New Mexico Joint Filing Agreement

Description

How to fill out Joint Filing Agreement?

If you want to comprehensive, down load, or produce lawful record themes, use US Legal Forms, the largest selection of lawful kinds, which can be found on the Internet. Take advantage of the site`s basic and hassle-free research to get the papers you require. Various themes for organization and individual purposes are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to get the New Mexico Joint Filing Agreement with a couple of mouse clicks.

Should you be previously a US Legal Forms client, log in to the bank account and click on the Download key to obtain the New Mexico Joint Filing Agreement. You may also access kinds you earlier downloaded in the My Forms tab of your own bank account.

If you are using US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for your right town/land.

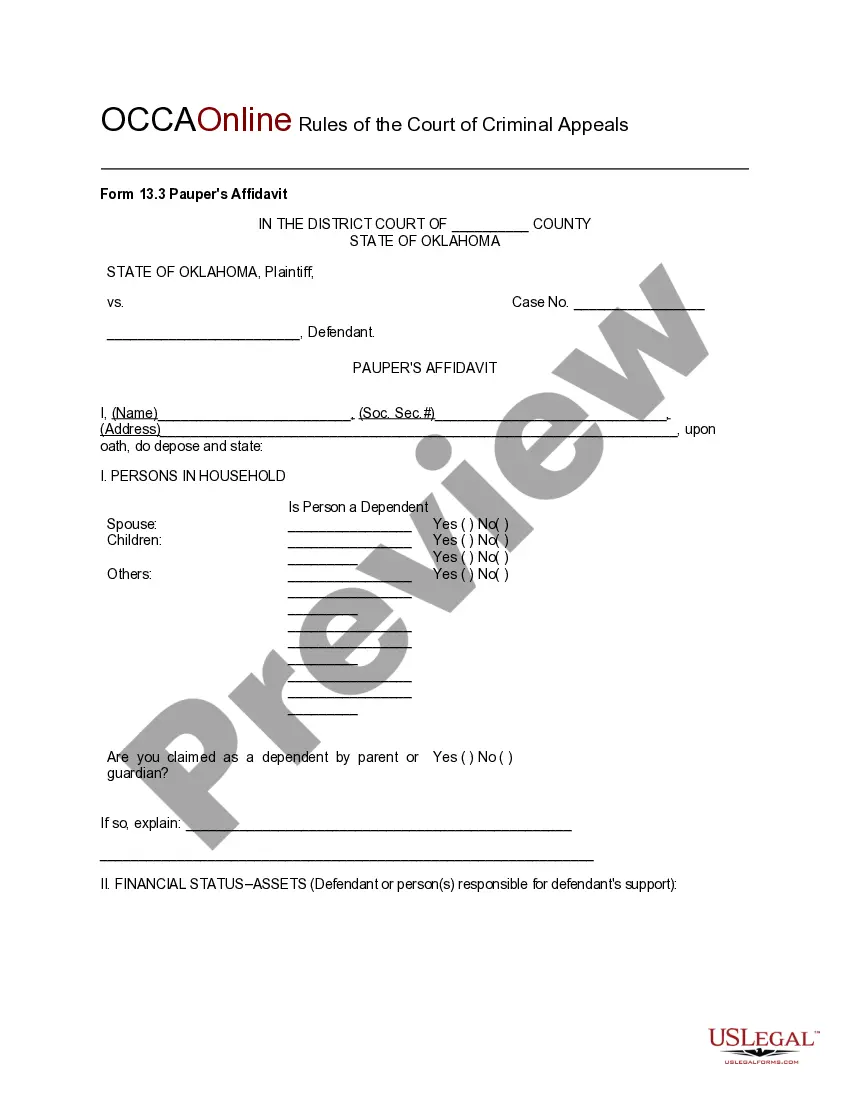

- Step 2. Use the Preview choice to check out the form`s information. Never forget about to read the description.

- Step 3. Should you be not happy using the type, make use of the Lookup field towards the top of the display to get other variations in the lawful type web template.

- Step 4. Upon having discovered the form you require, click on the Purchase now key. Select the prices plan you favor and add your references to sign up for the bank account.

- Step 5. Procedure the purchase. You should use your bank card or PayPal bank account to accomplish the purchase.

- Step 6. Select the structure in the lawful type and down load it on your device.

- Step 7. Full, change and produce or signal the New Mexico Joint Filing Agreement.

Each lawful record web template you purchase is yours permanently. You may have acces to every type you downloaded in your acccount. Go through the My Forms section and choose a type to produce or down load yet again.

Compete and down load, and produce the New Mexico Joint Filing Agreement with US Legal Forms. There are millions of specialist and condition-distinct kinds you can use to your organization or individual requires.

Form popularity

FAQ

While the tax code encourages married couples to file their tax returns jointly, there are a few scenarios where married filing separately could be beneficial. These include when both spouses have about the same amount of income and when combining income pushes a couple into a higher tax bracket. How married filing separately works & when to do it - Empower empower.com ? the-currency ? life ? when-... empower.com ? the-currency ? life ? when-...

New Mexico taxes all forms of retirement income, including Social Security, while offering a deduction to seniors with household income below a certain limit. New Mexico's sales taxes are above average, but its property taxes are generally low.

If your clients choose ?married filing separately? as their filing option, each spouse signs his or her own return. No permission is needed from the other spouse to file a return. However, they must know how each other is going to file. Can a Husband File a Tax Return Without His Wife's Permission? pstap.org ? can-a-husband-file-a-tax-return-witho... pstap.org ? can-a-husband-file-a-tax-return-witho...

For more on personal finance planning: However, some states require spouses living in different states to file separately. It is best to consult a tax expert about the most beneficial way to file. At a minimum, you should make sure you know what your home state legally requires. Spouses Who Live in Different States Face State Income-Tax Problems hcplive.com ? view ? spouses-who-live-in-d... hcplive.com ? view ? spouses-who-live-in-d...

Spouses using ?married filing jointly? for the IRS must use the same filing status for New Mexico; those using ?married filing separately? for the IRS must also use that filing status for New Mexico. Personal Income Tax Information Overview : Individuals NM Taxation and Revenue Department (.gov) ? individuals ? perso... NM Taxation and Revenue Department (.gov) ? individuals ? perso...

Spouses using ?married filing jointly? for the IRS must use the same filing status for New Mexico; those using ?married filing separately? for the IRS must also use that filing status for New Mexico.

Tax returns Although joint returns are not allowed, miscellaneous rules allow a married couple to have the highest income earner report all investment income. Since income splitting is not allowed, personal service income should be declared by the spouse earning it.

California is a community property state. When filing a separate return, each spouse/RDP reports the following: One-half of the community income. All of their own separate income.