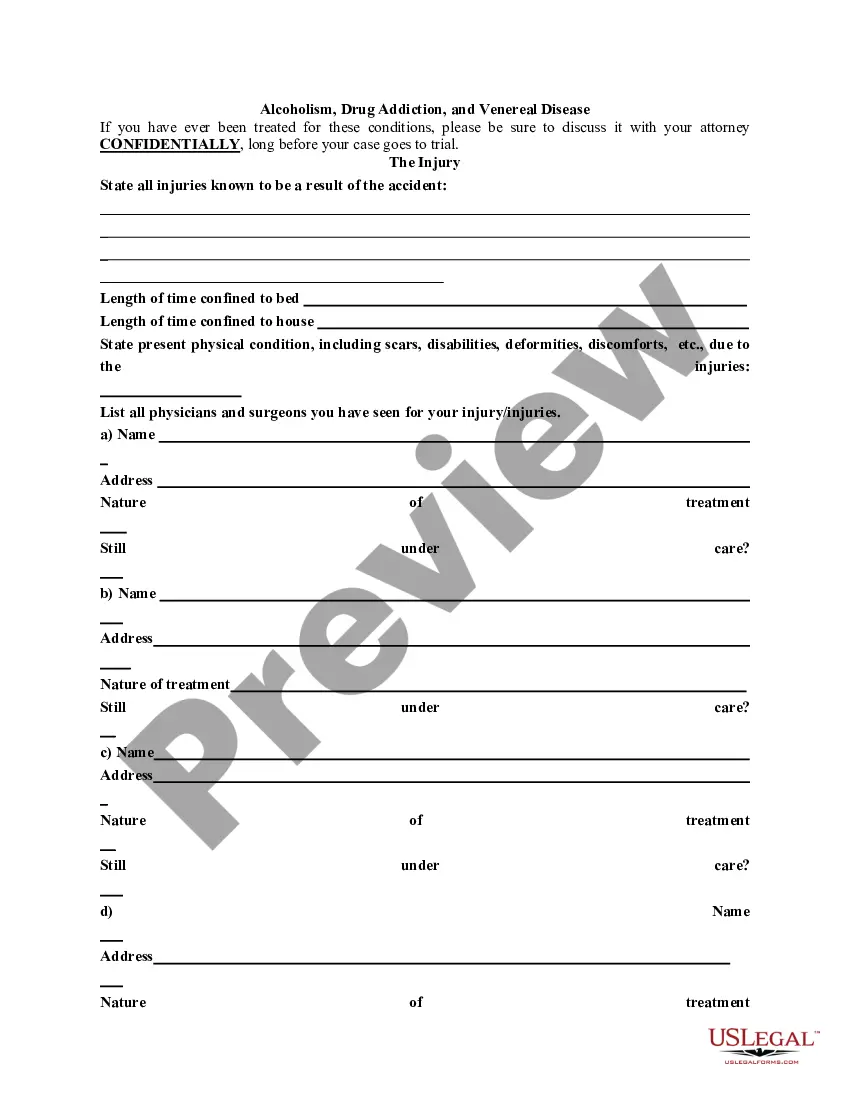

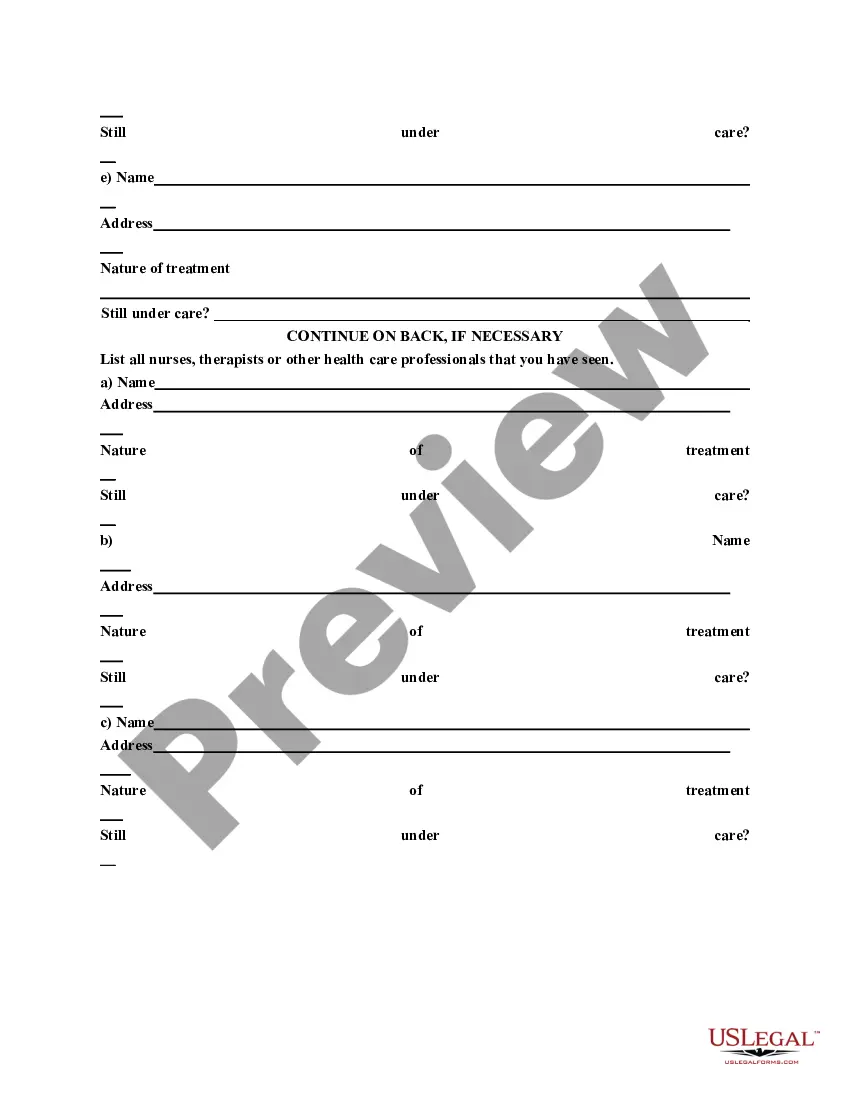

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Arkansas General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Selecting the optimal legal document template can be a challenge. Of course, there are numerous templates accessible online, but how do you find the legal form you desire? Utilize the US Legal Forms website. The service offers thousands of templates, including the Arkansas General Information Questionnaire, which you can use for both business and personal needs. All forms are verified by professionals and meet federal and state requirements.

If you are already registered, Log In to your account and click the Obtain button to retrieve the Arkansas General Information Questionnaire. Use your account to browse through the legal forms you have previously acquired. Navigate to the My documents section of your account to get another copy of the document you wish to access.

If you are a new user of US Legal Forms, here are simple guidelines for you to follow: First, make sure you have selected the correct form for your region/county. You can review the form using the Preview button and read the form description to confirm it is suitable for your needs. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain the form is suitable, click the Buy now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Arkansas General Information Questionnaire.

Overall, US Legal Forms is a valuable resource for accessing a wide array of legal templates that cater to both individual and business needs.

- US Legal Forms boasts the largest collection of legal documents where you can access various file templates.

- Utilize the service to download professionally crafted papers that comply with state regulations.

- The platform provides a user-friendly interface for easy navigation.

- You can manage your forms and retrieve past documents conveniently.

