New Mexico Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, categorized by groups, states, or keywords. You can access the latest versions of forms such as the New Mexico Pay in Lieu of Notice Guidelines in seconds.

If you already have an account, Log In and download the New Mexico Pay in Lieu of Notice Guidelines from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit. Fill, modify, print, and sign the downloaded New Mexico Pay in Lieu of Notice Guidelines. Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the New Mexico Pay in Lieu of Notice Guidelines with US Legal Forms, the most extensive collection of legal document templates. Utilize numerous professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your area/county.

- Click the Review button to examine the form's content.

- Refer to the form description to confirm that you have chosen the right one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find an appropriate one.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

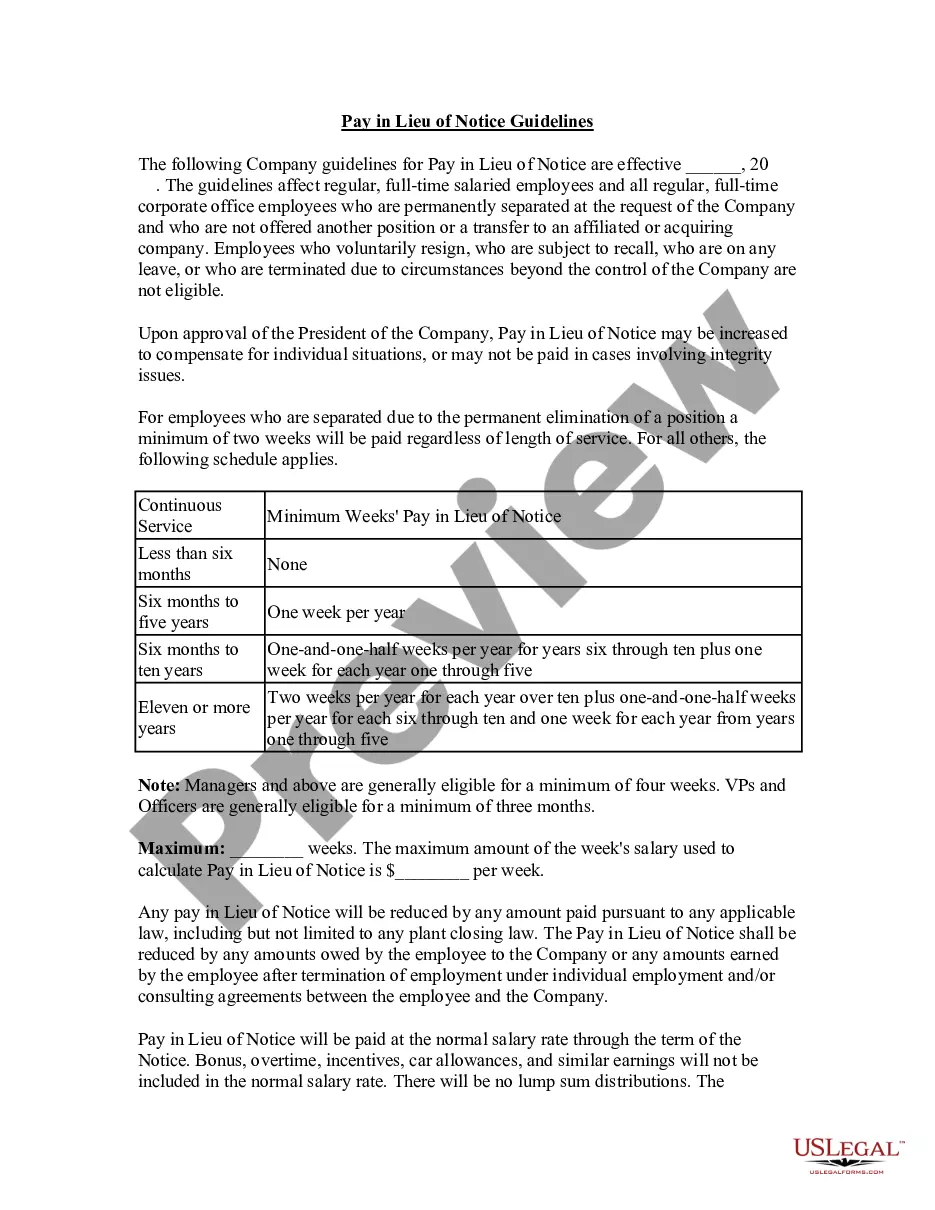

To calculate payment in lieu of notice, you multiply the employee's salary by the number of notice days or weeks that would normally be provided. Ensure that you factor in any applicable benefits or additional compensation that may apply. Following the New Mexico Pay in Lieu of Notice Guidelines can streamline this process.

To calculate days in lieu, identify how many days of notice the employer is required to provide. Next, refer to the employee’s standard work hours and rate of pay for these days. By using the New Mexico Pay in Lieu of Notice Guidelines, you can ensure that your calculations are compliant with state regulations.

