New Jersey Sales Order Form

Description

How to fill out Sales Order Form?

If you need to comprehensive, download, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s simple and convenient search to locate the documents you need.

A range of templates for business and personal purposes are organized by categories and claims, or keywords.

Every legal document template you acquire is yours indefinitely. You will have access to every form you downloaded within your account. Go to the My documents section and select a form to print or download again.

Be proactive and download, and print the New Jersey Sales Order Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to discover the New Jersey Sales Order Form with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to acquire the New Jersey Sales Order Form.

- You can also find forms you previously obtained from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow these instructions.

- Step 1. Ensure you have selected the form for the correct region/country.

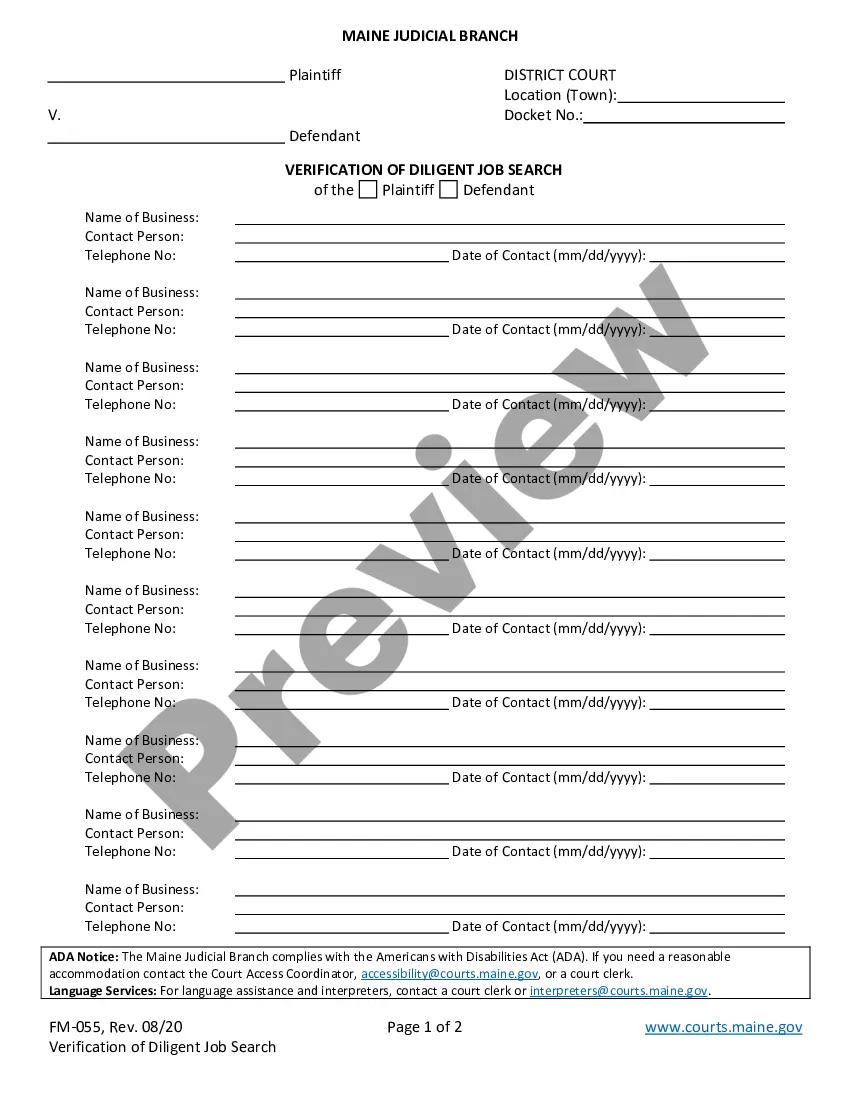

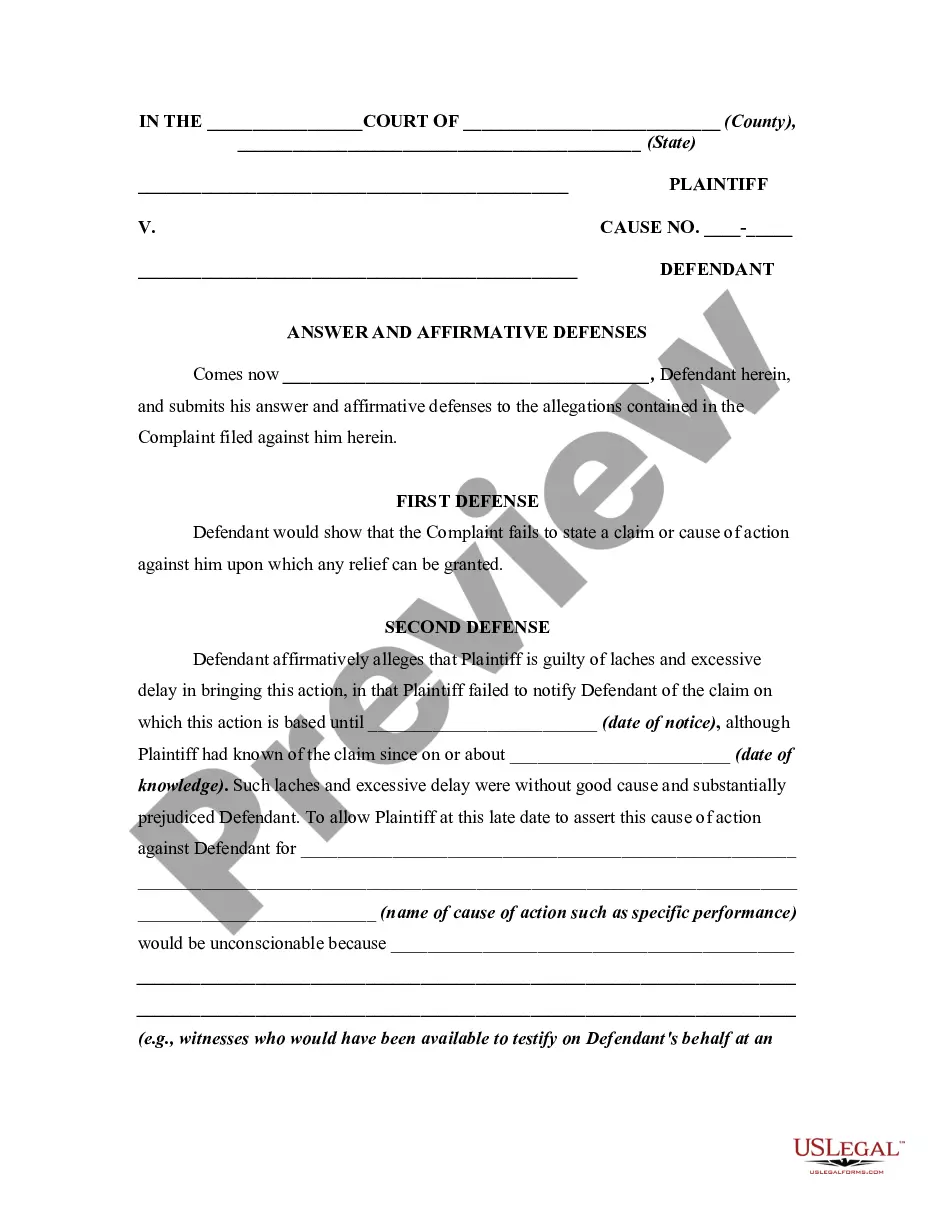

- Step 2. Use the Preview option to review the form’s content. Make sure to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of your legal document template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the purchase process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Retrieve the format of your legal document and download it to your device.

- Step 7. Complete, modify and print or sign the New Jersey Sales Order Form.

Form popularity

FAQ

The ST-5 form is an exemption certificate that nonprofit organizations use to make purchases without being charged sales tax in New Jersey. To qualify, the organization must be registered and recognized as tax-exempt by the state. Utilizing the New Jersey Sales Order Form alongside the ST-5 form can facilitate easier management of tax-exempt purchases.

