, driving for a delivery service qualifies as contractor or freelance work. In New Mexico, a delivery driver can operate as a self-employed individual if they enter into a New Mexico Delivery Driver Services Contract - Self-Employed. This contract outlines your responsibilities and rights, ensuring clarity in your work relationship. By formalizing this agreement, you can enjoy various benefits such as flexibility in your schedule and the potential for increased earnings.

Securing a delivery driver contract involves several simple steps. Begin by researching the companies that operate delivery services in your area, especially those that cater to New Mexico Delivery Driver Services Contract - Self-Employed. You can apply directly through their websites, or use platforms that specialize in connecting drivers with delivery gigs. Additionally, consider using UsLegalForms to create a professional contract that outlines your services and payment terms, ensuring you start your self-employed journey on the right foot.

Yes, a delivery driver can operate as an independent contractor, allowing for greater control over their work life. This structure typically means they choose their hours and delivery routes. To ensure clarity in the working relationship, a New Mexico Delivery Driver Services Contract - Self-Employed is highly recommended for all parties involved.

You can be a self-employed delivery driver, provided you meet the necessary requirements, like having a vehicle and insurance. This status allows you to work with multiple companies, offering flexibility in your schedule. A well-drafted New Mexico Delivery Driver Services Contract - Self-Employed can help outline your business framework.

Yes, a delivery driver can be classified as an independent contractor under certain conditions. This classification allows drivers to work flexibly without an employer's constraints. To formalize this relationship, consider using a New Mexico Delivery Driver Services Contract - Self-Employed to define expectations and responsibilities.

Writing a contract for a 1099 employee involves outlining the terms of work, payment structure, and duration. Make sure to specify that they are responsible for their taxes and any required insurances. A clear New Mexico Delivery Driver Services Contract - Self-Employed can serve this purpose effectively, ensuring all parties understand their roles.

To be a self-employed delivery driver, you need a reliable vehicle, valid driver's license, and insurance. Additionally, you must keep track of your expenses and income for tax purposes. Creating a detailed New Mexico Delivery Driver Services Contract - Self-Employed can help structure your business and outline your obligations.