New Mexico Indemnification Agreement for Litigation

Description

How to fill out Indemnification Agreement For Litigation?

If you need to total, obtain, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Make use of the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for business and individual uses are categorized by types and regions, or keywords. Utilize US Legal Forms to discover the New Mexico Indemnification Agreement for Litigation with just a few clicks.

Every legal document template you download is yours permanently. You have access to all forms you have downloaded in your account. Click the My documents section and choose a form to print or download again.

Be proactive and download and print the New Mexico Indemnification Agreement for Litigation with US Legal Forms. There are millions of professional and state-specific forms available for your business or individual needs.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Download button to access the New Mexico Indemnification Agreement for Litigation.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

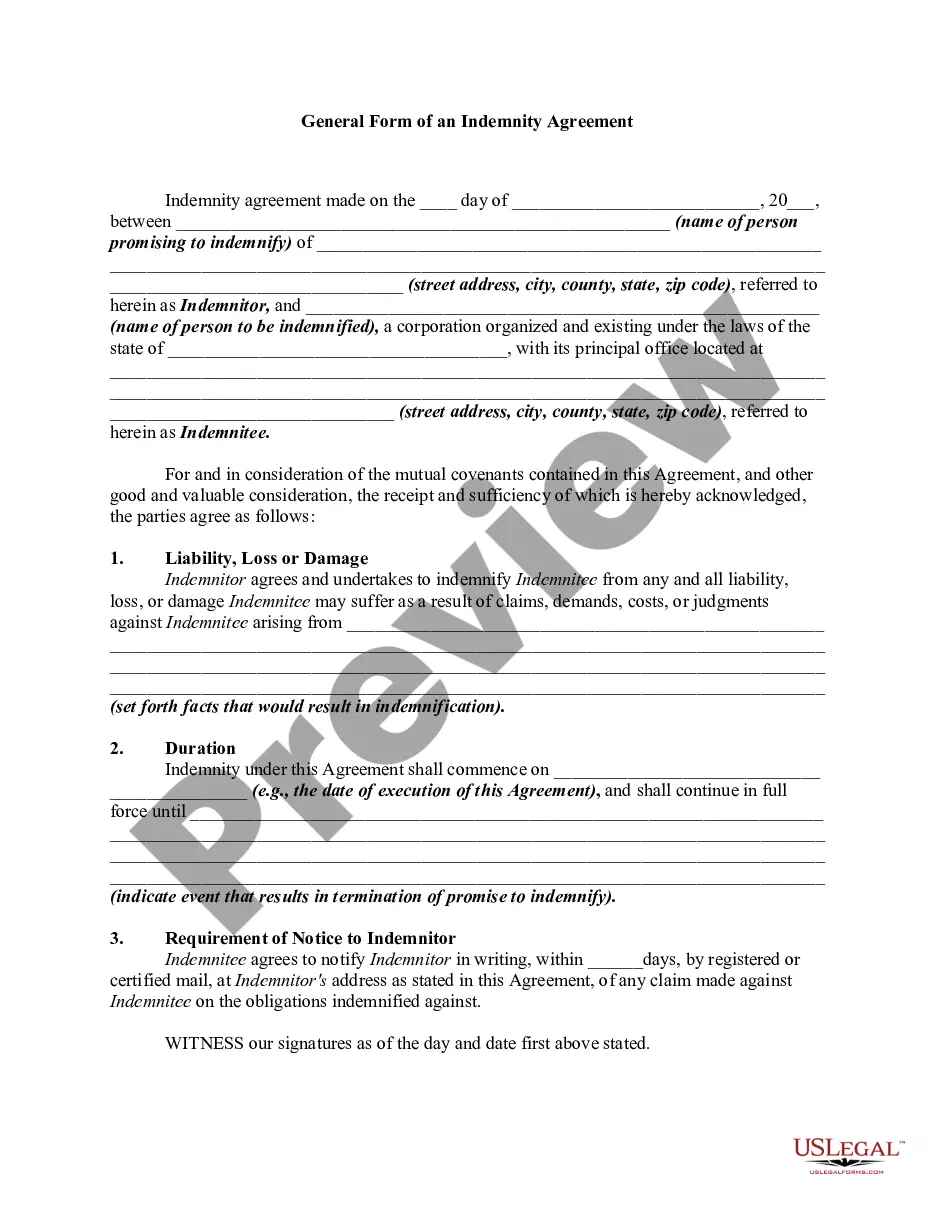

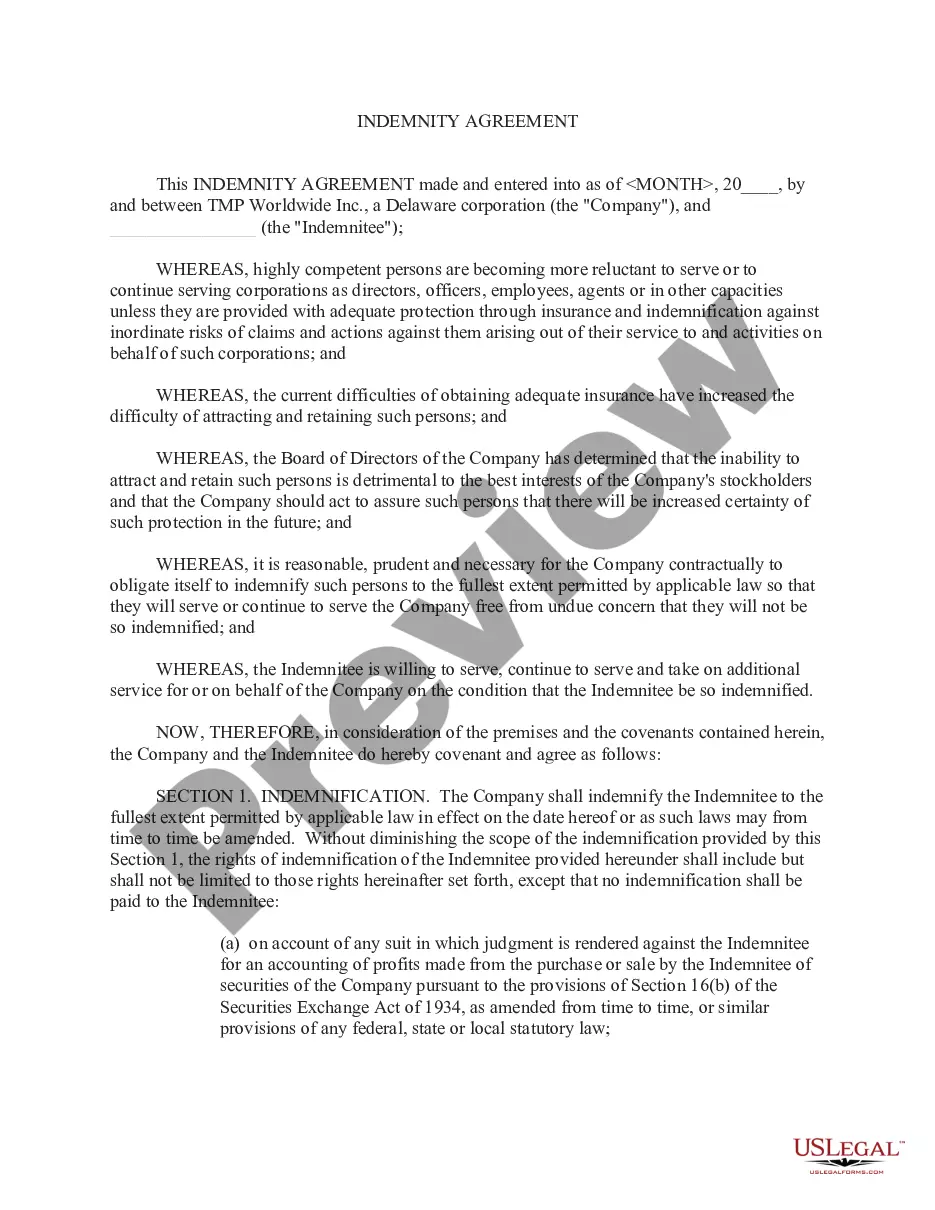

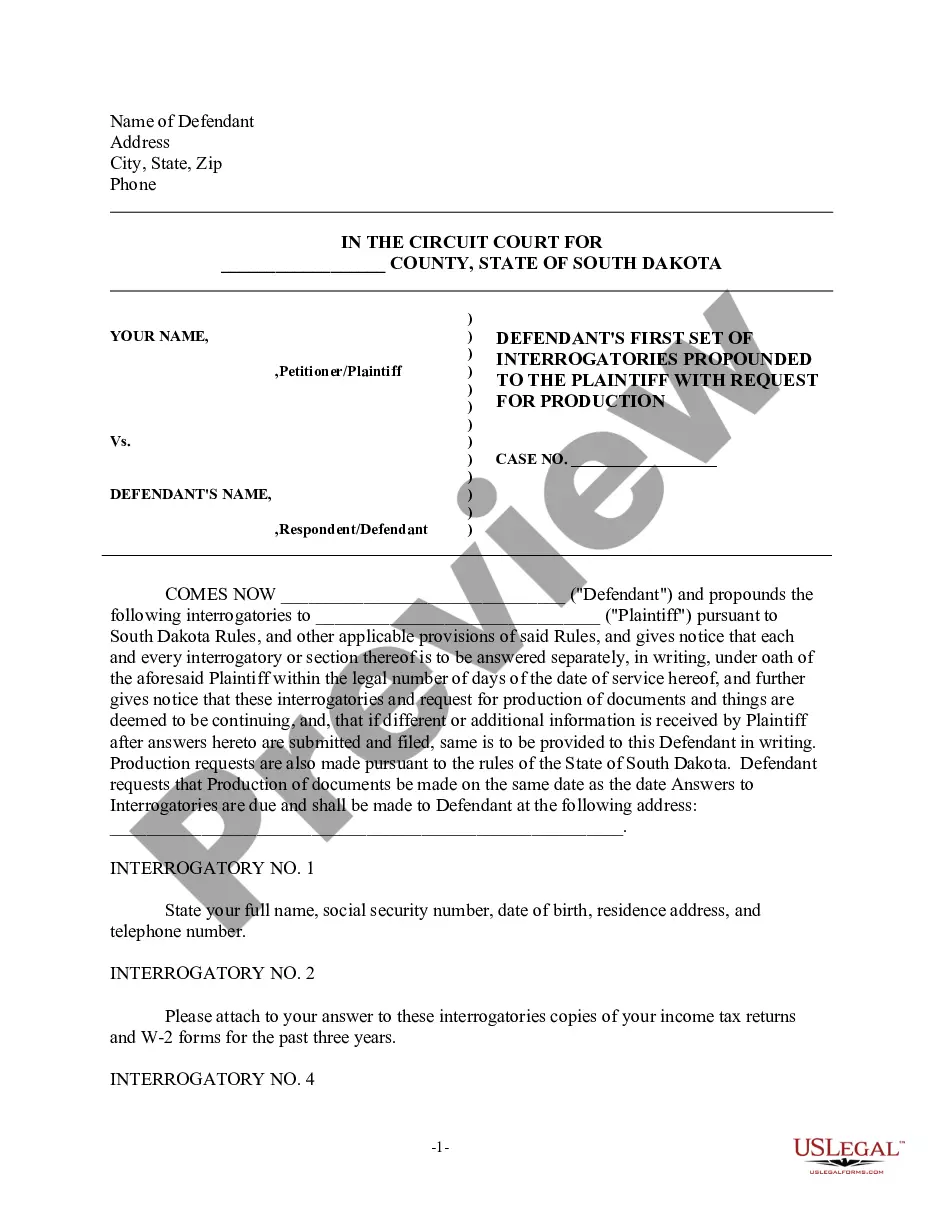

- Step 2. Utilize the Preview option to review the form’s details. Be sure to read the information.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. After finding the form you need, click the Get now button. Choose the payment plan you prefer and provide your credentials to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your system.

