Massachusetts Fiduciary Deed - Trustee to Individual

Description

Key Concepts & Definitions

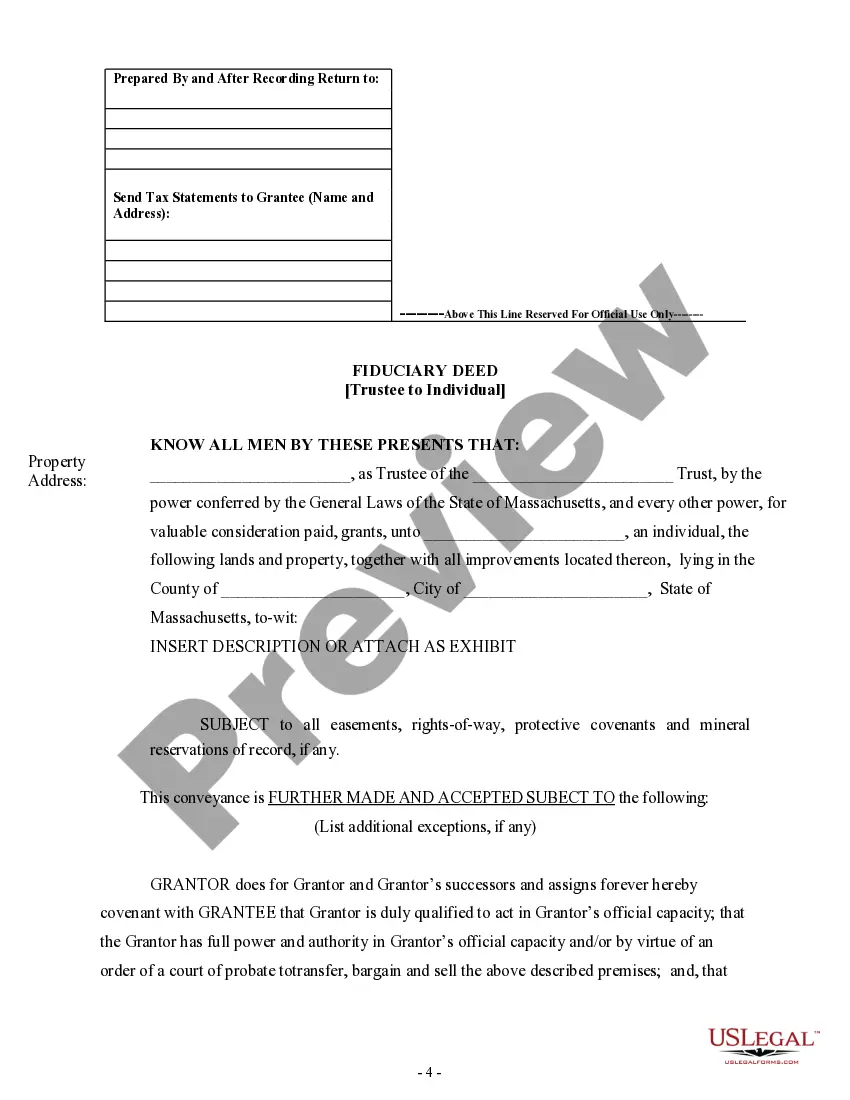

Fiduciary Deed Trustee to Individual refers to a specific legal scenario where the trustee of a fiduciary deed acts on behalf of the beneficiaries to transfer property ownership to an individual. This typically involves a situation where the trustee holds the property in trust until certain conditions are met.

Step-by-Step Guide

- Identify the Trust and Trustee: Verify the details of the trust and identify the trustee responsible for managing the fiduciary deed.

- Review the Trust Agreement: Examine the trust agreement to determine the conditions under which the property may be transferred to an individual.

- Prepare Transfer Documents: The trustee must prepare the necessary documents, including a new deed reflecting the transfer of property ownership.

