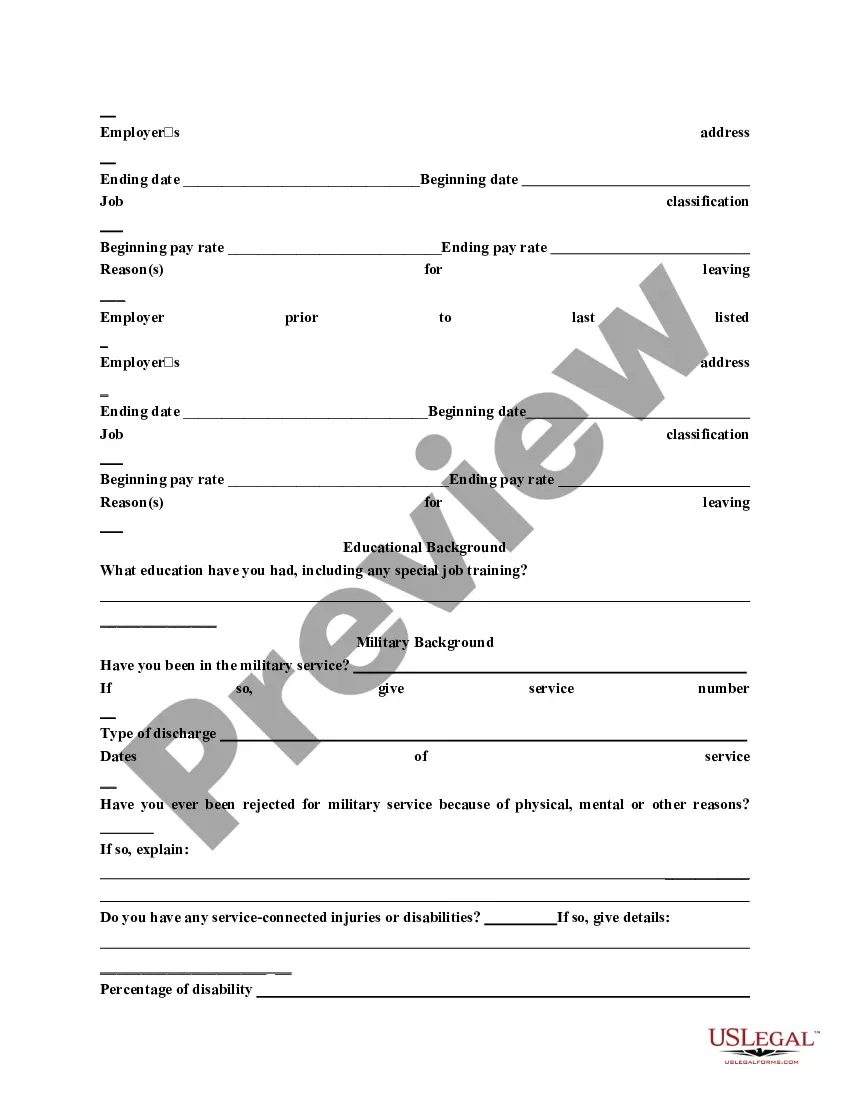

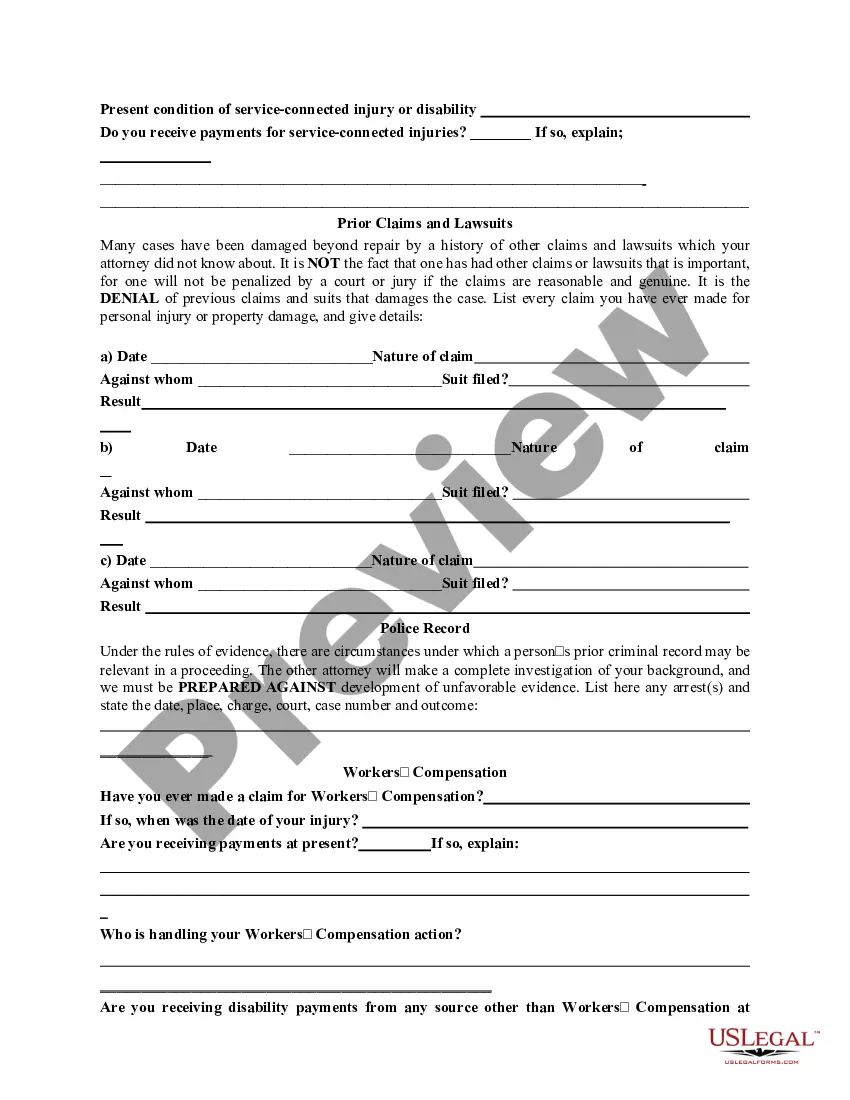

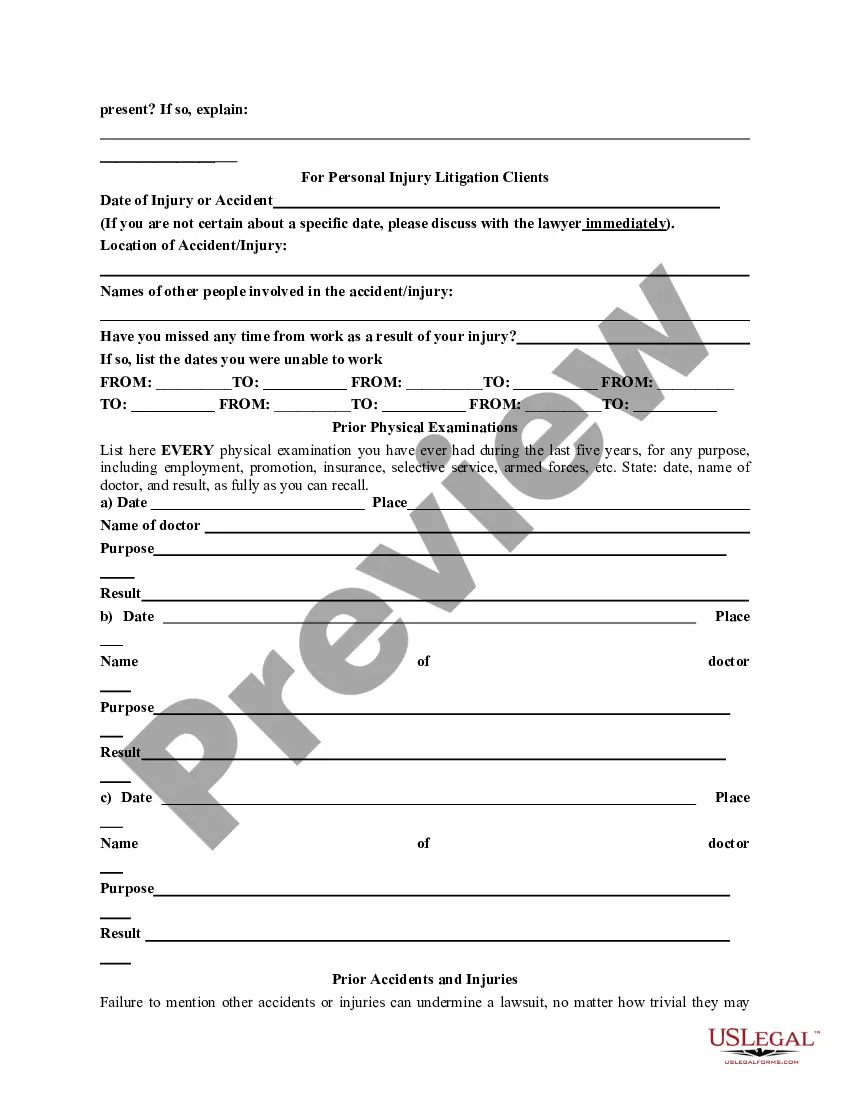

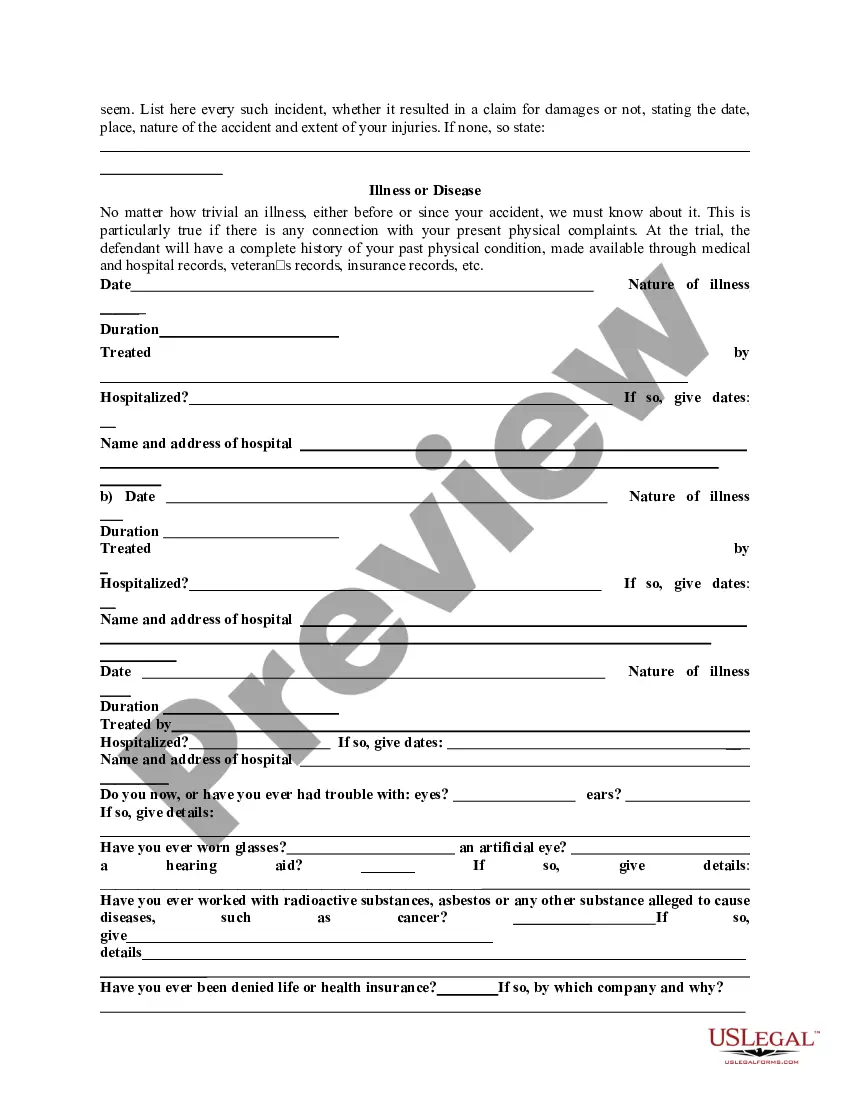

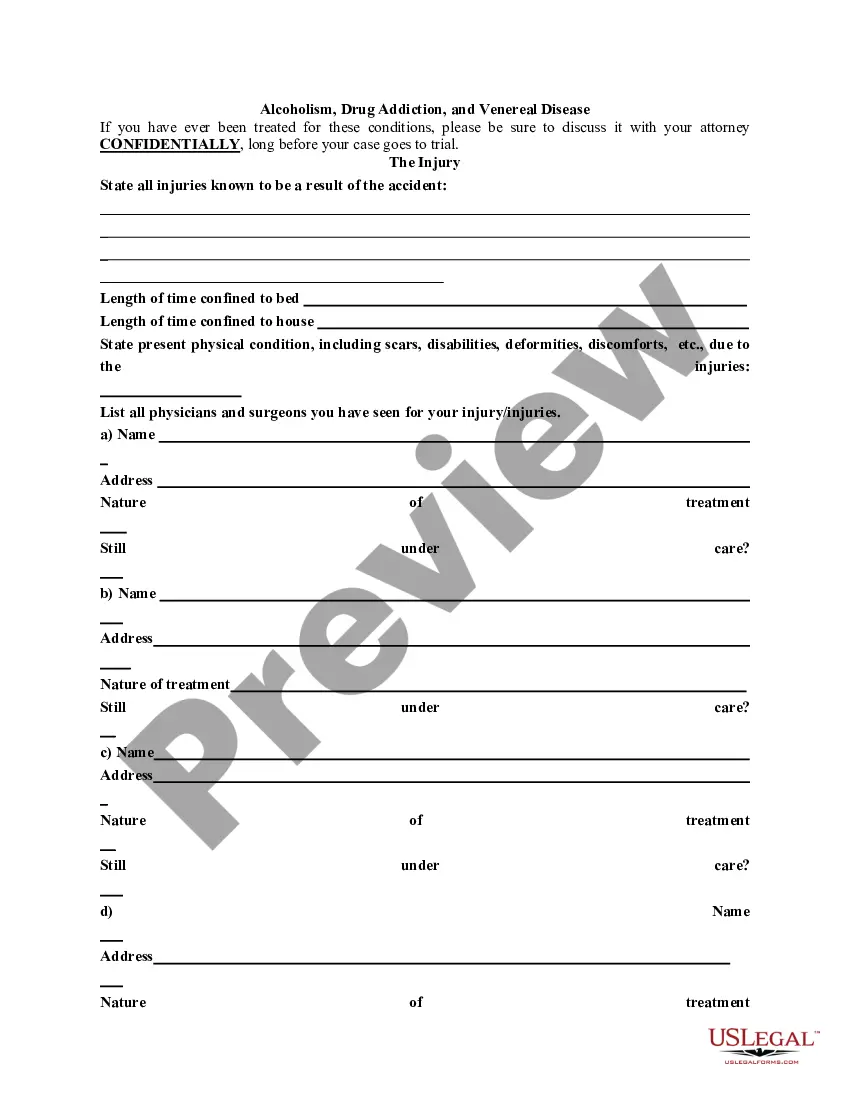

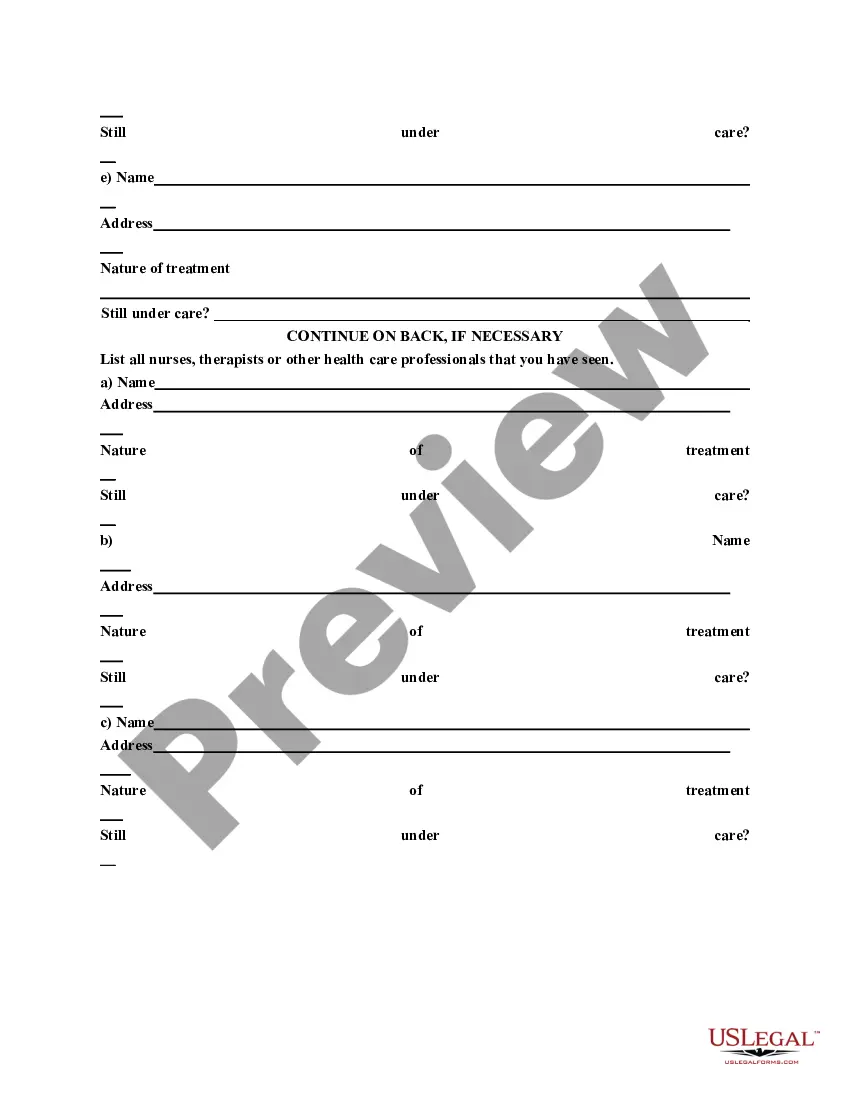

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Colorado General Information Questionnaire

Description

How to fill out General Information Questionnaire?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a variety of legal form templates that you can download or print. By utilizing the website, you can find thousands of forms for business and personal purposes, categorized by groups, states, or keywords. You can locate the latest versions of forms such as the Colorado General Information Questionnaire in just moments.

