New York Expense Account Form

Description

How to fill out Expense Account Form?

If you need to complete, obtain, or create authentic document templates, utilize US Legal Forms, the largest collection of official forms, available online.

Take advantage of the site`s user-friendly and convenient search to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Each legal document template you purchase is your property for years. You will have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Compete and download, then print the New York Expense Account Form with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the New York Expense Account Form with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and hit the Download button to obtain the New York Expense Account Form.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct area or region.

- Step 2. Utilize the Preview feature to review the form`s content.

- Step 3. If you are not satisfied with the form, utilize the Search box located at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you require, click on the Purchase now button. Select the pricing plan you prefer and input your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it onto your device.

- Step 7. Fill out, modify, and print or sign the New York Expense Account Form.

Form popularity

FAQ

You should file NYS IT-201 by mailing it to the address specified in the form's instructions. This would typically be directed to the New York State Department of Taxation and Finance. Make sure to attach the New York Expense Account Form if any expenses pertain to your income reported. Additionally, consider using uslegalforms to access all necessary forms and ensure compliance.

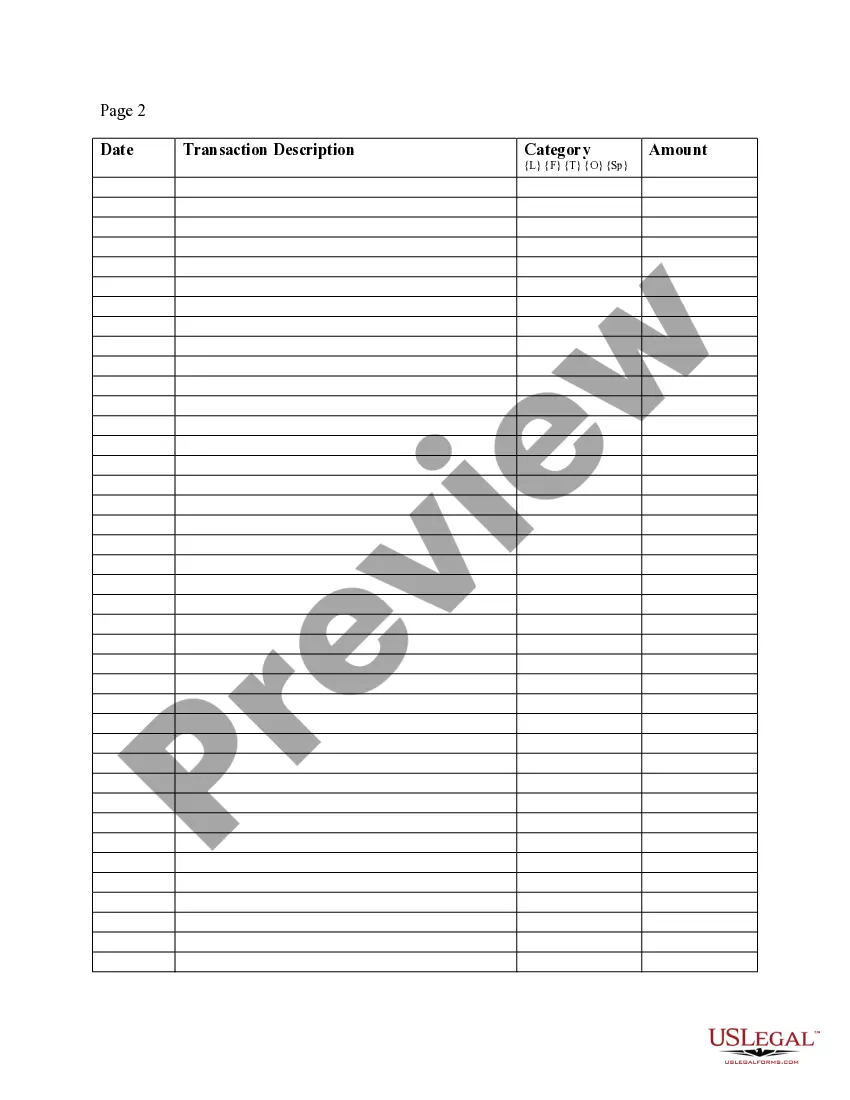

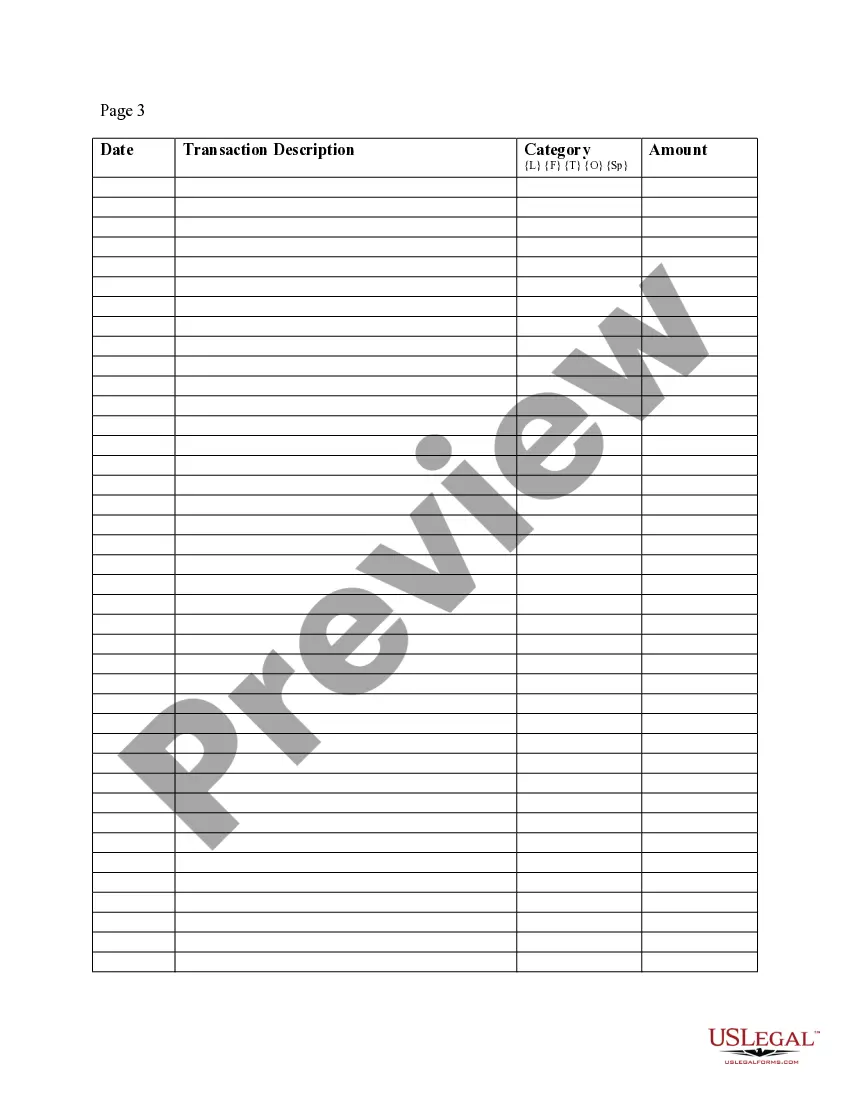

Key takeaway: Key components of an expense report include the date expenses were paid, who the money went to, how much was specifically spent and the type of expense it was.

Information Included in an Expense Report The nature of the expense (such as airline tickets, meals, or parking fees) The amount of the expense (matches the amount of the related receipt) The account to which the expense should be charged. A subtotal for each type of expense.

