New Mexico Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

Have you ever found yourself in a circumstance where you require documents for either business or personal reasons almost constantly.

There are numerous legal document templates accessible online, but locating ones you can depend on is not simple.

US Legal Forms provides a vast array of form templates, such as the New Mexico Acknowledgment by Charitable or Educational Institution of Receipt of Gift, which are designed to meet federal and state requirements.

Once you obtain the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New Mexico Acknowledgment by Charitable or Educational Institution of Receipt of Gift template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for your correct city/region.

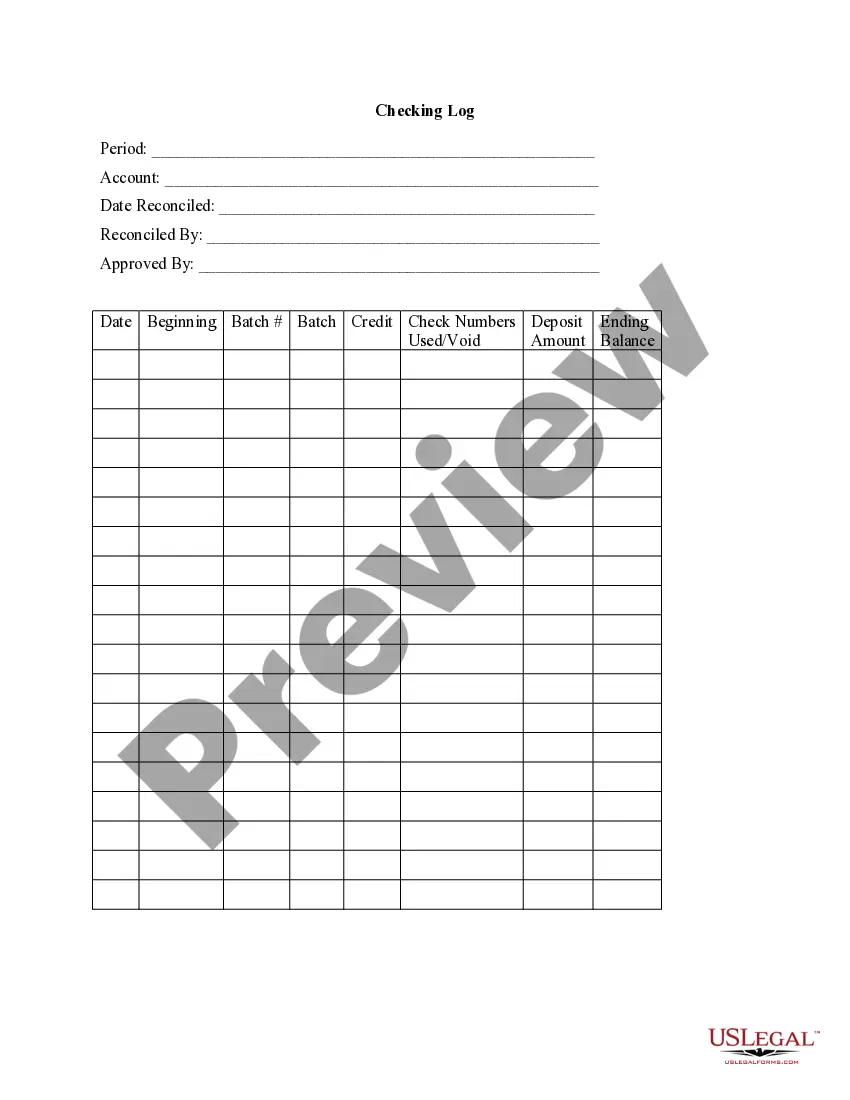

- Use the Review button to examine the form.

- Read the details to confirm you have chosen the right document.

- If the form isn’t what you’re looking for, use the Search field to find the document that meets your needs and requirements.

Form popularity

FAQ

An example of a written acknowledgment for a charitable contribution would include a letter stating the organization's name, the donor's name, the amount of the donation, and a note confirming that no goods or services were provided in exchange. This letter should be signed by an authorized representative of the organization. Such an acknowledgment fulfills the requirements for New Mexico Acknowledgment by Charitable or Educational Institution of Receipt of Gift and serves as essential documentation for the donor.

In New Mexico, there is no state-level gift tax. However, federal gift tax rules apply, and gifts exceeding a certain amount may require the donor to file a federal gift tax return. Understanding these tax implications is important for both donors and charitable organizations, especially when considering the benefits outlined by New Mexico Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

To properly acknowledge receipt of a donation, you should create a written acknowledgment that includes the donor's name, the date of the gift, and the donation amount. You may also include a personal message expressing gratitude for their support. This step is crucial for maintaining transparency and trust, and it aligns with the guidelines of New Mexico Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

A contemporaneous written acknowledgment of a charitable gift should clearly state the donor's name, the date of the gift, and the amount donated. Additionally, it must describe any goods or services received in return for the donation, if applicable. This acknowledgment serves as proof for the donor when claiming tax deductions and is essential for compliance with New Mexico Acknowledgment by Charitable or Educational Institution of Receipt of Gift requirements.

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

Gift acknowledgment letters are letters sent to donors that formally acknowledge their generous donation. These letters should express gratitude and appreciation while also providing the donor with a record of the donation.

Acknowledging each donation gives you an additional opportunity to show your gratitude to donors. It also serves as immediate confirmation. At the same time, the year-end acknowledgment letter is an excellent opportunity to summarize your donor's charitable giving and highlight what it helped accomplish.

Tip #1: Although the IRS doesn't require acknowledgment letters to be sent for gifts under $250, it's a good rule of thumb to express thanks for every gift, regardless of its size.

Sample Donor Acknowledgement Letter for Non-Cash Donation On [DATE], you donated [DESCRIPTION ? WITHOUT MONETARY VALUE]. This gift is greatly appreciated and will be used to support our mission. In exchange for this contribution, you received [GOODS OR SERVICES ? WITH ESTIMATE OF FAIR MARKET VALUE].

Examples of acknowledge in a Sentence They acknowledged that the decision was a mistake. Do you acknowledge that you caused this mess? They readily acknowledged their mistake. She won't acknowledge responsibility for her actions.