New Mexico Guaranty Attachment to Lease for Guarantor or Cosigner

About this form

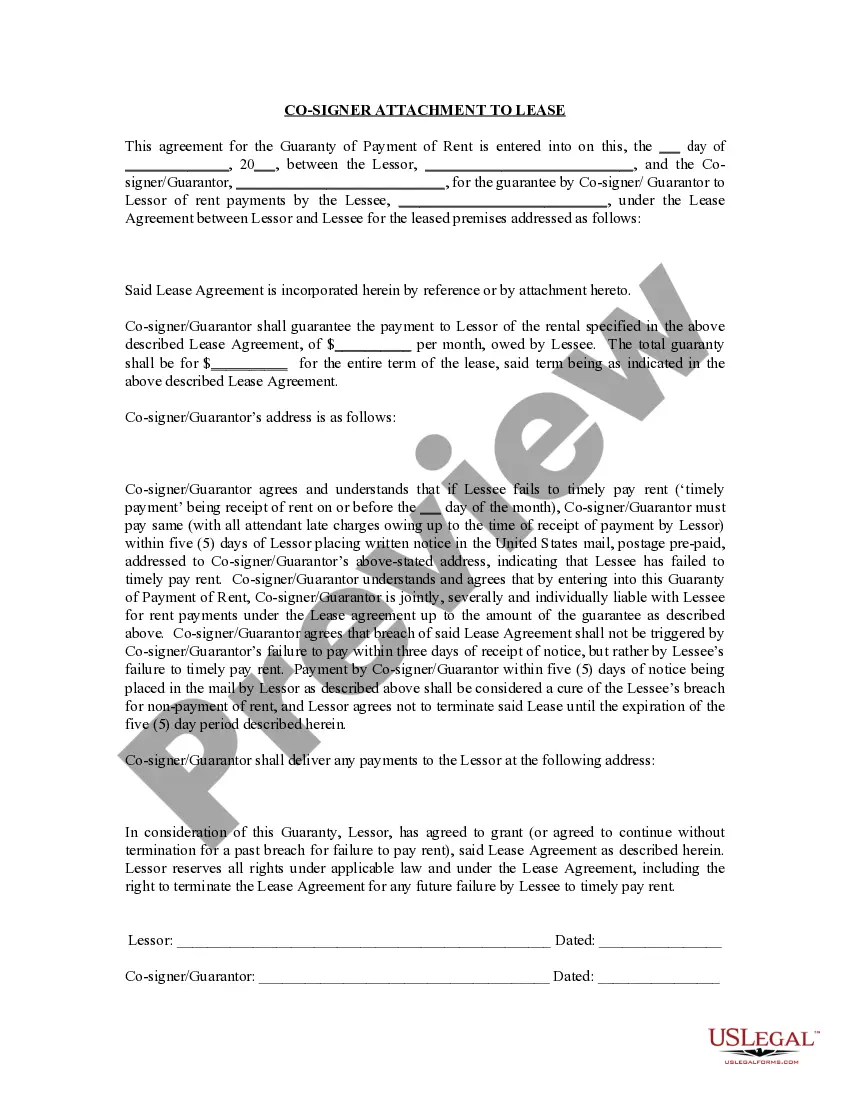

The Guaranty Attachment to Lease for Guarantor or Cosigner is a legal document used when a third party agrees to co-sign a lease. This form ensures that if the primary tenant fails to pay rent, the guarantor is legally obligated to cover any unpaid amounts. This type of guaranty differs from other leasing documents by specifically establishing the responsibilities of a co-signer or guarantor in a rental agreement.

Key parts of this document

- Guarantor's name and address.

- Lessor's name and address.

- Date of signing for both parties.

- Clear stipulation of the guaranty's obligations.

Jurisdiction-specific notes

This form does not have state-specific variations as it can be used across multiple jurisdictions.

When to use this document

This form is typically used when a tenant may not qualify for a lease on their own due to insufficient credit history, income, or rental history. It is also applicable when landlords require added security to ensure rent payments. Using this form gives landlords and property managers peace of mind while allowing tenants access to rental properties.

Who this form is for

- Landlords seeking a guarantor for a tenant.

- Tenants who are unable to secure a lease independently.

- Guarantors willing to assume financial responsibility for the tenant's obligations.

Steps to complete this form

- Identify the parties involved, including names and addresses of the lessor and guarantor.

- Specify the property address covered by the lease.

- Enter the date on which the document is signed.

- Both the lessee and the guarantor should sign and date the form to make it legally binding.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Avoid these common issues

- Failing to include the correct names of the parties involved.

- Not providing an up-to-date date of signing.

- Omitting the address of the property in question.

Benefits of completing this form online

- Easy to download and print, providing immediate access to necessary documents.

- Editability allows you to fill out the form with your specific details before finalizing.

- Reliability of professionally drafted templates ensures compliance with legal standards.

Form popularity

FAQ

The most simple way to get out of being someone's guarantor is for the main borrower to pay off their loan and essentially, terminate the agreement.

The guarantor covenanted under the lease that the tenant would pay the rent and sums due under the lease and will observe the tenant's covenants. In the event of tenant default, the guarantor covenanted to make good to the landlord on demand all loss, damage, costs and expenses arising or incurred by the landlord.

When The Lease Is Up When having a guarantor on the lease, the best way to be able to have him removed as soon as possible is to set a good payment record with the landlord.

A Guarantor Agreement Form is a written document that defines the terms and conditions in the event a tenant or buyer is not able to fulfill the payment on time.The obligations of a guarantor include paying the rent on time and avoiding doing damage to the property.

One reason could be the need to take a loan yourself. However, a bank may not allow a guarantor to withdraw from the role unless the borrower gets another guarantor or brings in additional collateral. Even if you get another guarantor, the bank has the discretion to disallow the switch.

Business owners are often required to give a personal guarantee to get a business loan or to lease commercial space for their business. Most business advisors say you should keep business and personal financial matters separate, and the loan is for the business, not for the individual.

It's very common for a guarantee to last as long as the tenancy lasts. So, if the tenant remains in the property for four years, you will continue to be responsible for any arrears or damages during that entire period. Most tenancies will run for a fixed term and will then continue on a month-by-month basis.

A guarantor is another word for cosigner, and by definition, a guarantor is someone who guarantees to be legally responsible for paying the rent as stipulated by the lease, but only if the tenant cannot pay for one reason or another.

Does being a guarantor affect my credit rating? Providing the borrower keeps up with their repayments your credit score won't be affected. However, should they fail to make their payments and the loan/mortgage falls into default, it will be added to your credit report.