Washington Receipt Template for Small Business

Description

How to fill out Receipt Template For Small Business?

You may spend time online searching for the legal document template that meets the federal and state requirements you will need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

It is easy to download or create the Washington Receipt Template for Small Business from their service.

To locate another version of the form, use the Search section to find the template that meets your preferences and requirements.

- If you already have an account with US Legal Forms, you may Log In and then click the Download button.

- Following that, you can fill out, modify, print, or sign the Washington Receipt Template for Small Business.

- Each legal document template you purchase is yours permanently.

- To access another copy of the acquired form, visit the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the form description to confirm that you have selected the proper document.

Form popularity

FAQ

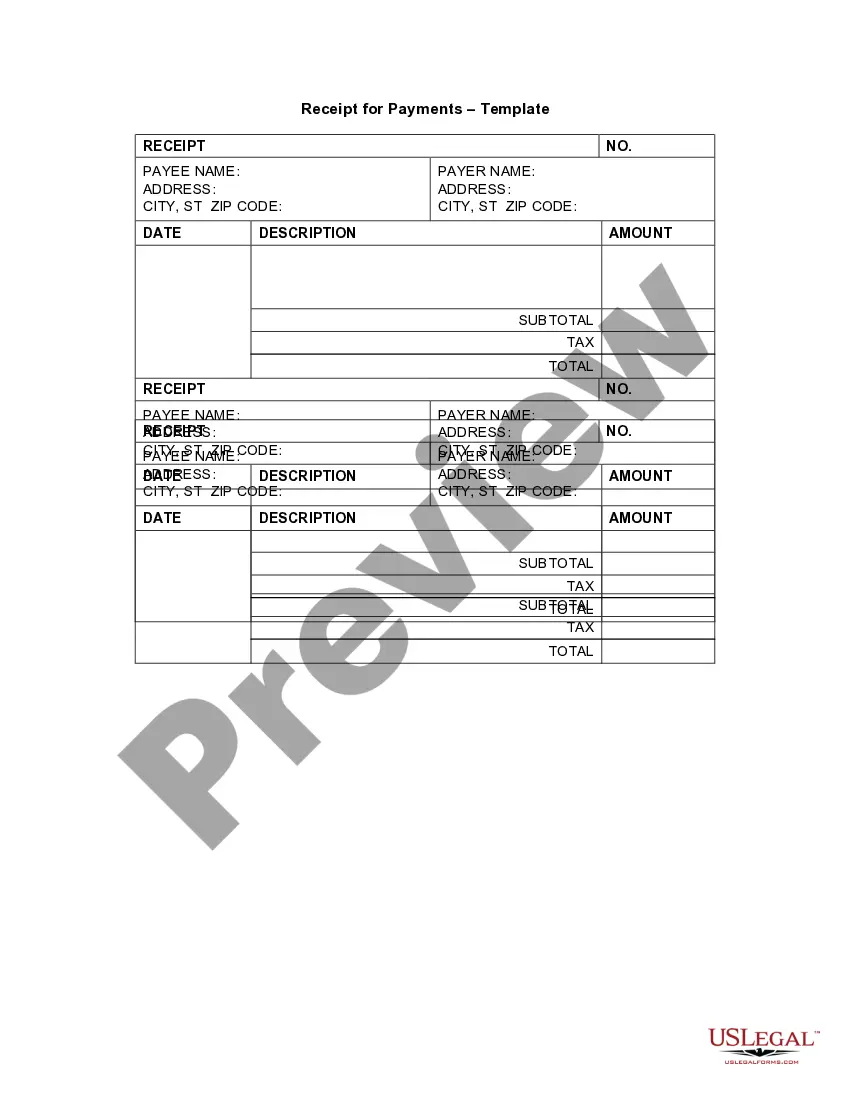

Creating a receipt format is simple when you use a Washington Receipt Template for Small Business. Begin by selecting a digital or printable template that suits your needs. Customize it by adding your business logo, contact details, and layout preferences. This will ensure your receipts reflect your brand while providing essential information to customers.

Writing a receipt for a small business begins by utilizing a Washington Receipt Template for Small Business. Clearly list your business details at the top, followed by customer information and transaction specifics. Make sure to detail each item sold, their prices, and the grand total to provide a transparent record for your customers.

Formatting a receipt can be made easy with a Washington Receipt Template for Small Business. Start with your business name and contact information at the top. Leave space for transaction details such as items, quantities, prices, and totals. Organize the information in a clear, logical manner for better readability.

To fill out a simple receipt, first, select a Washington Receipt Template for Small Business for ease. Write your business name and contact information. List the items purchased with their corresponding prices, then calculate the total. Make sure to sign or print your name at the bottom for authenticity.

Filling out a receipt form is straightforward when you use a Washington Receipt Template for Small Business. Input your business information at the top, followed by customer details and the list of items sold. Ensure you accurately list quantities, prices, and any applicable taxes, then total the amount at the end for clarity.

To create your own receipt, start with a Washington Receipt Template for Small Business. Include essential information such as your business name, address, and contact details. Next, detail the transaction with items sold, prices, and payment method. Finally, add any additional notes or policies to personalize your receipt.

To file taxes as a small business owner, start by gathering all your income and expenses for the year. Use the appropriate forms, like Schedule C if you're a sole proprietor. To simplify your filing, consider a Washington Receipt Template for Small Business to help you organize your financial documents and accurately report your taxable income.

For small business taxes, you should keep receipts for all business-related expenses, such as supplies, services, and travel. Documentation for income sources is also crucial. Using a Washington Receipt Template for Small Business can help you ensure you maintain these records, making tax preparation more straightforward and compliant.

Yes, if you operate a single-member LLC, you report your business income on your personal tax return using Schedule C. However, multi-member LLCs file their own tax returns while passing any profits or losses to their members. A Washington Receipt Template for Small Business can be a useful tool to keep both personal and business finances organized, ensuring an easier filing process.

The tax form an LLC uses depends on its classification. Single-member LLCs usually file as sole proprietors using Schedule C, while multi-member LLCs often file Form 1065. For optimal organization, consider utilizing a Washington Receipt Template for Small Business to maintain accurate records of your expenses, which will simplify your tax filing process.