New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information

Description

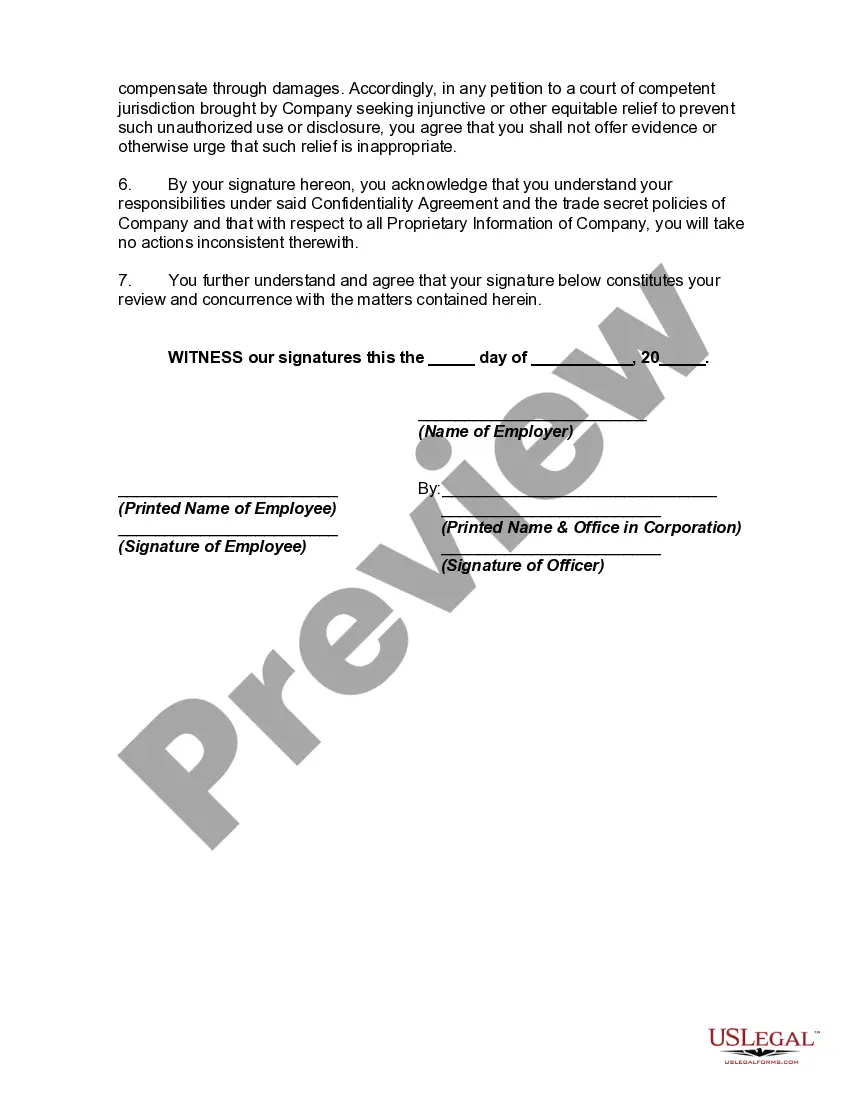

How to fill out Exit Procedure Acknowledgment Regarding Proprietary Information?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal templates that you can download or print.

By using the website, you will find thousands of forms for corporate and personal use, organized by categories, claims, or keywords. You can access the most recent versions of forms such as the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information in just a few minutes.

If you already have a monthly subscription, Log In to retrieve the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information from the US Legal Forms library. The Obtain button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit, fill out, print, and sign the saved New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure that you have selected the correct form for your area/state.

- Click the Preview button to review the content of the form.

- Check the description of the form to confirm that you have selected the right one.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

NJ Form C 9600 is used for the New Jersey Business Registration Application. This form is essential for businesses seeking to operate within the state. Utilizing the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information during the registration process ensures that your business information is handled securely.

The New Jersey Division of Taxation is responsible for issuing tax clearance certificates. These certificates confirm that you have met your tax obligations in the state. Following the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information protects your information throughout this certification process.

To file a Pass-Through Business Entity (PTE) election in New Jersey, you need to fill out the appropriate forms and submit them by the specified deadline. This election allows for the pass-through taxation of certain business entities. Incorporating the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information can protect your sensitive details while filing.

Yes, New Jersey offers an e-file authorization form that allows taxpayers to file electronically. This form simplifies the process by enabling faster submissions and quicker processing of tax documents. When utilizing the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information, you ensure that your electronic submissions are safeguarded from unauthorized access.

You can obtain a tax clearance certificate in New Jersey by filling out the necessary forms and submitting them to the Division of Taxation. It’s important to check your tax status before applying, as any outstanding obligations can delay your request. Utilizing the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information helps protect your proprietary data during the application process.

The statute of limitations for the land (property-related) claims in New Jersey typically spans six years. This timeframe applies to disputes concerning property damage or ownership. Knowing this limit is significant when handling the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information, protecting your legal interests.

In New Jersey, individuals generally have a limited timeframe of up to 180 days to file a discrimination claim. This timeframe varies depending on whether the claim is filed with state or federal agencies. Understanding these timelines is key to effectively apply the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information, ensuring rights are upheld.

A statement of information in New Jersey refers to a document that provides critical data about a business entity, including its formation and structure. This document helps inform the state and the public about the entity’s operations. If you're working through the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information, this statement may be a vital part of your reporting requirements.

In New Jersey, certain serious crimes, such as murder, have no statute of limitations. This means that charges can be filed against someone at any time, regardless of when the crime took place. It’s essential to be aware of these exceptional cases, particularly in the context of the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information.

To avoid the New Jersey exit tax, you can consider retaining residency by maintaining a permanent home in the state. Additionally, planning your departure and closely reviewing your financial status can provide opportunities for mitigation. Professional advice and resources, like those offered by uslegalforms, can facilitate understanding the New Jersey Exit Procedure Acknowledgment Regarding Proprietary Information.