New Mexico Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

Selecting the ideal legal document template can be a challenge. Certainly, there are numerous designs available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of designs, including the New Mexico Promissory Note with Payments Amortized for a Specified Number of Years, which can be utilized for business and personal purposes. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the New Mexico Promissory Note with Payments Amortized for a Specified Number of Years. Use your account to search through the legal forms you have previously acquired. Visit the My documents tab in your account to access another copy of the document you need.

Choose the document format and download the legal document template for your device. Complete, modify, print, and sign the acquired New Mexico Promissory Note with Payments Amortized for a Specified Number of Years. US Legal Forms is the premier collection of legal forms where you can find various document templates. Use the service to obtain professionally designed documents that comply with state requirements.

- First, make sure you have selected the right form for your region/county.

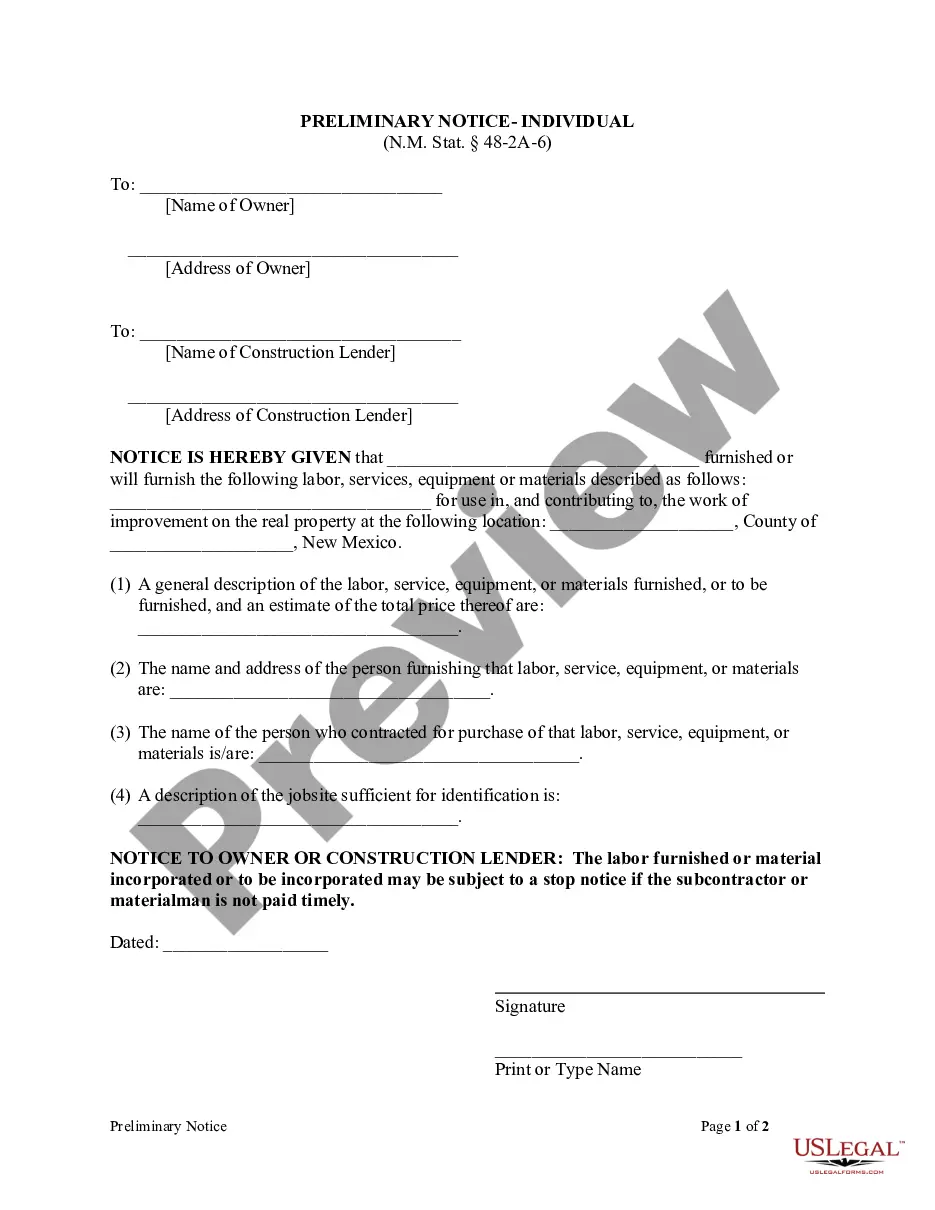

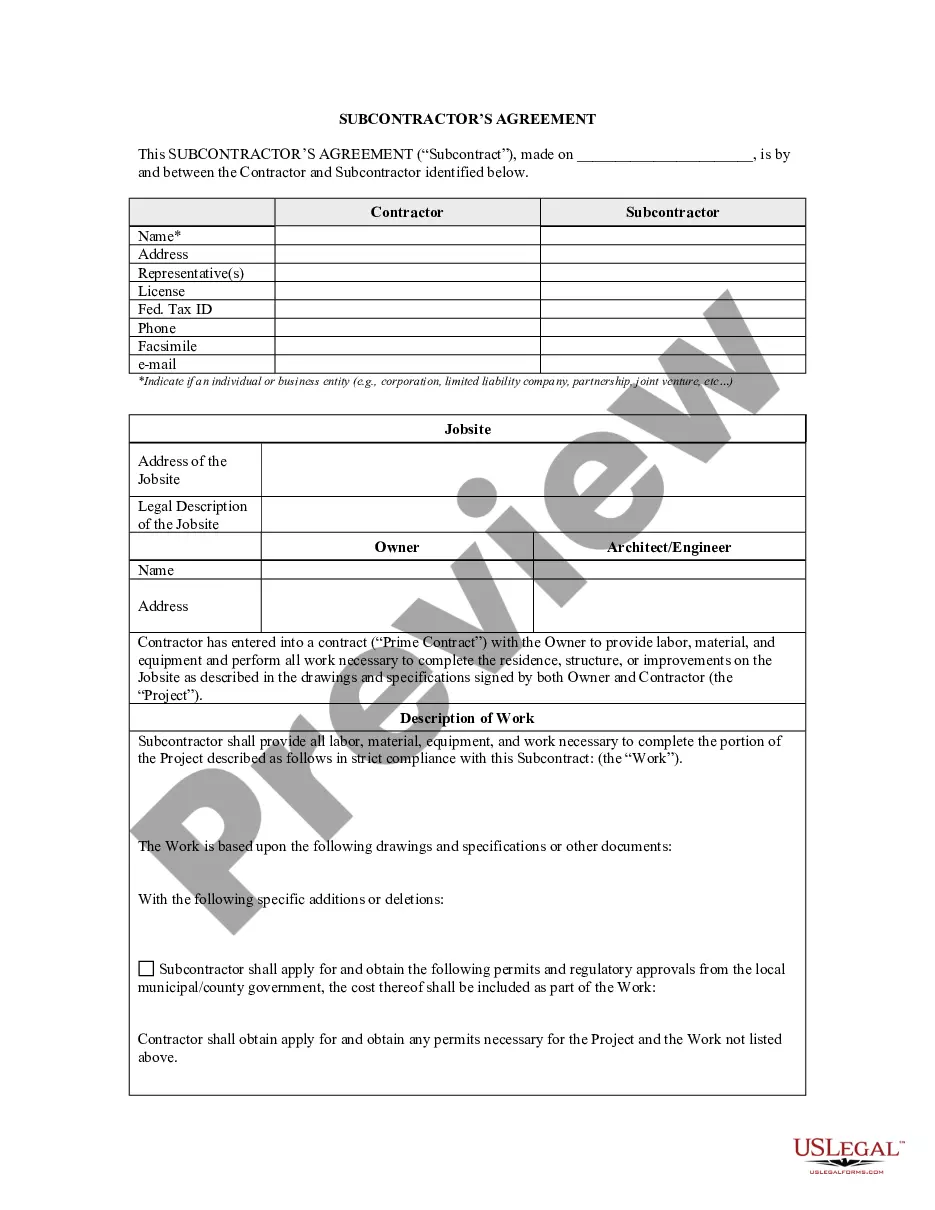

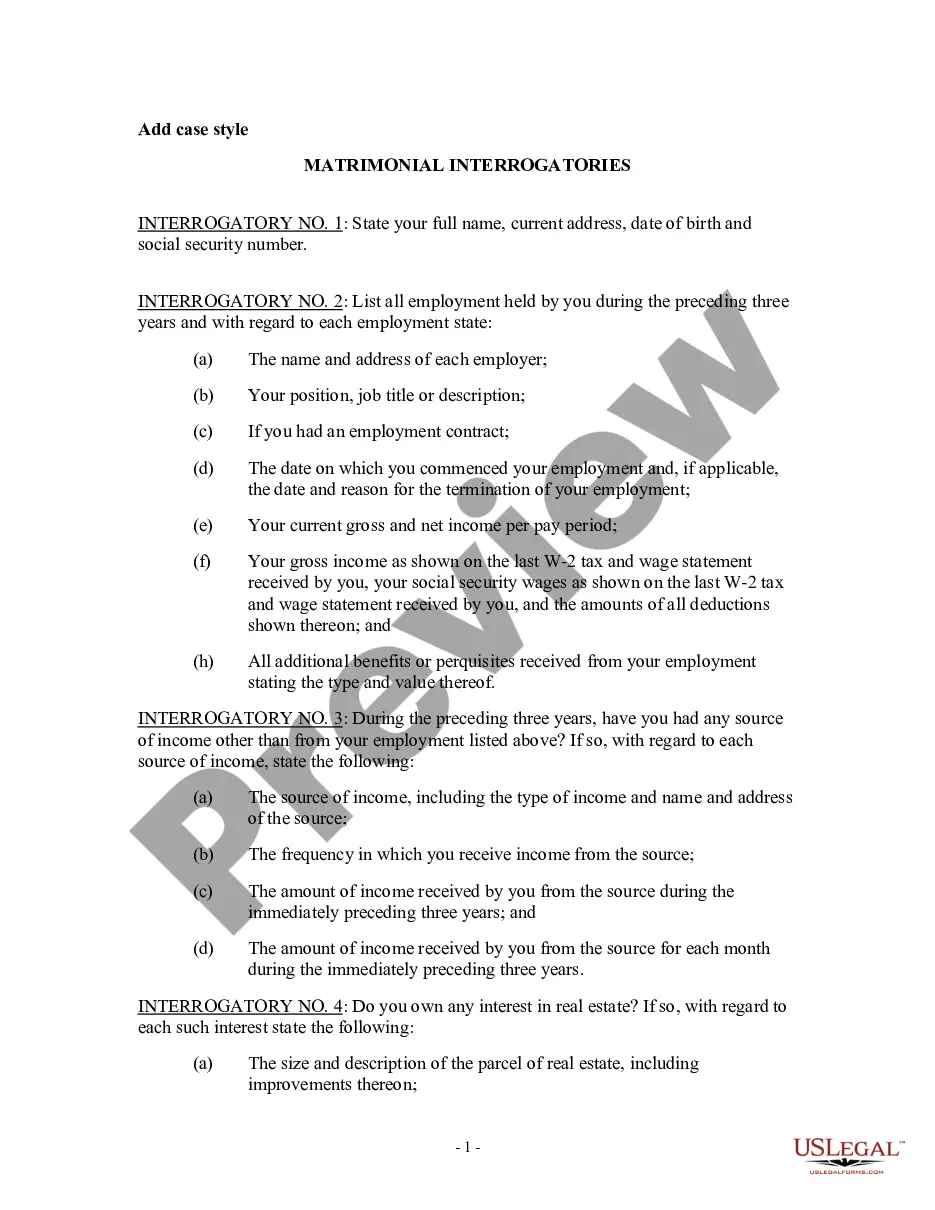

- You can preview the document using the Review option and examine the form description to confirm it is the correct one for you.

- If the form does not meet your needs, use the Search feature to locate the appropriate form.

- Once you are confident that the form is suitable, click on the Purchase now button to obtain the form.

