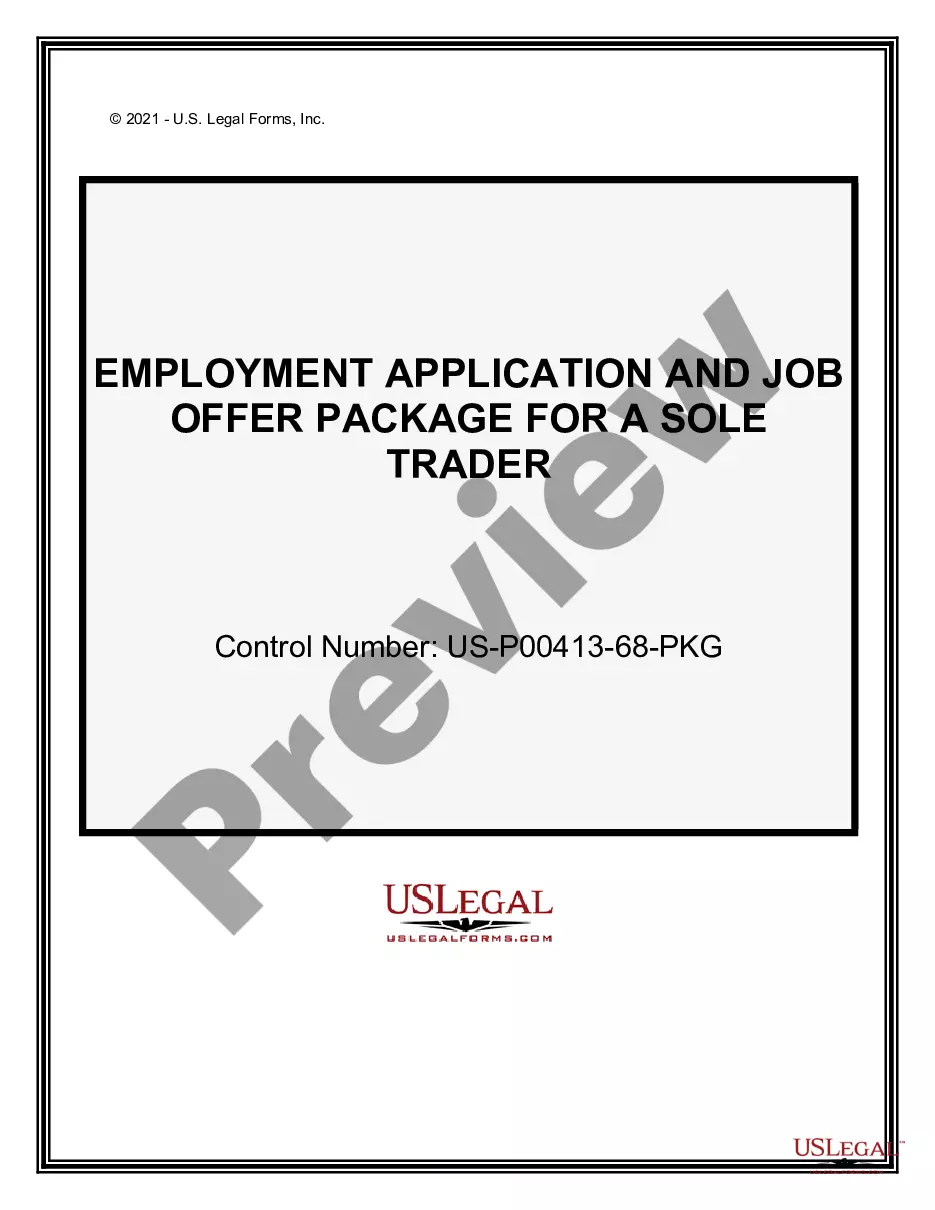

New Jersey Employment Application for Sole Trader

Description

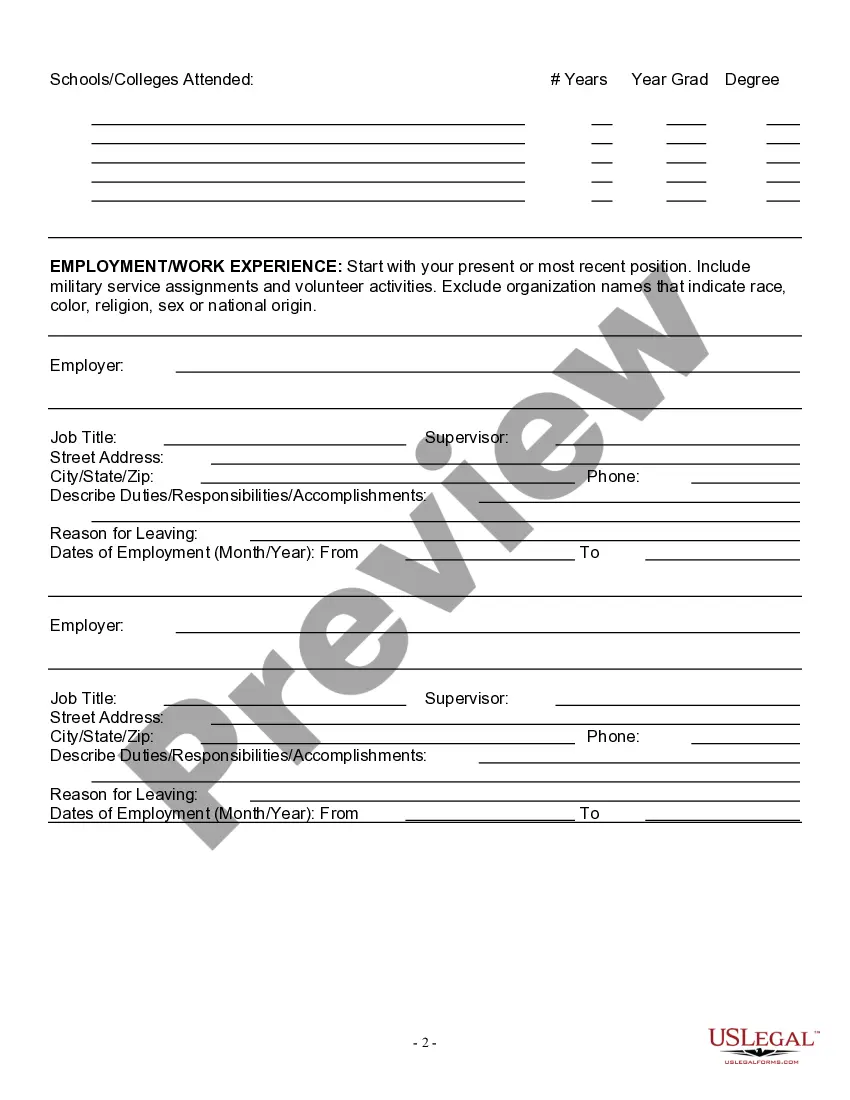

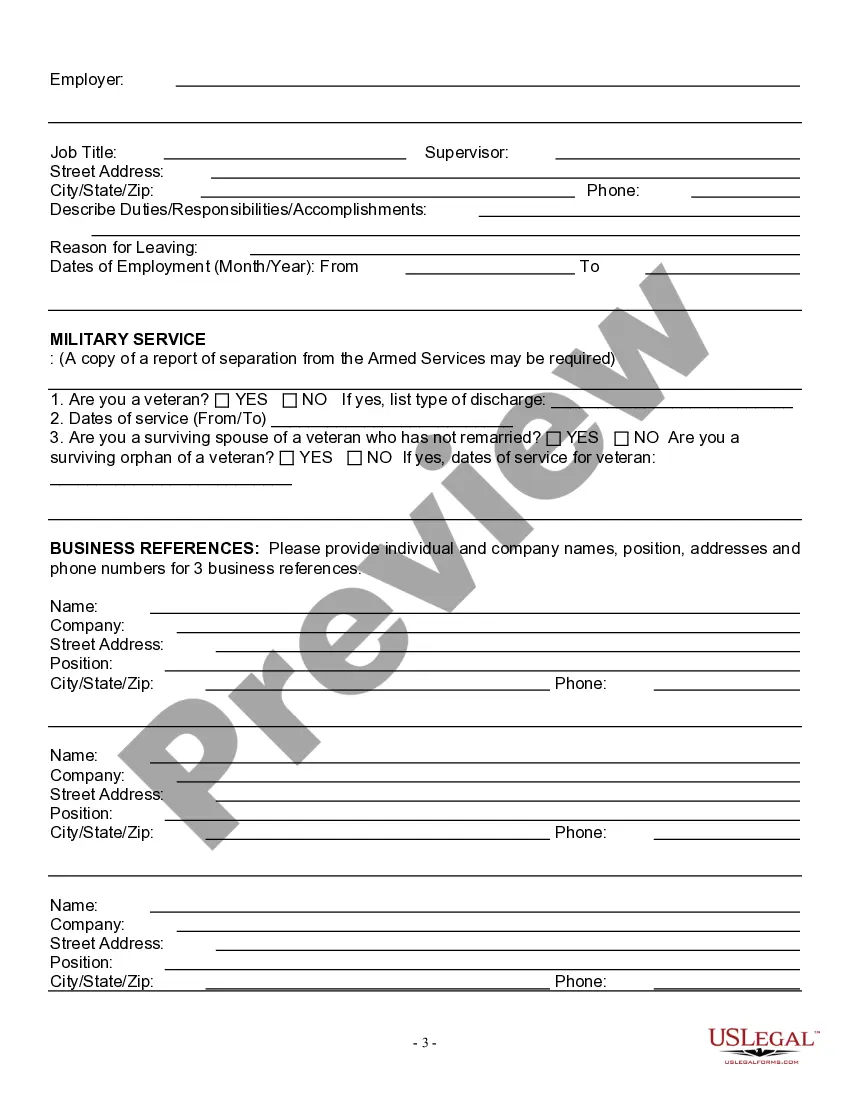

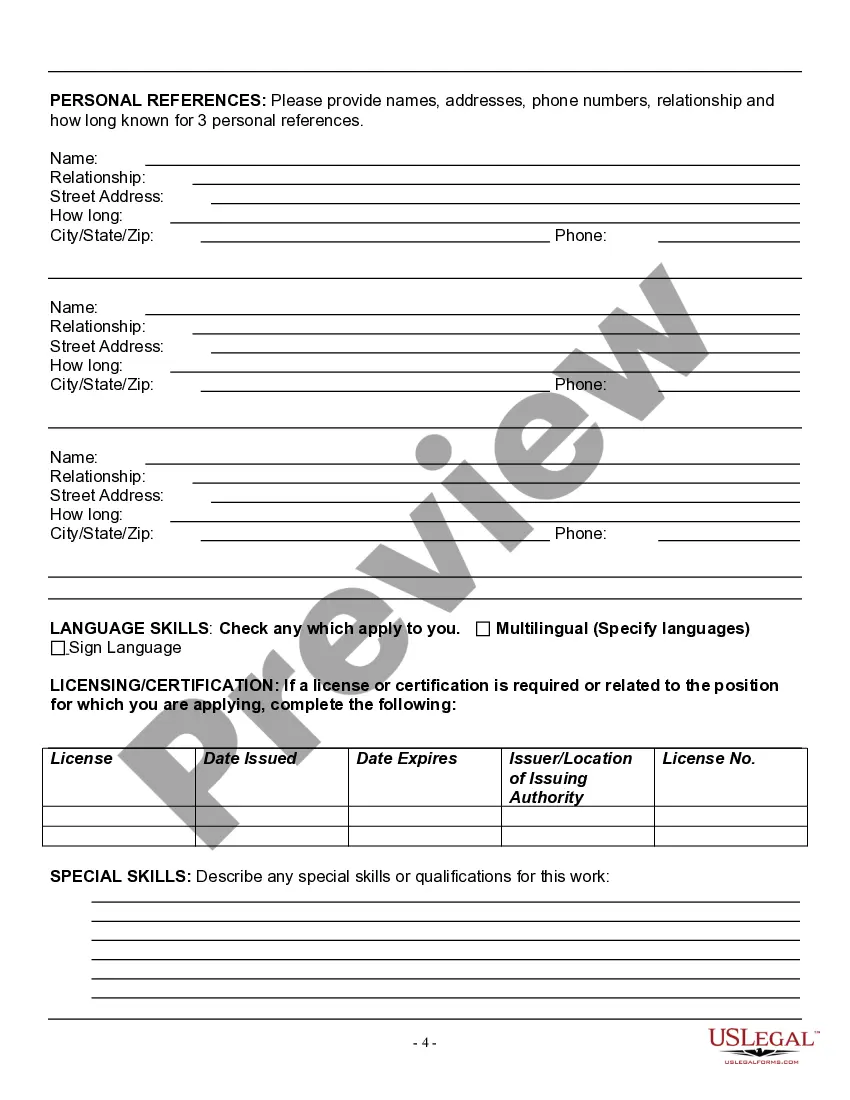

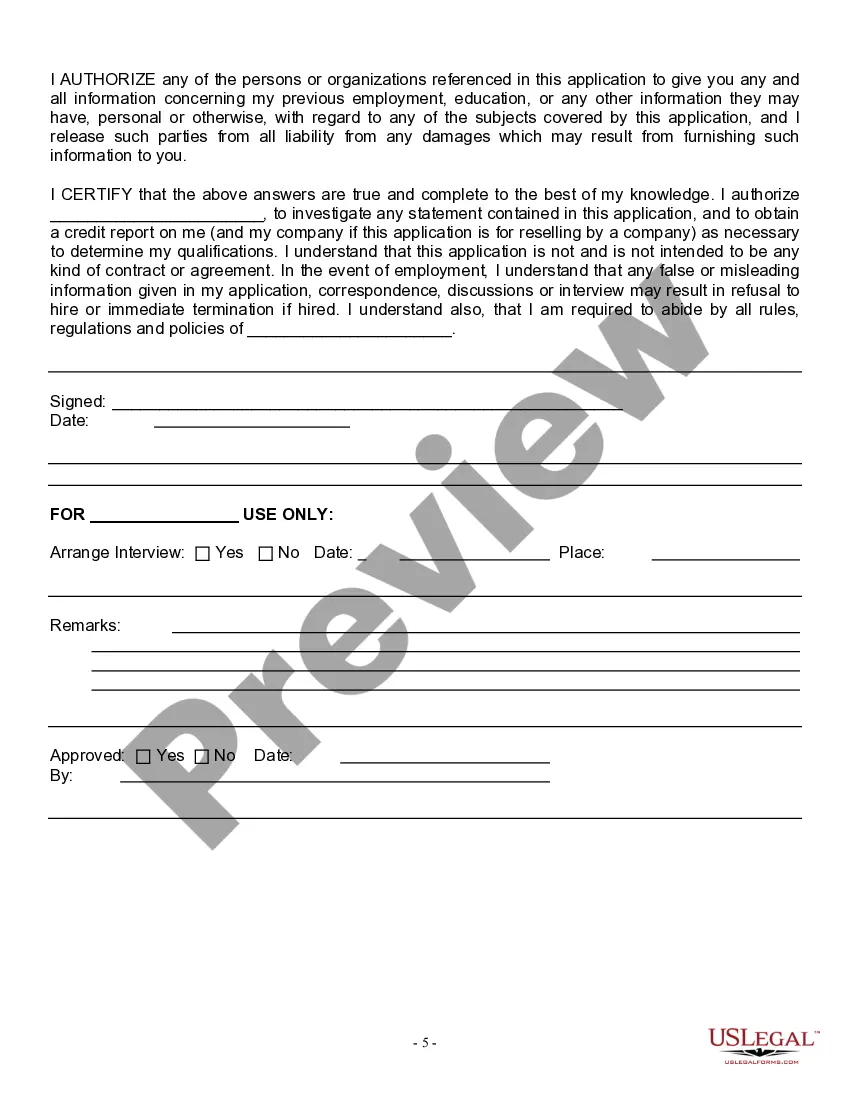

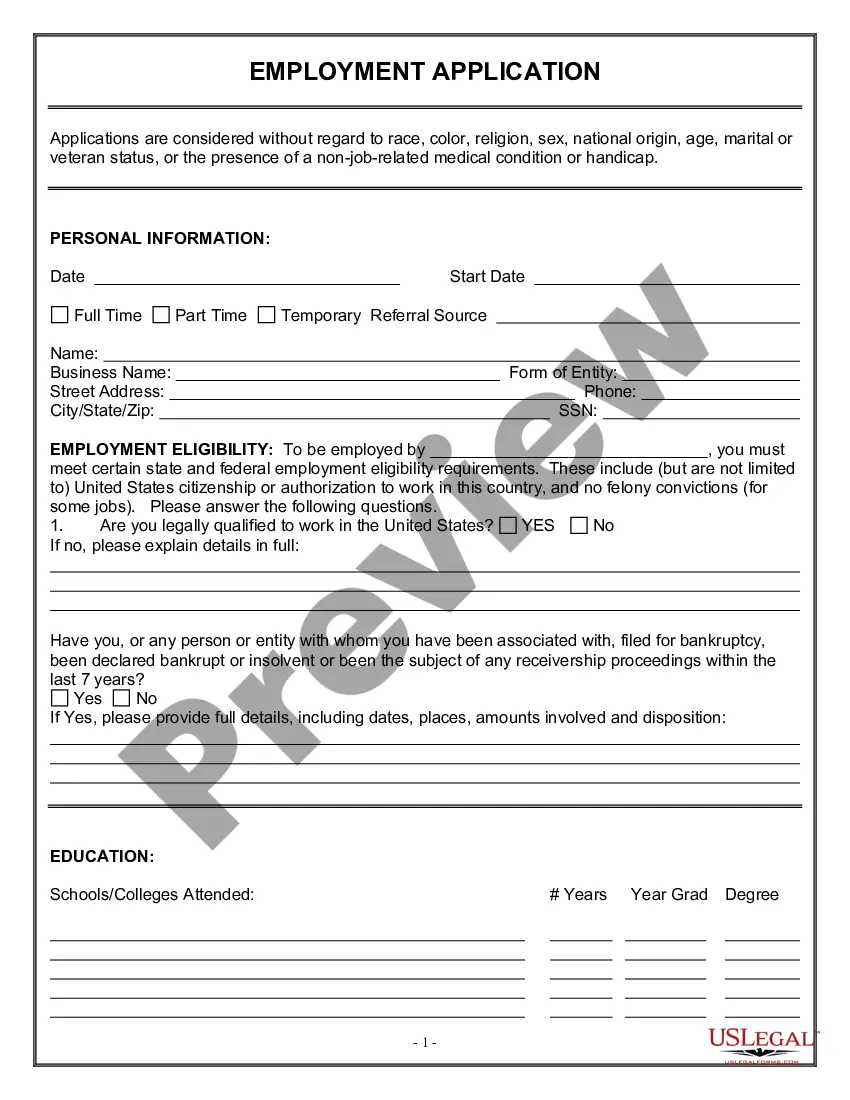

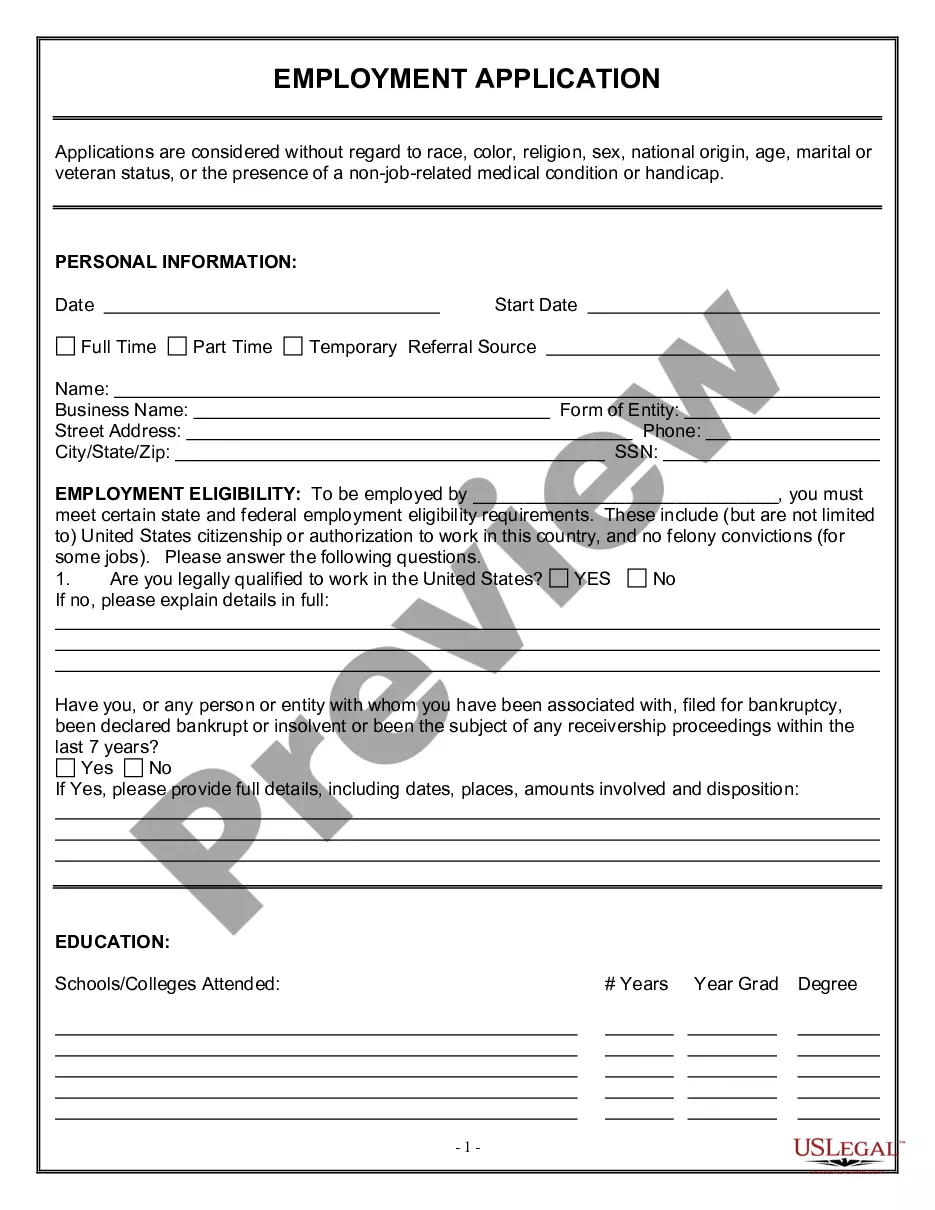

How to fill out Employment Application For Sole Trader?