New Mexico Promissory Note with Installment Payments

Description

How to fill out Promissory Note With Installment Payments?

You can spend time online trying to locate the legal document format that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

It is easy to download or generate the New Mexico Promissory Note with Installment Payments from my assistance.

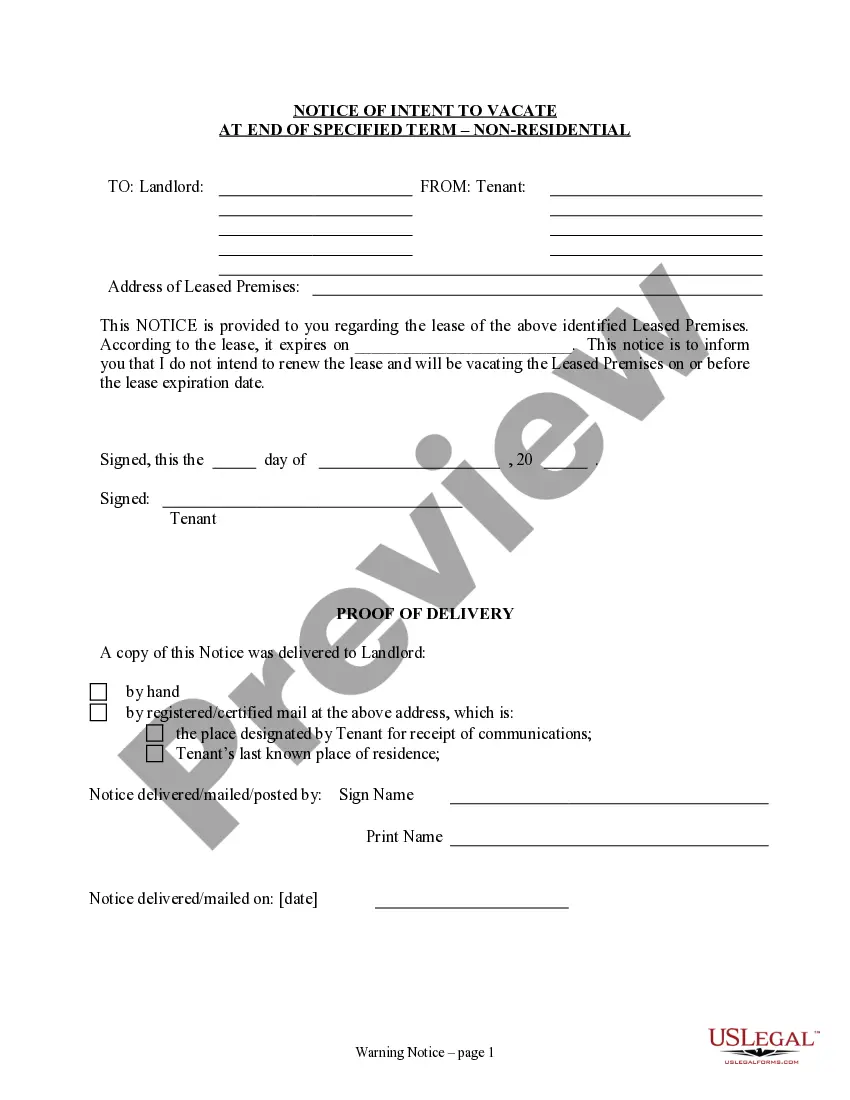

If available, take advantage of the Preview button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can fill out, modify, print, or sign the New Mexico Promissory Note with Installment Payments.

- Every legal document format you obtain is yours permanently.

- To get another copy of an acquired form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for the area/town of your preference.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

To record promissory notes payable in relation to a New Mexico Promissory Note with Installment Payments, you should establish a liability entry in your accounting system. This involves noting the amount owed on the note, the interest rate, and the payment terms. This approach provides clarity and helps in tracking your obligations properly.

To create a promissory note for payment, start by clearly stating the purpose of the note and the amount being borrowed. Include the names and contact information of both the borrower and the lender, as well as the payment schedule and any interest terms. Using a reliable resource like uslegalforms will help you draft an effective New Mexico Promissory Note with Installment Payments that meets your needs.

To create a promissory note for a balance payment, you need to include important details such as the names of the parties, the amount due, and the payment schedule. Clearly outline the installment payment terms to avoid any confusion in the future. Using a template from uslegalforms can simplify this process, particularly for a New Mexico Promissory Note with Installment Payments.

Yes, you can demand a promissory note when you need formal proof of a debt agreement. This document specifies the amount owed and the terms of repayment, including installment payments. In the context of a New Mexico Promissory Note with Installment Payments, it establishes clear expectations for both parties and ensures that everyone understands their responsibilities.

An installment promissory note allows borrowers to make periodic payments over a specified timeframe, instead of paying the entire amount at once. This type of note is particularly beneficial for individuals in New Mexico who may need financial flexibility. By utilizing a New Mexico promissory note with installment payments, you can enjoy structured repayments that fit your budget.

A promissory note typically contains several key components such as the principal amount, interest rate, payment due dates, and terms of default. For those in New Mexico, a promissory note with installment payments often provides clarity on these elements. Understanding how many sections are in your note can help ensure all necessary information is covered.

Types of promissory notes include personal loans, business loans, and real estate notes. Each serves a unique purpose, but the New Mexico promissory note with installment payments is particularly useful for individuals seeking manageable repayment options. This approach can make the borrowing process smoother and less stressful.

The most common promissory note is the one used in personal loans, known as a simple promissory note. In New Mexico, a promissory note with installment payments allows borrowers to repay over time, making financial management easier. This type of document clearly outlines the repayment terms and conditions, providing security for both parties involved.

Filling out a promissory demand note involves specifying the amount owed, the interest rate, and the terms of repayment. You should include the names and addresses of the lender and borrower, along with the signature of the borrower to validate the agreement. Utilizing a New Mexico Promissory Note with Installment Payments can simplify this process, allowing you to customize the terms to suit both parties.