New Mexico Form of Convertible Promissory Note, Common Stock

Description

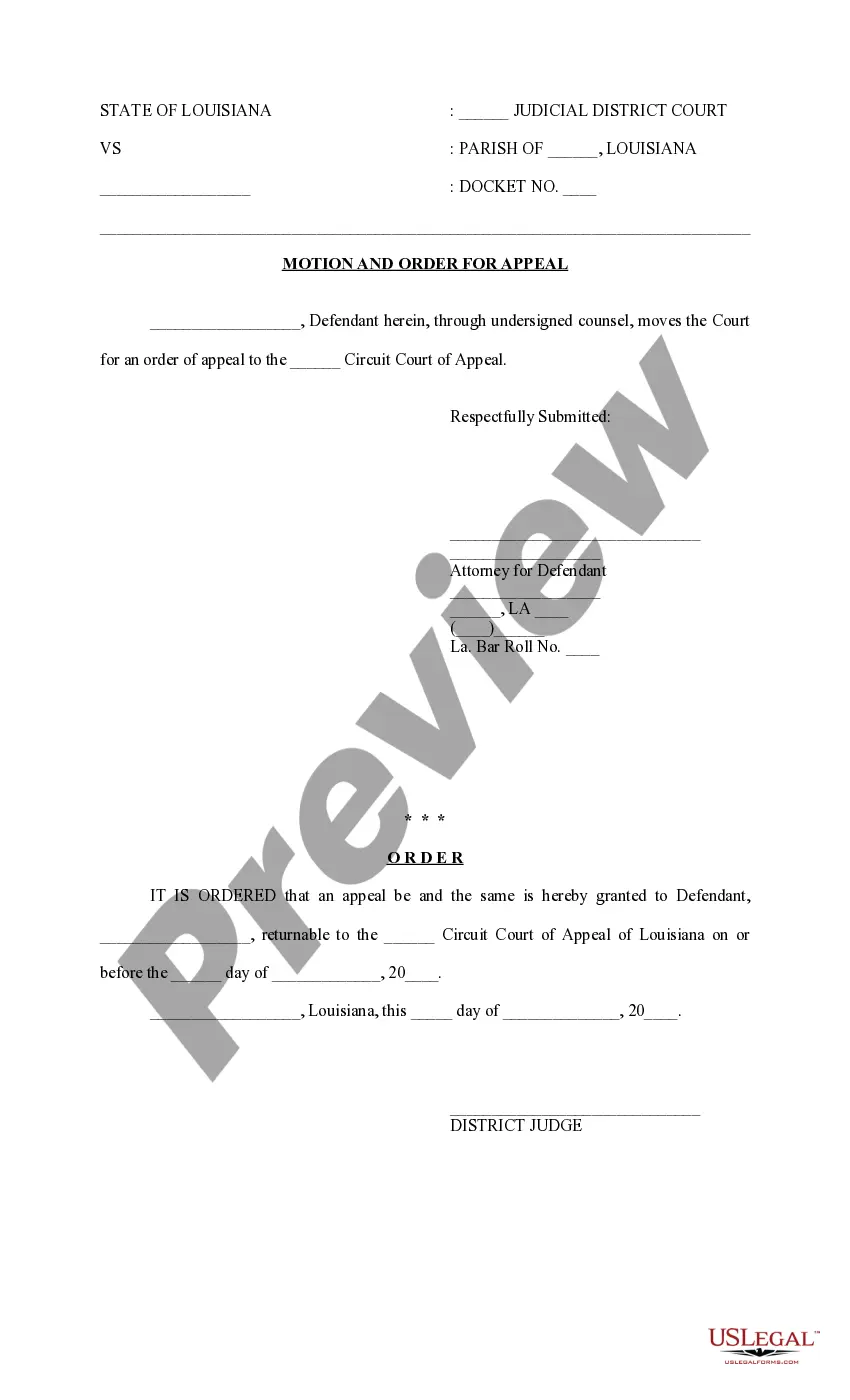

How to fill out Form Of Convertible Promissory Note, Common Stock?

Choosing the best lawful record format can be a have difficulties. Obviously, there are a lot of web templates accessible on the Internet, but how would you obtain the lawful type you want? Use the US Legal Forms site. The support provides a huge number of web templates, like the New Mexico Form of Convertible Promissory Note, Common Stock, which you can use for company and personal requirements. All the kinds are checked by experts and fulfill federal and state needs.

If you are currently registered, log in for your accounts and click the Acquire switch to get the New Mexico Form of Convertible Promissory Note, Common Stock. Make use of accounts to appear throughout the lawful kinds you have purchased in the past. Check out the My Forms tab of your own accounts and have another version of the record you want.

If you are a fresh customer of US Legal Forms, here are easy recommendations that you can adhere to:

- Initially, make certain you have chosen the appropriate type for your personal city/county. You may look over the form utilizing the Preview switch and study the form outline to make sure this is the right one for you.

- When the type is not going to fulfill your needs, use the Seach industry to find the correct type.

- Once you are sure that the form is acceptable, click the Purchase now switch to get the type.

- Select the costs strategy you want and enter in the required information. Design your accounts and pay for an order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the submit format and acquire the lawful record format for your system.

- Comprehensive, change and print out and indication the obtained New Mexico Form of Convertible Promissory Note, Common Stock.

US Legal Forms is the biggest local library of lawful kinds that you will find different record web templates. Use the company to acquire skillfully-produced paperwork that adhere to status needs.

Form popularity

FAQ

In common speech, other terms, such as "loan", "loan agreement", and "loan contract" may be used interchangeably with "promissory note". The term "loan contract" is often used to describe a contract that is lengthy and detailed. A promissory note is very similar to a loan.

SAFE stands for Simple Agreement for Future Equity. In recent years, SAFEs have become the most common convertible instrument due to their relative simplicity. Like convertible notes, SAFEs convert into stock in a future priced round.

Convertible debt is a loan, note or bond instrument that converts to equity when a specified future event occurs. A convertible promissory note is a promissory note that converts in the same way as all other convertible debt.

Convertible notes (sometimes called ?convertible loan notes? or ?CLNs?) have become increasingly popular in the world of startup financing, particularly in seed stage companies.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

Convertible Note Meaning: A Hybrid of Debt and Equity. What is a convertible note? In short, a convertible note is originally structured as a debt investment but has a provision that allows the principal plus accrued interest to convert into an equity investment at a later date.

A promissory note is simply a form of debt - like a loan or an IOU - that a company may issue to raise money. An investor typically agrees to loan money to a company in exchange for the company's promise that it will pay back the amount, plus interest, over a specific time period.

Typically, promissory notes are securities. They must be registered with the SEC, a state securities regulator, or be exempt from registration.