Washington Receipt Template for Nanny Services

Description

How to fill out Receipt Template For Nanny Services?

Selecting the ideal legal document template can be challenging.

Clearly, there are numerous designs available online, but how can you acquire the legal form you need.

Utilize the US Legal Forms website. This service offers a wide array of templates, such as the Washington Receipt Template for Nanny Services, which can be utilized for both business and personal purposes.

You can browse the form using the Review button and read the form description to confirm it is suitable for you.

- All documents are verified by professionals and comply with both state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Washington Receipt Template for Nanny Services.

- Use your account to search for the legal forms you have previously purchased.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

To prove childcare expenses, collect all relevant receipts that record payments made for child care services. Make sure these receipts include the necessary details to satisfy IRS requirements. A Washington Receipt Template for Nanny Services can serve as a reliable proof of payment, making your documentation clear and comprehensive.

Filling out a receipt book for childcare requires you to input the date, the name of the caregiver, the services rendered, and the total payment. It’s also wise to keep a running total of payments made. Using a Washington Receipt Template for Nanny Services can ensure accuracy and consistency across your records.

The IRS requires proof of child care expenses when you apply for tax deductions or credits related to childcare. You should maintain receipts that document the payments made for these services. A Washington Receipt Template for Nanny Services can help you organize your expenses efficiently, making it easier to provide proof if necessary.

Yes, the IRS does ask for proof of childcare expenses if you claim them as a deduction or a credit. It is crucial to maintain records of all related payments, such as receipts, to substantiate your claims. Having a Washington Receipt Template for Nanny Services will help you keep accurate documentation that the IRS may require.

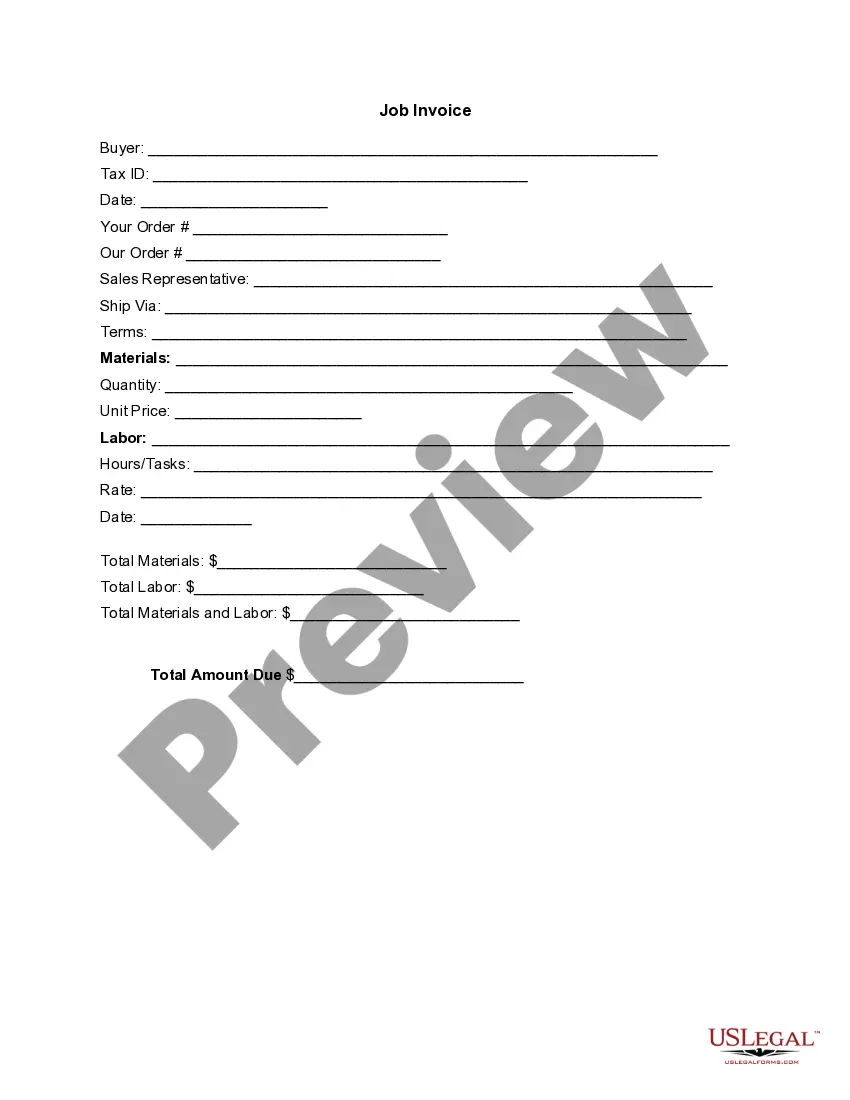

To make a receipt for a nanny, include key details such as your name, the parent's information, the date of service, and the payment amount. Specify the services provided, whether hourly or flat rate. A Washington Receipt Template for Nanny Services offers a handy structure for creating a clear and professional receipt, benefiting both parties.

To write an invoice for childcare, include your name, the parent's details, the date of service, and a breakdown of hours worked. Clearly state the total amount due and payment methods. Utilizing a Washington Receipt Template for Nanny Services can help you ensure that all necessary components are present and organized.

Yes, you can generate an invoice for your own services. It is essential to present your work professionally to your clients. A Washington Receipt Template for Nanny Services can help you create a structured invoice that reflects your services accurately and is easy for parents to understand.

Creating your own invoice involves listing your services and specifying the costs. Include your contact details, the client's information, and payment terms clearly. You can simplify this process using a Washington Receipt Template for Nanny Services, ensuring you adhere to professional standards.

To create a receipt for a service, start with your business name and contact information. Be sure to include the service provided, date, amount, and any payment method used. Opt for a Washington Receipt Template for Nanny Services to ensure that your receipt meets the expectations of parents and serves as a clear record.

Yes, it is legal to create your own invoice as long as it contains essential information. You should include your name, business details, service description, and payment terms. A Washington Receipt Template for Nanny Services can guide you in including all required details to keep everything compliant and professional.