An expense report typically has the following information that you'll need to provide:Name, department, and contact information.List of itemized expense names.Date of purchase for each item.Receipts.Total amount spent.Purpose of the expense.Actual cost of item (subtraction of discounts)Repayment amount sought.More items...?

In short, the steps to create an expense sheet are:Choose a template or expense-tracking software.Edit the columns and categories (such as rent or mileage) as needed.Add itemized expenses with costs.Add up the total.Attach or save your corresponding receipts.Print or email the report.

What should an expense report include?Information identifying the person submitting the report (department, position, contact info, SSN, etc.)A date and dollar amount for each expense, matching the date and dollar amount on the receipt provided for that expense.A brief description of each expense.More items...?

An expense report is a form that itemizes expenses necessary to the functioning of a business. A small business may ask its employees to submit expense reports to reimburse them for business-related purchases such as gas or meals.

An expense report typically has the following information that you'll need to provide:Name, department, and contact information.List of itemized expense names.Date of purchase for each item.Receipts.Total amount spent.Purpose of the expense.Actual cost of item (subtraction of discounts)Repayment amount sought.More items...?09-Jul-2019

An expense report will usually ask you to itemize (break down into as much detail as possible) all of the expenses included on the report, and to attach any receipts associated with those expenses. It will also usually organize each expense by category, so that it's easy to plug into your company's bookkeeping system.

In short, the steps to create an expense sheet are:Choose a template or expense-tracking software.Edit the columns and categories (such as rent or mileage) as needed.Add itemized expenses with costs.Add up the total.Attach or save your corresponding receipts.Print or email the report.28-Mar-2019