An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

If you desire to acquire, obtain, or create sanctioned document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Leverage the site’s user-friendly and convenient search to find the documents you require. Numerous templates for business and personal purposes are categorized by areas and titles, or keywords.

Utilize US Legal Forms to access the North Dakota Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary with just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you saved in your account. Navigate to the My documents section and choose a document to print or download again.

Engage and acquire, and print the North Dakota Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to retrieve the North Dakota Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

- You can also access documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the following steps.

- Step 1. Ensure you have chosen the form for your specific city/state.

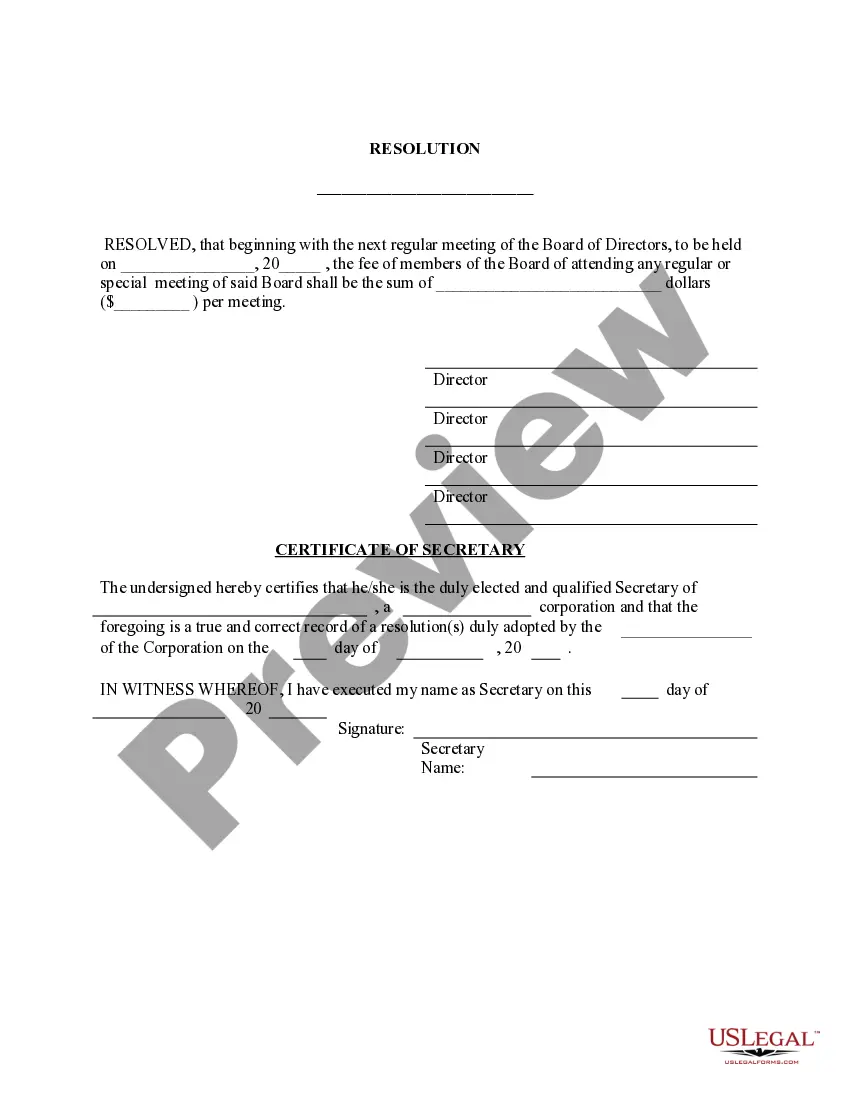

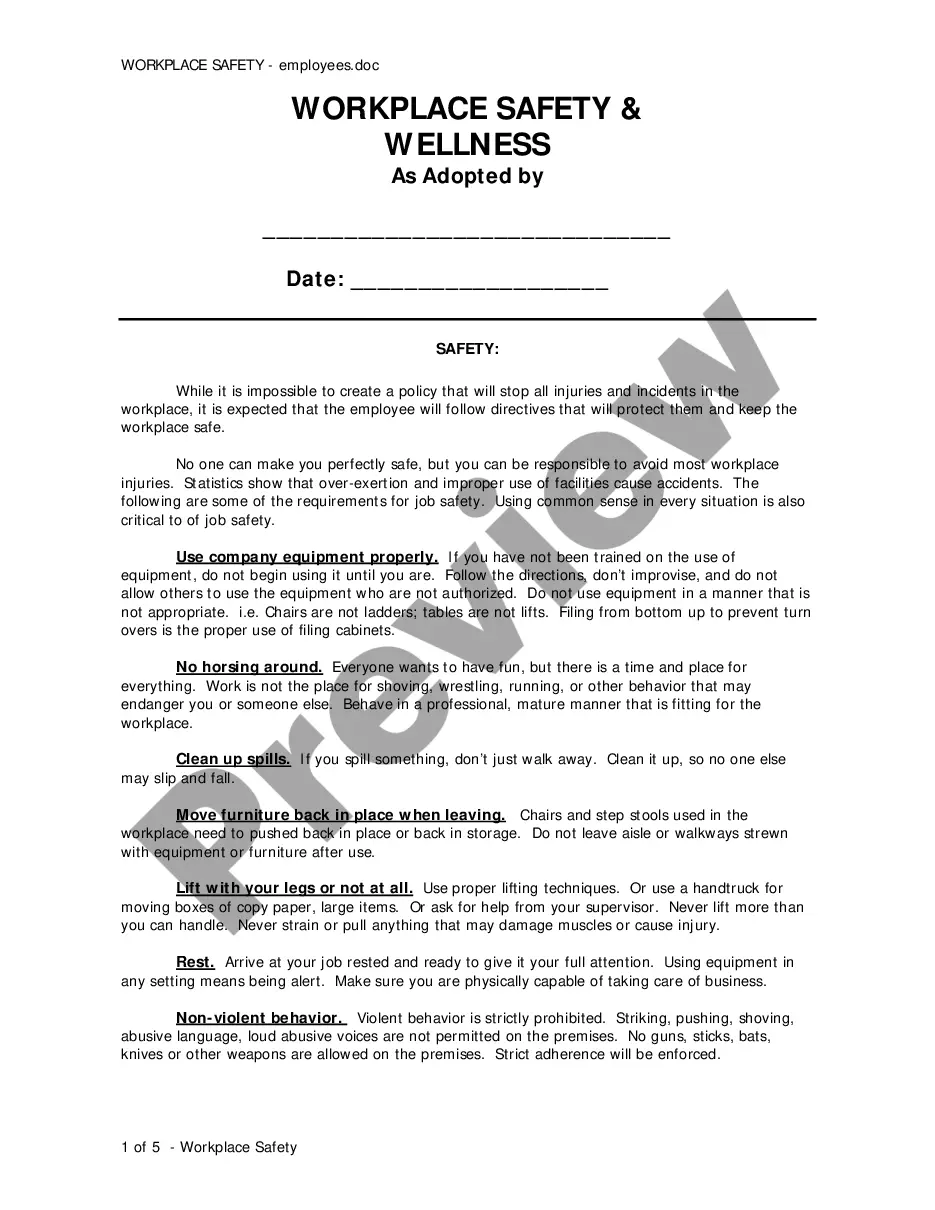

- Step 2. Use the Preview option to review the form’s content. Remember to examine the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to locate other templates of your legal document category.

- Step 4. Once you locate the form you want, click the Buy now button. Select the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the North Dakota Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

Form popularity

FAQ

The best way to list beneficiaries is to be clear and precise on the forms you use. Start with their full names, and include additional information such as relationships and contact details. Ensure each beneficiary's share is clearly stated, especially if using the North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, as this can enhance transparency and understanding for all parties involved.

Assigning a beneficiary is a straightforward task that involves naming the person or entity you wish to receive your assets. Start by obtaining a beneficiary form from your financial institution or legal platform. After filling in the required details, submit the form according to the guidelines. The North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can help clarify and document your choices.

Designating a beneficiary means officially naming individuals or entities to receive specific assets upon your passing. This process ensures that your wishes are followed without unnecessary delays or complications. Understanding this concept is crucial for effective estate planning, particularly when using the North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

