North Dakota Assignment of Interest in Trust

Description

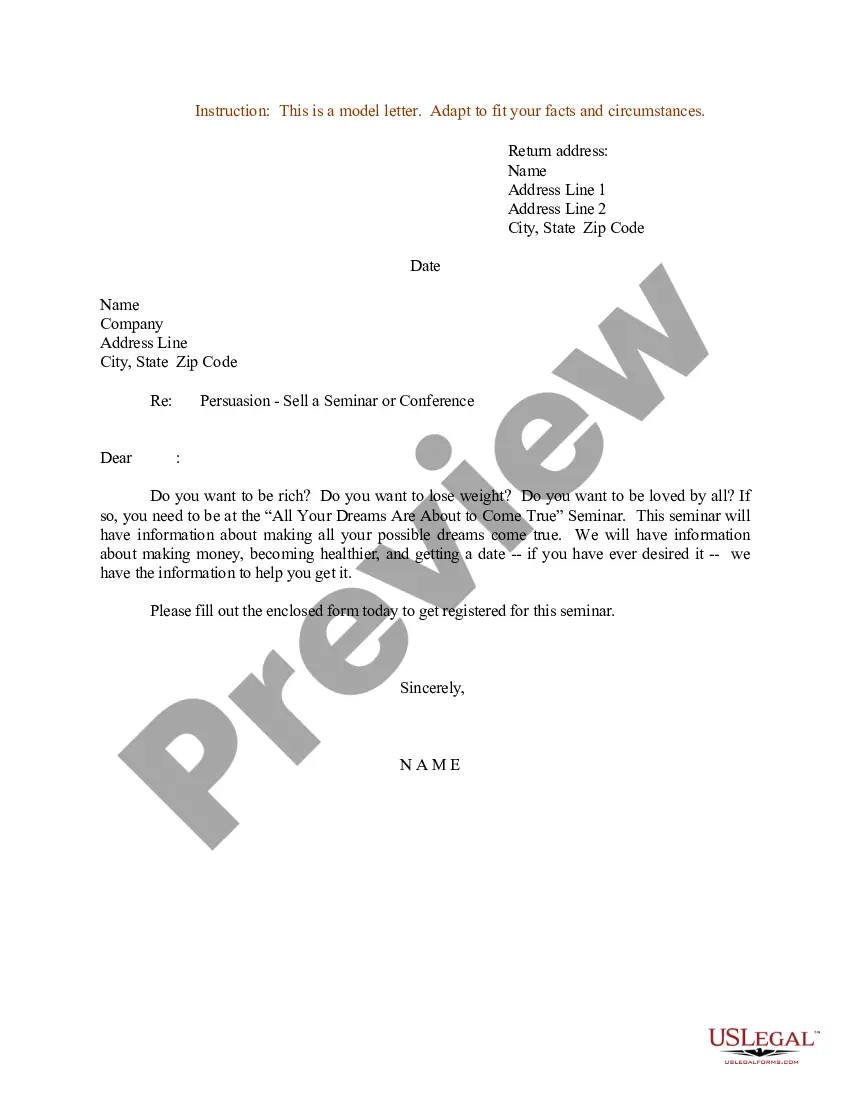

How to fill out Assignment Of Interest In Trust?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a vast selection of legal document templates available for purchase or printing.

By utilizing the website, you can access thousands of forms for both business and personal needs, organized by category, state, or keywords.

You can find the latest versions of documents such as the North Dakota Assignment of Interest in Trust within moments.

If the form does not meet your criteria, use the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- If you are already a subscriber, Log In to obtain the North Dakota Assignment of Interest in Trust from the US Legal Forms library.

- The Obtain button will be displayed on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Be sure you have selected the correct form for your city/state. Click the Review button to examine the form's content.

- Refer to the form description to ensure that you have chosen the correct document.

Form popularity

FAQ

A beneficiary typically has a future interest in the trust's assets meaning they might access funds at a determined time, such as when the recipient reaches a certain age.

When you receive a distribution of principal from irrevocable trust funds, you will be required to report this income on your standard IRS Form 1040 tax form, as this money will almost always be taxed at normal income tax rates.

Trust Interest means an account owner's interest in the trust created by a participating trust agreement and held for the benefit of a designated beneficiary.

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust.

Under a trust, there are 2 types of interest in trust property that the parties to the trust instrument will acquire. A trustee has a legal interest in the trust property and the power to deal and invest the trust property, subject to the terms of the instrument that created the trust.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors. Next, disclaimers are used when a beneficiary, or heir, refuses to accept a gift or inheritance.

Trustees are trusted to make decisions in the beneficiary's best interests and often have a fiduciary responsibility, meaning they act in the best interests of the trust beneficiaries to manage their assets.

A conflict of interest for a trustee occurs when the trustee's personal interests potentially conflict with their responsibilities to the trust beneficiaries.