New Mexico Sample Letter for Payroll Dispute

Description

How to fill out Sample Letter For Payroll Dispute?

You can invest several hours on the Internet searching for the lawful papers template that suits the federal and state needs you want. US Legal Forms supplies a huge number of lawful varieties that are reviewed by professionals. It is simple to down load or printing the New Mexico Sample Letter for Payroll Dispute from your support.

If you already have a US Legal Forms bank account, you are able to log in and then click the Obtain key. Next, you are able to full, revise, printing, or sign the New Mexico Sample Letter for Payroll Dispute. Every lawful papers template you buy is your own property permanently. To have yet another version associated with a bought form, check out the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms site the first time, adhere to the easy recommendations listed below:

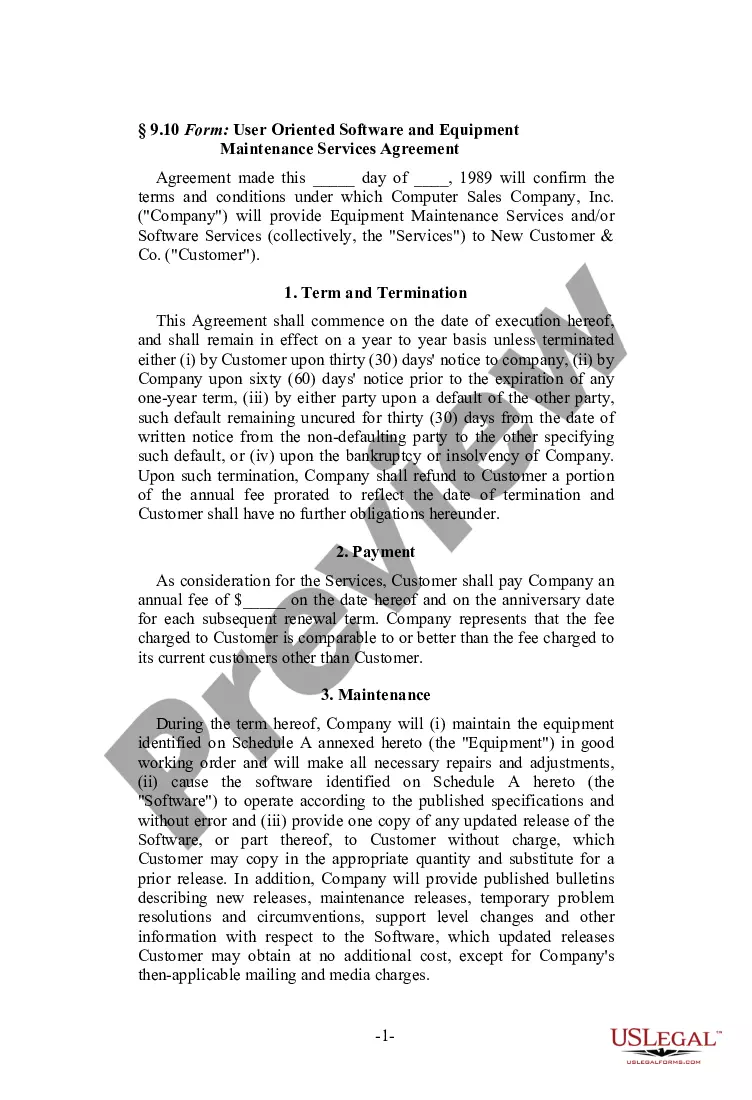

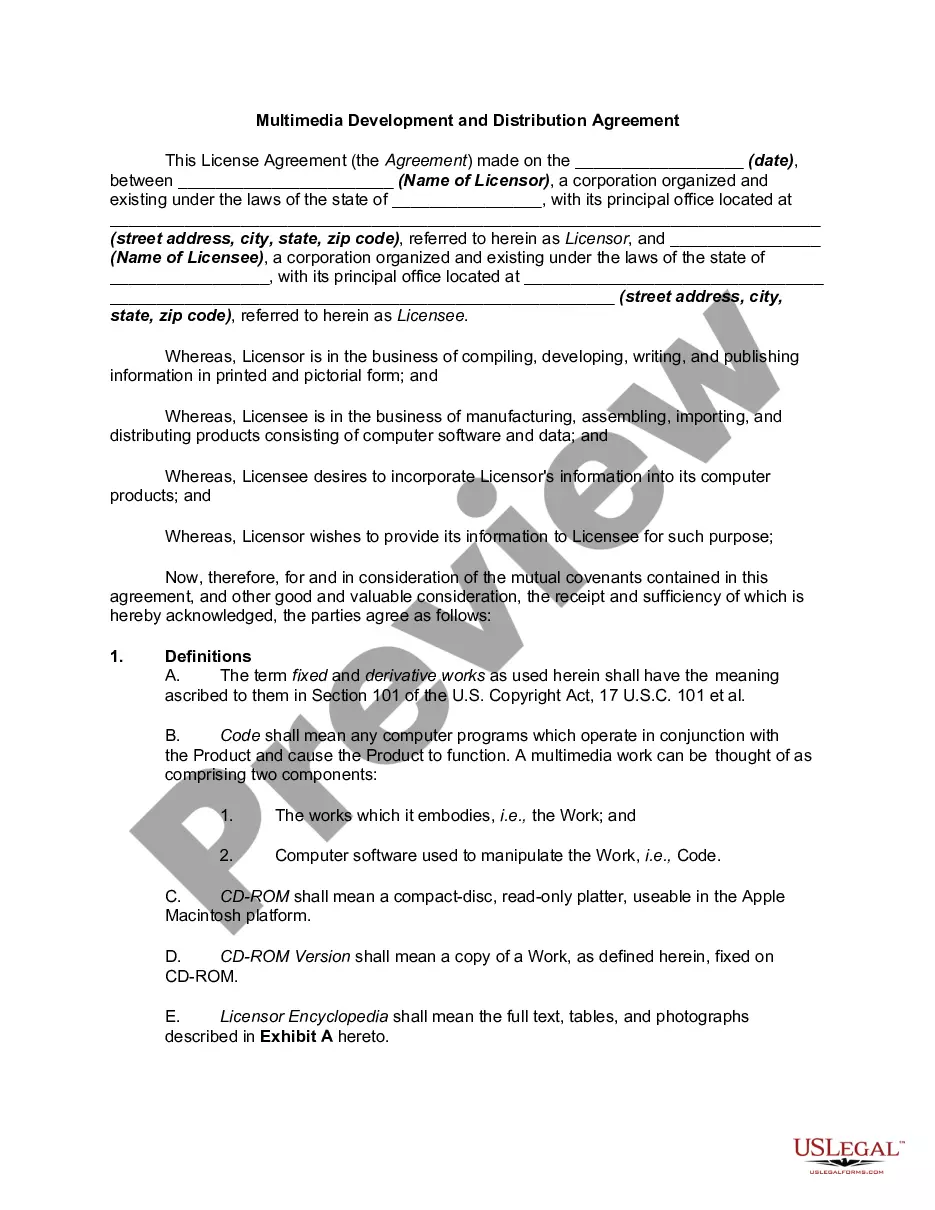

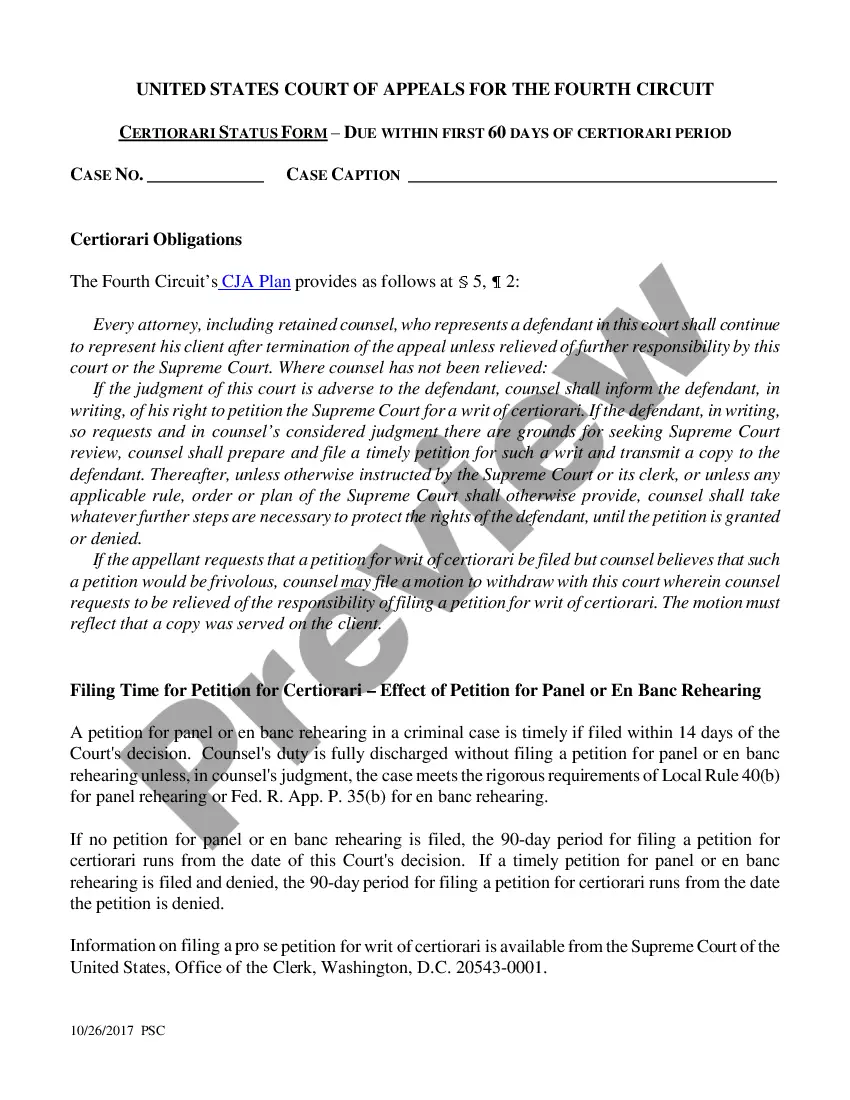

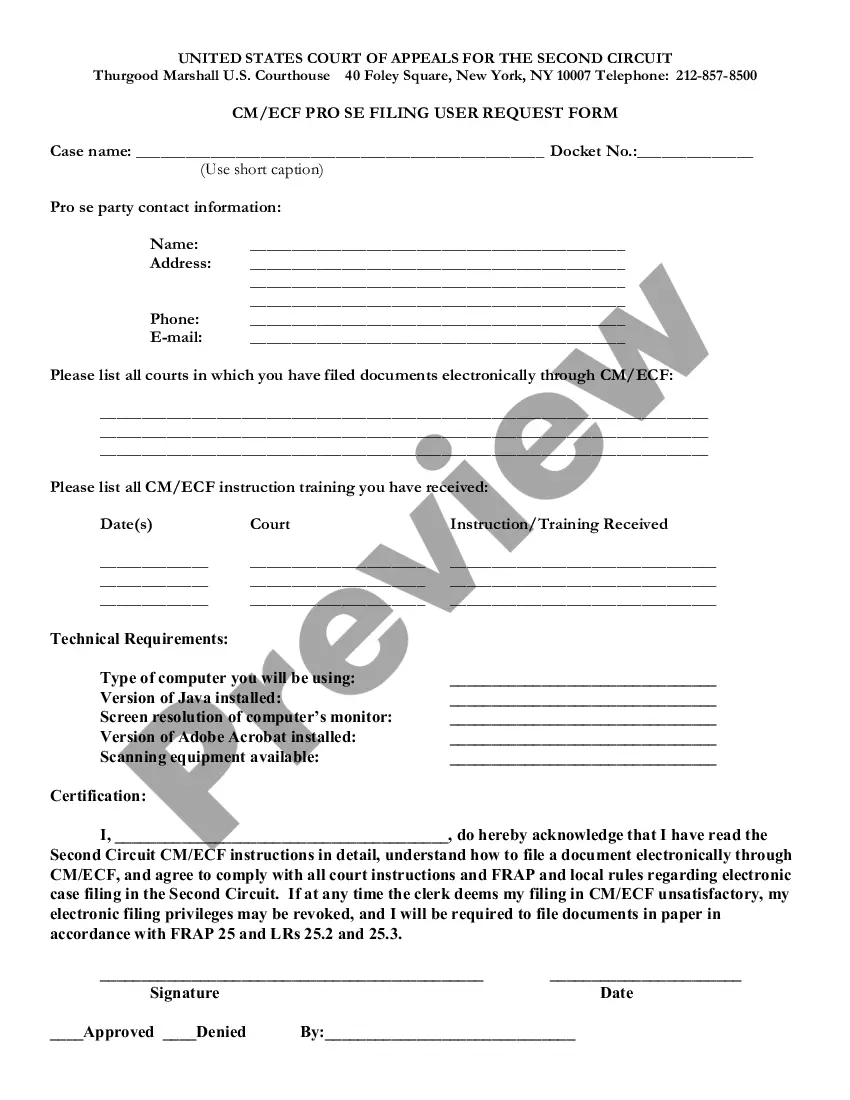