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You'll find the latest versions of documents like the New Jersey Employment Application for Sole Proprietor in moments.

If you already have an account, Log In and retrieve the New Jersey Employment Application for Sole Proprietor from the US Legal Forms library. The Download button will be visible on every document you view. You can access all previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make updates. Fill out, edit, print, and sign the downloaded New Jersey Employment Application for Sole Proprietor.

Every template you save in your account does not expire and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the document you want. Access the New Jersey Employment Application for Sole Proprietor with US Legal Forms, the most extensive collection of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal requirements and needs.

- Ensure you have chosen the correct form for your city/area.

- Click the Preview button to review the document's details.

- Check the form information to confirm you have the right document.

- If the document doesn't meet your requirements, use the Search box at the top of the page to find the one that does.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

New Jersey Business Licenses. New Jersey does not have a statewide business license however businesses may need to register with the New Jersey Department of State. All businesses must register with the New Jersey Department of Treasury. Businesses may be liable for business tax, sales tax, payroll tax and others.

Thankfully, New Jersey makes it easy to determine your sole proprietorship tax obligations. You must simply register your business with the state either online here or by completing form NJ-REG in the Business Registration Packet located here.

Can a sole trader have employees? Yes, sole traders can have employees as long as they remain the sole owner of the business. If you're a sole trader and you want to hire employees, you won't need to set up a limited company.

A Sole Proprietorship form of business organisation is where a business is managed by a single person. Generally, it does not require any registration as such. Any individual who wants to start a business with less investment can choose this type of business form.

