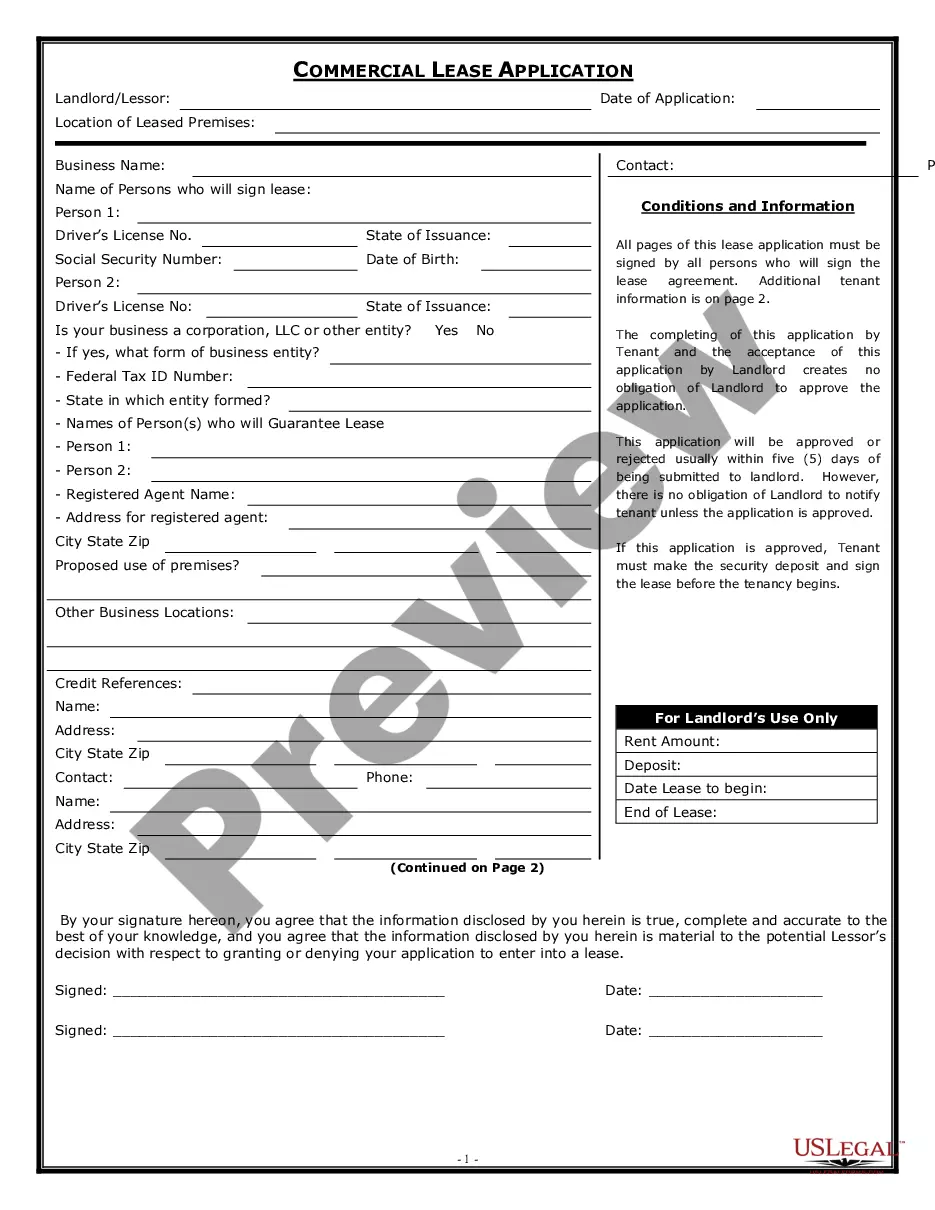

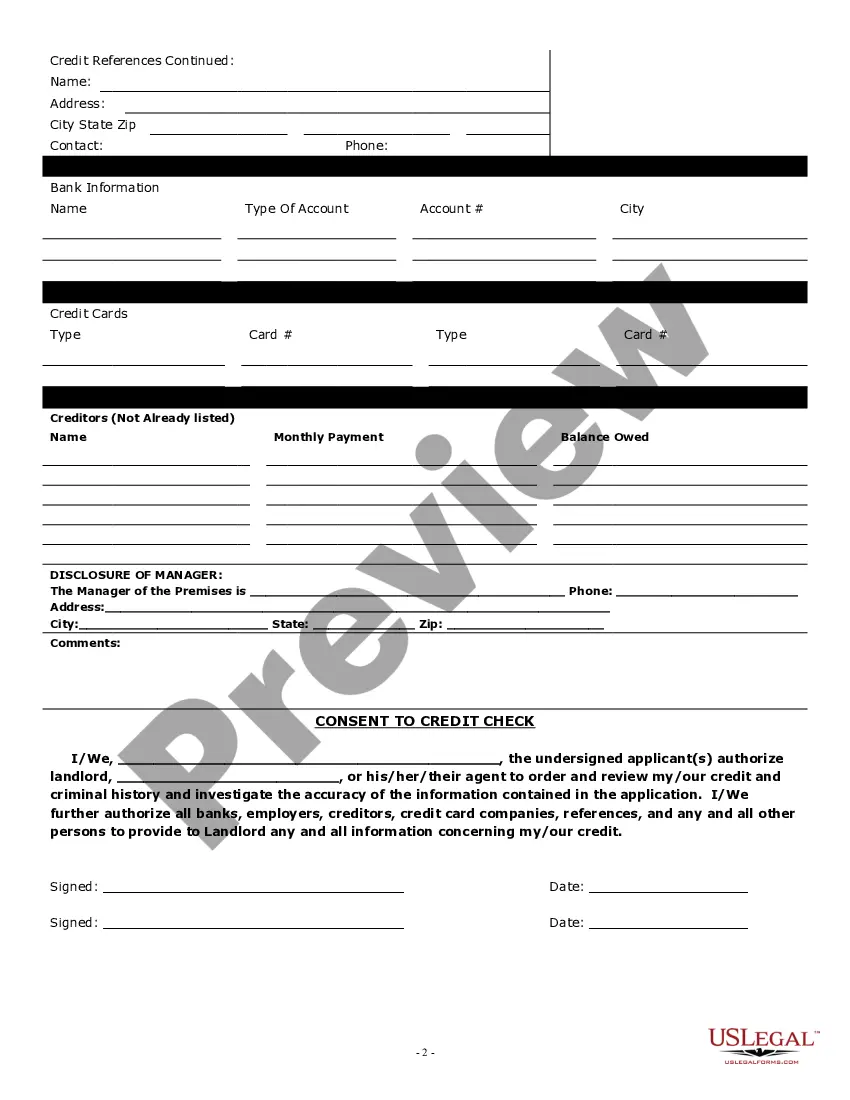

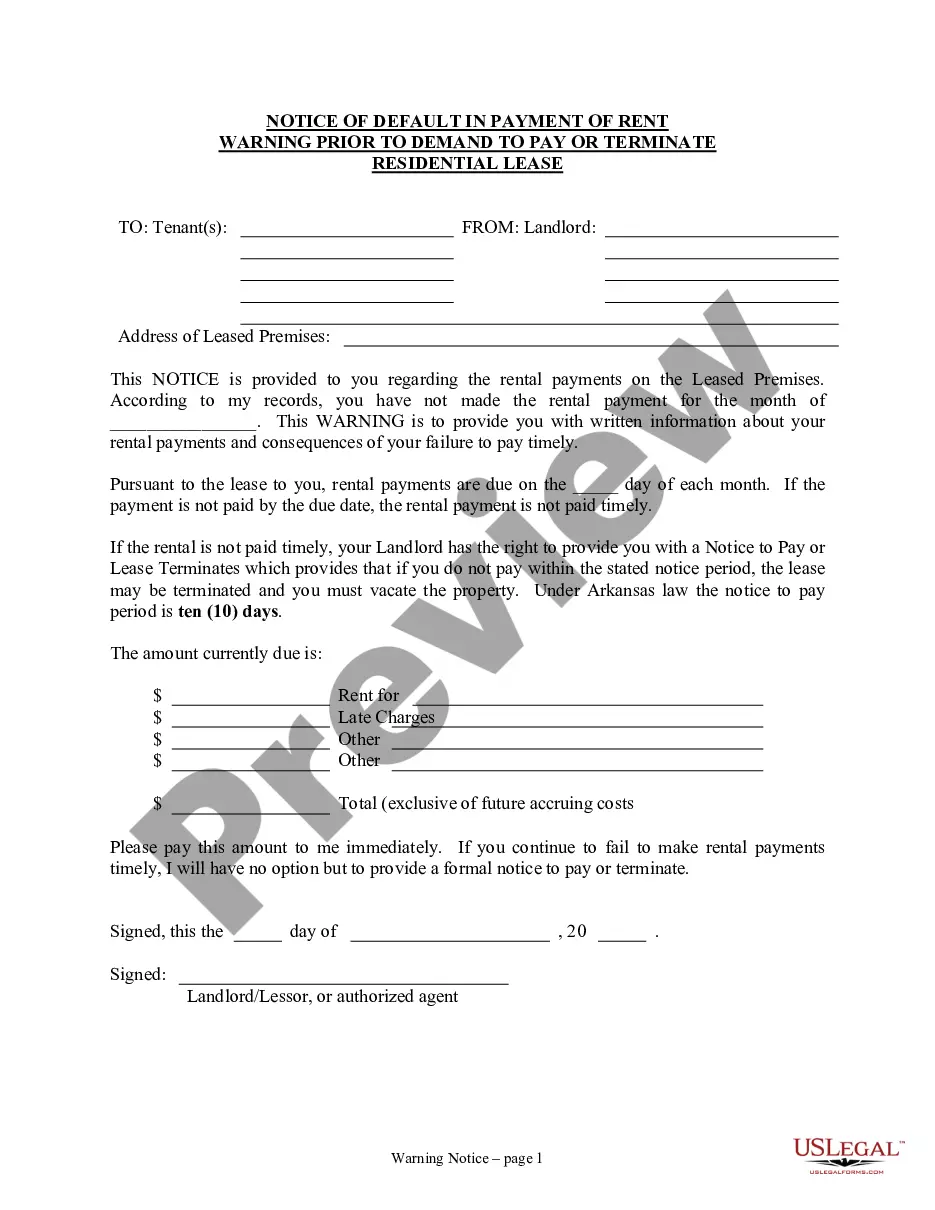

Commercial Lease Application

Description Commercial Lease Application Pdf

How to fill out Florida Rental Application?

Get the most extensive library of legal forms. US Legal Forms is really a solution to find any state-specific document in a few clicks, such as Florida Commercial Rental Lease Application Questionnaire samples. No need to spend hrs of your time seeking a court-admissible sample. Our qualified pros ensure that you receive up to date examples all the time.

To take advantage of the documents library, pick a subscription, and register your account. If you already created it, just log in and then click Download. The Florida Commercial Rental Lease Application Questionnaire file will automatically get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, follow the short instructions listed below:

- If you're going to use a state-specific example, ensure you indicate the proper state.

- If it’s possible, look at the description to know all of the ins and outs of the document.

- Make use of the Preview option if it’s offered to look for the document's information.

- If everything’s right, click on Buy Now button.

- Right after selecting a pricing plan, create your account.

- Pay out by credit card or PayPal.

- Downoad the sample to your computer by clicking on Download button.

That's all! You ought to complete the Florida Commercial Rental Lease Application Questionnaire form and double-check it. To ensure that things are exact, speak to your local legal counsel for help. Register and simply browse around 85,000 helpful forms.