Wisconsin Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship

Description

How to fill out Agreement Between Unmarried Individuals To Purchase And Hold Residence As Joint Tenants With Right Of Survivorship?

If you need to gather, acquire, or print official document templates, utilize US Legal Forms, the largest selection of official forms, which are accessible online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you require.

Different templates for business and personal purposes are organized by categories and states or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of your official form template.

Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Utilize US Legal Forms to locate the Wisconsin Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to retrieve the Wisconsin Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

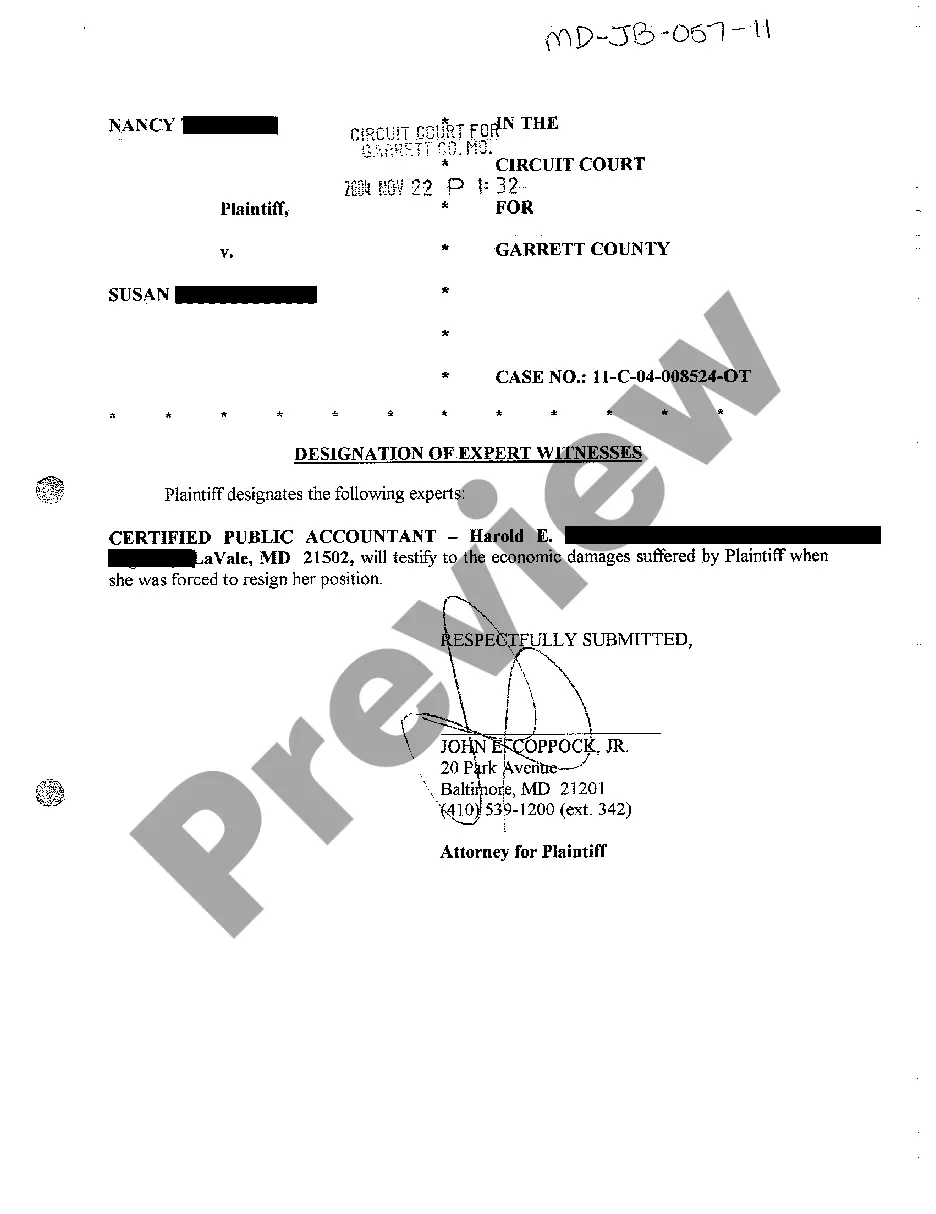

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

Form popularity

FAQ

If you've bought the property and own it jointly, so both of your names are on the property ownership papers, you should be able to keep living there and also be entitled to half the value of the property. This is regardless of how much money you contributed to it when you bought it.

In fact, members of unmarried couples have no rights to support, unless the two have previously agreed on it. To avoid a tense disagreement about palimony, it's in the couple's best interest to include whether or not support will be paid in a written agreement.

Property Rights of Unmarried Couples When an unmarried partner dies, the arrangement is very similar to that in married couples, except for the imposition of inheritance tax upon spouses. Upon the death of one of the partners, the other partner only gets to retain the entire house if they own it as a joint tenancy.

Jointly owned assets will usually be split between you 50/50 or in accordance with any agreement you have made. Money or property in your partner's sole name will be presumed to belong to them alone, unless you can prove otherwise.

There are disadvantages, primarily tax disadvantages, to either type of joint tenancy for estate planning. You might incur gift taxes when creating joint title to property. If the other owner is your spouse, there is no problem because unlimited tax free gifts can be made between spouses.

Common law marriage, or cohabitation, was abolished by Wisconsin state law in 1917 and as such is not recognized in Wisconsin. It does not matter how long the couple has lived together, and the circumstances surrounding the cohabitation do not matter either. A common law marriage is not considered a legal marriage.