filing your New Jersey state return can take anywhere from a few minutes to a few days for processing. Generally, you can expect a quicker response time compared to paper filing. Keep in mind that using the New Jersey Sales Order Form can streamline your submission and help avoid common delays.

To stop the withholding of New Jersey Income Tax, complete an Employee's Certificate of Nonresidence in New Jersey (Form NJ-165) and give it to your employer.

For a nonprofit corporation in New Jersey to obtain a state corporate tax exemption, the nonprofit must submit to the Regulatory Services Branch of the New Jersey Division of Taxation the following items: A copy of the nonprofit's certificate of incorporation. A copy of the nonprofit organization's bylaws.

ST-3 (3-17) The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. State of New Jersey. Division of Taxation. SALES TAX.

Your New Jersey tax identification (ID) number has 12 digits. If you have a Federal Employer Identification Number (FEIN) assigned by the Internal Revenue Service (IRS), your New Jersey tax ID number is your FEIN followed by a 3 digit suffix. If you do not have a suffix, enter three zeroes.

To register, file a Business Registration Application (Form NJ-REG) online with the Division of Revenue and Enterprise Services. Once registered, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Certificate of Authority (to be able to collect Sales Tax).

SALES TAX. FORM ST-4. EXEMPT USE CERTIFICATE. To be completed by purchaser and given to and retained by seller.

The ST-5 exemption certificate grants your organization exemption from New Jersey sales and use tax on the organization's purchases of goods, meals, services, room occupancies and admissions that are directly related to the purposes of the organization, except purchases of energy and utility services.

How to Fill Out NJ Sales Tax Exempt Form ST-3?Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction.Provide your taxpayer registration number.Describe the nature of goods or services you sell in an ordinary course of business.More items...