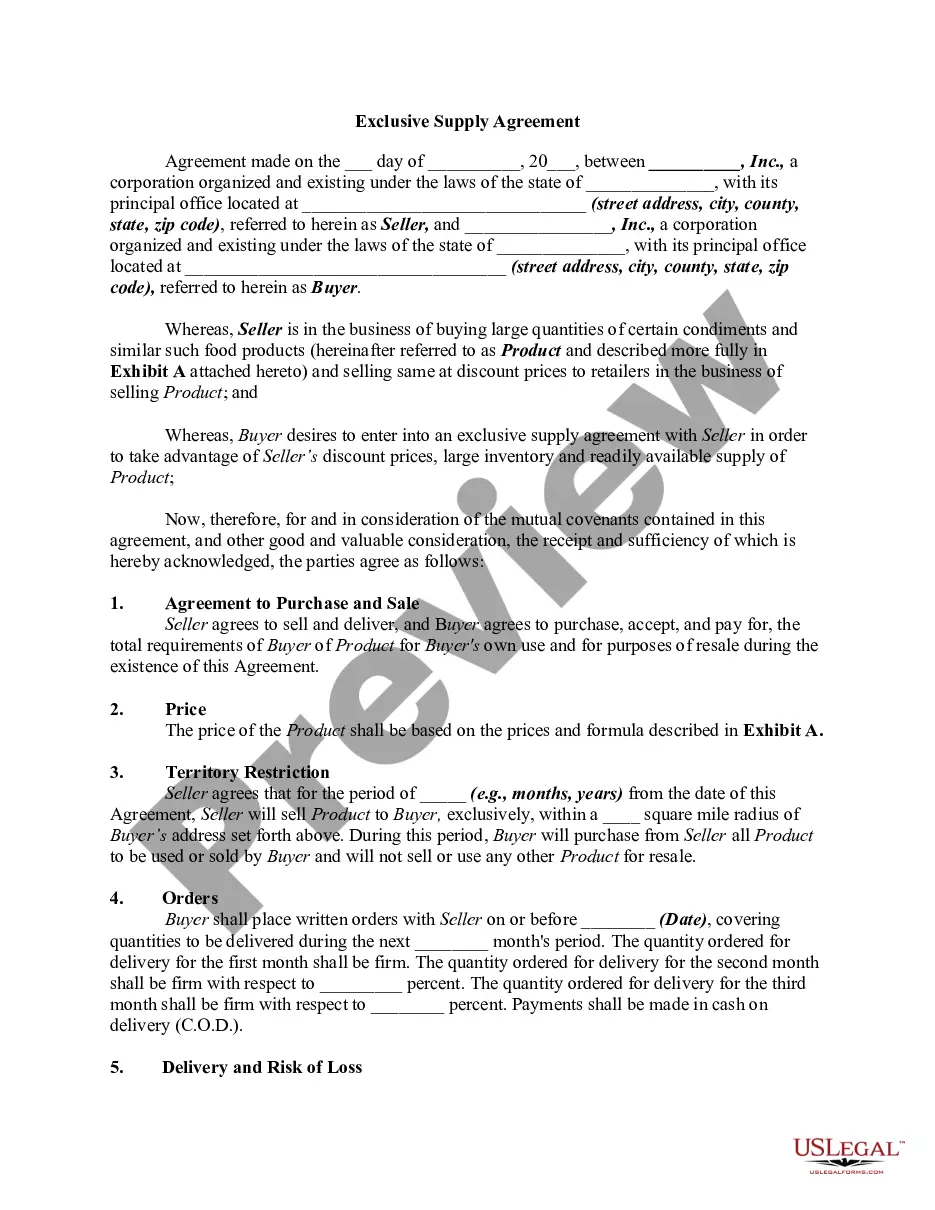

New Mexico Exclusive Supply Agreement

Description

How to fill out Exclusive Supply Agreement?

US Legal Forms - one of the most important collections of legal forms in the United States - offers a vast selection of legal document templates that you can download or print.

By visiting the website, you can find thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms like the New Mexico Exclusive Supply Agreement in just a few seconds.

Read the form description to confirm that you have chosen the right form.

If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you currently have a monthly subscription, Log In to download the New Mexico Exclusive Supply Agreement from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously saved forms in the My documents tab of your account.

- To use US Legal Forms for the first time, here are some simple instructions to get you started.

- Make sure you have selected the correct form for your area/region.

- Click the Preview button to review the form's content.