- Initial, be sure that you have chosen the right papers template for that region/city of your liking. Read the form information to ensure you have selected the right form. If accessible, use the Preview key to look from the papers template at the same time.

- In order to find yet another version of the form, use the Look for field to find the template that meets your needs and needs.

- When you have found the template you need, simply click Buy now to proceed.

- Choose the pricing prepare you need, type in your accreditations, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal bank account to cover the lawful form.

- Choose the structure of the papers and down load it to the system.

- Make adjustments to the papers if possible. You can full, revise and sign and printing New Mexico Sample Letter for Payroll Dispute.

Obtain and printing a huge number of papers layouts using the US Legal Forms website, which offers the biggest assortment of lawful varieties. Use professional and condition-distinct layouts to deal with your company or person demands.

Form popularity

FAQ

No. Any deductions other than income taxes and court-ordered payments require your written authorization. If you agreed in writing about the payment amount, that agreement is binding on both you and your employer, ing to the state laws which govern written contracts.

You have the option to take legal action against an employer who refuses to pay your earned wages. In that event, your case may be filed in the Magistrate Court or Metropolitan Court for the county where you worked. You will then be notified of the court date, and you will be asked to testify on your behalf.

Paycheck deductions permitted by law ? and without the expressed consent of the employee ? are limited to taxes, wage garnishments, and meals and lodging. Wage deductions for taxes are more commonly referred to as tax withholdings, and nearly everyone earning a paycheck is subject to them.

Sample wage claim letter (terminated) Dear [employer name]: This is a demand for my final wages. My last day of work was [last day of work]. I have worked and not been paid for [number of hours] hours and I am owed [dollar-amount owed] at this time.

Labor Code Section 224 clearly prohibits any deduction from an employee's wages which is not either authorized by the employee in writing or permitted by law, and any employer who resorts to self-help does so at its own risk as an objective test is applied to determine whether the loss was due to dishonesty, ...

Under California law, an employer can legally deduct from your wages if certain conditions are met. Only under the following circumstances are employers allowed to deduct from your wages: Deductions required by federal or state law including deductions for tax payments, and wage garnishment as ordered by a court.

Report it right away to your boss or human resources: Assume it's an honest mistake and ask for an immediate correction. You should get your unpaid wages in your next check, if not sooner. Otherwise, you're lending your boss money at no interest.

If you are at the receiving end of payroll errors, you should inform your employer immediately. Let them know the exact problem you experienced. Provide your proof of payment (paystub) to show evidence of the error. Your HR team should rectify the problem immediately.