New Jersey Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Agreement To Form Partnership In Future To Conduct Business?

You might spend hours online trying to locate the official document template that satisfies the state and federal requirements you need.

US Legal Forms offers a wide array of legal forms that are evaluated by professionals.

You can obtain or print the New Jersey Agreement to Form Partnership in Future to Conduct Business from their service.

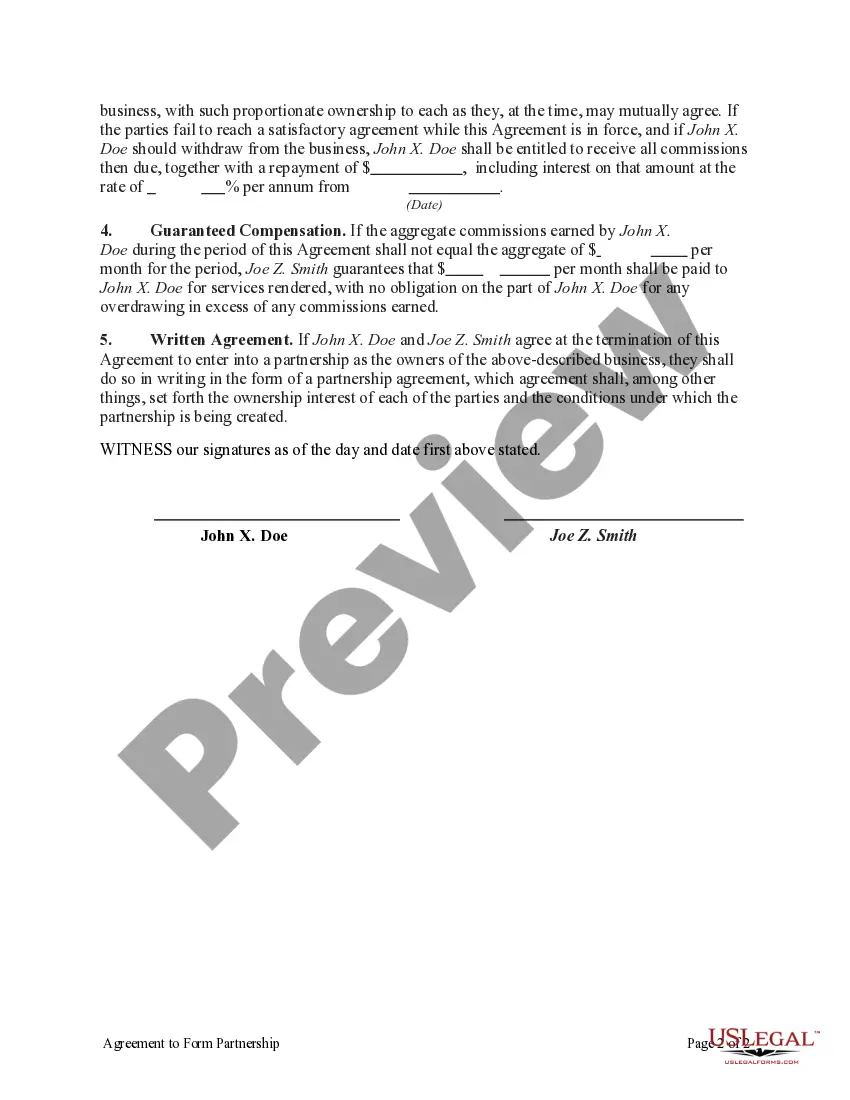

If available, utilize the Preview option to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, edit, print, or sign the New Jersey Agreement to Form Partnership in Future to Conduct Business.

- Every legal document template you purchase belongs to you for life.

- To acquire another copy of a purchased form, go to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your region/city of choice.

- Review the form description to confirm you have chosen the correct template.

Form popularity

FAQ

Filing a partnership return late in New Jersey can result in substantial penalties, generally calculated as a percentage of the unpaid tax amount. Additionally, partners may face personal liability under certain circumstances. To avoid these penalties, partners should review their New Jersey Agreement to Form Partnership in Future to Conduct Business and file on time. Using US Legal can help ensure you understand your obligations and avoid late fees.

Any partnership with income, loss, or other tax reportable events in New Jersey must file a partnership return. This includes all types of partnerships, such as general, limited, and limited liability partnerships. Timely filing is crucial to adhere to state regulations outlined in your New Jersey Agreement to Form Partnership in Future to Conduct Business. For guidance, check with US Legal, which provides useful tools for partnerships.

While it's possible to form a partnership verbally in New Jersey, having a written agreement is strongly advised. A written document, such as a New Jersey Agreement to Form Partnership in Future to Conduct Business, clearly outlines roles, responsibilities, and expectations. This clarity can prevent disputes and misunderstandings in the future. US Legal offers resources to help you draft a comprehensive agreement.

To extend the NJ 1065 return, submit Form IT-204, along with payment for any estimated taxes owed, before the original due date. This form grants a six-month extension, helping partners avoid late filing penalties. Ensuring this step is aligned with the New Jersey Agreement to Form Partnership in Future to Conduct Business is crucial for compliance. Consult with US Legal for detailed instructions and easy access to necessary forms.

A partnership in New Jersey must file its return extension by the 15th day of the third month following the end of its tax year. This extension allows more time to prepare and submit the partnership tax return without incurring late penalties. It's essential to ensure that this filing aligns with your partnership agreement. For clarity on the procedure, a New Jersey Agreement to Form Partnership in Future to Conduct Business can be referenced through US Legal.

To write a business partnership agreement, start by clearly stating the intent to create a partnership in New Jersey. Include essential details such as the partnership name, contributions of each partner, profit distribution, and operational procedures. This framework ensures all parties share the same expectations and minimizes conflicts. Utilizing the US Legal platform can provide templates and guidance tailored to a New Jersey Agreement to Form Partnership in Future to Conduct Business.

The structure of a partnership agreement typically includes an introduction, definitions, and the main terms of the partnership. Key sections should cover contributions from each partner, profit distribution methods, and decision-making protocols. Additionally, provisions for resolution of disputes should be included. A New Jersey Agreement to Form Partnership in Future to Conduct Business can provide a useful framework for establishing this structure.

Writing a simple partnership agreement involves clearly stating the essential terms and conditions of the partnership. Begin with the partners' names, then describe the partnership's purpose and terms of operation. Make sure to address profit sharing and responsibilities. A New Jersey Agreement to Form Partnership in Future to Conduct Business provides a straightforward template that can simplify this process.

A comprehensive partnership agreement should include the names of all partners, the business purpose, and the duration of the partnership. Additionally, outline profit-sharing arrangements, decision-making processes, and terms for resolving disputes. Incorporating a New Jersey Agreement to Form Partnership in Future to Conduct Business ensures that all critical elements are systematically addressed.

To fill a partnership form, you should provide accurate information about each partner's identity and contributions. It’s important to define the partnership’s business purpose and structure. Additionally, include terms regarding profit distribution and decision-making. Using a New Jersey Agreement to Form Partnership in Future to Conduct Business can aid in ensuring all essential details are captured.