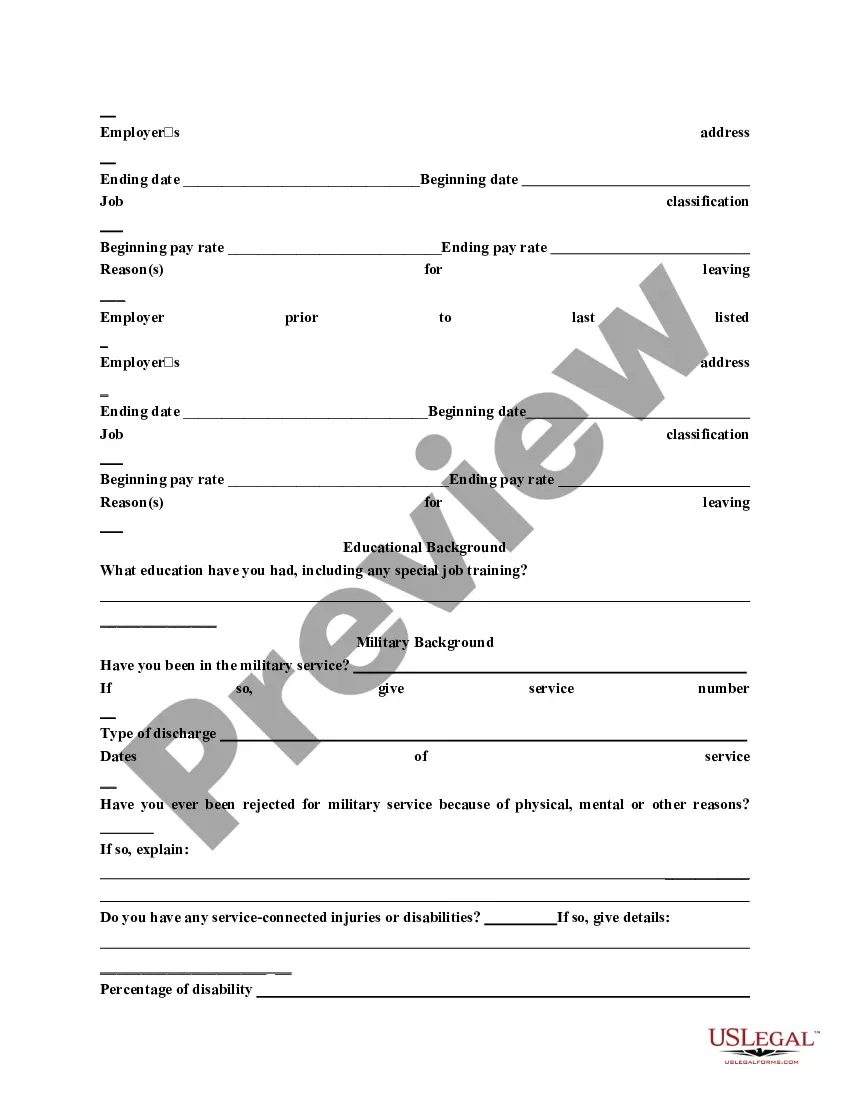

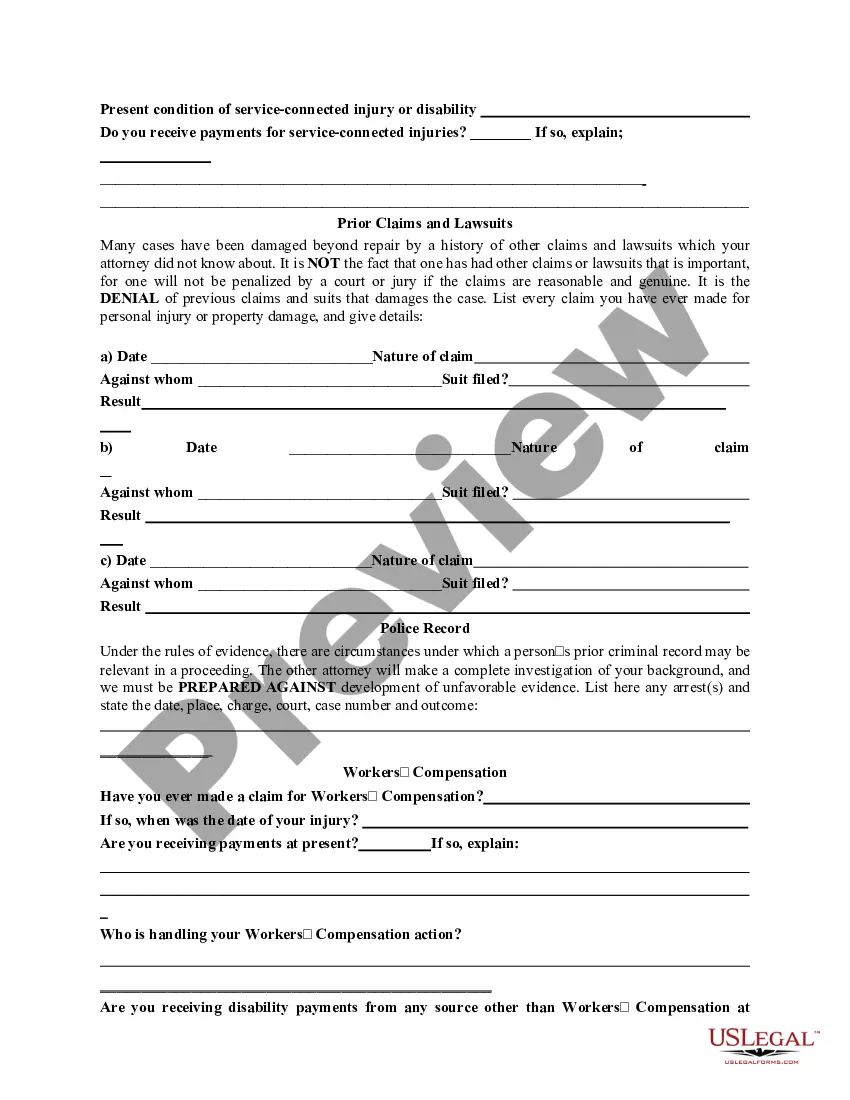

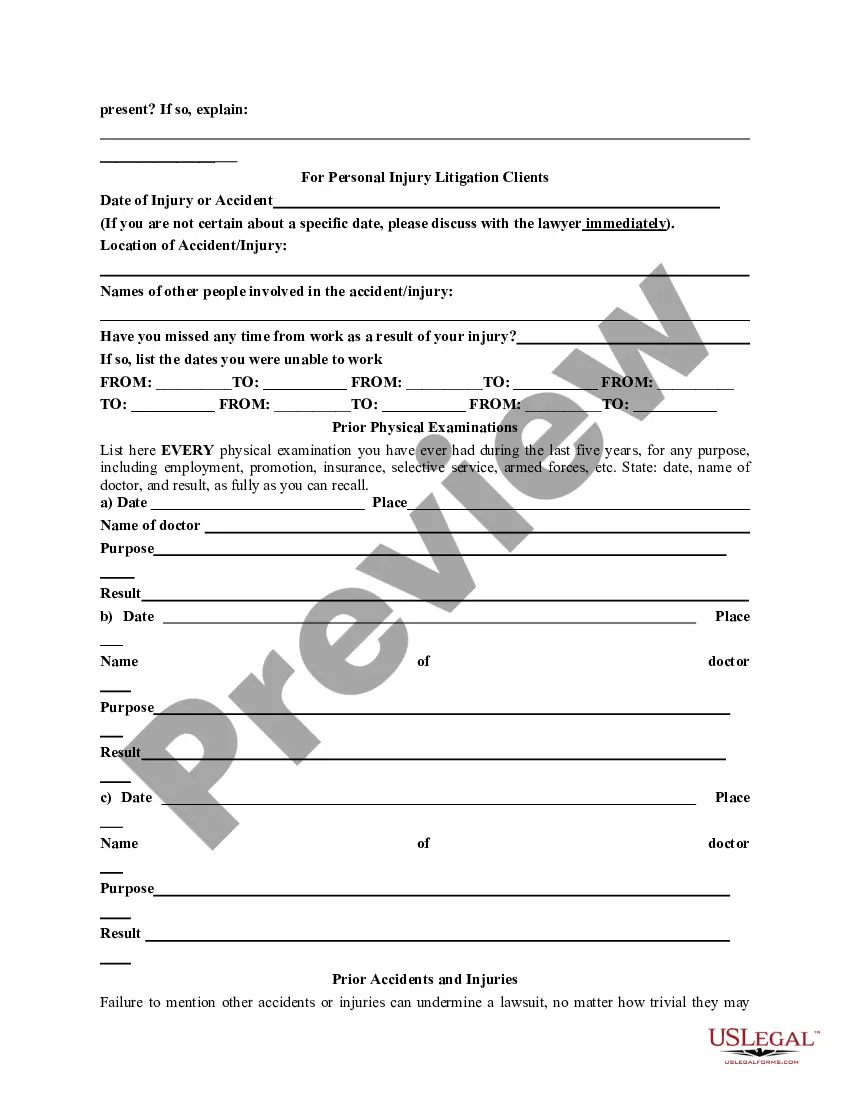

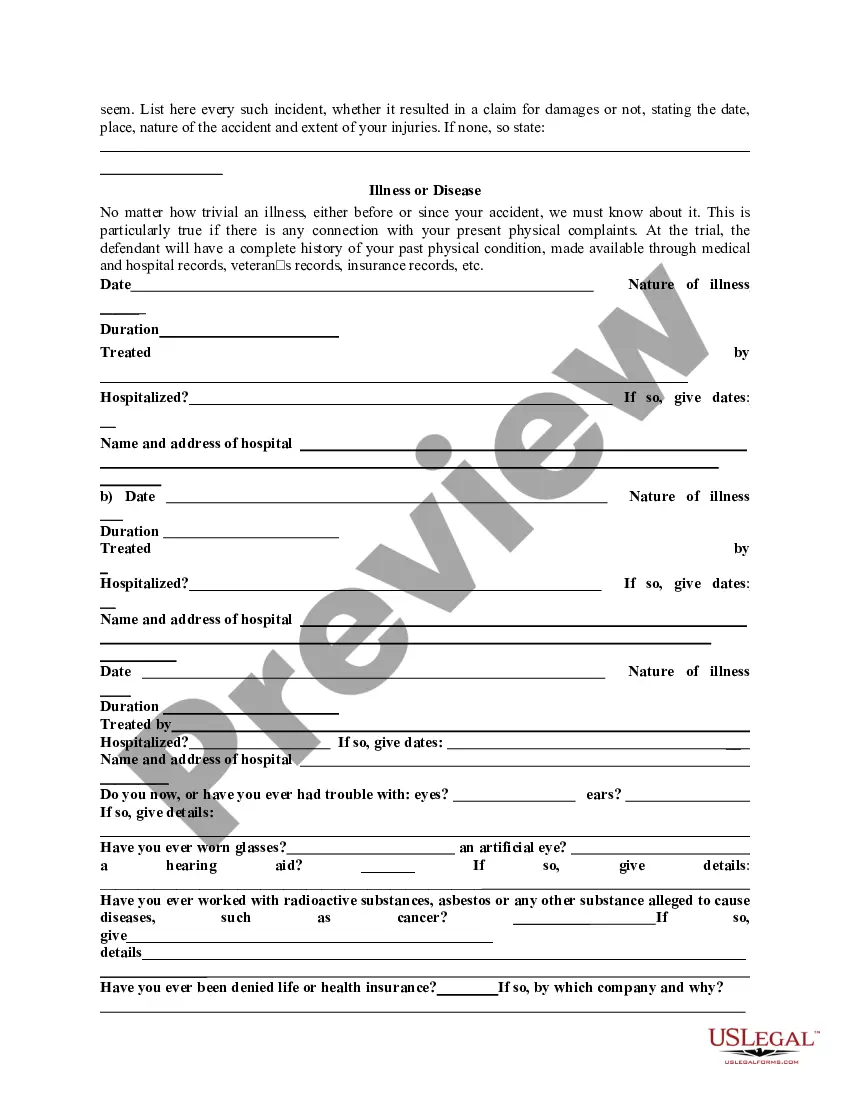

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

California General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Are you currently in a scenario where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, such as the California General Information Questionnaire, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click on Buy now.

Select the pricing plan you desire, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California General Information Questionnaire template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/county.

- Use the Review button to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Lookup section to find the form that meets your needs.

Form popularity

FAQ

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565.

Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. The LLC is organized in California. The LLC is organized in another state or foreign country, but registered with the California SOS.

Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. The LLC is organized in California. The LLC is organized in another state or foreign country, but registered with the California SOS.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

CA Form 568 vs. Form 565 is used by LLCs classified as corporations for federal tax purposes, whereas Form 568 is for LLCs classified as partnerships or disregarded entities. Determining your LLC's federal tax classification is essential to determine which form to use.

All businesses registered with the state of California have to pay the California Franchise Taxes (except for tax-exempt businesses like nonprofits). This means that C corps, S corps, LLCs, LPs, LLPs, and LLLPs all are all responsible for the California Franchise Tax.

In California, you are not required to file any paperwork with the State or elsewhere to create a general partnership (although you can choose to do so). If you do business under a trade name, then you must file a fictitious business name statement in the county where your principal place of business is located.