Form popularity

FAQ

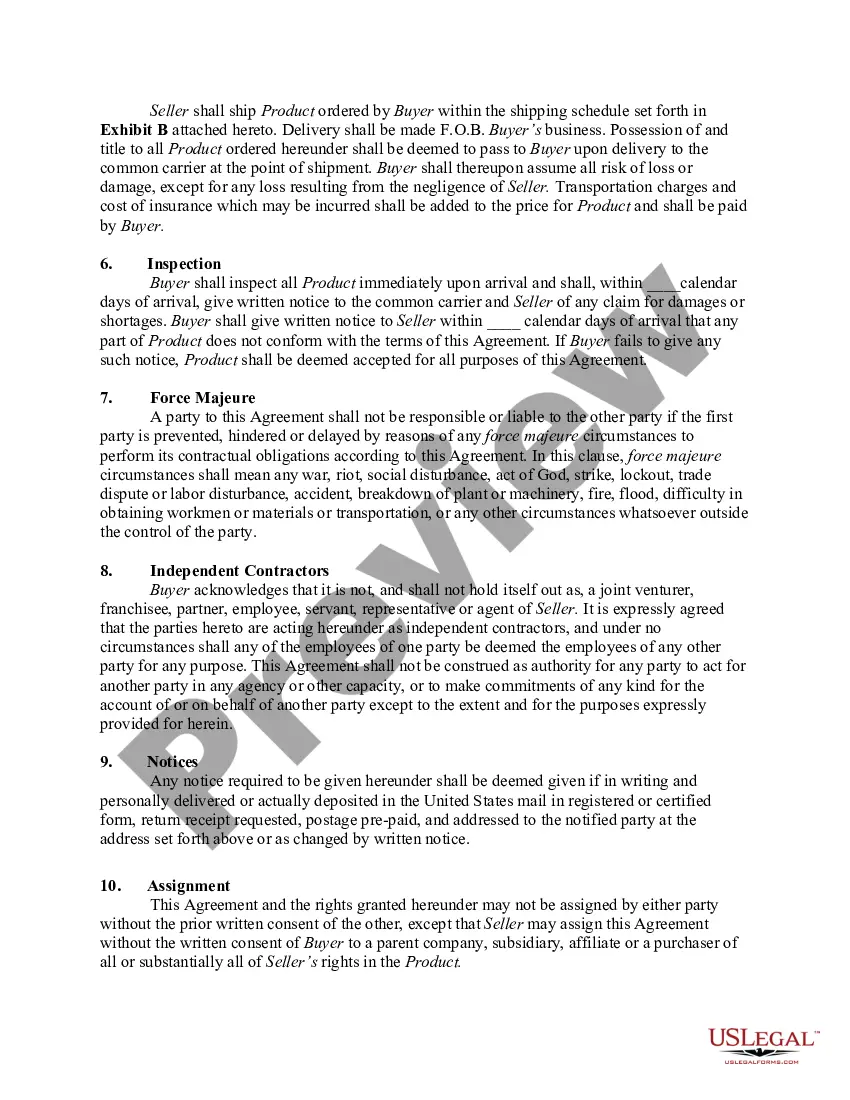

Filling out a New Mexico Exclusive Supply Agreement involves providing clear, detailed information about the parties involved, products supplied, and agreed-upon terms. Make sure to read carefully through each section before signing, ensuring data aligns with your business capabilities and needs. Utilizing platforms like US Legal Forms can streamline this process, offering templates and guidance for proper completion.

