North Carolina Affidavit of Heirship for the Owner of the Property

Description

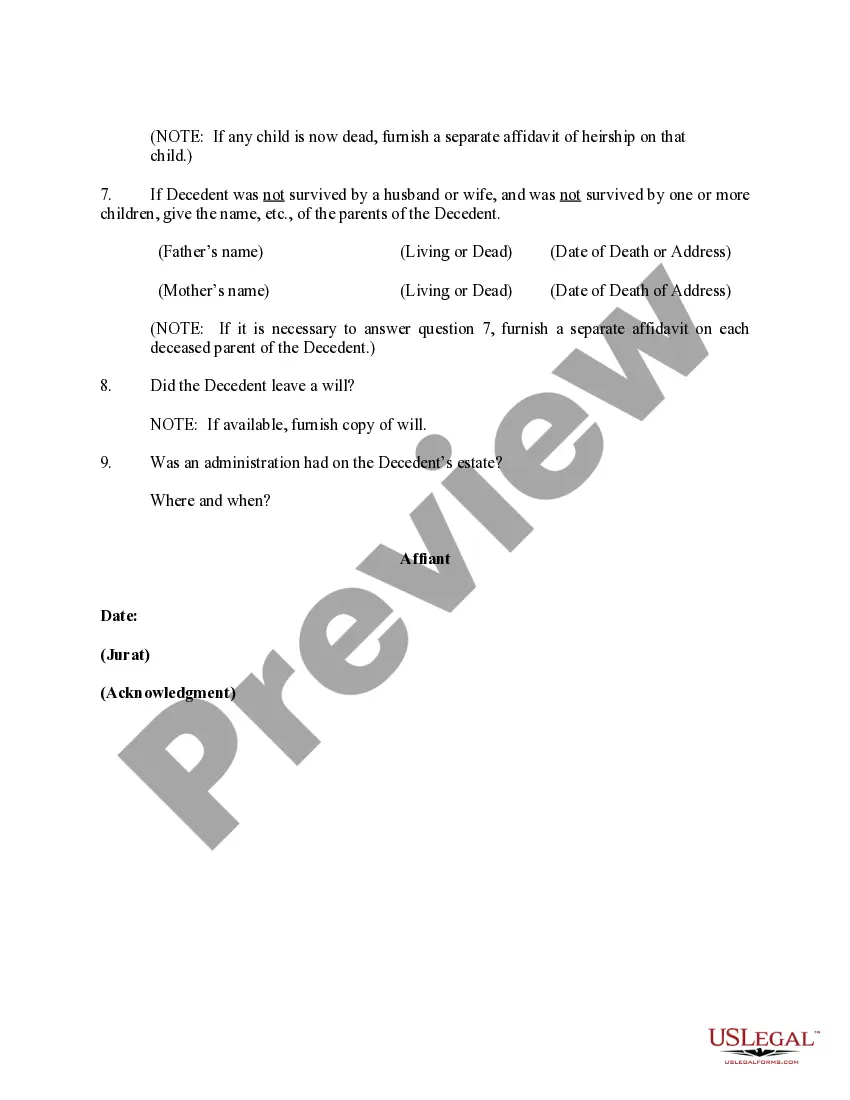

How to fill out Affidavit Of Heirship For The Owner Of The Property?

You may invest hrs on the Internet looking for the lawful file format which fits the federal and state demands you need. US Legal Forms offers a huge number of lawful types which are reviewed by specialists. You can easily obtain or print out the North Carolina Affidavit of Heirship for the Owner of the Property from the services.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Down load switch. Afterward, you are able to complete, change, print out, or indication the North Carolina Affidavit of Heirship for the Owner of the Property. Each lawful file format you get is your own property forever. To acquire one more copy for any bought develop, visit the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms web site for the first time, keep to the basic guidelines under:

- Initially, be sure that you have selected the proper file format for the area/town that you pick. Read the develop outline to make sure you have picked out the right develop. If offered, take advantage of the Review switch to search from the file format at the same time.

- If you want to find one more version in the develop, take advantage of the Research industry to find the format that meets your requirements and demands.

- After you have found the format you need, simply click Buy now to proceed.

- Find the prices prepare you need, key in your references, and register for an account on US Legal Forms.

- Total the deal. You can utilize your charge card or PayPal bank account to purchase the lawful develop.

- Find the structure in the file and obtain it to your gadget.

- Make changes to your file if needed. You may complete, change and indication and print out North Carolina Affidavit of Heirship for the Owner of the Property.

Down load and print out a huge number of file templates while using US Legal Forms site, which offers the largest variety of lawful types. Use professional and state-certain templates to take on your business or specific demands.

Form popularity

FAQ

An affidavit of heirship is used to transfer personal property and/or real property written by a disinterested third party who can testify to the relationship of the surviving spouse(s) and/or heir(s).

Claiming Property With a Small Estate Affidavit Sign the document. Get it notarized. Attach a copy of the will (if there is a will) File the completed affidavit with the local probate (superior) court in the North Carolina county where the deceased person lived.

What is The Affidavit for Collection of Personal Property? ing to the North Carolina statute § 28A-25-1, a heir can settle a deceased person's estate without going through probate by applying for the Affidavit for Collection of Personal Property of the Decedent (form AOC-E-203B).

Claiming Property With a Small Estate Affidavit North Carolina offers a simple procedure (called "small estate administration" or "administration by affidavit) that allows inheritors to skip probate altogether when the value of all the assets left behind (after subtracting liens and debts) is less than $20,000.

A Collection by Affidavit is available for a small estate whether the decedent dies intestate (without a will) or testate (with a will). The affiant, or person who makes the affidavit, can be the public administrator or the decedent's heir, creditor, executor, or devisee.

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.

Probate Threshold for North Carolina The formal probate process typically applies to estates with a value exceeding $20,000. This involves a more complex and court-supervised procedure, with an appointed executor overseeing the distribution of assets and the settlement of outstanding debts.

What is a ?Small Estate?? North Carolina considers ?small estates? to be any estate valued at less than $20,000.00 (or $30,000.00 if the only beneficiary is a surviving spouse). You do not have to count real property or certain retirement accounts and life insurance policies if they already include a named beneficiary.