An escrow is the deposit of a written instrument or something of value with a third person with instructions to deliver it to another when a stated condition is performed or a specified event occurs. The use of an escrow is most common in real estate sales transactions where the grantee deposits earnest money with the escrow agent to be delivered to the grantor upon consummation of the purchase and sale of the real estate and performance of other specified conditions.

New Jersey Escrow Agreement for Sale of Real Property and Deposit of Earnest Money

Description

How to fill out Escrow Agreement For Sale Of Real Property And Deposit Of Earnest Money?

If you wish to finalize, obtain, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to sign up for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to acquire the New Jersey Escrow Agreement for Sale of Real Property and Deposit of Earnest Money with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the New Jersey Escrow Agreement for Sale of Real Property and Deposit of Earnest Money.

- You may also access forms you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

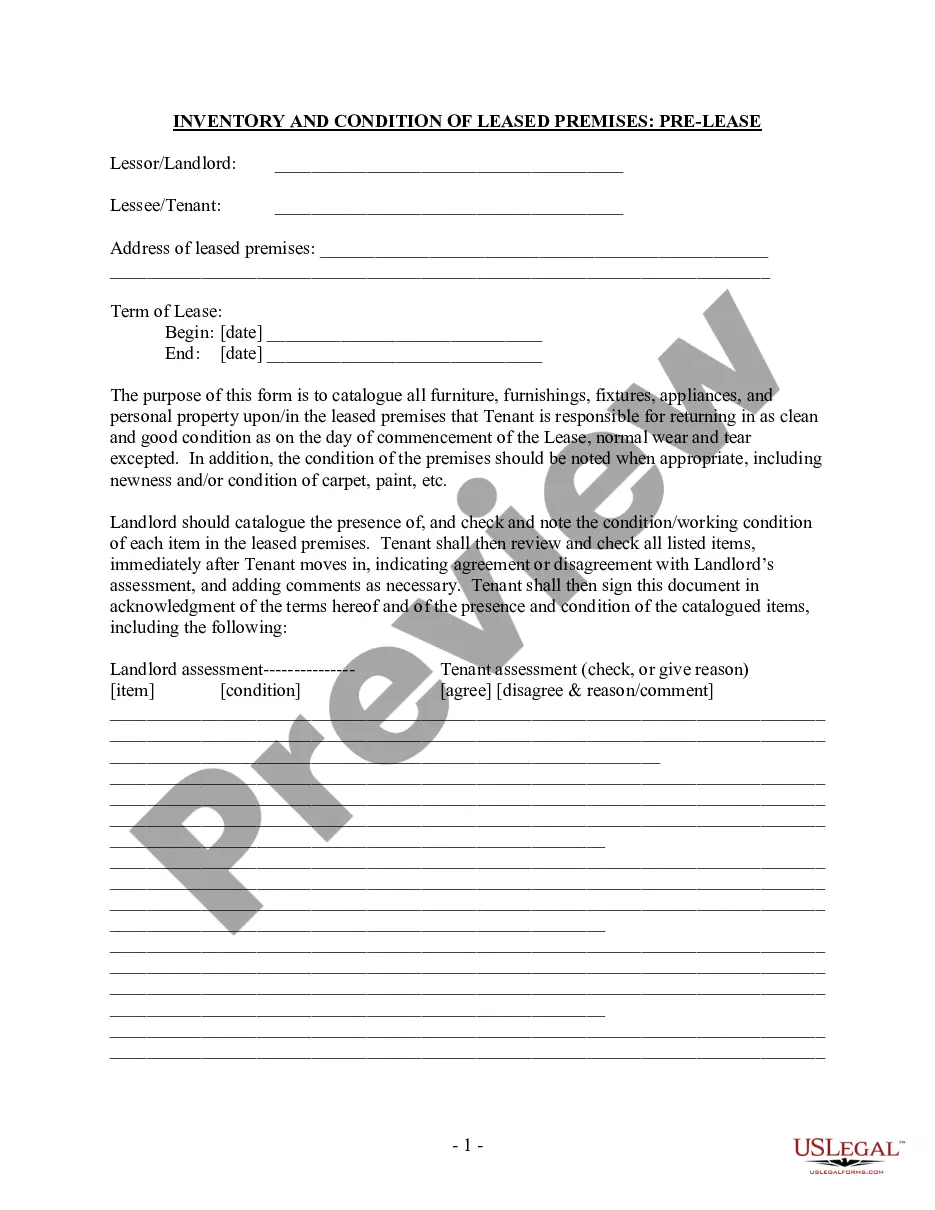

- Step 2. Use the Preview option to review the form’s specifics. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types within the legal form category.

Form popularity

FAQ

Typically, you pay earnest money to an escrow account or trust under a third-party like a legal firm, real estate broker or title company. Acceptable payment methods include personal check, certified check and wire transfer. The funds remain in the trust or escrow account until closing.

The offer is not legally binding until it has been agreed upon which is once the documentation has been signed. When you live in New Jersey or sell a property there the realtor contract has a three day review period for an attorney to look over it. During this time buyer or seller are able to withdraw legally.

The buyer pays a 'good faith deposit' to the seller's attorney or broker (not directly to the seller) upon signing the contract. This amount usually ranges from $1,000 to $5,000.

If you find yourself asking, What if I don't have earnest money? you have options. For example, in your offer, you can request a waiver of earnest money. Have your real estate agent write up the waiver contract and submit it through normal channels.

In an escrow agreement, one partyusually a depositordeposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

This states that the buyer will obtain a definite mortgage commitment by a certain date. If they fail to do so, either party can cancel the contract and the buyer will have their earnest money returned to them.

While not legally required in New Jersey, earnest money is a two-step process in the state. A smaller deposit will accompany the initial offer, usually around $1000. Once the offer is accepted, a larger deposit, typically 10% of the purchase price is submitted when the purchase agreement is signed.

Failing to pay a deposit on time is a fundamental breach of the Agreement of Purchase and Sale. When the buyer unilaterally decided not to abide by the terms of the Agreement by not paying the deposit, the buyer is in breach of the Agreement and that breach gives the Seller certain rights.

In all other cases, the licensee must deposit such monies within five business days of receipt.

Essential elements of a valid escrow arrangement are:A contract between the grantor and the grantee agreeing to the conditions of a deposit;Delivery of the deposited item to a depositary; and.Communication of the agreed conditions to the depositary.