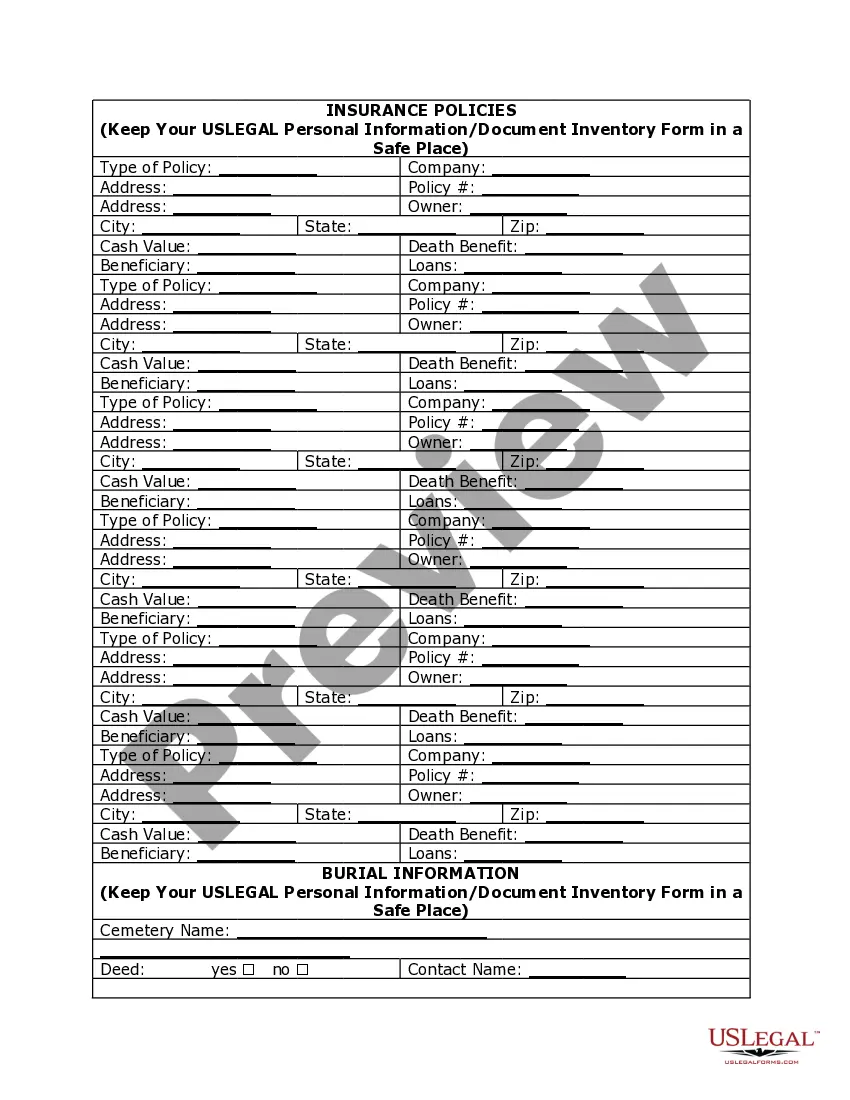

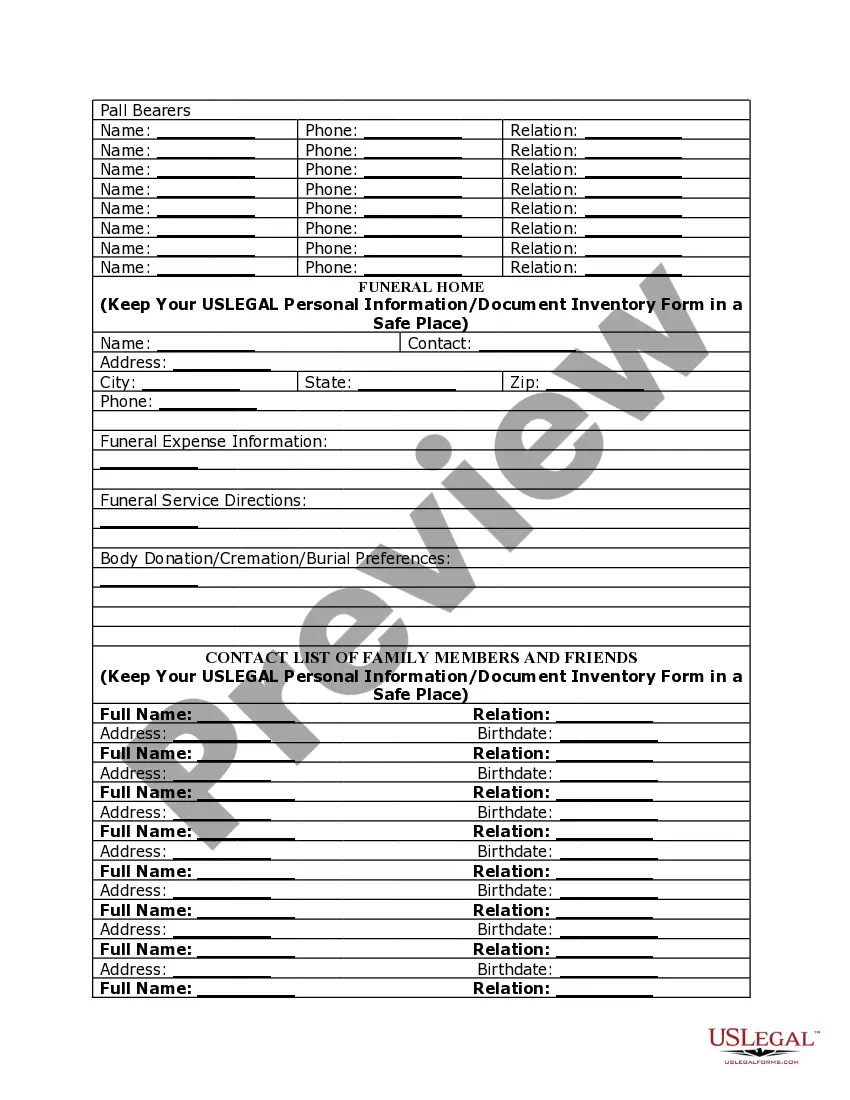

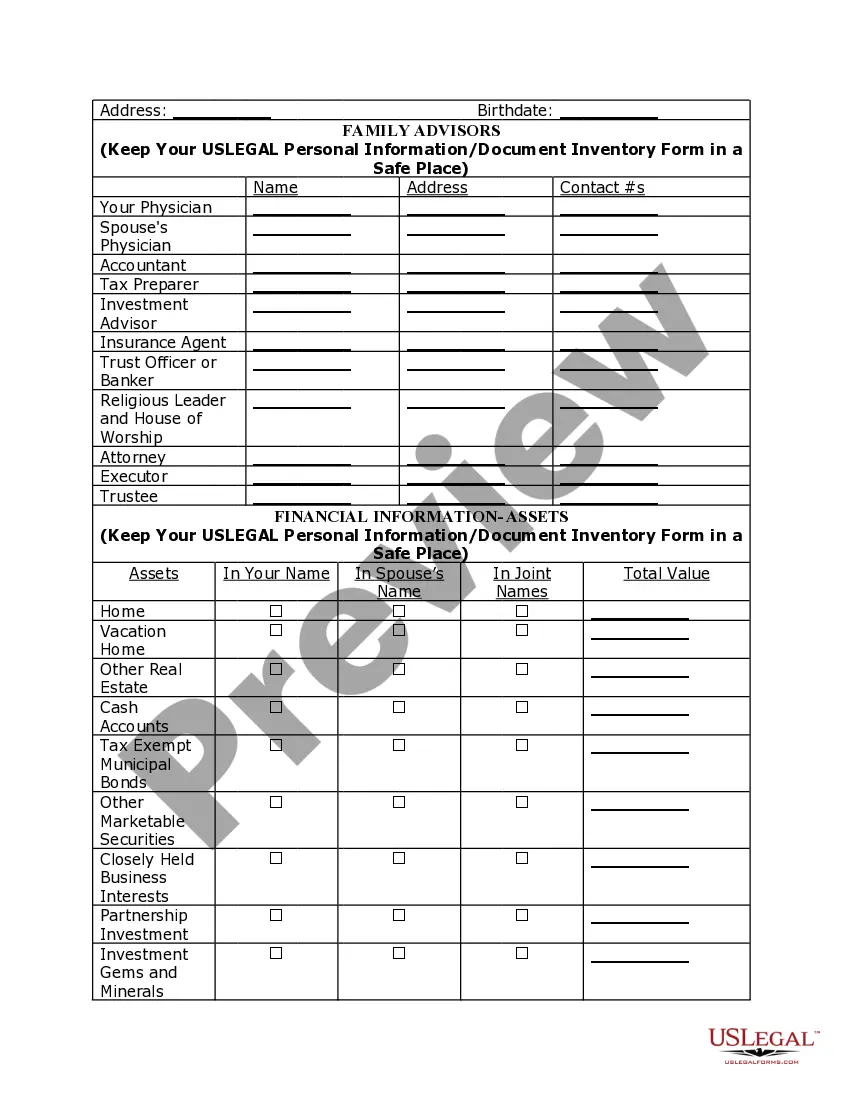

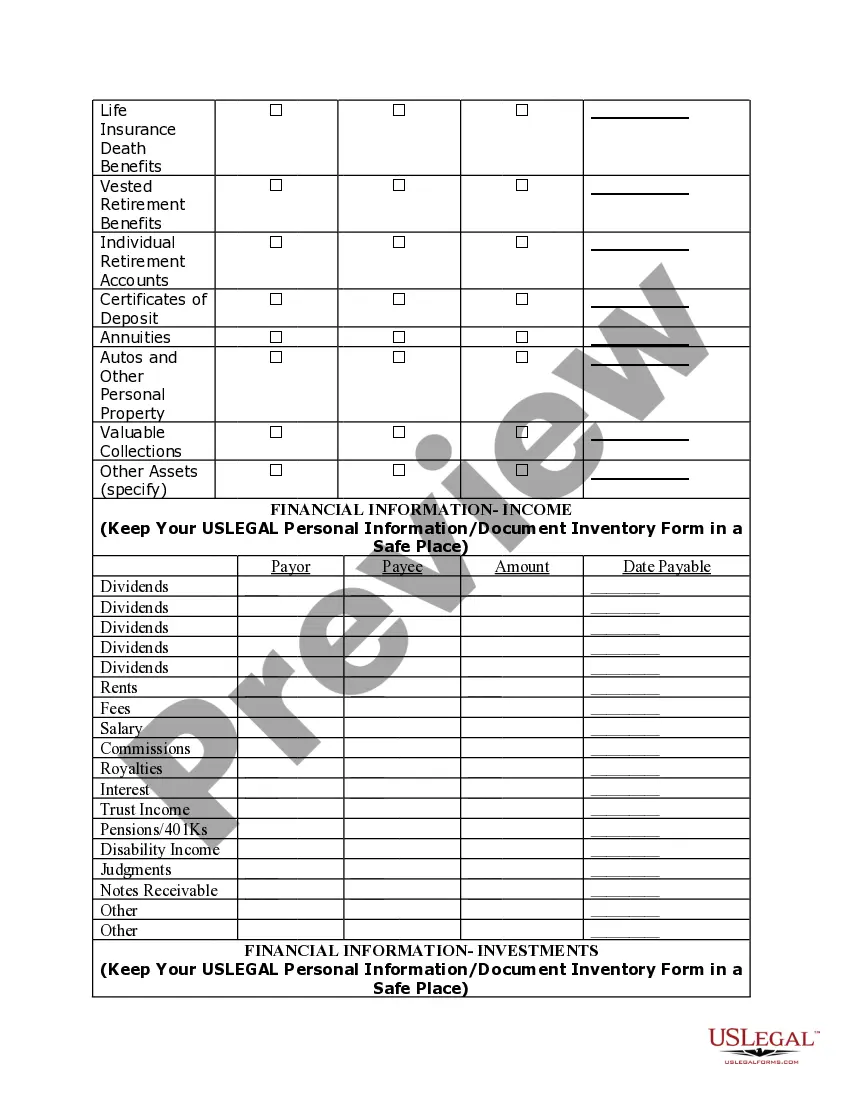

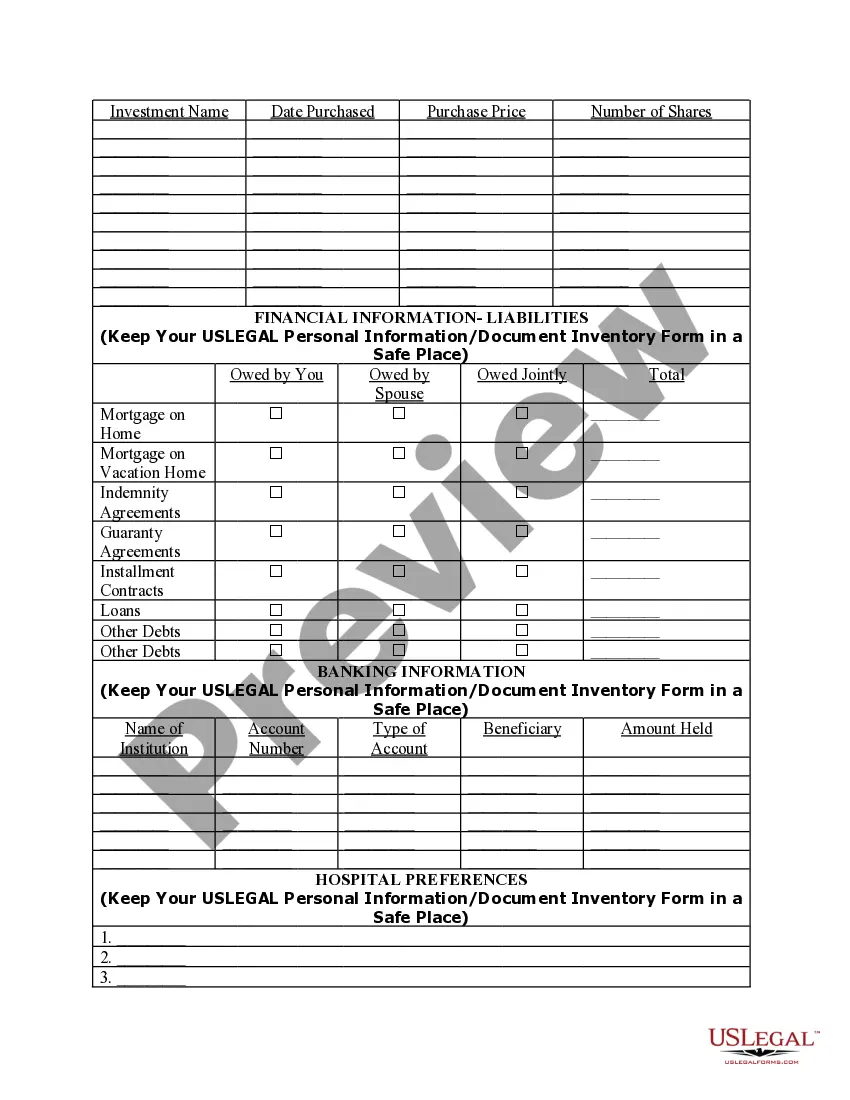

New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document

Description

How to fill out Personal Planning Information And Document Inventory Worksheets - A Legal Life Document?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a wide selection of legal template files you can download or print.

While using the website, you can access a vast number of templates for business and personal purposes, organized by categories, claims, or keywords.

You can find the most current versions of templates like the New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document in moments.

Check the form description to confirm that you have chosen the right form.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already possess an account, Log In and download the New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document from the US Legal Forms collection.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

