New Jersey Social Security Complaint

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Jersey Social Security Complaint?

If you’re searching for a way to properly prepare the New Jersey Social Security Complaint without hiring a legal professional, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business situation. Every piece of paperwork you find on our online service is drafted in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these simple guidelines on how to obtain the ready-to-use New Jersey Social Security Complaint:

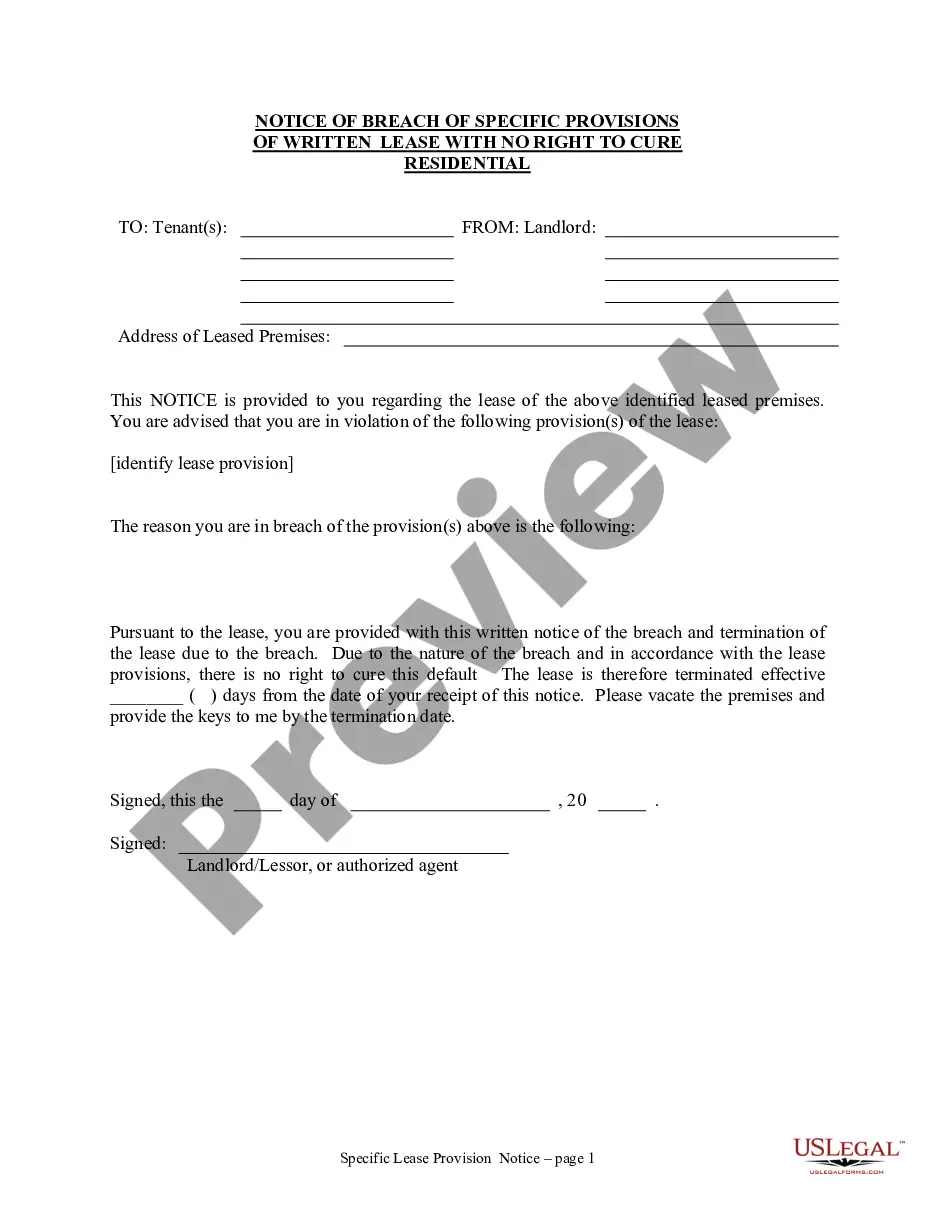

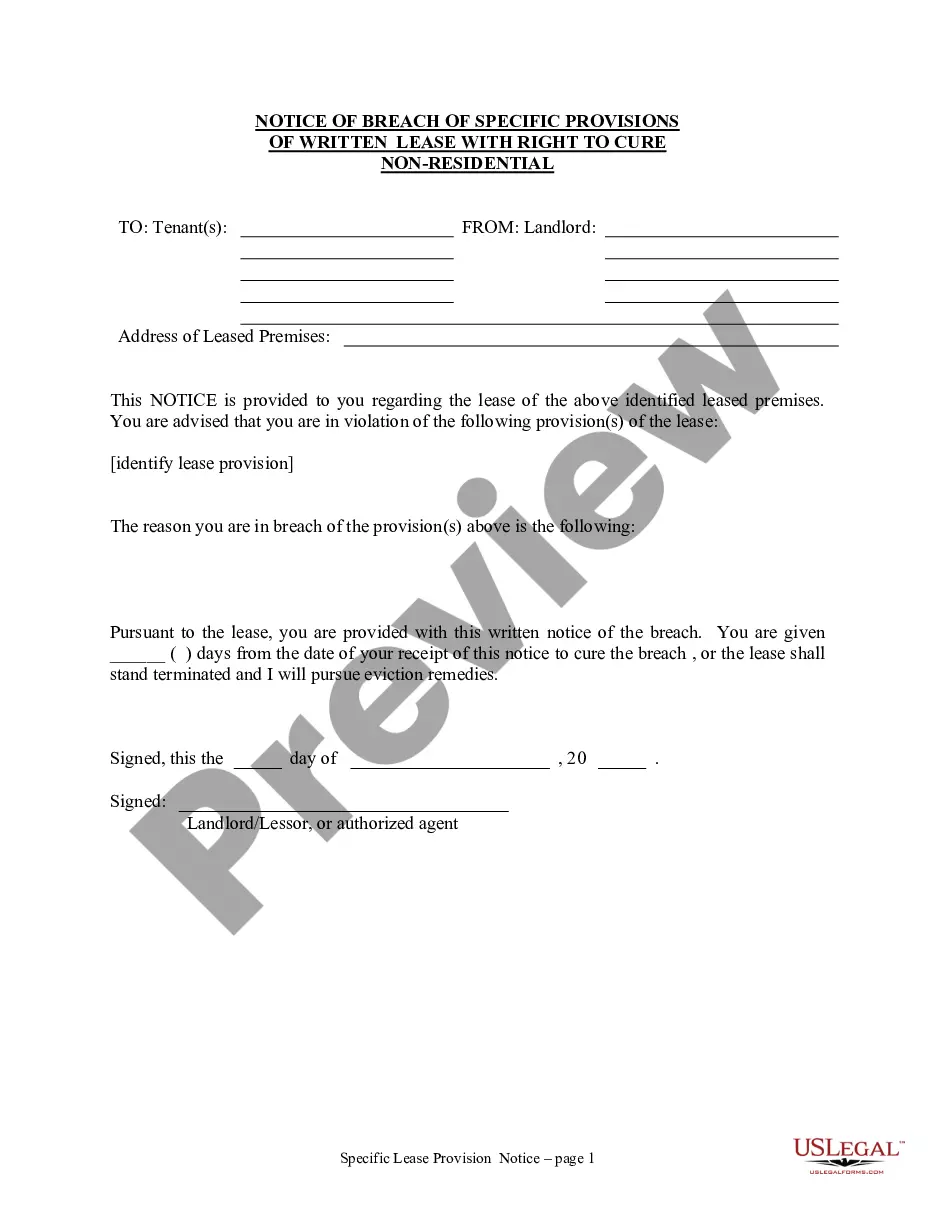

- Make sure the document you see on the page corresponds with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and select your state from the list to find another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your New Jersey Social Security Complaint and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

An SSA-1099 is a tax form we mail each year in January to people who receive Social Security benefits. It shows the total amount of benefits you received from us in the previous year so you know how much Social Security income to report to the Internal Revenue Service on your tax return.

You can call our National 800 Number at 1-800-772-1213 between a.m. ? p.m., Monday through Friday. Wait times to speak to a representative are typically shorter early in the day (between 8 a.m. and 10 a.m. local time) or later in the afternoon (between 4 p.m. and 7 p.m. local time).

Click the "Let's Talk" Button Below and Ask One of Our Live Advisors Your Free Social Security Question!

How do I report earnings? You may call us at 1-800-772-1213. Or you may call, visit, or write your local Social Security office. Social Security also offers a toll-free automated wage reporting telephone system and a mobile wage reporting application.

At .socialsecurity.gov/redbook/ ? Call our toll-free number at 1-800-772-1213 ? For the deaf or hearing-impaired, call TTY 1-800-325-0778 ? For income reporting for Supplemental Security Income, visit .socialsecurity.gov/ssi.

By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office.

Social Security (i.e. payments, coverage, claims, appeals, reports of fraud and identity theft) should be directed to the Social Security Administration (SSA) at 1-800-772-1213 or visit the SSA website at .ssa.gov/agency/contact.

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.