- The templates are regularly updated to meet current legal standards.

- Support is available to assist users with any inquiries regarding their forms.

Form popularity

FAQ

Arkansas standard deduction for tax year 2021 is $4,400 for married filing jointly and $2,200 for all other filers.

As previously reported (Tax Alert 2023-0779), on April 10, 2023, Arkansas Governor Sarah Huckabee Sanders signed into law SB 549, which, retroactive to January 1, 2023, lowers the top marginal personal income tax rate from 4.9% to 4.7%.

The 2023 standard deduction is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household. People 65 or older may be eligible for a higher standard deduction amount.

Refund: Arkansas State Income Tax. P.O. Box 1000. Little Rock, AR 72203-1000. Tax Due/No Tax: Arkansas State Income Tax. P.O. Box 2144. Little Rock, AR 72203-2144. State. ZIP.

The standard deduction in Arkansas is lower than the federal standard deduction. For most filers, the deduction is $2,200. For married persons filing jointly, it is twice that amount at $4,400.

How to Upload Documents? Once you have logged in to your Access Arkansas account, click on ?Details? for the case you want to upload the document for. If you don't see the case, please see section ?How to Link Your Case? for more details. On the right-hand side of the screen click on ?Upload files.?

Arkansas income taxes Arkansas income tax rates currently max out at 4.7%. The top tax rate will reduce to 4.4% in 2024. The table below shows 2023 Arkansas income tax rates for individuals with net incomes up to $84,500. Taxpayers with net incomes above this amount reach the higher tax brackets sooner.

Rep. Lane Jean, R-Magnolia, filed an identical bill as House Bill 1004. In April, Sanders signed into law a bill that cut the state's top individual income tax rate from 4.9% to 4.7% and the state's top corporate income tax rate from 5.3% to 5.1%, retroactive to Jan. 1, 2023.