If you already possess a subscription, Log In and download the Colorado General Information Questionnaire from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

If you want to use US Legal Forms for the first time, here are easy steps to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to examine the contents of the form. Review the form outline to ensure you have chosen the right one. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Buy Now button. Then, choose the pricing plan you prefer and provide your information to register for the account. Proceed with the purchase. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make changes. Fill out, edit, and print and sign the downloaded Colorado General Information Questionnaire. Every template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire.

- Access the Colorado General Information Questionnaire with US Legal Forms, the largest collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

If you were able to claim a federal earned income tax credit (EITC) including your spouse and up to three of your dependents, do not use this form.

Private letter rulings are advance rulings issued to specific taxpayers regarding the Department's application of tax statutes and rules to a proposed or completed transaction. Private letter rulings are generally binding upon the Department, but may only be relied upon by the taxpayer to whom they are issued.

The DR 1094 is used by employers to report Colorado W-2 income taxes that have been withheld from employee pay. Review the Wage Withholding Guide(opens in new window) for detailed information about filing requirements and frequencies.

Form 104 is a Colorado state income tax return. It requires taxpayers to report their federal adjusted gross income, taxable income, deductions, and credits. Additionally, taxpayers must report their Social Security number, filing status, and the amount of taxes they owe or the amount of refund they are due.

Non-residents are subject to Colorado filing requirements if they are required to file a federal income tax return and had taxable income from Colorado. Form 104PN is used for e-filing Non-Residents.

This Certificate is Optional for Employees. If you do not complete this certificate, then your employer will calculate your Colorado withholding based on your IRS Form W-4.

Eligibility Requirements: All full-year and part-year Colorado residents who qualify for the federal EITC are automatically eligible, and Colorado residents filing with Individual Taxpayer Identification Numbers (ITINs) qualify for the state EITC.

Colorado Form 104 ? Personal Income Tax Return for Residents.