New Jersey Complex Will - Max. Credit Shelter Marital Trust to Children

Description

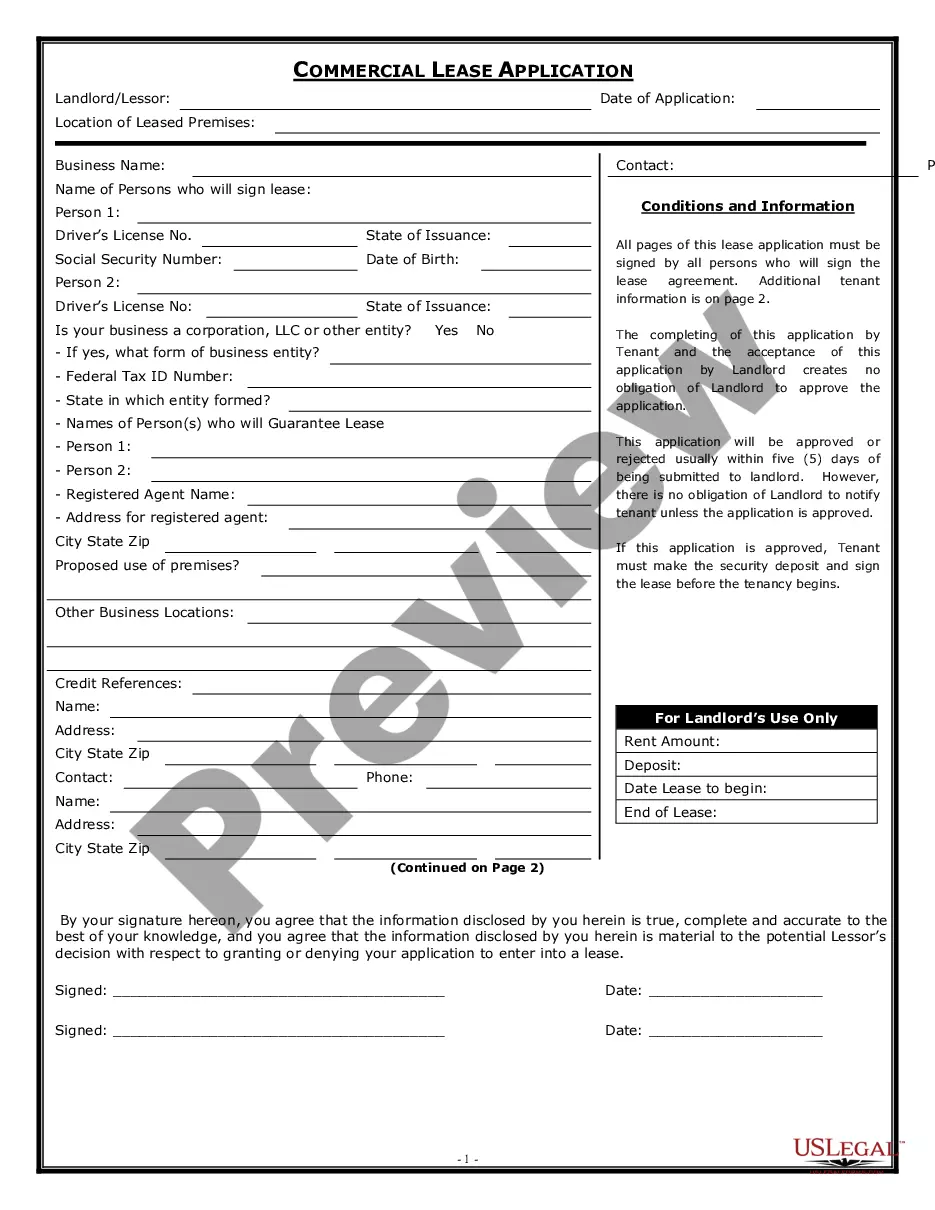

How to fill out Complex Will - Max. Credit Shelter Marital Trust To Children?

Have you been in the placement that you need papers for sometimes organization or person reasons almost every working day? There are plenty of authorized record layouts available online, but locating kinds you can rely is not easy. US Legal Forms delivers 1000s of type layouts, much like the New Jersey Complex Will - Max. Credit Shelter Marital Trust to Children, which can be written to fulfill state and federal specifications.

In case you are previously informed about US Legal Forms website and get a merchant account, just log in. Afterward, you can down load the New Jersey Complex Will - Max. Credit Shelter Marital Trust to Children format.

Should you not offer an account and need to start using US Legal Forms, adopt these measures:

- Find the type you will need and ensure it is to the right town/region.

- Take advantage of the Preview key to review the form.

- Browse the description to ensure that you have selected the proper type.

- In the event the type is not what you`re looking for, utilize the Lookup area to discover the type that meets your needs and specifications.

- When you get the right type, simply click Acquire now.

- Pick the pricing program you would like, submit the desired information and facts to create your account, and buy the transaction utilizing your PayPal or bank card.

- Choose a convenient file formatting and down load your backup.

Locate all the record layouts you might have purchased in the My Forms food list. You can get a further backup of New Jersey Complex Will - Max. Credit Shelter Marital Trust to Children any time, if necessary. Just select the essential type to down load or printing the record format.

Use US Legal Forms, the most substantial collection of authorized forms, to conserve some time and stay away from blunders. The service delivers skillfully created authorized record layouts that you can use for a variety of reasons. Make a merchant account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments.

There is a $25,000 exemption for amounts inherited by Class C beneficiaries. The tax rate is 11% on the first $1,075,000 inherited above the exemption amount, 13% on the next $300,000, 14% on the next $300,000, and 16% on the amount above $1,700,000. Class D beneficiaries can receive $500 tax free.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.