New Jersey Equipment Inventory List

Description

How to fill out Equipment Inventory List?

Are you currently in a location where you require documents for either business or particular activities almost every day? There are numerous legal document templates accessible online, but finding versions you can trust isn’t simple.

US Legal Forms offers a vast selection of form templates, including the New Jersey Equipment Inventory List, which are crafted to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. After that, you can download the New Jersey Equipment Inventory List template.

You can view all the document templates you have purchased in the My documents section. You can obtain another copy of the New Jersey Equipment Inventory List at any time if necessary. Just select the desired template to download or print the document form.

Utilize US Legal Forms, the most comprehensive selection of legal forms, to save time and avoid mistakes. The service provides properly designed legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

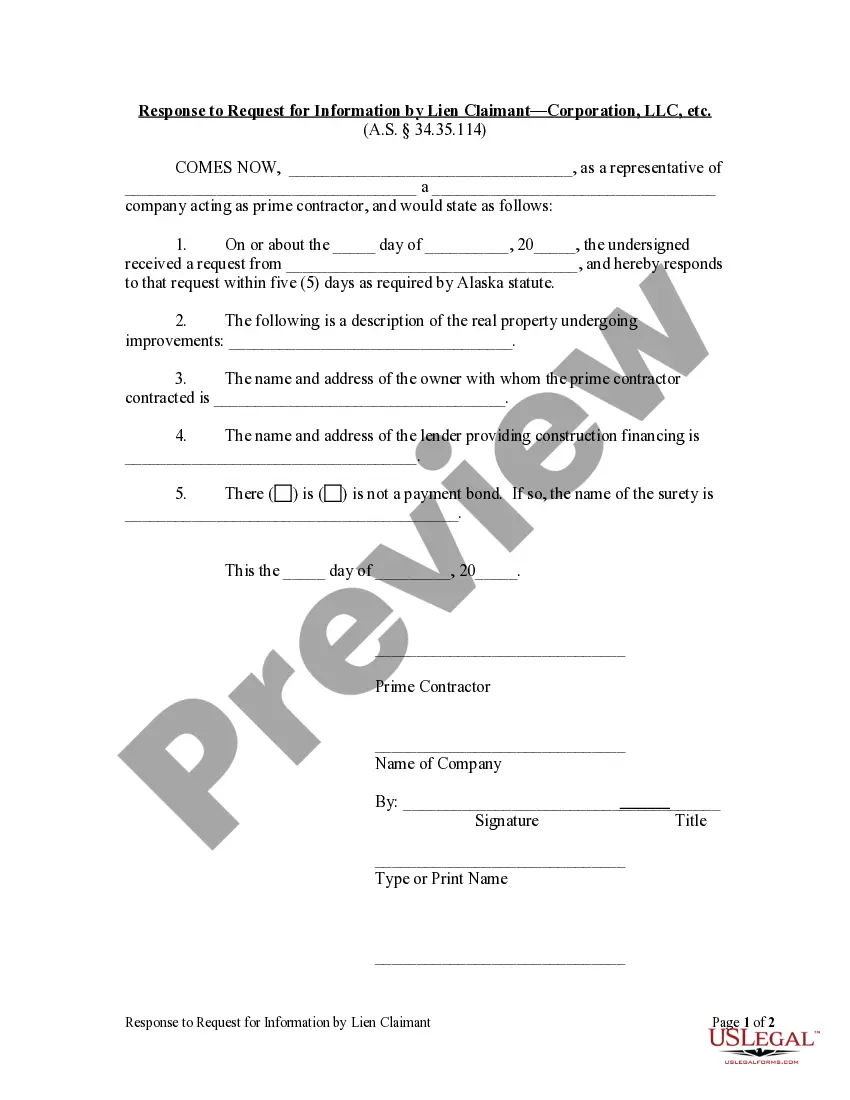

- Search for the form you need and ensure it is for the correct state region.

- Utilize the Review button to examine the form.

- Read the description to confirm you have selected the right template.

- If the form isn’t what you’re looking for, use the Search field to find the template that suits your needs and requirements.

- When you find the correct form, click Buy now.

- Select the pricing plan you wish, fill in the required details to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

To create an equipment list, start by conducting a thorough audit of all your equipment. Document each item’s details, including specifications and conditions. Using platforms like US Legal Forms can simplify this process, allowing you to generate a professional New Jersey Equipment Inventory List that meets your needs and keeps your equipment well-organized.

Equipment inventory refers to the total count and condition of all physical assets a business possesses. This includes tools, machinery, and any other items used in operations. By managing your equipment inventory effectively, you create a clear New Jersey Equipment Inventory List that helps streamline your operations and enhance productivity.

An equipment inventory list is a comprehensive record that outlines all equipment owned by a business or organization. This list enables effective tracking of assets, helps in maintaining organization, and is essential for accounting purposes. By creating an efficient New Jersey Equipment Inventory List, you can keep tabs on your assets and ensure your records are accurate.

In New Jersey, certain items are exempt from sales tax, including food for home consumption, clothing, and medical devices. Specific types of machinery and equipment used in manufacturing may also qualify for exemption. Knowing these exemptions can help you effectively manage your New Jersey Equipment Inventory List, as you can track which items are tax-exempt and potentially reduce your tax liability.

In New Jersey, equipment is generally subject to taxation, depending on its use and ownership. To accurately determine your tax obligations, it's important to maintain a detailed New Jersey Equipment Inventory List. This list helps you keep track of taxable items and ensure that you report them correctly. To navigate these regulations effectively, consider using the resources available through USLegalForms.

Yes, you can file your New Jersey taxes online, making the process more convenient and efficient. Many taxpayers prefer this method for submitting their equipment inventory as part of the New Jersey Equipment Inventory List. The New Jersey Division of Taxation provides an online platform for this purpose. Additionally, USLegalForms offers solutions that guide you through online filing, ensuring you meet all necessary requirements.

Filling out the ST-4 form in New Jersey involves providing detailed information about your equipment as part of the New Jersey Equipment Inventory List. Start by entering your business information, followed by itemizing the equipment you own. Make sure to adhere closely to the guidelines and regulations provided by the New Jersey Division of Taxation. If you need assistance, USLegalForms offers resources to help simplify this process.

NJ Form C 9600 is a key document used for reporting the New Jersey Equipment Inventory List. This form enables businesses to list their equipment and machinery for tax purposes. It's crucial for ensuring compliance with state tax regulations. By properly completing this form, you can accurately report your equipment, which may help in correctly assessing any potential taxes owed.