North Carolina Affidavit of Heirship for Real Property

Description

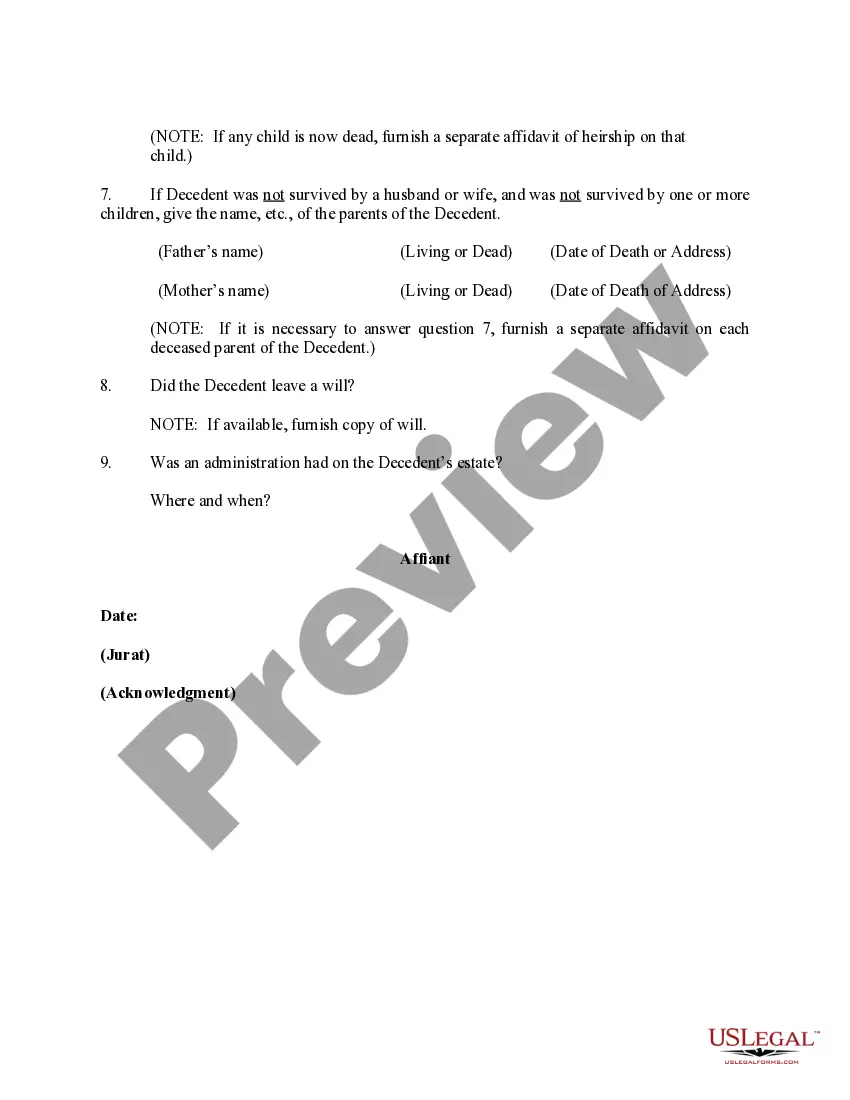

How to fill out Affidavit Of Heirship For Real Property?

US Legal Forms - one of several biggest libraries of authorized types in the States - offers a wide range of authorized papers themes you can down load or print. Using the site, you may get 1000s of types for business and personal functions, sorted by classes, says, or key phrases.You can get the most up-to-date types of types much like the North Carolina Affidavit of Heirship for Real Property in seconds.

If you already have a monthly subscription, log in and down load North Carolina Affidavit of Heirship for Real Property from your US Legal Forms library. The Download key can look on each form you see. You have accessibility to all previously acquired types from the My Forms tab of the bank account.

If you wish to use US Legal Forms the very first time, listed below are easy guidelines to get you began:

- Make sure you have picked the proper form for your personal metropolis/county. Click the Preview key to examine the form`s content material. See the form outline to actually have chosen the correct form.

- If the form doesn`t fit your needs, utilize the Search discipline at the top of the screen to obtain the one which does.

- When you are pleased with the shape, confirm your option by visiting the Buy now key. Then, select the pricing plan you prefer and give your credentials to register for an bank account.

- Process the financial transaction. Make use of your bank card or PayPal bank account to accomplish the financial transaction.

- Pick the formatting and down load the shape on your device.

- Make modifications. Fill up, change and print and signal the acquired North Carolina Affidavit of Heirship for Real Property.

Every single web template you included in your account does not have an expiry particular date which is your own property for a long time. So, in order to down load or print one more duplicate, just check out the My Forms section and click in the form you need.

Gain access to the North Carolina Affidavit of Heirship for Real Property with US Legal Forms, the most comprehensive library of authorized papers themes. Use 1000s of skilled and express-particular themes that meet your business or personal requires and needs.

Form popularity

FAQ

Claiming Property With a Small Estate Affidavit Sign the document. Get it notarized. Attach a copy of the will (if there is a will) File the completed affidavit with the local probate (superior) court in the North Carolina county where the deceased person lived.

What is The Affidavit for Collection of Personal Property? ing to the North Carolina statute § 28A-25-1, a heir can settle a deceased person's estate without going through probate by applying for the Affidavit for Collection of Personal Property of the Decedent (form AOC-E-203B).

Claiming Property With a Small Estate Affidavit North Carolina offers a simple procedure (called "small estate administration" or "administration by affidavit) that allows inheritors to skip probate altogether when the value of all the assets left behind (after subtracting liens and debts) is less than $20,000.

If they cannot agree, they will need to get legal help and file a petition in court that forces the sale of the property. This way, all beneficiaries can get what they are entitled to.

What is a ?Small Estate?? North Carolina considers ?small estates? to be any estate valued at less than $20,000.00 (or $30,000.00 if the only beneficiary is a surviving spouse). You do not have to count real property or certain retirement accounts and life insurance policies if they already include a named beneficiary.

A Collection by Affidavit is available for a small estate whether the decedent dies intestate (without a will) or testate (with a will). The affiant, or person who makes the affidavit, can be the public administrator or the decedent's heir, creditor, executor, or devisee.

An affidavit of heirship is used to transfer personal property and/or real property written by a disinterested third party who can testify to the relationship of the surviving spouse(s) and/or heir(s).

Probate Threshold for North Carolina The formal probate process typically applies to estates with a value exceeding $20,000. This involves a more complex and court-supervised procedure, with an appointed executor overseeing the distribution of assets and the settlement of outstanding debts.