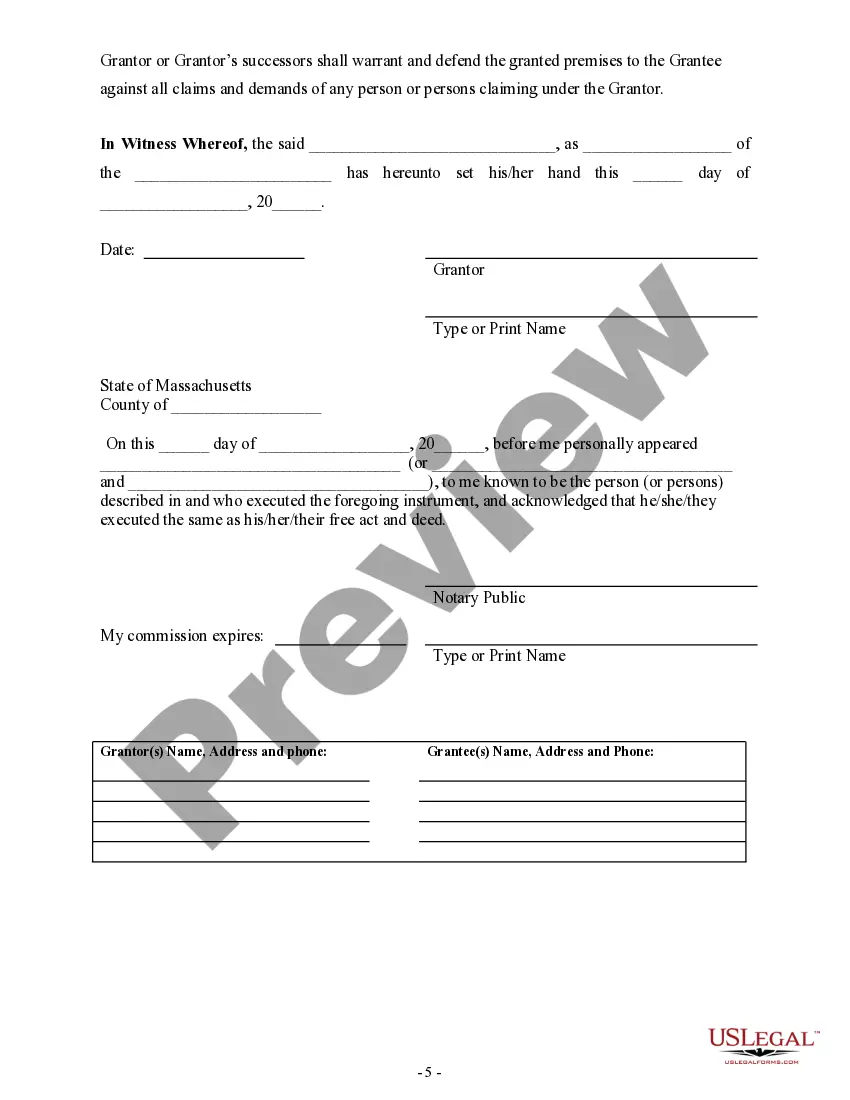

- Execute Transfer: The trustee signs the deed, officially transferring property ownership from the trust to the designated individual.

- Record the Deed: File the executed deed with the appropriate county recorders office to make the transfer public and legally binding.

Risk Analysis

- Legal Compliance: Failure to comply with trust terms or state laws can invalidate the transfer.

- Beneficiary Disputes: Potential disputes among beneficiaries regarding the transfer can arise, leading to legal challenges.

- Incorrect Documentation: Inaccurate or incomplete documents can delay or derail the transfer process.

Best Practices

- Consult Legal Professionals: Engage with attorneys or legal advisors to ensure compliance with all legal requirements.

- Transparent Communication: Keep all beneficiaries informed throughout the process to avoid disputes and misunderstandings.

- Meticulous Record-Keeping: Maintain detailed records of all actions and decisions made as trustee to provide clarity and accountability.

Common Mistakes & How to Avoid Them

- Overlooking Beneficiary Rights: Always acknowledge and respect the rights and interests of all beneficiaries. Engage with them early in the process to mitigate risks of disputes.

- Inadequate Documentation: Ensure all transaction documents are thorough and double-checked for accuracy. Missing or incorrect details can lead to legal complications.

- Failing to Record the Deed: Always record the deed post-transfer to ensure the change is legally recognized and enforceable.

How to fill out Massachusetts Fiduciary Deed - Trustee To Individual?

Greetings to the finest collection of legal documents, US Legal Forms. Here you can locate any template, including Massachusetts Fiduciary Deed - Trustee to Individual templates, and preserve them (as many as you desire). Prepare official paperwork in mere hours, rather than days or even weeks, without spending a fortune on an attorney. Obtain your state-specific template in just a couple of clicks and be assured that it was crafted by our experienced legal experts.

If you’re already a registered user, simply Log In to your account and then click Download next to the Massachusetts Fiduciary Deed - Trustee to Individual you need. Because US Legal Forms is online, you’ll consistently have access to your saved documents, regardless of the device you’re using. View them in the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions listed below to begin.

After you’ve finalized the Massachusetts Fiduciary Deed - Trustee to Individual, present it to your legal advisor for validation. It’s an extra measure but an essential one to ensure you’re thoroughly protected. Join US Legal Forms today and access a vast collection of reusable templates.

- If this is a state-specific sample, verify its validity in your residing state.

- Review the description (if available) to determine if it’s the suitable template.

- Explore more options with the Preview feature.

- If the sample fulfills your requirements, simply click Buy Now.

- To establish your account, choose a pricing plan.

- Utilize a credit card or PayPal account for subscription.

- Save the document in the desired format (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

Trustees aren't allowed to sell trust property to themselves unless the trust agreement has explicitly allowed them to do so. They also shouldn't sell the trust property to another trust that they manage, or borrow trust funds for personal use.

The trustee cannot grant legitimate and reasonable requests from one beneficiary in a timely manner and deny or delay granting legitimate and reasonable requests from another beneficiary simply because the trustee does not particularly care for that beneficiary. Invest trust assets in a conservative manner.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

Prior to enacting G.L.c. 184, §35, Massachusetts was among the few states requiring the full trust document for trusts containing real property to be recorded.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

Since the Schedule of Beneficiaries to a trust is not recorded with the Declaration of Trust at the Registry of Deeds, the identity of the Beneficiaries is not a matter of public record.There are two types of Trusts in Massachusetts.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

How to sign as a Trustee. When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.