Calculating in lieu involves assessing the employee's pay over the required notice period. You take the employee's daily or weekly wage and multiply it by the number of notice days specified in the employment agreement or state guidelines. Adhering to the New Mexico Pay in Lieu of Notice Guidelines ensures you do this correctly.

Using in lieu of notice means that an employer opts to provide payment instead of the employee working through their notice period. This approach allows both parties to part ways more amicably, without extending the working relationship unnecessarily. Referencing the New Mexico Pay in Lieu of Notice Guidelines can help clarify how to proceed effectively.

To calculate in lieu of notice, first determine the employee’s regular pay rate and the length of notice required. Typically, you multiply the pay rate by the number of weeks or days of notice that is mandated by your company’s policy. Keeping in mind the New Mexico Pay in Lieu of Notice Guidelines will help ensure accurate calculations.

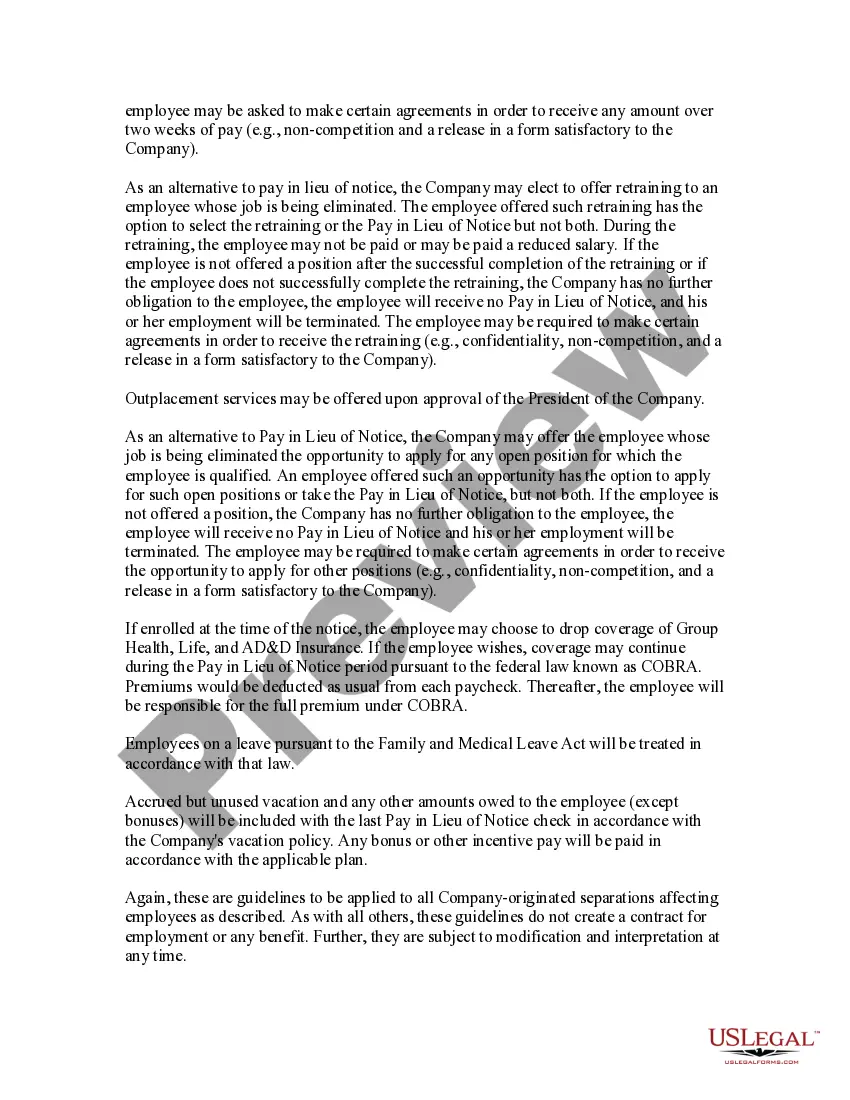

New Mexico is an employment-at-will state. This means that an employer may generally terminate an employee at any time, for any reason, or for no reason, unless an agreement exists that provides otherwise.

Under New Mexico law, employees are entitled to certain leaves or time off, including military leave, voting leave, domestic violence leave, emergency responder leave and jury duty leave. See Time Off and Leaves of Absence. New Mexico prohibits smoking in the workplace and texting while driving. See Health and Safety.

Severance pay or Voluntary Buyout payments and legal settlements which result in payments to an employee are not considered wages and are not reportable to the Department.

No federal or state law in New Mexico requires employers to pay out an employee's accrued vacation, sick leave, or other paid time off (PTO) at the termination of employment.

New Mexico is an employment-at-will state. This means that an employer may generally terminate an employee at any time, for any reason, or for no reason, unless an agreement exists that provides otherwise.