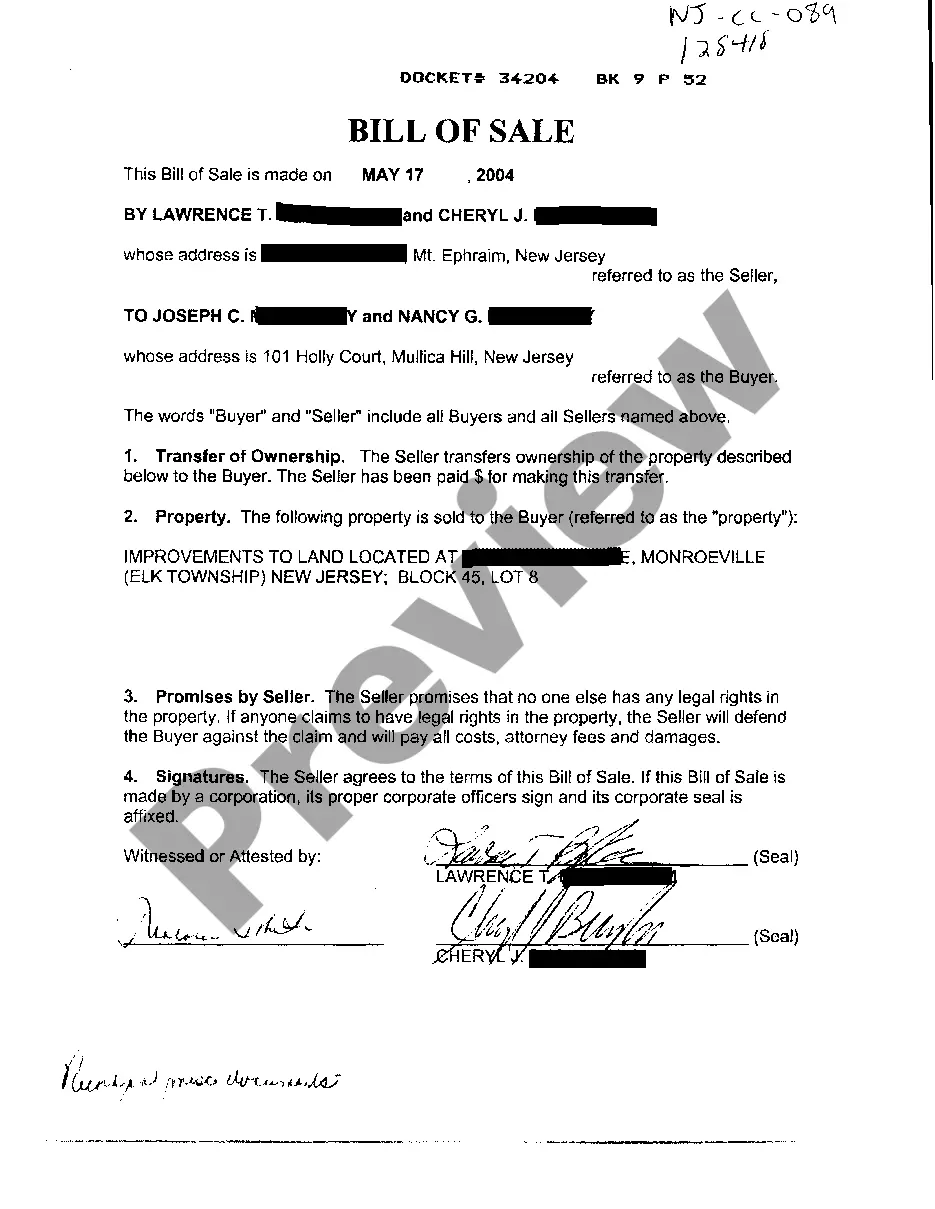

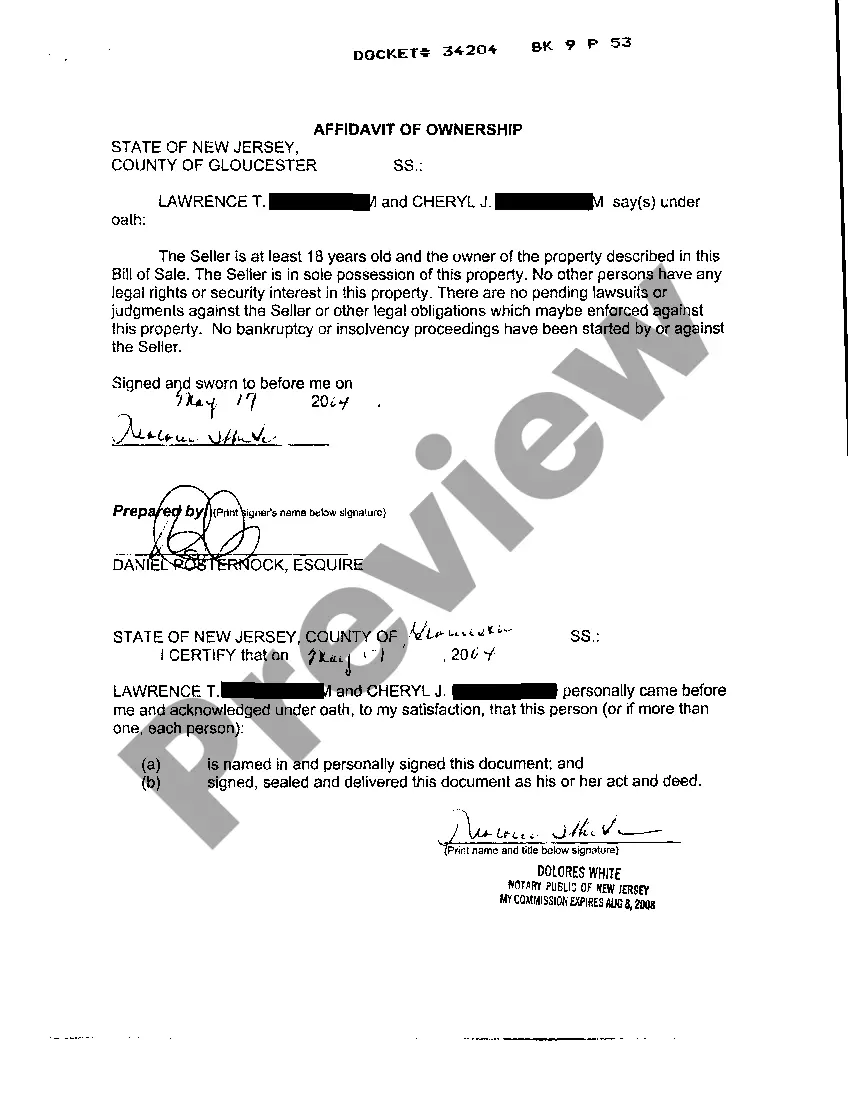

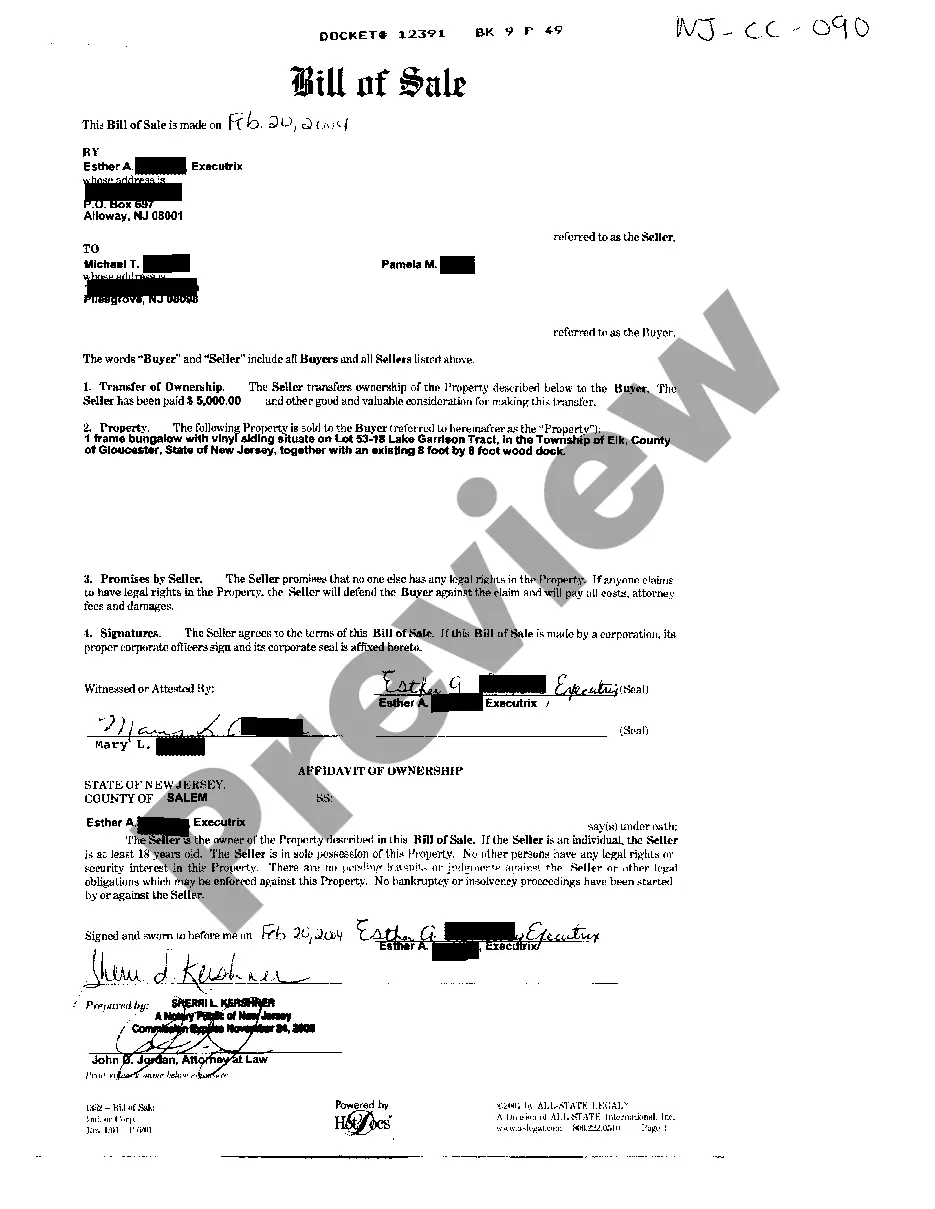

New Jersey Bill Of Sale for Improvements to Land

Description

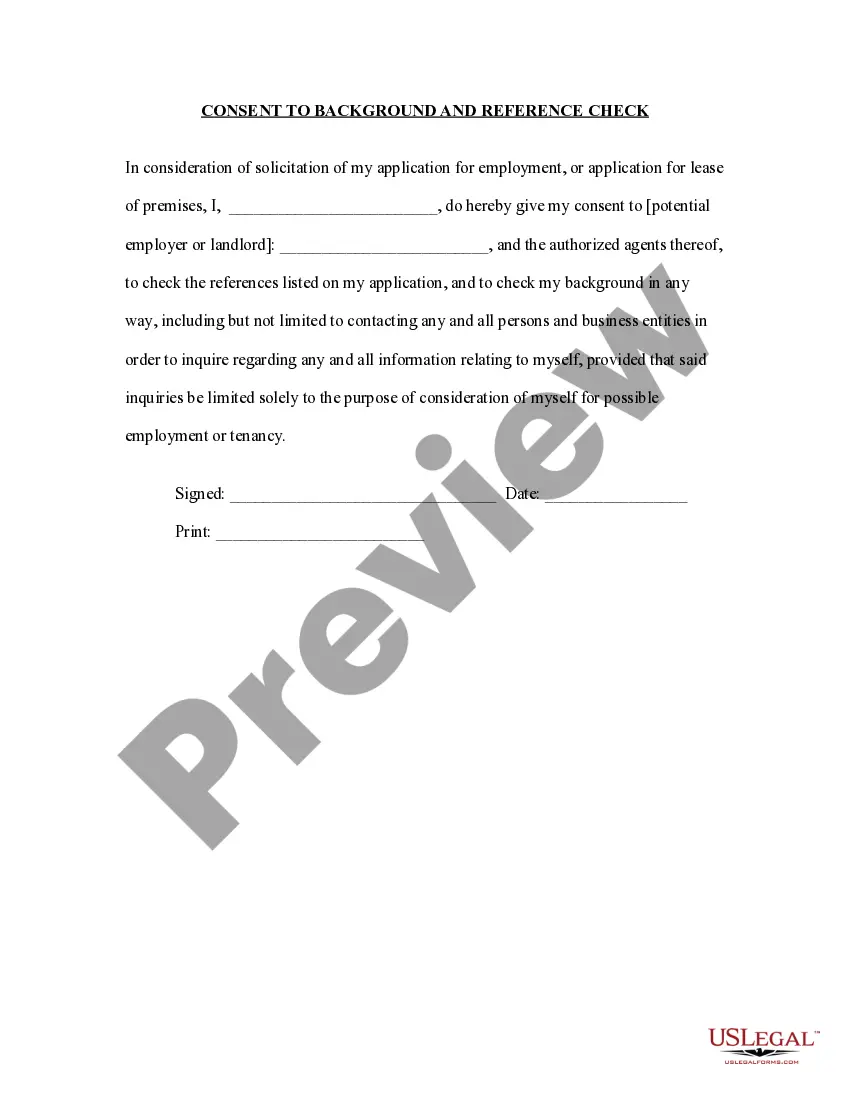

How to fill out New Jersey Bill Of Sale For Improvements To Land?

US Legal Forms is actually a unique system to find any legal or tax document for completing, such as New Jersey Bill Of Sale for Improvements to Land. If you’re tired of wasting time searching for appropriate samples and spending money on papers preparation/legal professional fees, then US Legal Forms is exactly what you’re looking for.

To experience all of the service’s advantages, you don't need to download any application but simply pick a subscription plan and create an account. If you have one, just log in and find the right sample, save it, and fill it out. Saved