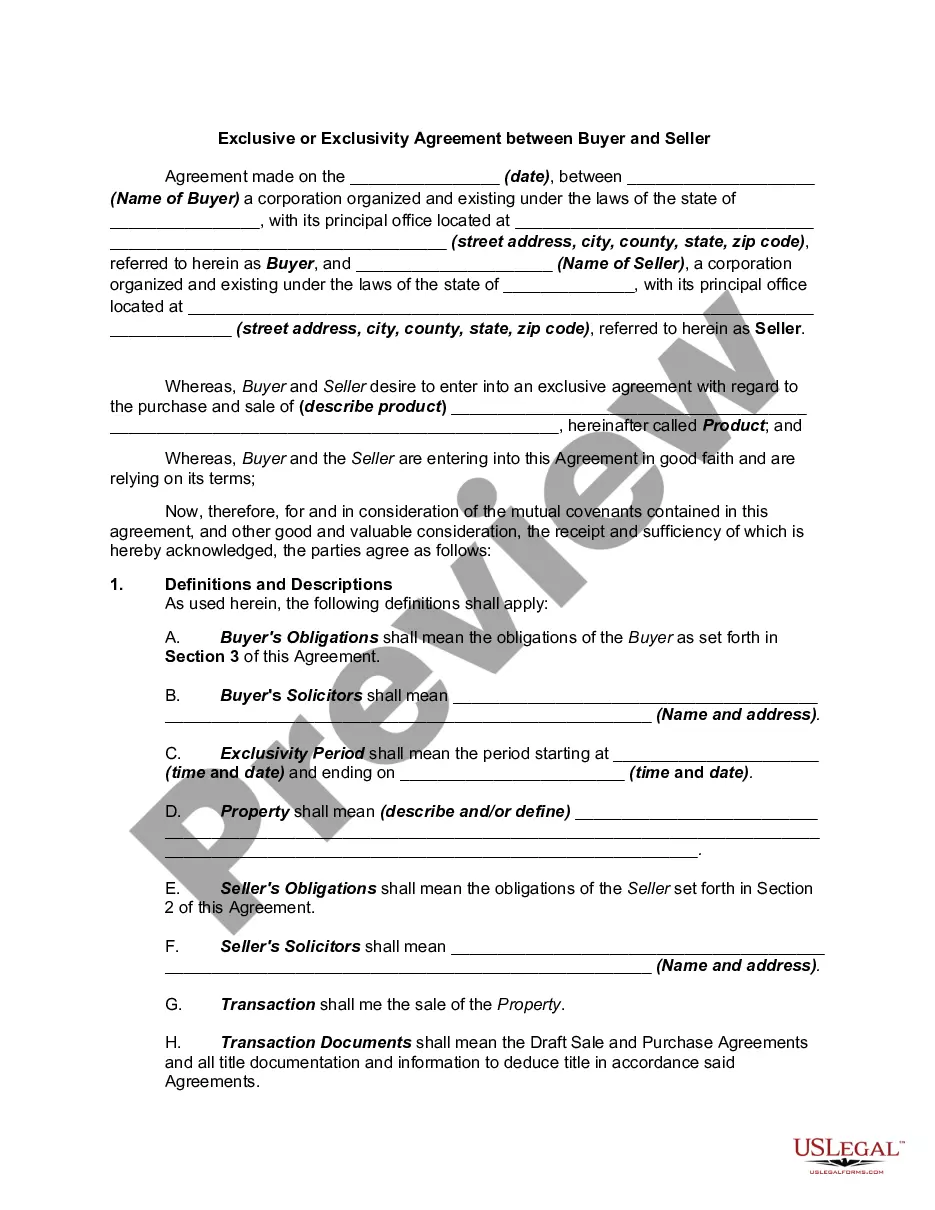

An exclusive agreement can take various forms, including those that grant rights to a specific seller for a particular product or service within a designated area. In the context of a New Mexico Exclusive Supply Agreement, this means that one party exclusively supplies a product without competition from similar providers. Such agreements foster loyalty and stability in business relationships.

While New Mexico does not legally require an operating agreement for an LLC, having one is highly recommended. An operating agreement outlines the management structure and operational guidelines of the business, providing a framework that governs the internal processes. This is particularly valuable for businesses entering into a New Mexico Exclusive Supply Agreement as it sets clear expectations.

An exclusive distribution agreement is similar to a supply agreement but focuses on the distribution aspect. In New Mexico, this could mean that a supplier grants one distributor the rights to market and distribute goods in a defined region. This helps businesses streamline their distribution channels while maximizing sales potential.

An example of a New Mexico Exclusive Supply Agreement could involve a manufacturer providing their product solely to a single retailer for a particular territory. In this agreement, the retailer agrees not to source similar products from other manufacturers. Such an agreement often leads to a stronger relationship between both parties while ensuring market control.

A supplier exclusivity clause in a New Mexico Exclusive Supply Agreement prevents a supplier from selling the same product to other buyers within a specified region or market for a defined time. This clause protects the interests of the buyer by ensuring that they have exclusive access to the supplier's goods. This kind of arrangement can be beneficial for establishing a strong market presence.

To file an S Corp in New Mexico, you must first register your corporation with the New Mexico Secretary of State. After registration, you'll need to file Form 2553 with the IRS to elect S Corporation status. This structure may be beneficial for your business, especially if you are entering into a New Mexico Exclusive Supply Agreement and want to optimize tax advantages.

An independent contractor agreement in New Mexico outlines the relationship between a business and an independent contractor. This document specifies the scope of work, payment terms, and other important conditions of the engagement. If you are completing a New Mexico Exclusive Supply Agreement, consider including clauses regarding independent contractors to clarify responsibilities.

Yes, New Mexico requires 1099 filing for various payments made to contractors and service providers. This includes payments associated with a New Mexico Exclusive Supply Agreement. Filing accurately can help you avoid penalties and ensure compliance with state regulations.

Yes, New Mexico allows pass-through entity (PTE) elections for certain businesses. Making this election can benefit owners by simplifying the tax process and potentially lowering personal tax burdens. If you are considering a New Mexico Exclusive Supply Agreement with a pass-through entity, this election could provide financial advantages.