To list a trust as a beneficiary, clearly state the trust’s name and its identifying details on your beneficiary form. Ensure you reference the trust document to confirm its validity and set terms. This step is important for effective estate management, especially when incorporating the North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

Assigning beneficiaries involves specifying who will receive your assets upon your passing. Start by listing your beneficiaries, providing their identifying details, and indicating their shares. It's crucial to ensure that your assignments align with your estate planning strategy. Utilizing the North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can simplify this task.

Allocating percentages to beneficiaries requires thoughtful consideration of your wishes. Start with the total value of the trust or account and then allocate portions based on your intentions. Clearly document these percentages in your beneficiary form. For those using the North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, this allocation can be essential for ensuring your intent is honored.

To fill out a beneficiary designation form, first read the instructions carefully. Next, provide the necessary information for each beneficiary, including their relationship to you and their percentage of interest. Don't forget to sign and date the form. This process is simple, particularly when referencing the North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary for clarity.

Filling out a beneficiary form for an IRA involves specifying the recipients of your account upon your passing. Start by gathering the full names, birthdates, and Social Security numbers of your beneficiaries. Ensure you indicate primary and contingent beneficiaries clearly. Completing this form correctly is essential, especially when utilizing the North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

A simple trust can only distribute income, not principal, which may limit flexibility for beneficiaries. Additionally, the income earned may be fully taxable to beneficiaries, which could create unwanted tax liabilities. Understanding the implications of a North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is essential for effective trust management.

If a simple trust fails to distribute income, it may face tax penalties and could affect the beneficiaries' tax obligations. Moreover, the IRS may impose additional requirements for the trust. When managing a North Dakota Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, consider compliance and timely distributions to avoid complications.