- Select the payment plan you wish and provide the required information.

- Create your account and finalize the order using your PayPal account or credit card.

Form popularity

FAQ

The duration a promissory note is good for largely depends on the agreement made between the parties involved. For a New Mexico Promissory Note with Payments Amortized for a Certain Number of Years, the term can vary, but it commonly ranges from one to thirty years based on the specifics outlined. Your choice of duration should align with your financial goals and repayment capacity. For tailored solutions, consider using US Legal Forms to create an effective promissory note that meets your needs.

Indeed, there is often a time limit on a promissory note, which varies by state. For a New Mexico Promissory Note with Payments Amortized for a Certain Number of Years, the statute of limitations generally dictates how long you can legally enforce the note. This timeframe can be critical if you plan to collect on the note or take legal action. Understanding these limits can help you manage your financial agreements more effectively.

Yes, a promissory note can expire depending on state laws and the terms outlined in the document. In the case of a New Mexico Promissory Note with Payments Amortized for a Certain Number of Years, it typically remains valid for a specific duration as defined in the agreement. If the period lapses without payment or renewal, the note may no longer be enforceable. It's essential to understand the terms and conditions of your promissory note to avoid any issues.

To fill out a promissory note sample, start by entering the names and addresses of both the lender and borrower. You will then specify the principal amount, interest rate, and repayment terms, particularly if it’s a New Mexico Promissory Note with Payments Amortized for a Certain Number of Years. Ensure that all terms are clear to avoid misunderstandings. Using guides and templates from UsLegalForms can simplify this process and ensure legal compliance.

Yes, a handwritten promissory note can be legal as long as it meets certain criteria. In the context of a New Mexico Promissory Note with Payments Amortized for a Certain Number of Years, the key factors include the clarity of terms and the signatures of both parties. However, for added protection and clarity, it is recommended to use a formal template. Platforms like UsLegalForms can help you create a valid and thorough promissory note.

A document that promises payment of a specific amount to a designated individual is known as a promissory note. When it comes to a New Mexico Promissory Note with Payments Amortized for a Certain Number of Years, it outlines the repayment terms clearly. This type of note provides both the lender and borrower with a structured plan to ensure timely payments. Using a proper format is essential to enforce the agreement legally.

The payment on a fully amortized installment note is calculated to ensure that the borrower pays off the principal and interest over a set period. This means that each payment will reduce the outstanding balance until it reaches zero at the end of the term. With a New Mexico Promissory Note with Payments Amortized for a Certain Number of Years, you can expect consistent monthly payments that simplify financial planning.