Yes, you can file the NJ W3 form online. This form serves as a summary of all W-2 forms submitted and is essential for employers. For those managing multiple reports, using New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can help you organize your documents, making the filing process smoother and more efficient.

The NJ 1040-HW form is a supplemental form used for reporting specific types of income or adjustments associated with the NJ-1040. It helps taxpayers accurately report their financial information and potentially reduce their tax burden. To streamline your tax planning, consider using New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to ensure you have everything you need at hand.

The NJ-1040 form is the primary state income tax return form for residents of New Jersey. It is used to report your income and calculate the amount of tax you owe to the state. To efficiently manage your tax documentation, consider New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to keep track of your forms and filings.

Yes, you can file your New Jersey taxes online, making the process more efficient and straightforward. The New Jersey Division of Taxation provides online options that simplify submissions. When preparing to file, consider using New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to ensure all required information is organized and ready for submission.

The 3-year rule in New Jersey pertains to tax returns, where taxpayers must file an amended return within three years from the original due date to claim a refund. Understanding this rule is crucial, as missing the deadline may result in losing out on potential refunds. For better compliance and planning, you can utilize New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to manage your documents and deadlines.

In New Jersey, the tax rate on $100,000 of income can vary based on your filing status and any deductions you may qualify for. Generally, the effective tax rate will be between 5% to 7% for this income level, depending on the tax brackets. To plan effectively, consider using New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document, which can assist in organizing your financial information.

Yes, a Simplified Employee Pension (SEP) can be deductible in New Jersey. This means that contributions you make to your SEP plan may reduce your taxable income, offering you valuable tax savings. Utilizing New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can help you track your contributions and understand the impact on your taxes.

Residents of New Jersey who earn income, as well as non-residents with earning sources within the state, need to file a NJ state tax return. Each individual's tax obligation may vary depending on income sources and residency status. You can rely on the New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to offer clarity and help in preparing your tax return.

You need to file a NJ 1041 form if you are managing an estate or trust with income derived from New Jersey sources. This return is essential for tax compliance and ensures that you report income generated by the estate or trust properly. To streamline this process, refer to New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document for effective management of estate documents.

The 1040NR form is necessary for non-residents who have earned income in the United States. This includes individuals who are not citizens or residents for tax purposes but have income from U.S. sources. Understanding the requirements of this form becomes easier when you utilize New Jersey Personal Planning Information and Document Inventory Worksheets - A Legal Life Document to prepare and maintain accurate records.