Sole proprietors must register with the Department of Trade & Industry (DTI) while corporations and partnerships are registered with the Securities & Exchange Commission (SEC).

The current self-employment tax rate is 15.3 percent. You'll be able to deduct some of your business expenses from your income when calculating how much self-employment tax you owe.

200bIncome when you work for yourselfIf you start working for yourself you're classed as self-employed. You need to declare any income from your self-employment on your tax return. If you're running your own business or a sole trader selling goods or services then you're self-employed.

A person is self-employed if they run their business for themselves and take responsibility for its success or failure. Self-employed workers are not paid through PAYE, and they do not have the rights and responsibilities of an employee.

Thankfully, New Jersey makes it easy to determine your sole proprietorship tax obligations. You must simply register your business with the state either online here or by completing form NJ-REG in the Business Registration Packet located here.

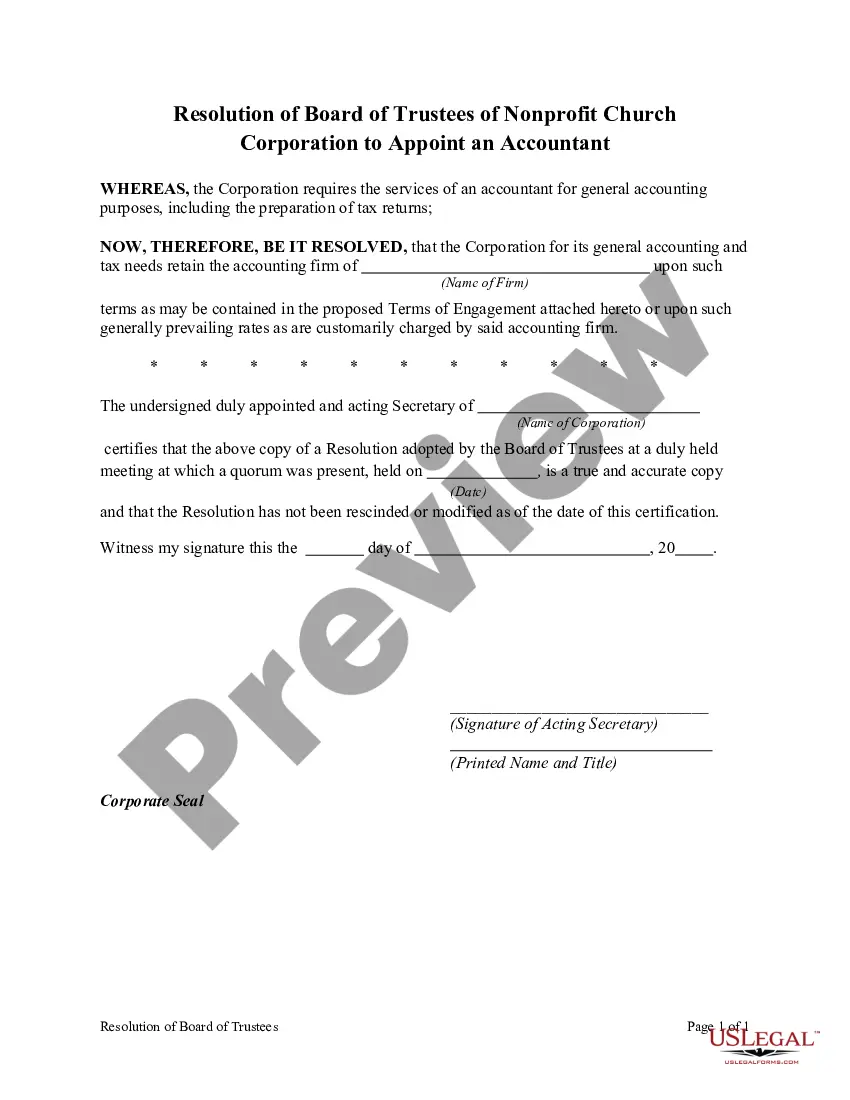

Documents a sole trader might needConsultancy agreement.Office sharing agreement.Terms and conditions of business.Website terms and conditions.Privacy policy.Confidentiality agreement.Contract of employment.