New Mexico Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

You can dedicate multiple hours online searching for the legal document format that meets the state and federal requirements you require.

US Legal Forms offers thousands of legal templates that have been reviewed by specialists.

You can easily obtain or create the New Mexico Private Annuity Agreement from your service.

If available, use the Review button to view the format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, edit, print, or sign the New Mexico Private Annuity Agreement.

- Every legal document you purchase is yours indefinitely.

- To get another copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure that you have chosen the correct format for the state/region of your selection.

- Check the form description to confirm you have chosen the correct form.

Form popularity

FAQ

When you receive payments from a qualified annuity, those payments are fully taxable as income. That's because no taxes have been paid on that money. But annuities purchased with a Roth IRA or Roth 401(k) are completely tax free if certain requirements are met.

There are four basic types of annuities to meet your needs: immediate fixed, immediate variable, deferred fixed, and deferred variable annuities. These four types are based on two primary factors: when you want to start receiving payments and how you would like your annuity to grow.

Each annuity payment includes a return of part of the sum invested (the capital) plus the part that is interest. You won't pay income tax on the capital. You'll only pay tax on the interest part of your annuity income. They can be written on a capital protected basis.

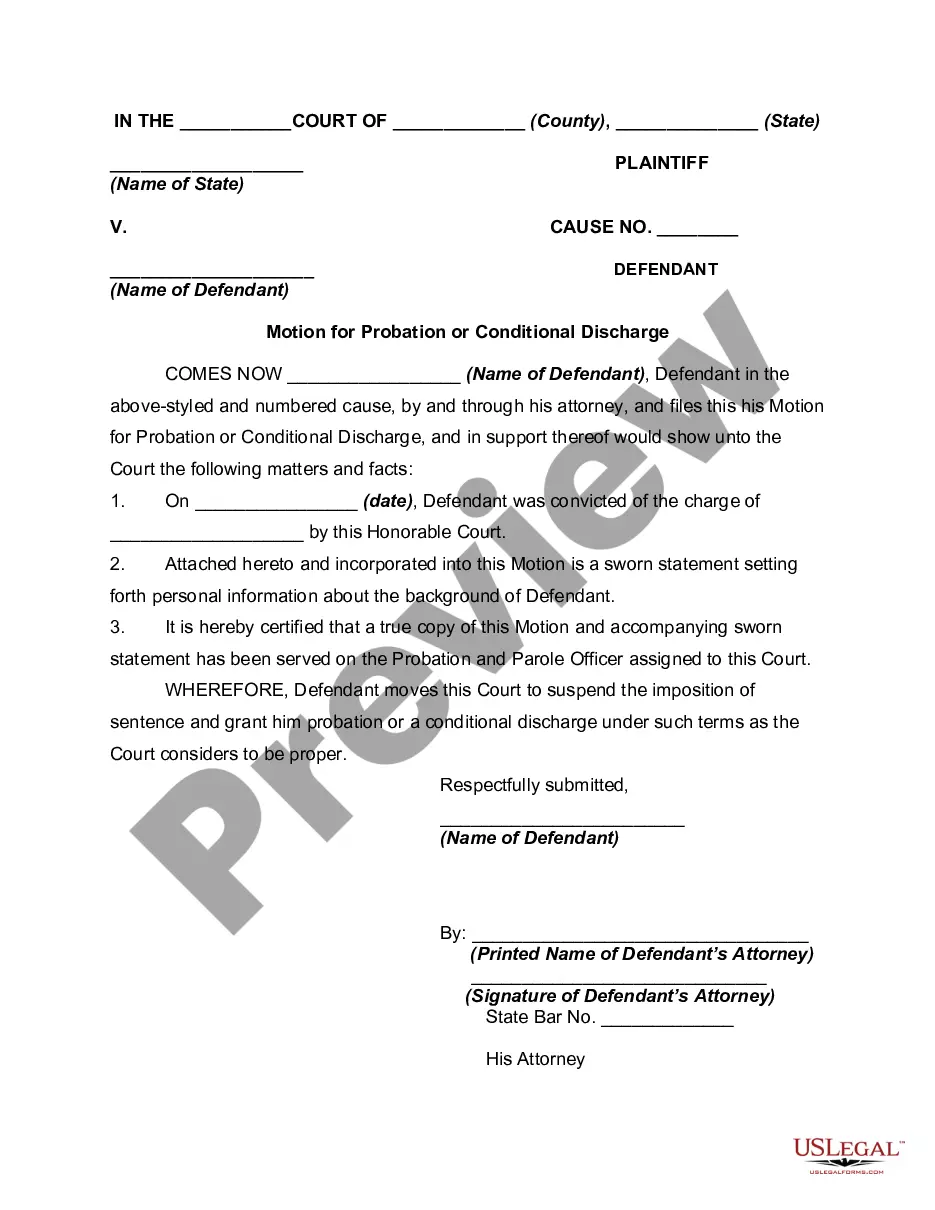

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.

In the simplest terms, an annuity is a financial contract between a person and an insurance company that provides retirement income or death benefits.

There are three parties to an annuity contract: the owner, annuitant and the beneficiary. The owner makes the initial investment, decides when to begin taking income and can change the beneficiary designation at will. The annuitant's life is used to determine the benefits to be paid out under the contract.

A private annuity is an arrangement where an individual (the annuitant) transfers assets to another (the obligor) in exchange for regular payments for the remainder of the annuitant's life (an annuity).

The annual annuity payment is calculated thus:Annual Annuity Payment = FMV of Property Transferred ÷ Present Value of Annuity Factor.Expected Return of Annuity = Annual Payment A Life Expectancy.Exclusion Ratio = Sellers Cost Basis A· Expected Return.More items...a¢

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

Annuitants pay taxes as they receive payments from their annuity. The tax rate depends on a variety of factors, including the type of annuity, payout option, and type of funds used for the premium. Some people use pre-tax dollars, such as funds from a 401(k) or IRA, to buy an annuity.