New Mexico Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

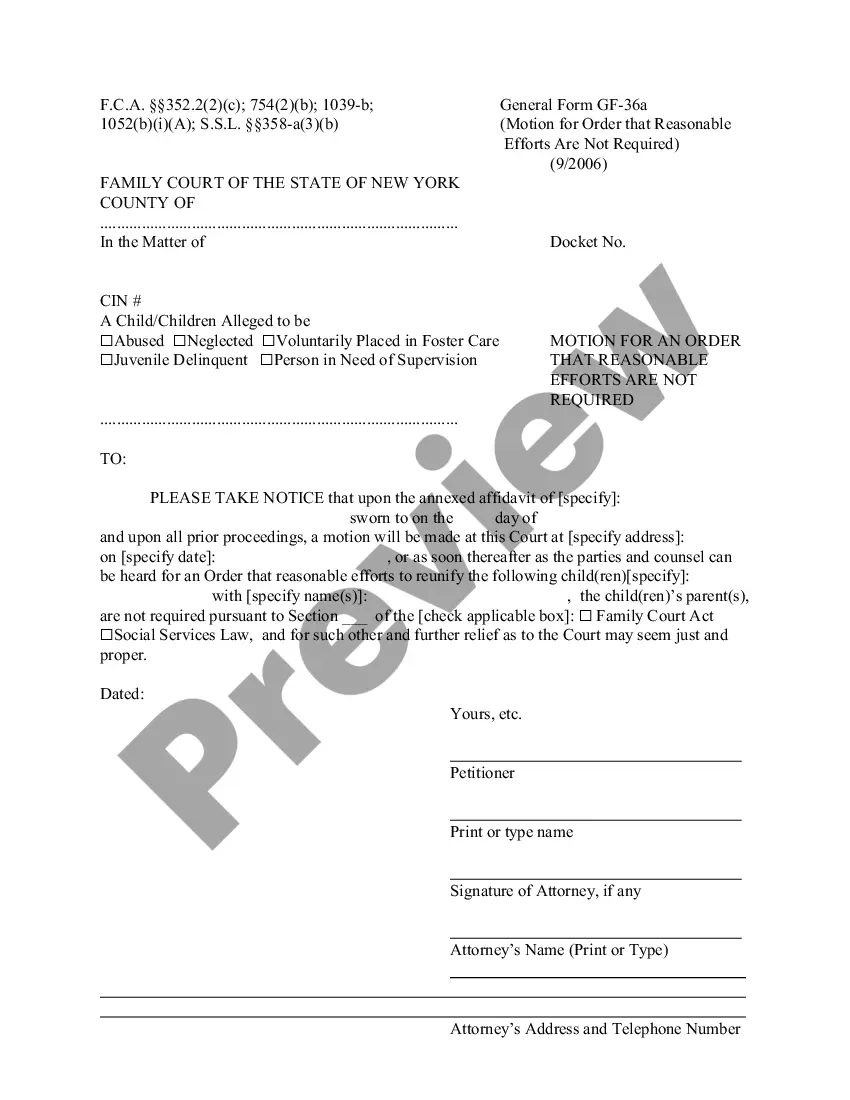

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

You might spend hours online searching for the legal document template that complies with the federal and state standards you require.

US Legal Forms provides a multitude of legal forms that have been reviewed by professionals.

You can easily download or print the New Mexico Provision in Testamentary Trust with Bequest to Charity for a Specific Charitable Purpose from their services.

If available, use the Preview option to examine the document template as well.

- If you possess a US Legal Forms account, you may Log In and select the Download option.

- Next, you can fill out, alter, print, or sign the New Mexico Provision in Testamentary Trust with Bequest to Charity for a Specific Charitable Purpose.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the region/area of your choice.

- Review the form details to make sure you've chosen the right document.

Form popularity

FAQ

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

Generally, you can name anyone, even a charity, as the beneficiary of your life insurance policy or retirement account. You can leave the entire amount of your death benefit to a charity or designate that only a portion of the proceeds goes to the charity and the remainder to a family member or other beneficiary.

Naming a charity as a life insurance beneficiary is simple: Write in the charity name and contact information when you choose or change your beneficiaries. You can name multiple beneficiaries and specify what percentage of the death benefit should go to each.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.

Charitable Beneficiary means one (1) or more beneficiaries of the Trust as determined pursuant to Section 5.9(iii)(f), provided that each such organization must be described in Section 501(c)(3) of the Code and contributions to each such organization must be eligible for deduction under each of Sections 170(b)(1)(A),

As noted above, estates and some older trusts may be eligible for an expanded charitable deduction for amounts permanently set aside for charity. For an irrevocable trust to qualify for a charitable set-aside deduction, in general, (1) no assets may have been contributed to the trust after Oct.

You can make a gift bequest to benefit MCCF by designating a dollar amount, securities, specific property or a percentage of the remainder of your estate. According to current laws, your estate will receive a charitable deduction for the donation, so your heirs will not be required to pay estate tax on these assets.

Although we commonly think of trust beneficiaries as single individuals, it is also possible to name an organization, such as a charity, as the beneficiary of a revocable trust. The process of naming the charity as the beneficiary is virtually no different than the one used to name an individual.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

Beneficiary: Beneficiary(ies) refers to the person, persons, or organization that receives payments or assets from a trust. Beneficiaries can be either charitable or non-charitable, and can be either an income beneficiary or a remainder beneficiary. The beneficiary holds the beneficial title to the trust property.