New Hampshire Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust On A Mineral / Royalty Interest Sold By Grantor?

Are you presently in a place the place you need papers for possibly enterprise or personal purposes almost every time? There are a lot of lawful document web templates accessible on the Internet, but finding ones you can trust is not effortless. US Legal Forms offers thousands of kind web templates, much like the New Hampshire Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor, that are composed to fulfill state and federal specifications.

When you are presently familiar with US Legal Forms site and possess a merchant account, just log in. Following that, it is possible to down load the New Hampshire Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor web template.

Should you not offer an accounts and want to begin to use US Legal Forms, abide by these steps:

- Find the kind you need and ensure it is to the proper metropolis/county.

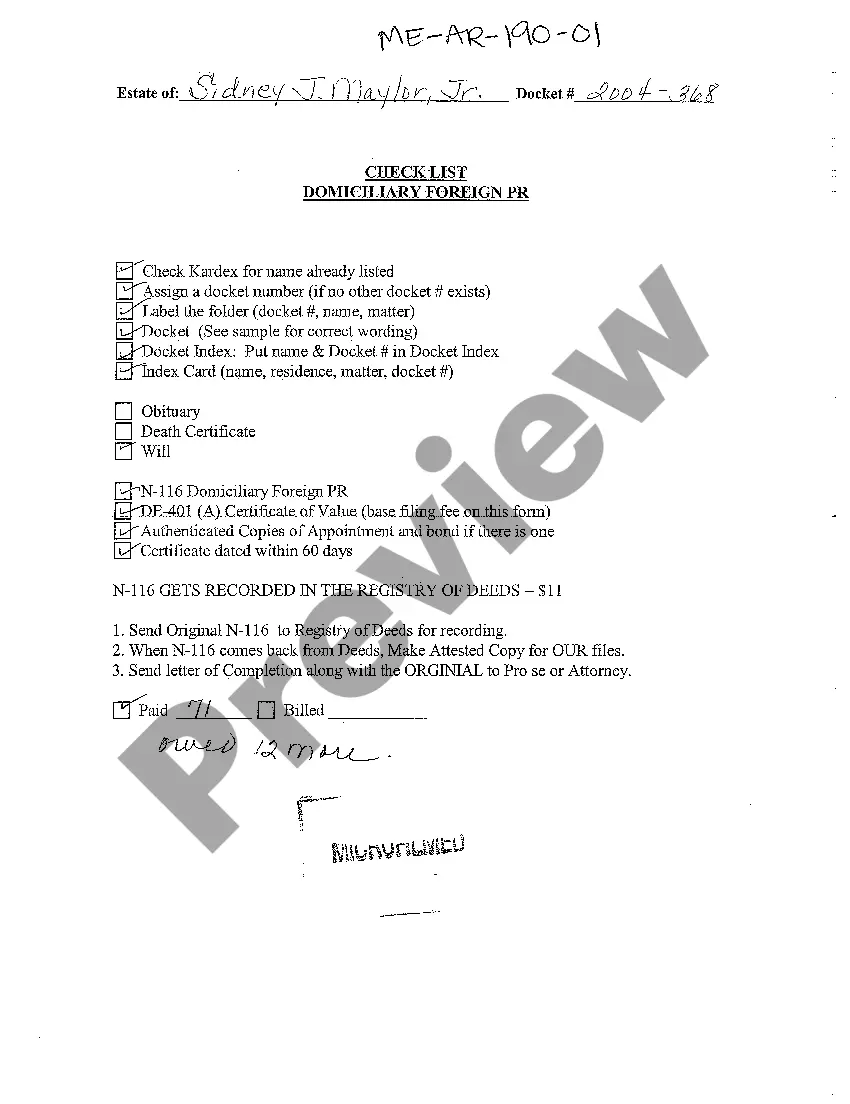

- Make use of the Review switch to examine the shape.

- Browse the explanation to actually have selected the appropriate kind.

- In the event the kind is not what you are trying to find, use the Lookup industry to get the kind that meets your requirements and specifications.

- Once you find the proper kind, click Get now.

- Select the prices prepare you would like, fill in the required details to make your money, and pay for an order with your PayPal or Visa or Mastercard.

- Choose a practical data file formatting and down load your backup.

Discover every one of the document web templates you possess bought in the My Forms food list. You can obtain a further backup of New Hampshire Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor anytime, if possible. Just go through the essential kind to down load or produce the document web template.

Use US Legal Forms, probably the most substantial selection of lawful varieties, to save lots of efforts and stay away from mistakes. The service offers appropriately manufactured lawful document web templates which can be used for a variety of purposes. Make a merchant account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

Mortgage Deed of Trust Although a Deed of Trust is similar to a Mortgage, which is used in other states, it is not a Mortgage. Good to know: Texas does not use mortgages. Instead, Texas uses Deeds of Trust. The document is referred to as a Deed of Trust because there is a Trustee named for the property.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...