New Mexico Agreement Replacing Joint Interest with Annuity

Description

How to fill out Agreement Replacing Joint Interest With Annuity?

You can invest hours online attempting to locate the legitimate document format that fulfills the state and federal requirements you seek.

US Legal Forms provides an extensive collection of legal documents that have been reviewed by experts.

It is easy to download or print the New Mexico Agreement Replacing Joint Interest with Annuity from our service.

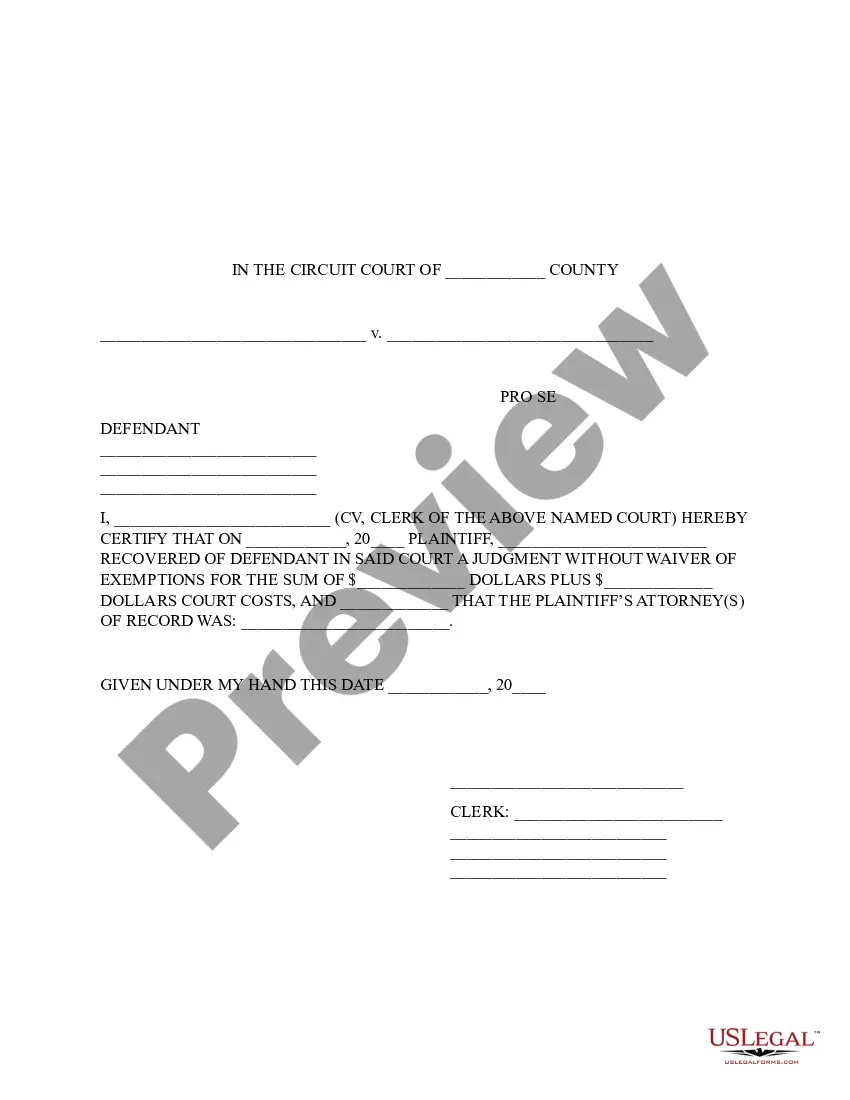

If available, use the Preview button to view the format as well.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Subsequently, you can fill out, edit, print, or sign the New Mexico Agreement Replacing Joint Interest with Annuity.

- Every legal document you obtain is yours permanently.

- To receive an additional copy of a purchased document, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct format for the county or town of your choice.

- Review the document description to confirm you have chosen the right format.

Form popularity

FAQ

Definition: Replacement is any transaction where, in connection with the purchase of New Insurance or a New Annuity, you lapse, surrender, convert to Paid-up Insurance, Place on Extended Term, or borrow all or part of the policy loan values on an existing insurance policy or an annuity.

Variable annuities are securities and under FINRA's jurisdiction. Annuities are often products investors consider when they plan for retirementso it pays to understand them. They also are often marketed as tax-deferred savings products.

The second primary impact of the SECURE Act involves changes to IRA distributions, including the elimination of stretch IRA options for future non-spouse beneficiaries this applies to annuities included in retirement plans. Unless an annuity made payments before the enactment date of the SECURE Act (Jan.

A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange, but you cannot exchange an annuity contract for a life insurance policy.

Generally, the Section 1035 exchange rules allow the owner of a financial product, such as a life insurance or annuity contract, to exchange one product for another without treating the transaction as a saleno gain is recognized when the first contract is disposed of, and there is no intervening tax liability.

Are Annuities Protected? The short answer is yes. Annuities are regulated and protected at the state level. Every state has a nonprofit guaranty organization that each insurance company operating in that state must join.

If you purchase an annuity and later find an annuity with better terms, there is a provision in the law that permits exchanging one annuity for another, as long as the person who holds the contract doesn't change.

Annuities are now an option for your 401(k), thanks to the SECURE Act.

(The SECURE Act does not impact non-qualified annuities.) The SECURE Act increases the age at which an individual is generally required to begin taking RMDs from their employer-sponsored retirement plan and/or traditional IRA, from age 70½ to 72.

So what is not allowable in a 1035 exchange? Single Premium Immediate Annuities (SPIAs), Deferred Income Annuities (DIAs), and Qualified Longevity Annuity Contracts (QLACs) are not allowed because these are irrevocable income contracts.