files are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Bill Of Sale for Improvements to Land, take a look at the guidelines below:

- make sure that the form you’re checking out is valid in the state you need it in.

- Preview the example and look at its description.

- Click Buy Now to get to the sign up webpage.

- Pick a pricing plan and proceed signing up by providing some information.

- Pick a payment method to finish the registration.

- Download the file by selecting your preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you are unsure about your New Jersey Bill Of Sale for Improvements to Land form, speak to a legal professional to review it before you send out or file it. Start hassle-free!

Form popularity

FAQ

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more. You can find more information on the Realty Transfer Fee, including rates and exemptions, here.

Transfer Tax (Local Treasurer's Office) this is tax imposed on the sale, barter, or any other method of transferring of the ownership or title of real property, at the maximum rate of 50% of 1 percent of a property's worth (in the case of cities and municipalities within Metro Manila, this is 75% of 1 percent)

Capital improvements are exempt from tax with the exception of the following, which became subject to tax as of October 1, 2006: certain landscaping services, carpet and other floor covering installations, and hard-wired alarm or security system installations.

There's not really an exit tax in New Jersey. It's actually the prepayment of an estimated tax that could be due on the sale of your home. The state requires that either 8.97% of the net gain from the sale or 2% of the consideration. That's the so-called exit tax.

The Realty Transfer Fee is calculated based on the amount of consideration recited in the deed or, in certain instances, the assessed valuation of the property conveyed divided by the Director's Ratio.The State of New Jersey and New Jersey's twenty-one counties share Realty Transfer Fee proceeds.

Although the work done and items used for the capital improvement are not taxable to the purchaser of the improvement, the items purchased along with the capital improvement as part of the job are taxable.

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

This so-called Exit Tax is two percent of the gross sale price, without regard to whether there is a capital gain on the sale or not. For example, you could have paid $400,000 for your house in 2008 and sold it in 2013 for $300,000, (a loss of $100,000), but still have to pay $6,000 to the State of New Jersey.