New Mexico Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Increase Dividend - Resolution Form - Corporate Resolutions?

Are you in a situation where you require documents for organizational or specific needs on a daily basis.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of document templates, such as the New Mexico Increase Dividend - Resolution Form - Corporate Resolutions, designed to meet both state and federal standards.

Once you find the appropriate template, click Get now.

Select a payment plan you prefer, complete the required information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can obtain the New Mexico Increase Dividend - Resolution Form - Corporate Resolutions template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it fits the correct state/region.

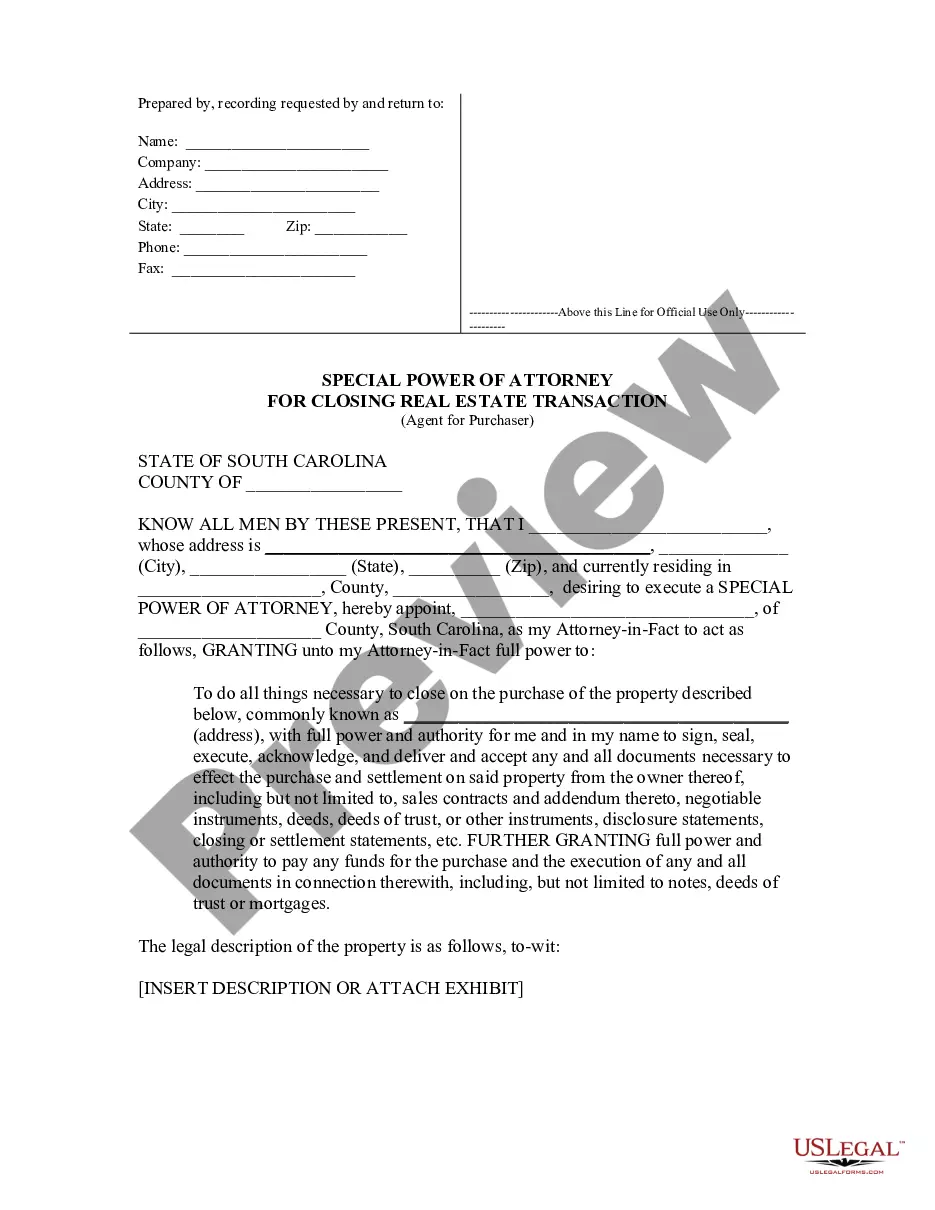

- Use the Preview button to review the document.

- Check the description to confirm you have selected the right template.

- If the template isn’t what you’re seeking, utilize the Search feature to locate the document that meets your needs.

Form popularity

FAQ

To declare a dividend, you need a formal board resolution that specifies the amount to be distributed and the payment schedule. This resolution not only formalizes the decision but also complies with corporate governance standards. The New Mexico Increase Dividend - Resolution Form - Corporate Resolutions can help you structure this resolution effectively and efficiently.

The resolution required for the declaration of a dividend is the board’s official decision authorizing the payment. This resolution must detail the dividend amount and the timing of the payment. Using the New Mexico Increase Dividend - Resolution Form - Corporate Resolutions streamlines this process, ensuring all necessary details are captured.

To document a dividend payment, create a formal record that includes the resolution for the dividend, payment details, and any related approvals. This documentation serves as a legal record for the corporation’s financial activities. The New Mexico Increase Dividend - Resolution Form - Corporate Resolutions provides a structured way to capture this information accurately.

The resolution for declaring a dividend outlines the specifics regarding the payment of dividends to shareholders. It typically includes details such as the dividend amount, payment dates, and any conditions surrounding the dividend. Leveraging the New Mexico Increase Dividend - Resolution Form - Corporate Resolutions can enhance clarity and ensure proper documentation.

Yes, a resolution is necessary to declare a dividend. This document provides legal backing for the dividend and protects the interests of the corporation. By using the New Mexico Increase Dividend - Resolution Form - Corporate Resolutions, you can clearly outline the terms and ensure all shareholders are informed of the decision.

Writing a dividend resolution involves outlining the proposed dividend amount and the rationale behind the proposal. Begin with the title and date, provide details about the financial standing of the company, and justify the decision to increase dividends. Finally, ensure all directors sign off on the resolution, using the New Mexico Increase Dividend - Resolution Form - Corporate Resolutions for guidance and structure.

To write a good resolution, focus on clarity and precision. Clearly state what the resolution aims to achieve and include any necessary financial details. Use straightforward language so that all directors can understand the implications. A solid approach is to utilize the New Mexico Increase Dividend - Resolution Form - Corporate Resolutions, which provides a structured format for your needs.

An example of a resolution could be a proposal to increase dividends for shareholders. This resolution should outline the proposed dividend amount and the reasons behind this decision. Once the directors review the details, they can vote on it in a meeting and document it using the appropriate New Mexico Increase Dividend - Resolution Form - Corporate Resolutions.

Writing a resolution form involves documenting essential information clearly and concisely. Start with the name of the organization and the date, followed by the resolution details. Be sure to include a section for directors’ signatures at the end. Using the New Mexico Increase Dividend - Resolution Form - Corporate Resolutions can help ensure all necessary components are included.

To create a resolution form, start with a header that includes the company name and the title 'Resolution.' Below, provide sections for the details of the resolution, including dates and specifics. You should also leave space for signatures from the directors. The New Mexico Increase Dividend - Resolution Form - Corporate Resolutions is an excellent template to follow for this task.