- Step 7. Complete, modify, and print or sign the New Mexico Indemnification Agreement for Litigation.

Form popularity

FAQ

An indemnification agreement provides additional protection for businesses by ensuring that they are not held liable for damages or losses that occur outside of their control. This agreement allows the company to continue its operations while protecting against lawsuits.

Sellers should also limit the survival period for most indemnification claims to just a short time after closing, i.e., six months to two years (although certain "fundamental" claims or particularly risky claims typically survive for much longer periods).

Tips for Enforcing Indemnification ProvisionsIdentify Time Periods for Asserting Indemnification Rights.Provide Notice in a Timely Fashion.Notify All Concerned Parties.Understand Limitations on Recovery.Exclusive Remedy.Scope of Damages.Claims Process/Dispute Resolution.

At their core, indemnification provisions transfer liabilities related to a claim from one party to another party, generally in the event of a breach of contract or a party's negligence or misconduct in the performance of the agreement.

As an initial matter, there are generally three forms of indemnification agreements: (1) the broad form, which includes the sole negligence of the indemnitee; (2) the moderate form, which includes all negligence, but the sole negligence of the indemnitee; and (3) the narrow form, which includes only the negligence of

The rule of indemnity, or the indemnity principle, says that an insurance policy should not confer a benefit that is greater in value than the loss suffered by the insured. Indemnities and insurance both guard against financial losses and aim to restore a party to the financial status held before an event occurred.

Causes of action.The indemnifying party becomes responsible for a cause of action when the indemnified party'sor a third party'sright to seek relief, as the case may be, accrues.

Indemnification provisions are generally enforceable. There are certain exceptions however. Indemnifications that require a party to indemnify another party for any claim irrespective of fault ('broad form' or 'no fault' indemnities) generally have been found to violate public policy.

For the indemnifying party, the obligation to defend consists of both:An obligation. The indemnifying party must: Reimburse paid defense costs and expenses. Make advance payment for unpaid defense costs and expenses.A right. The indemnifying party has the right to assume and control the defense of the third-party suit.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c