New Jersey Complex Will - Maximum Unified Credit to Spouse

Description

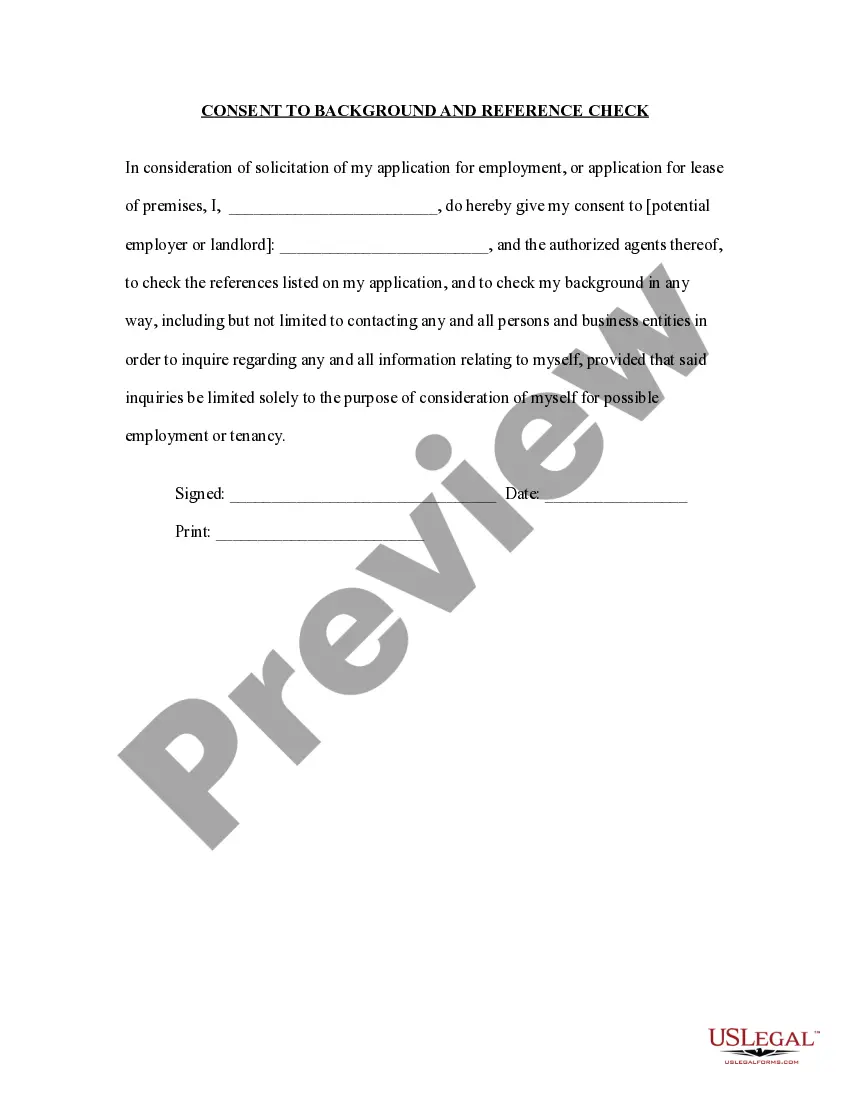

How to fill out Complex Will - Maximum Unified Credit To Spouse?

US Legal Forms - one of many most significant libraries of lawful kinds in the States - offers an array of lawful file themes you are able to download or print out. Making use of the internet site, you will get a large number of kinds for enterprise and specific uses, categorized by categories, says, or key phrases.You can find the most recent versions of kinds such as the New Jersey Complex Will - Maximum Unified Credit to Spouse in seconds.

If you already have a monthly subscription, log in and download New Jersey Complex Will - Maximum Unified Credit to Spouse from the US Legal Forms local library. The Down load button can look on each and every kind you see. You have access to all in the past saved kinds inside the My Forms tab of your respective account.

If you wish to use US Legal Forms the first time, listed below are easy instructions to help you get began:

- Make sure you have picked out the correct kind for the town/county. Click on the Review button to examine the form`s information. Read the kind information to ensure that you have selected the right kind.

- In the event the kind does not fit your requirements, use the Search discipline near the top of the display to find the the one that does.

- Should you be pleased with the shape, verify your option by simply clicking the Acquire now button. Then, opt for the rates strategy you want and supply your qualifications to register on an account.

- Procedure the financial transaction. Use your charge card or PayPal account to complete the financial transaction.

- Select the formatting and download the shape on your device.

- Make modifications. Fill out, revise and print out and indication the saved New Jersey Complex Will - Maximum Unified Credit to Spouse.

Every template you put into your account does not have an expiry particular date and is also the one you have permanently. So, if you wish to download or print out another copy, just proceed to the My Forms area and click on about the kind you require.

Obtain access to the New Jersey Complex Will - Maximum Unified Credit to Spouse with US Legal Forms, probably the most substantial local library of lawful file themes. Use a large number of skilled and express-distinct themes that fulfill your business or specific demands and requirements.

Form popularity

FAQ

The tax credit unifies the gift and estate taxes into one tax that decreases the tax bill of the individual or estate, dollar for dollar. The lifetime gift and estate tax exemption for 2022 is $12.06 million for individuals and $24.12 million for married couples filing jointly.

The spouse exemption is unlimited if neither of the spouses or civil partners is UK domiciled or if a non-UK domiciled individual makes gifts to a UK domiciled spouse or civil partner. However, the spouse exemption is capped when a UK domiciled individual gives assets to a non-UK domiciled spouse or civil partner.

Each spouse needs to file a separate return if they make any taxable gifts. You can, however, choose to ?split? gifts with your spouse. Making a split gift allows you to take advantage of your annual gift tax exclusion plus your spouse's exclusion for a gift that is made entirely by you.

Generally, the answer to ?do I have to pay taxes on a gift?? is this: the person receiving a gift typically does not have to pay gift tax. The giver, however, will generally file a gift tax return when the gift exceeds the annual gift tax exclusion amount, which is $16,000 per recipient for 2022.

The gift is treated as half from the taxpayer and half from the taxpayer's spouse. Because spouses may not file joint gift tax returns, each spouse would then report half the value of the gift on their respective Forms 709.

Donors are required to report gifts on Form 709, U.S. Gift (and Generation-Skipping Transfer) Tax Return. Several types of gifts do not have to be reported, such as gifts that do not exceed the annual exclusion amount, deductible charitable gifts, gifts to a spouse, and gifts that the donee properly disclaims.

UNIFIED CREDIT AMOUNT: If your and your spouse's combined estimated estate value is below the unified credit exemption amount, currently $2 million, the marital deduction is enough to prevent any estate taxes at the federal level.

If you give gifts of cash, property, or other assets to someone during any given tax year, you're required to file Form 709 to report the gift. There are, however, some scenarios in which financial gifts are not subject to the gift tax. These include: Gifts that fall within the annual exclusion limit.